Weekend thoughts: Capital allocation and opportunity at $BBBY

One lukewarm take I’ve been thinking about recently: there’s going to be opportunities in meme stocks (or meme adjacent stocks) after their “meme” fades.

The thought is kind of simple: meme stocks are so freaking volatile that when they wash out they can wash out really hard to the downside. And, once a stock has that “taint” of meme on it, most professional investors won’t even consider touching it anymore. The combination of extreme volatility and a (possibly) limited buyer pool on the downside creates opportunities.

So I’ve been keeping track of a few different meme stocks out of the corner of my eye. The one that’s particularly interested me is Bed Bath and Beyond (BBBY). I’ll note I’m a little angry because I’ve been toying with this posting on them for a while and decided to after they announced a bunch of news this week and Citron slightly beat me to the punch (they tweeted about the stock Friday), but I see lots of the same thing that Citron sees. BBBY trades at a cheap valuation, and the company is buying back shares aggressively. Even with shares up ~50% this week, BBBY remains shockingly cheap, and the management team seems content to buy back shares aggressively until the market’s view of their valuation matches their own. I think the market is underestimating just how aggressive BBBY is willing to be with their share buybacks; a few years ago, Restoration Hardware’s (RH) stock went parabolic on the threat of an “infinity squeeze” after they bought back a huge amount of stock at a clip no one believed they could achieve. It’s very possible a similar dynamic plays out at BBBY.

There’s a funny ending to the Restoration Hardware story: while the stock buyback drove an infinity squeeze in the short term, the real profits were delivered in the long run. The company had a differentiated business model and brand that created an insane amount of value; the CEO clearly saw that and got greedy buying back shares because he knew the market was way underestimating the company’s potential. At the time of the “infinity squeeze” in 2017, RH’s shares had spiked to ~$75/share. A lot of investors thought that share price was unsustainably fueled by a short squeeze and way overvalued…. and they were proven dramatically wrong. Two years later, Berkshire picked up some RH shares, and as I write this the stock is trading for ~$660/share. The “infinity squeeze” looks like just a blip on the longer term value creation for RH, and those aggressive share buybacks that a lot of short sellers thought was market manipulation proved to be incredibly astute capital allocation.

I’m not saying the same thing will happen to BBBY; I don’t think their brand or competitive positioning is close to as good as RH’s. But the company is extremely cheap, and they are in the middle of a turn around with several pretty easy levers to pull to create a lot of value. Even after the recent run, the current share price doesn’t really discount any of that, and management seems content to aggressively buyback shares until the market’s view of value matches their own.

I’m going to break this post down into three parts:

Why I think the board’s view of intrinsic value is much higher than today’s price and they will be aggressive in repurchasing shares

A quick look at BBBY’s valuation

Some of the longer term levers BBBY has to create value

Normally I’d order those bullets slightly differently, but I think #1 is the buzziest here so without further adieu…..

Part 1) Why I think the board’s view of intrinsic value is much higher than today’s price and they will be aggressive in repurchasing shares

Earlier this year, BBBY became a meme stock, and the stock went on a wild run. Most companies would see retail traders ramping the stock higher by buying short term call options and immediately pause all repurchase plans until things cooled off a bit. Not BBBY; the company leaned into their share repurchases.

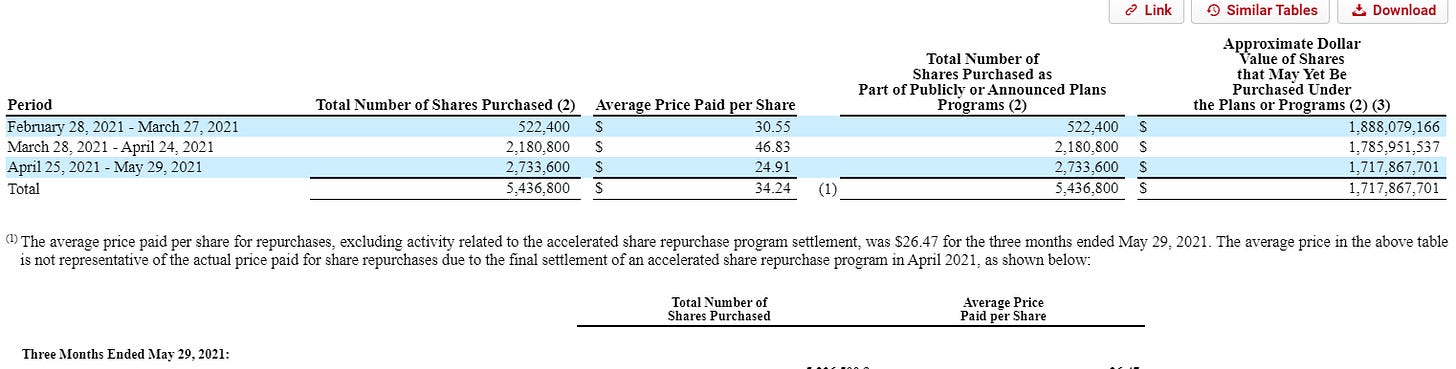

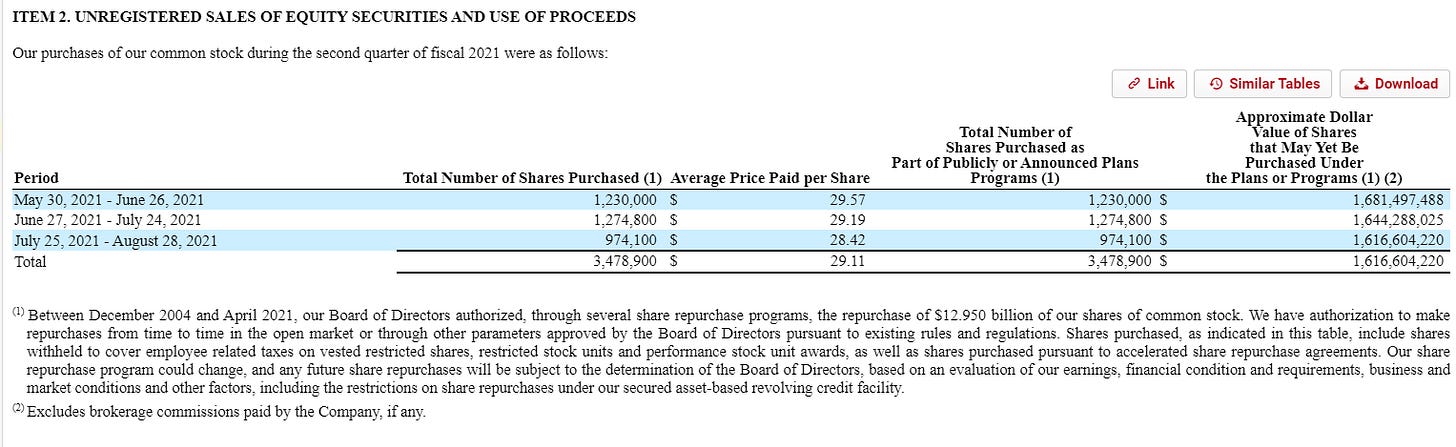

Below I’ve posted the two repurchase tables from BBBY’s 10-Qs this year. The company had an accelerated share repo (ASR) program that ended in April, so you can ignore the repurchases that happened before April 24 in the first table as they are influenced by the ASR. What I want you to focus on is the repurchases after the ASR expires; you’ll see BBBY is doing an aggressive share repurchase whenever their stock is below $30 (~$67.m in the April/May time frame, and then >$100m in Q2’21).

Why does that matter?

BBBY’s stock was up a lot this week because they announced plans to complete their share repurchase program this year, two years ahead of schedule. They had done $600m in buybacks as of the end of August 2021, so they’ll need to do $400m between now and fiscal year end. Their prior target had been to do $100m more by the end of the year, so they effectively have increased they planned buyback target for this year by $300m.

I think the market is underestimating the repurchase program in two ways.

First, BBBY had to know that announcing they were speeding up the share repurchase program would drive the stock higher. My guess is that they completed the $100m they were targeting by year end before announcing the increase. Until this announcement, BBBY’s stock hasn’t traded above $20 since they announced Q2 earnings in late September. Let’s say I’m right and that BBBY finished their $100m program before announcing the speed up, and let’s say they did the majority of it after their earnings blow up so the average price they paid is under $20/share. That means they already bought more than 5m shares so far this quarter; BBBY had 101m shares out at the end of August, so BBBY would have bought ~5% of their shares outstanding before making this announcement. That’s a very, very aggressive buyback (and, as I’ll show later, done at a very low multiple).

That may seem like a crazy number, but if you think back to those monthly buyback charts in the 10-Q you’ll remember in May BBBY bought back 2.7m shares at ~$25/share for a total repurchase of ~$70m, which I think shows BBBY is willing to be very aggressive when they think the share price is attractive (and, of course, it’s worth noting that May price was higher than today’s).

The second thing I think the market is underestimating is how aggressive BBBY is willing to be on repurchases going forward. I mean this in two ways: with the stock screaming higher after the share repurchase announcement, people might be wondering if BBBY is going to dial back the share repurchase. And, with the company not communicating an increased share repurchase authorization alongside the acceleration, investors might be wondering if BBBY is going to lay off the share repurchases after this round is done.

I’m here to tell you both of those fears are wrong: unless the stock goes absolutely parabolic, BBBY will be finishing the accelerated repurchase program this year. And, once BBBY finishes this repurchase program, they will almost certainly be authorizing and aggressively pursuing another repurchase program (again, unless the stock goes parabolically higher). This belief is based on two things:

Look at BBBY’s historical share repurchases. The company has clearly shown that retiring shares when the stock is trading below their intrinsic value appraisal is a key piece of their capital allocation program. In my experience, the best indicator a company is going to aggressively buyback shares going forward is that they’ve historically bought back shares aggressively. That certainly applies to BBBY.

The biggest barrier to aggressive share buybacks is generally having the cash to buy back shares when the stock is cheap. BBBY has a reasonable amount of leverage, a huge amount of cash on hand, and has published forward targets that would have them gushing cash flow; the combination will give them plenty of fire power to continue aggressively buying back shares if they want to.

The second point actually blends nicely into both part 2 and part 3 of this post, so let’s use it to transition.

Part 2: A quick look at BBBY’s valuation

Over the years, I’ve tried to divorce myself a little from simply using trailing valuation stats to find undervalued stocks. Historically, I’ve passed on something like Games Workshop (which owns the Warhammer brand) because it was trading at a little too expensive on trailing earnings in favor of some beaten down company trading at 5x earnings only to watch the former go up 5x as earnings inflect upwards while the later struggles one too many times.

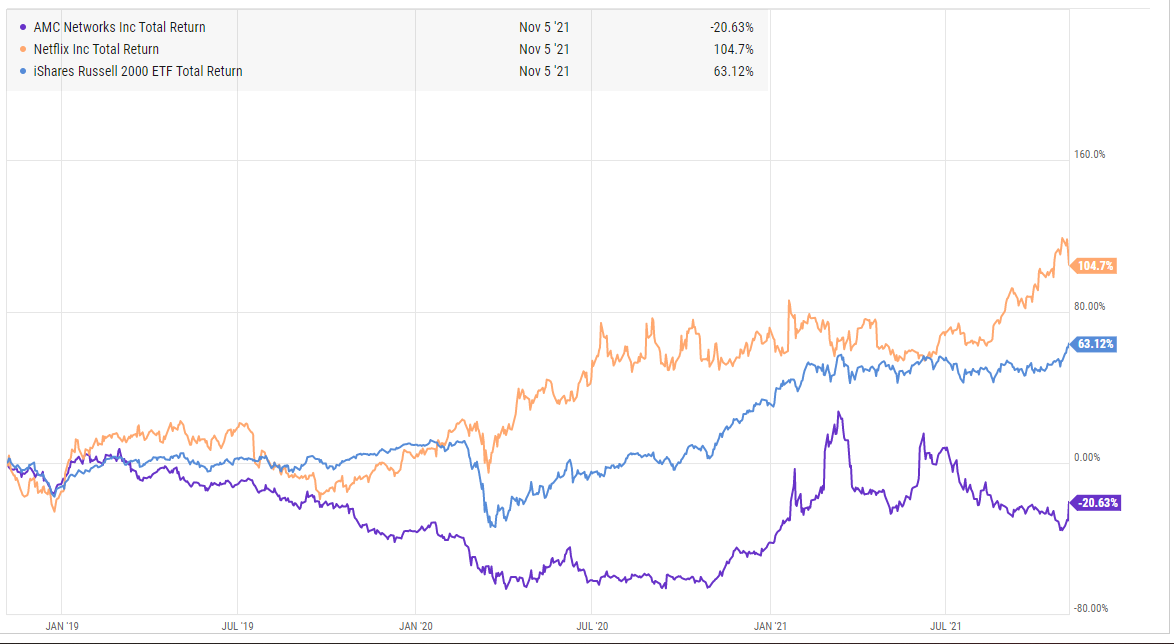

Or a simpler / more widely known example: three years ago, it was pretty clear that Netflix (NFLX) had reached “escape velocity” and the legacy media properties, particularly the subscale ones, would struggle. Media moguls like Barry Diller and John Malone both said it 2017/2018. For anyone paying attention to media, it was completely obvious…. and yet dumb dumbs like me spent time looking at beaten down subscale media companies like AMC Networks (AMCX) because they looked very cheap on historical metrics despite a future that would clearly be more difficult than their past. Big mistake; over the next three years, Netflix would more than double and handily beat the indices while AMCX would continue to lag.

I get those are small sample sizes, but I think they point to something important: in the internet age, things can change very quickly. What looks awfully expensive one day can look screamingly cheap the next given the power of scale and operating leverage as you grow.

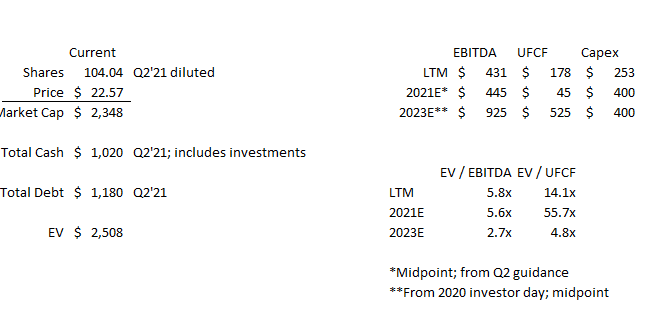

So I’ve tried to divorce myself a little from simply looking at trailing earnings to find cheap stocks. Still, a simple LTM valuation can be really useful as a starting off point because it can inform you what the market is pricing in. So let’s take a look at what the market is pricing into BBBY.

I’ll discuss it a little more in part 3, but BBBY is basically undergoing a turn around. They recently closed a bunch of unprofitable stores, and they’re working to do some basic things like improve their stores, their supply chains, and push more private label brands. The company hosted an investor day in 2020 where they laid out all of their plans and provided guidance for what their 2023 financials would look like after the turn around.

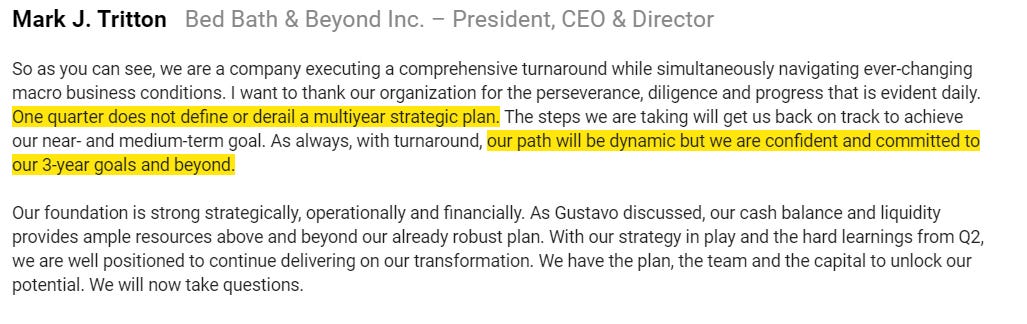

So there’s two ways to look at BBBY: you can look at them on their near term / trailing numbers, which have some noise from the associated store closures and doesn’t give them credit for their plans. Or you can look at the company on what they’re saying they’ll do in 2023. The instinct is probably not to give them any credit for the 2023 projections; a popular rule of thumb for investing is turnarounds never turn, and given the company missed badly in Q2’21 and is discussing all sorts of supply chain issues, it’s probably right to be doubtful. But management seems confident they can hit their 2023 targets (the quote below is from their Q2’21 call), and I think the market can shoot a little too quickly in burying companies undergoing an operational turnaround just because one quarter comes up weak (particularly given the supply chain issues that BBBY discussed are not exactly a BBBY unique issue; every retailer in America is seeing similar issues).

Anyway, whether you believe the company’s targets or not, the stock looks pretty cheap. <6x EBITDA on trailing numbers, and <3x on the midpoint of 2023 guidance. Near term free cash flow (which I define as EBITDA less capex) is pretty limited as the company is making a bunch of investments, but if you believe the company’s line that 2023 capex will resemble the current years than this is a company trading at <5x 2023 free cash flow.

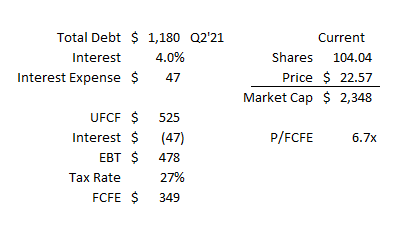

That’s very cheap…. but the numbers actually look better when you start looking at the company on a “cash flow to equity” perspective. BBBY is currently borrowing at <4% interest rates, and their tax rate is 27% (per their 10-q). If you just assume that capex roughly matches their D&A, then on their 2023 projections BBBY would be generating ~$350m in free cash flow to equity (that is, cash flow after taxes, interest, capex, etc.) per year. Right now, BBBY’s market cap is ~$2.35B, so you’re talking a <7x free cash flow to equity multiple if you just use their current capital structure and their 2023 targets.

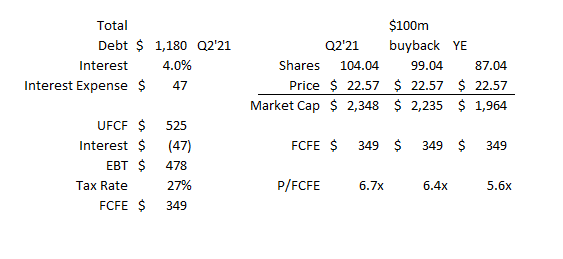

But there’s more! Remember from part #1 that I thought BBBY had repurchased ~5% of their shares before announcing the increased share repo pace. If that’s right, BBBY’s diluted shares count is currently under 100m (versus the 104m number used in the table above). They also have another ~$300m repurchase authorization they plan on using between now and fiscal year end; if they do that at ~$25/share (a premium to the current price), they’ll retire another 12m shares, which would bring their share count down to ~87m. Run the same math on those numbers, and suddenly the P/FCFE dips under 6x.

Yes, there’s all sorts of assumptions in there, chief among them that BBBY hits their 2023 earnings target. But I think the current aggressive repurchase shows how confident BBBY is in hitting their financial targets, and running the numbers shows how accretive these share buybacks can be.

One other thing worth mentioning: I’ve assumed share repurchases stop at the end of this year. As discussed at the end of part 1, that’s probably a pretty poor assumption; BBBY had $1B in cash on their balance sheet at the end of Q2’21. Even if they burn through the whole buyback authorization this year, they’ll still have plenty of excess cash and a business that should generate a decent amount of ongoing cash if they can come close to their financial targets. Management has shown they are willing to aggressively repurchase shares at these levels; if the stock continues to languish, it wouldn’t surprise me at all if they devoted another $500m to buying back shares next year. Doing so could retire another ~20% of the float, and the cash flow to equity numbers would start to look really bonkers (this is why levered buy back models are so appealing on low multiple stocks! of course, the economics and financials need to hold up!).

Again, all of this is a little garbage in / garbage out. It’s very reliant on the company executing and delivering on their 2023 targets. If the company’s strategy is awful and same store sales are dropping 10% every year, none of these buybacks or analysis is going to mean anything. The financials are going to be awful, and the company will probably file for bankruptcy.

But management is indicating they’re confident they can hit those targets. And they’re backing those words up with actions given how aggressively they’re repurchasing shares. By laying out the numbers, I hope this section helped show why management is being so aggressive with their share repurchases (if they believe the numbers, the shares are a steal at these prices) and showed how accretive the repurchases at these levels can be.

Part 3: Some of the longer term levers BBBY has to create value

Most of this post so far has been simply playing around with numbers to show how cheap BBY is and why these share repos can be so accretive while also showing why I believe management will continue to be aggressive with share repurchases at today’s levels (the two are kind of linked at the hip).

But I wanted to spend a second and talk about a few levers that might not be obvious that BBBY could pull to create value.

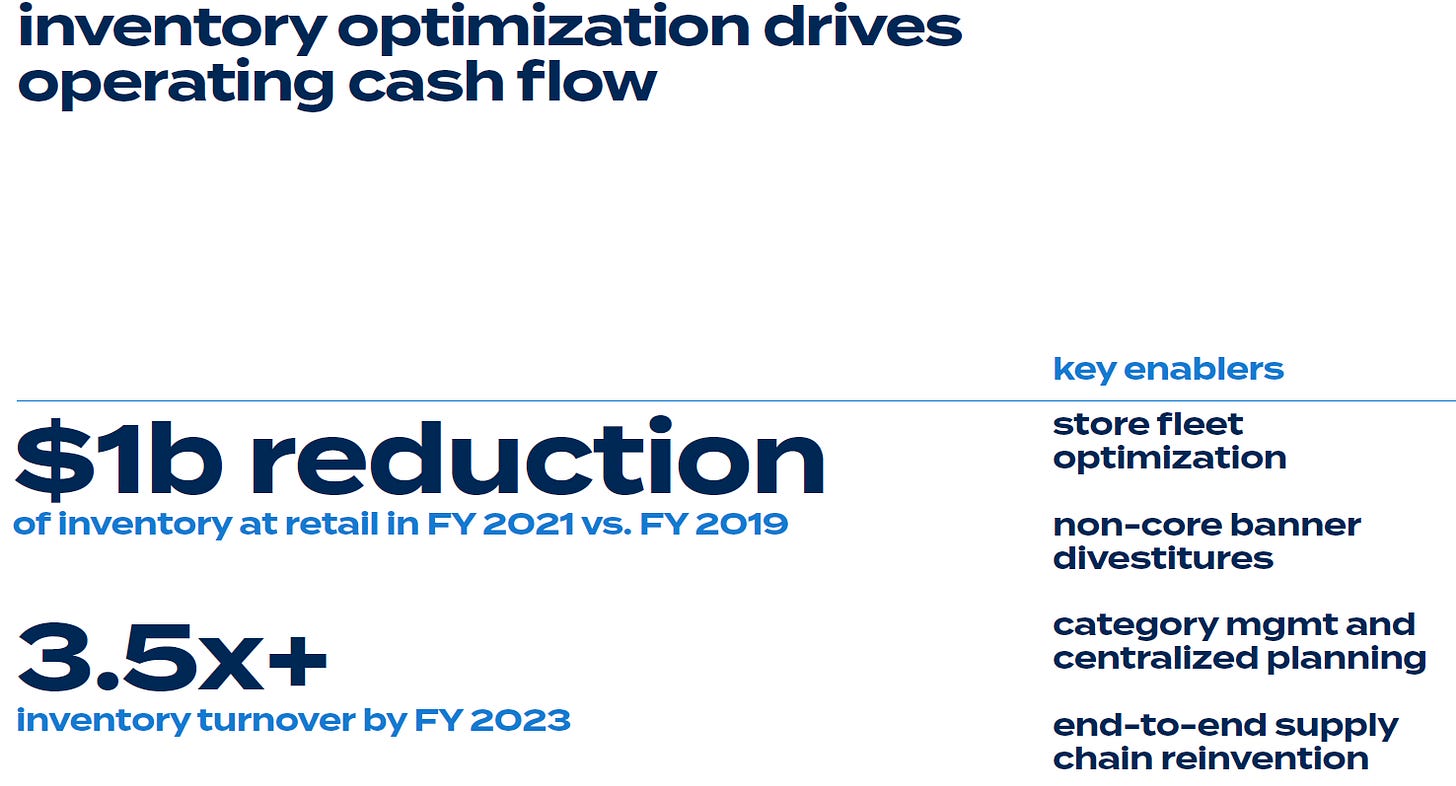

The first is inventory turnover. You can go back to the company’s 2020 investor day for more, but I estimate there’s still hundreds of millions of dollars of excess inventory on the company’s balance sheet if they can hit their inventory target (it’s difficult to give an exact number because the store closures, supply chain issues, etc. put a lot of noise in the analysis). Cutting inventory should improve COGS (less write offs) as well as freeing up cash that can be used for more share repurchases.

The second lever would be financial engineering of some form (beyond just continued buybacks). I think the most obvious would be spinning off their buybuy BABY segment; buybuy BABY is seeing solid growth and has a long runway ahead of it. These types of category focused growth stories can get very high multiples as a standalone company, either selling to a strategic or private equity player or simply spinning off into a standalone stock. But BBBY as a whole could be a buyout candidate as well; we’ve seen lots of private equity interest in the retail space recently (Michael’s, Sportsman’s, At Home); none are perfect comps for BBBY but in general they point to take out multiples for BBBY that are well above where it currently trades (particularly if you start giving them credit for their 2023 targets).

There are a variety of other levers and upside opportunities the company has. The “digital marketplace” and Kroger partnership could create tons of value if operated successfully; I’m skeptical but it is a reasonably low risk option. Private label brands, which are higher margin, are growing, but they were still just over 20% of sales in Q2’21. I don’t see why that number isn’t significantly higher in the long run, which would improve margins and likely customer loyalty as well.

But this story is really about how cheap the stock is, the capital allocation, and executing on the 2023 plan. If those three all come together, the stock is a multi-bagger from here and everything else is pure gravy. If they don’t work, then the stock is somewhere between fairly valued to overpriced (depending on how poorly those initiatives go) and all of those upside options won’t matter because the company will be too busy trying to turn around to deliver on growth options.

Four bonus points before I wrap this up:

BBBY indicated their long term target for leverage is <3x gross debt to EBITDA (see p. 155 of their investor deck). One of the nice things about a leveraged buyback model is that as your earnings go up, you continue to take on more debt to buy back shares and keep your leverage constant. I haven’t assumed any increase in share repurchases or anything beyond this year, but given the cash flow generation + the leverage commitment + how they’ve approached buybacks so far, I’d guess they continue to return capital through repurchases as earnings grow and the repurchase numbers needed to keep leverage constant could get pretty silly if they get anywhere close to their 2023 EBITDA targets (which call for EBITDA going from ~$450m currently to >$900m).

BBBY had a poor Q2’21, and that drove a lot of the recent stock swoon. There were lots of reasons for the poor results, and management suggested many of them were one time. My personal favorite was that cutting back on printed circulars hit their traffic; long time value investors will remember JC Penney pursued a similar strategy to disastrous results in the Ackman / Johnson years.

I’m always hesitant to mention options on the blog; options are extremely risky. You should remember nothing on here is investing advice, and I’ll disclose I have a (small) position in BBBY and BBBY options. All that said, like many meme stocks, BBBY has volatility that is off the charts. For instance, the December $15 puts last traded for ~$0.55. If you sold those, you’re getting just under 4% return in exchange for providing insurance BBBY doesn’t go below the price it was trading at before they announced the increased buyback with the next ~month and a half. The IRR on that is pretty crazy. Or you could buy the stock and write December $30 calls against them for >$2/share. With the stock currently at ~$22, you’re getting almost 10% of your principal back in exchange for selling your stock if it goes up 40% in a little over a month. Again, not investing advice, and you should remember options carry heightened risk, but the volatility is so high here that I think you can express a variety of different views in really interesting ways with the options.

Note that I highlight the December options for a reason: BBBY’s current fiscal quarter (Q3) ends in November, and they generally report results in early January. So the December options are trading with incredibly high volatility, but they expire before the company is scheduled to release any financial information. Obviously that doesn’t mean there won’t be news; the company could do a pre-release, or sales tracking data could give good insight into black Friday sales. But I think the high volatility before scheduled fundamental news is interesting, and given the aggressive share buybacks my guess is the next fundamental piece of news for BBBY is much more likely to be positive than negative.

I am far from an expert in the retail space; I’ve obviously done work on both BBBY specifically and the retail sector in general, but if you’ve done work on the company that differs or reinforces my views here, I’d love to hear from you. Feel free to shoot me an email (if you got this through email / substack, you can just reply to this message) or head over to Twitter and slide on into my DMs.