Weekend thoughts: boardroom drama at $CANO

Stocks represent ownership stakes in an underlying business. Ultimately, enough ownership can be turned into control at those businesses, and control can result in decision making powers. The right or wrong decision managing those businesses can be the difference between creating generational family wealth or eventually filing a company for bankruptcy, so control can have huge value when there’s a difference of opinions on the right path / strategy for a company.

With that much money on the line, sometimes you’ll have a fight for control at a company spill into the open / get taken to shareholders.

Typically, these fights are pretty dry. An activist disagrees with the direction management is taking a company and pushes to take control of the board and fire management, management (obviously) disagrees, both sides take their reasoning to shareholders and the proxy advisory firms, and the shareholders vote and decide a winner.

Of course, sometimes things can get a little colorful:

Arconic’s CEO had to step down after making some veiled threats to Elliott during their proxy fight.

Starboard’s proxy fight against Darden was headlined by the bombshell accusation that Olive Garden was no longer salting their pasta water.

After their father passed away, two sisters aligned to oust their brother from RDI’s CEO spot in a “massive power grab”

Canadian cable telecom giant Rogers briefly found itself with two boards of directors in a bitter family power struggle.

So, yes, with (potentially) billions of dollars on the line, things can get a little colorful sometimes. But in the past month, we’ve seen proxy fight / board contest situations at Cano Health (CANO) and Cutera (CUTR) that I think would rank towards the top of any “wild corporate fight” lists.

Let’s talk about CANO today; I believe I’ll be doing a podcast on CUTR with Vince Martin from Overlooked Alpha (who wrote CUTR up here) on Monday, so I might just fully cover CUTR in the podcast or I might do a follow up post on CUTR tomorrow as I prep for the podcast!

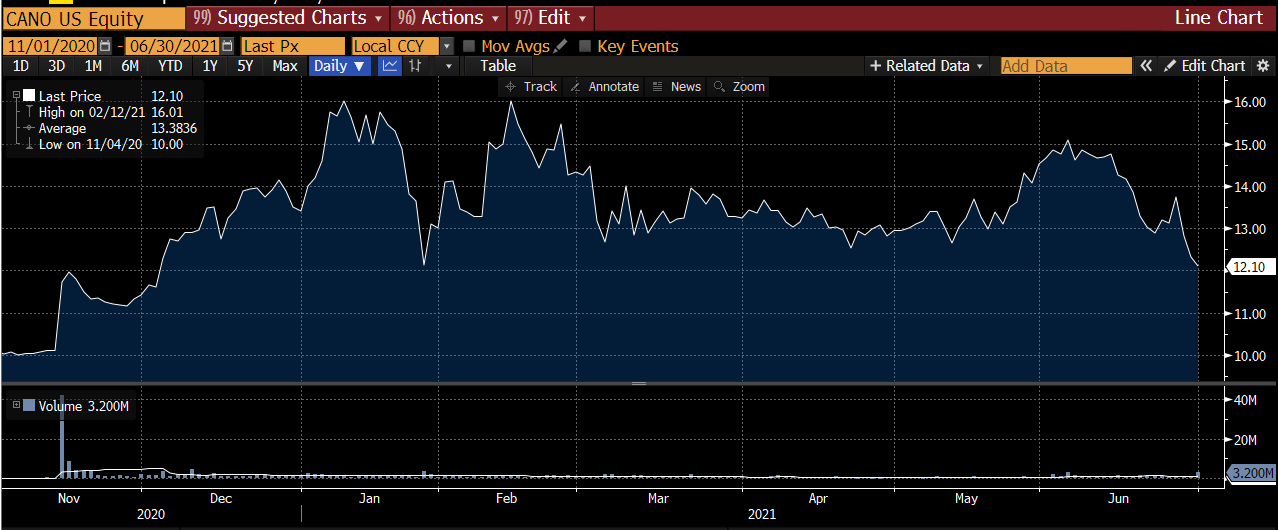

To fully cover the CANO story, we have to go all the way back to November 2020. CANO went public through a merger with JAWS, Barry Sternlicht’s SPAC. Remember that this was maybe a month before SPACs started really taking off; in fact, I think you could argue the success of CANO is one of the (many) things that led to the SPAC bubble we got in early 2021. JAWS and CANO announce their merger in November, and the stock immediately pops. By the end of the month, JAWS is trading for ~$12/share (versus a pre-deal price of $10, roughly mirroring its trust value), and the stock would go as high as ~$16/share by early January 2021. The CANO / JAWS deal closes in early June 2021 with the stock trading around $15/share.

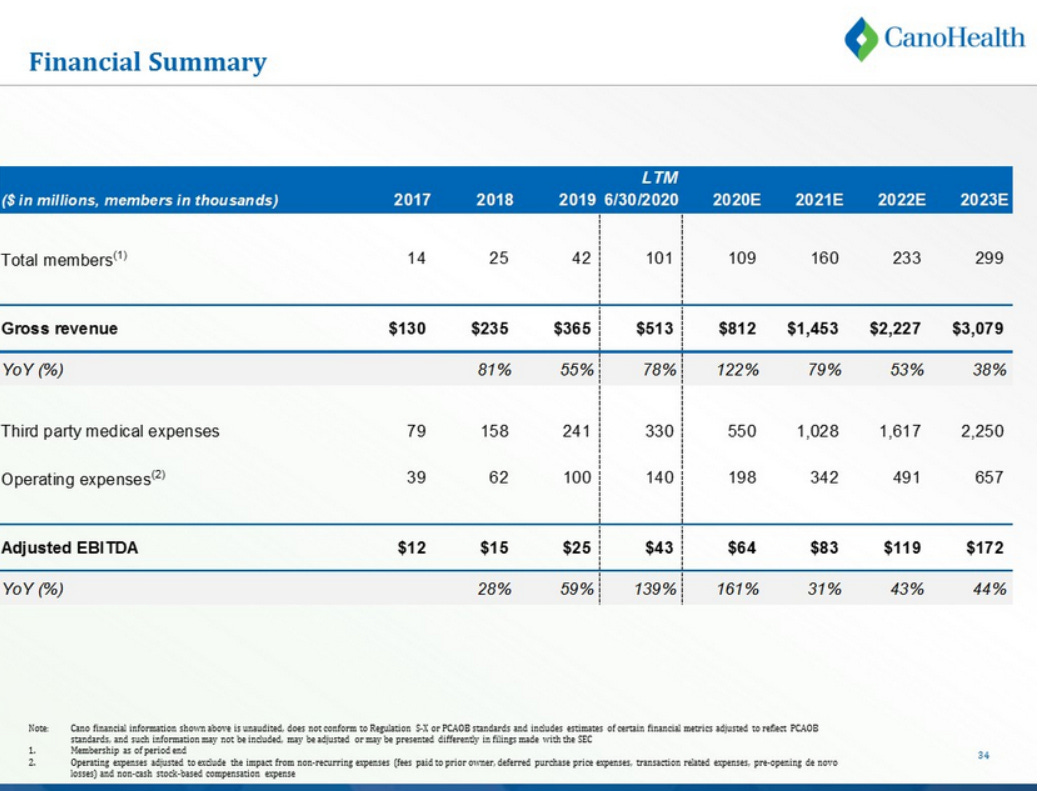

And it’s no wonder the market loved the CANO / JAWS deal; it had everything a growth oriented market wanted. JAWS had a buzzy sponsor, and they were bringing a consistently profitable, rapidly growing healthcare company in CANO (slide below from their merger deck). Remember, this was November 2020; the vaccine had just been approved and COVID was still towards the top of the news cycle. The market was desperate for rapidly growing and profitable healthcare companies.

But CANO wasn’t just any rapidly growing + profitable healthcare company. CANO was led by Marlow Hernandez, who was just 35 and who Barry Sternlicht called “the Elon Musk of healthcare.” That quote is from the JAWS / CANO merger call; I highly encourage you to read it because it is just so glowing about Marlow and CANO and really puts what has happened here into perspective.

Anyway, the CANO / JAWS merger closed in early June 2021, and things don’t go great from there. CANO is just incinerating cash as they grow, and with interest rates rising that cash incineration starts to get a lot more expensive. On top of the cash burn, CANO needs to delay its first annual earnings as it looks into some accounting and revenue recognition issues.

The combination of fast growth, accounting issues, and cash incineration is never a good sign. Fortunately for CANO, the industry is undergoing a wave of strategic deals, and multiple investors call for CANO to explore selling themselves to a strategic. CVS entered late stage talks to acquire CANO in the fall of 2022, but they eventually pulled out and caused the stock to tank (full disclosure: I wrote about the company then and took a bath on that trade!).

It hasn’t gotten any better for CANO since CVS pulled out. The stock has continued to collapse as no other strategic players stepped up to the acquisition plate and the company needed to do some wildly expensive debt funding in order to avoid a restructuring.

Which brings us to the present. In late March, Barry Sternlicht resigns from CANO’s board. His letter is well worth a read as it’s one of the most inflammatory letters I’ve seen in the public markets, but the highlights include calling out board members “who appear willing to support the CEO at any cost,” noting he “can no longer lend my name and reputation to the Company,” and he’s “never witnessed such poor corporate governance at any company, let alone a public company, and I have been involved in at least nine and served as Chairman or CEO of six.”

Things move fast from there. CANO responds to Barry’s letter by calling out his “reckless” resignation, while Barry and the other directors who resign enter into a 13-D group that covers >35% of CANO’s stock. It’s particularly worth calling out Lewis Gold’s resignation letter. Why? Not because it’s pretty damning (though it is pretty damning for CANO’s board!), but because he clearly wrote the whole thing up on his iPhone and didn’t spell check or proofread any of it (it says “sent from my iPhone” at the bottom, the capitalization through the whole letter is wonky, and he talks to “u” several times). The man is waging a multi-billion dollar activist battle from his iPhone. Incredible.

But Dr. Gold’s iPhone letter is where things start to get really juicy. For the first time (at least as far as I can see), the letter reveals the board was investigating some truly questionable transactions related to the CEO. These include secretly borrowing “30 million dollars from an executive whose practice Cano acquired and who is a direct report” without feeling the need to disclose the borrowings, related party issues relating to the CEO’s father’s involvement in CANO builders and marketing endeavors, and other undisclosed related party issues like On Site providing all dental services to CANO despite “the CEO’s wife owning a significant equity position in the company.”

Failing to disclose related party loans and deals with family members? CANO’s CEO really is the Elon Musk of healthcare!

In response to the Dr. Gold letter, CANO’s CEO quickly pays down the $30m related party loan in question by transferring ~20m shares valued at $1.50/share. But even that transfer is interesting; it includes an agreement that lets the CEO repurchase the shares for 1 year at $3/share.

CANO’s stock is currently trading for ~$1.32/share. The CEO paid down a loan and specifically negotiated the right to buy back the stock at $3/share. That’s a strange, strange thing to negotiate…. but if you throw it into the (newly revealed) history of the CEO’s related party dealings, you have to wonder if he negotiates for that call option with some line of sight to turning that call option “in the money” (likely through a sale of the company at a big premium). That line of thinking is particularly interesting given the share for loan paydown deal devotes two full paragraphs for how to handle paying off the call option in the event of a company sale or merger.

The Sternlicht group follows up on that debt paydown by absolutely blasting CANO, noting that many of these arrangements have not been disclosed and questioning whether they would have been disclosed if the company weren’t getting called out by former board members.

That filing basically brings us to today. I have no firm takeaways or predictions here; if I had to guess, I’d think management tries to sell the company quickly in order to save face before the Sternlicht group replaces them in a proxy fight and fires everyone, but given the level of dysfunction here it seems like everything and anything could happen.

So no firm takeaways… but the whole thing was so wild and happened so quickly I wanted to document it for people who hadn’t seen it.

Between the CANO and CUTR situations, it’ll be an entertaining couple of months in the proxy world!

High finance, Hi Drama

- Sent from my iPhone

Ah ah ah "sent from my iphone" reveals the real level of many of those guys involved in multi millions transactions...