The $WWE / $SPOT tag team, part 2 (WWE)

Last week, the WWE and Spotify announced a deal where Spotify’s The Ringer will team up with the WWE to launch “an exclusive audio network.” The WWE and SPOT are two of my favorite companies, and I thought that tie up really illustrated lots of the reasons I like both, so I wanted to put some pen to paper on it. I already released part 1 covering the tie up from the Spotify side here; today I’ll be diving into the deal from the WWE side.

The reason the Spotify / WWE deal interests me so much is because I think it illustrates the continued optionality brands that command significant consumer mindshare will have. Netflix has famously said (and I believe they stole this from Matthew Ball) that their competition isn’t Disney+ or HBOMax; it’s everything else that a consumer can do (sleep, play video games, read a book, etc.). Every playform in the world is starting face that type of issue; these platforms are absolute machines at monetizing you when you’re spending time on them, but they need something to hook you in and get you to continue to spend time on them.

There are few entertainment brands that some segment of the population loves so much that they will follow it / find it no matter where it is. Marvel is one of them and (despite J.J. Abrams’ attempt to butcher the latest trilogy) Star Wars is too. Elite athletes like LeBron James and Steph Curry would certainly qualify. But there aren’t a ton of those brands, and the few that are out there are either spoken for (like Marvel / Star Wars) or just one person who can only do so much (like Lebron / Steph).

That’s why the WWE is so great as an investment to me. The company / product is not for the majority of the population, but for the people it is for, they absolutely love it. I’m not a die hard fan (outside of flipping on a few highlights when researching the company; I don’t think I’ve watched a show since I was ~12, but I was a hardcore fan when I was a kid, so I still have some attachment to it), but I went to Wrestlemania a few years ago when it was in New Orleans and had an absolute blast. It was like the Super Bowl; every person on the flight to New Orleans was going to Wrestlemania, and you could pretty quickly identify them because they were decked out in WWE merch (and often were covered in tattoos connected to the WWE). (PS- WWE is in Dallas in 2022, and if I can get tickets, I’m planning on going. You know, for due diligence. If you’re making the trek, let me know!).

So what the WWE has is die hard fans who will ravenously consume their content and follow them to any platform. That will give them unbelievable monetization opportunities going forward, and it means that every time the rights to WWE’s properties come up (i.e. the rights to air Raw, Smackdown, etc.), large platforms are going to be desperate to throw gobs of cash at the WWE because getting their rights guarantees a legion of passionate fans will sign up for and use your platform on a consistent weekly basis.

I’m going to dive into a lot of the ways that optionality / monetizing fan passion can play out for the WWE, but I want you to keep one thing in mind while I discuss all of it: you aren’t paying a lot for that optionality, as the WWE is very reasonably priced. At current prices (~$50/share), the WWE’s EV and market cap are ~$4.3B (assuming their deep in the money convert debt converts, they are basically net debt neutral). Guidance for this year is ~$285m in OIBDA (though I suspect that is a little low). This is a reasonably capital light business; annual capex should be $20-30m/year (it’ll be higher in the near term as they build a new headquarters, but that’s very much a one time thing), and adjusted OIBIDA excludes ~$30m in annual stock comp. All in, depending on how you treat the stock comp, the company is trading for a mid to high teens OIBDA multiple and less than 20x unlevered free cash flow. In a world of zero interest rates and for a company whose earnings should be reasonably recession resistant (they just put up record numbers in the midst of a pandemic that stopped them from doing live shows!), that seems like a reasonable valuation!

Again, that’s not screamingly cheap, but it’s reasonably valued. I’ll just add three things to that valuation:

The WWE has been impacted by COVID. It is really strange watching strong men in their underwear preen around in a ring without an audience (seriously, watch Gronk make his WWE entrance to an empty stadium right at the height of COVID to get a feel for how weird it was. High comedy now, but sobering to think back to those dark days!), and the WWE lost tons of merchandise and live ticket sales. Those aren’t mammoth profit drivers versus the TV rights deals, but as they come back results should naturally inflect higher.

The WWE’s guidance during Q2’21 noted “During the second quarter, key performance metrics demonstrated positive trends, and the Company continued to realize better-than-expected television production efficiencies, stronger sponsorship sales, and heightened demand for its live events. However, management is not adjusting full year 2021 guidance at this time given ongoing caution regarding the potential impact of COVID-19 and its variants on WWE’s operations,” so I’d guess they ultimately smash these guidance numbers, which will put the effective multiple a little lower.

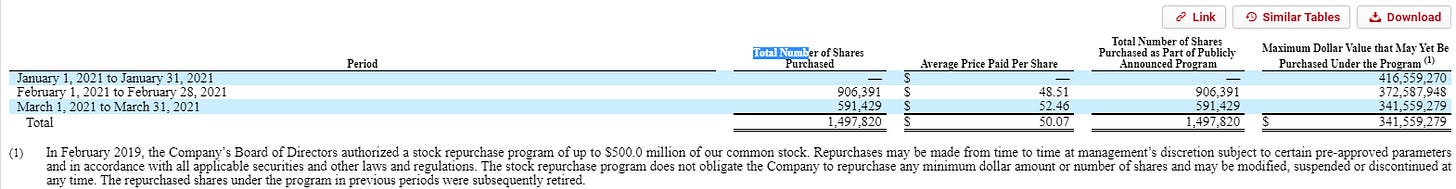

The company seems to agree with me on their undervaluation. After years of paltry share buybacks, the company has started to repurchase stock. And I like how they’re going at it; they repurchased at a casual pace in Q2’21 when the stock was in the mid to high $50s (that pace would retire ~1-2% of shares out every year), and an aggressive pace in Q1’21 when shares were in the high $40s / low $50s (that pace would take out 5-10% of shares out every year, depending on how you annualize January when they weren’t in the market). Tables below from the company’s 10-Qs:

Anyway, I want this discussion to be more qualitative than quantitative, but I wanted the WWE’s reasonable valuation to be in the back of your mind as we talk about some of the WWE’s upside optionality.

The first and most obvious upside for the WWE is in their TV rights. The currently hayve three major TV rights deals: with Fox for Smackdown @ ~$205m/year; with USA for Raw at ~$265m/year, and their recent PPV and library deal with Peacock for ~$200m (source for Raw + Smackdown; here’s the company’s PR announcement when they struck the Raw/Smackdown deals).

Those rights are set to expire in 2024, so they’ll probably get renegotiated between late 2022 to early 2023. I’ve seen lots of handwringing on how that negotiation will go; some people think the WWE will see a down round. I’d suspect the market is currently pricing in a flat to slightly up round.

I strongly disagree; I think the WWE is going to see a nice uplift when their next deal comes on. In fact, I wouldn’t be surprised if a major media conglomerate (cough Comcast cough cough) decided to buyout the WWE as the rights negotiations went along. That assumes that the McMahon family (the WWE’s controlling shareholders) would be willing sellers; I think they’re open to it at a massive premium but I’ll discuss that later.

Why do I think the WWE will see a rights bump in their next deal? The WWE is a brand that draws hyper passionate audience. I think those brands have historically been under-monetized versus their potential due to the “opportunity cost” posed by the time constraints of the legacy cable bundle; as we move more to a streaming world, that opportunity cost goes away and large streaming platforms will pay huge premiums for things like the WWE that are guaranteed to attract a small but hyper passionate crowd.

An example might show this best; in the old days, cable channels had to balance two things: ratings and fan passion. All else equal, cable channels of course wanted ratings higher; higher ratings meant more eyeballs for advertising dollars, and it was a nice stick when you went to cable companies to negotiate carriage fees. Fan passion / engagement was critical to negotiating cable contracts; high ratings are nice, but what you really want is programming that fans love so much that they will call your cable channel and say “I will cancel my service / switch providers if you do not get this programming back on now.” That’s why football programming has been the holy grail for cable channels; it draws mammoth ratings and attracts an incredibly engaged audiences (I can’t remember where, but one network exec once cracked that there’s a reason most carriage disputes end on a Friday before football airs).

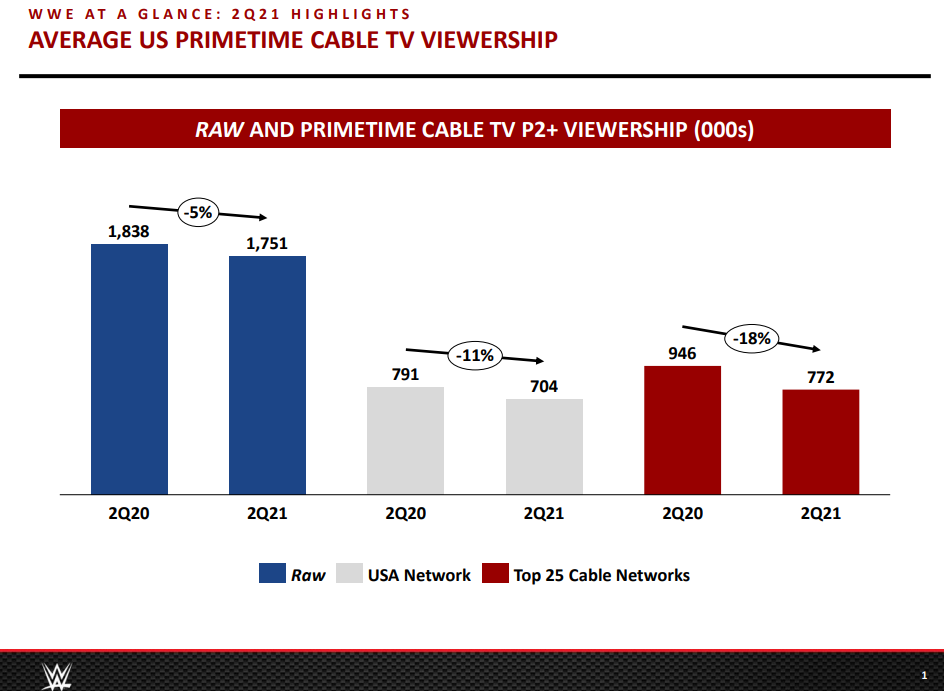

The WWE scores great ratings for fan passion, but as far as viewership goes it’s pretty bleh. For example, right now Smackdown is averaging ~2m viewers per episode. That’s nice, and those viewers are highly engaged… but it’s basically in line with what an average primetime broadcast show is grabbing.

In the legacy cable bundle, time slots are limited and networks have to bid with their opportunity cost in mind. If they bid for Smackdown, they’ll get 2m passionate viewers in that time slot…. but they could instead put a Friends rerun on, which might also get 2m viewers. Or they could take a shot on a new program, which could be a breakout hit like the Walking Dead or Breaking Bad that redefines a network. Or they could save money and air some lower cost rerun (NCIS? Law and Order?) that eats time; it might not draw a lot of viewers, but it won’t cost a lot. (Note: I choose Smackdown, which airs on Fox, here because its average is inline with network TV averages; Raw airs on USA and outperforms an average cable show. So you could start getting into technicalities and hair splitting over if WWE outperforms reruns and stuff; I was just simplifying to drive the point home!).

Anyway, here’s my thesis: in the legacy bundle, networks faced opportunity cost of time / limited TV slots. In the streaming world, they have no such constraints. It’s not an “either / or” proposition, they could get Friends reruns and launch a buzzy new show and bid for Raw. So, in the legacy bundle, you paid huge premiums for things like football, which attracted hyper passionate fan bases and huge audiences that were way in excess of the “opportunity cost” of airing a Friends rerun. You could see that premium if you compared how little the WWE was getting “per eyeball” versus other live sports. In a streaming world, the most important thing is fan engagement and passion; my bet is that if you have two properties with relatively equal engagement / passion, then a streamer will pay roughly the same cost per eyeball for a smaller property (like the WWE) as they would for a larger property larger property (like the NFL). If that’s right, then the massive monetization gap between the WWE and “real” sports should close over time, and the WWE is going to see a continued massive increase in their rights prices. (I’ll note that, as far as I know, that’s a reasonably original thesis / thought on my end. I know other people have said “the WWE can close some of the gap to other live shows”, but I haven’t heard anyone articulate the gap like this. I say this because it’s an out there thesis and if anyone has said something similar or done a rebuttal, I’d love to see it / discuss!).

So, for example, ESPN’s new MNF deal will cost $2.7B annually; that deal gets them 23 regular season games as well as two super bowls, two playoff games per year, and some other rights. Those extra goodies are obviously very valuable, so it makes a direct “cost per eyeball” comparison a little difficult (i.e. if you pay $100 for 100 viewers, you’re paying $1/viewer), but we can make a rough guess. MNF is averaging ~15m viewers. A divisional round and wildcard game get 25-30m viewers, and the Super Bowl gets ~100m. They get two superbowls over the next 10 years, so let’s average the Super Bowls and say the Super Bowl brings them another ~20m eyeballs/year (100m viewers * 2 Super Bowls divided by 10 years). All in, ESPN’s contract brings in ~420m viewers / year, and they’re paying ~$2.7B annually, so I’ve got their cost per viewer at ~$6.43. What you really care about is the cost / viewer hour (a football game lasts ~3 hours, so you need to adjust that cost when comparing to, say, a 30 minute TV episode); assume a football game lasts 3 hours, and ESPN is paying ~$2.14/viewer hour for MNF.

How’s that compare to WWE? Again, we know the value for the WWE deals- $205m/year for Smackdown, $265m for Raw. Let’s focus on Smackdown since the numbers are really clean / easily divisible. Smackdown is a two hour show, and it’s doing ~2m viewers/show. Smackdown runs every Friday night, so you get 52 shows a year. Put it all together, and I’ve got the cost of Smackdown at just under $2/viewer, or just under $1/viewer hour.

Again, that’s not an exact science. I don’t have access to all the internal data that I’m sure TV execs do, and I’m not accounting for all of the shoulder programming that is super valuable for football (pregame, postgame, etc.), nor have I included the value of highlights rights that often come with football packages. On the other hand, the WWE is year round, which is probably nice for steadiness of demand. That’ll be important in a full streaming world; the WWE’s year round nature will massively reduce churn, while a service with football rights might face issues with customers churning right when football season ends and then needing to go reacquire those consumers every year.

Anyway, it’s not perfect, but I think it’s directionally correct. As a spot check, I have an old JPM report (from 2018; remember, that’s before the new MNF deal that increased ESPN’s cost but gave them several extra games) that analyzed the cost per hour for different sports properties; directionally, their numbers point to the same conclusions as mine (I read almost no sell side research; I’ve just got this 2018 report lying around. If someone has an updated chart or anything, I’d love to see it!).

So bottom line is that WWE gets a substantial discount per eyeball to football. But it’s not just football that the WWE gets a big discount to; since that JPM chart above was published, we’ve seen cost inflation for most sports properties; the MLB’s new deals saw nice cost inflation (their ESPN deal saw its cost drop but included much fewer games, so their cost/hour went way up), NHL got a nice increase in switching from NBC to ESPN (CNBC said the NHL deal was more than double their previous one once you factored in Turner’s side; given NHL was next to WWE in lowest cost/eyeball in that JPM chart, that deal provides real ammo to me that the WWE deal remains way underpriced / has a lot of upside next go round), and the rumor is the NBA is looking to almost triple their deal value when it comes up in a few years.

Put it all together and I feel pretty strongly the the WWE is going to see another big step up in rights when their U.S. deals get renegotiated again in the next few years. Increases in right dollars should be extremely high margin (ther’es basically no incremental cost associated with them), so even a small increase in rights would result in a big increase in profits. Right now, the WWE is getting ~$470m combined for Raw and Smackdown. I think they could get a >30% increase on those rights; I wouldn’t be shocked if it was more given the dynamics I listed above and how I think there’s going to be a continued knife fight among streaming platforms for customers. But let’s just say the WWE got a 20% increase, which would come out to ~$100m, and the incremental profit on that increase is 50% (I have no idea why it wouldn’t be way higher). That means renegotiating the streaming deals would increase the WWE’s OIBDA by $50m. Earlier, I showed the midpoint of the company’s OIBDA for this year is $285m, so we’re talking about a potentially mammoth increase in earnings in one swoop for the WWE. And, again, I think those numbers are conservative: run the math for if the WWE gets a 30% bump and incremental margins are 80% and suddenly you’re talking about earnings going up by >$100m. That’s a massive bump, and the WWE starts to look real cheap if you think they can get there.

That was a very U.S. focused lens, which makes sense because the WWE is a U.S. focused business and that’s where most of their earnings come from. But the WWE is a global business with global rights, and they are making a concerted effort to increase their international fan base. I suspect all of the same dynamics I discussed here will apply to the rest of the world; in fact, given the WWE is likely to have smaller but more passionate fan bases outside of the U.S. (it’s hard to casually follow the WWE or any sport if you’re in a completely different time zone, so if you’re following it internationally it’s probably because you’re a real fan), the passion dynamics internationally might apply more so then here. The WWE has seen some success with increasing international rights over the years, but I suspect going forward the combination of these dynamics and their focus on increasing their international presence will pay real dividends in continued international rights increases.

This post is running super long (I get passionate talking about sports rights and the WWE!), but I wanted to discuss one more possibility and then wrap this up (I might have to do a follow up post next week to discuss some other things the WWE has that I think are misunderstood): the possibility the WWE gets sold when their negotiating their next rights deal.

Obviously, speculating on a sale is always a long shot. People has speculated Vince was a seller for years, and he never has been. And most of the language I hear from Vince and his children suggests they want to keep this in the family for the long term.

But I thought it was curious that the WWE’s new President (Nick Khan) floated a “we’re open to a sale” bubble recently. I can’t claim to know him, but I’ve been impressed with the creativity he’s brought to the job so far and, from what I can understand, he is a political animal. Anyone who follows the WWE knows that Vince rules with an iron fist and is not afraid to fire people who piss him off, and I would think a political animal would know that floating a sale bubble is the type of thing that could really piss Vince off. So I think that sale bubble thought would be floated very strategically.

Here’s my thought: the WWE knows it’s going to negotiate its next deal from a position of real strength, and there may never be a better time for them to look to sell. I think that sale bubble was floated strategically to say to bidders “now’s the time boys. Lock us up before our rights come up and we sell them for a huge premium to multiple platforms.”

If the WWE was for sale, I think the bidding would be pretty intense. Disney and Fox would be natural acquirers with nice synergies. There would probably be a few other strategic sniffing around (Paramount is partnering with WWE on Rumble, which will premier next year, so throw Viacom into the mix!), I think a private equity firm could make an interesting case for them, and the WWE is a lower end trophy property so I wouldn’t be surprised to see a few billionaires who have been shut out of the sports team ownership game lob in a bid to stroke their ego. But if you’re talking acquirers, Comcast would be the player to beat. They already have the rights to Raw and WWE’s PPVs, and the WWE has its own vertical on Peacock (I’ve got a screenshot in the tweet below; the top of Peacock’s home page has featured, movies, tv shows, sports, WWE, then news); giving the WWE its own vertical is a big investment. If Comcast lost the WWE’s rights, that would be a massive blow.

Anyway, a sale is a long shot. But I can’t help but think that sale bubble was floated for a reason, and I’m very confident that the WWE would be in huge demand if it was actually for a sale. With all of these streaming platforms desperate to attract and retain passionate viewers, I’m not sure there’s ever been a better time for the WWE to explore a sale. If a sale happened, Comcast would probably win, but only after they paid an enormous premium to lock the WWE down. And remember: Comcast is not afraid to pay a big premium for properties they consider strategic (often to the chagrin of their shareholders). Look back at the multiples and premiums they paid for Dreamworks and Sky in the past decade. If the WWE really got sold, I would not be surprised to see a similar premium. Heck, Vince is a competitive guys. The WWE’s all time high is ~$100/share. He might demand a premium to the all time high to sell the company…. and given what I think will be a very competitive bidding process, lots of natural synergies with a variety of players, the scarcity of content with fan passion like the WWE, and super cheap cost of capital for all of the strategic buyers, he might just get that premium!

Odds and ends

I’ll highlight my podcast with Mario Cibelli on the WWE from earlier this year. Mario’s a super clear thinker, and he covers lots of goodies on the WWE with the perspective of someone who has invested off and on in them since the stock was in the single digits!

Similar to what I did for MNF, I tried to back into some math on regional RSN cost/eyeball and the SEC’s new deal; my take is that WWE is a bargain compared to both but I was ending up with just too many assumptions to trust the numbers (and RSNs have really unique dynamics that don’t apply to WWE or other national sports, but are a little instructive when thinking about the value of passion!). I’ll give you the info I was playing with in case you want to try yourself.

For the SEC: their new deal gets “low $300m” per year for 15 football games, 8 basketball games, and the SEC championship game (in football). Football is the prize here; typical Saturday games get ~5m viewers, while the SEC championship game gets ~15m viewers (though it got just 9m last year). SEC basketball tourney games get maybe 3m viewers.

For RSNs: I was using the Royals (Kansas City) new $50m/year deal. They get 40k viewers per game.

A little stale, but the WWE used to provide their ratings versus NASCAR / NBA / NHL (scroll down to the ~5th tweet). It’s interesting to comp the WWE’s ratings versus NHL’s and then see that the NHL is getting more money than the WWE does for Smackdown + Raw combined.

The other thing I see people worry about with the WWE is new competition from AEW. AEW just signed former WWE super-super star CM Punk to a deal and got a lot of buzz when he made his debut. The history of competitive leagues, whether you’re talking wrestling specifically or sports in general, is the competitor can’t break the legacy players larger size and historical engagement with fans. AEW has <700k twitter followers; the WWE has 11.5m and their defunct WWE network has 1.7m. We’re simply comparing a tiny fish to an international whale when we talk about those two.

If I do another post, the direction I wanted to highlight is all of the other optionality the WWE’s brand and scale gives it. I just think that, as the internet continues to scale, great brands are going to have new monetization opportunities open up all the time. Things like the WWE and MLB partnering on title belts is one small example; the ability to buy WWE merch right through Twitter is another.

I feel like I’ve seen the pace of these types of partnerships / monetization opportunities pick up over the past ~six months. I mentioned above I like the WWE’s new President / chief revenue officer; I suspect he’s the driving force behind a lot of these.

Nice post and arguments for WWE valuation. One question that comes to mind across the "value per eyeball" comparisons is what are the nature of those eyeballs. I'm not a marketing expert, but it seems that monetizing viewers would be based to some extent on the demographics of the viewer. Not just how engaged they are, but how much spending power they have. Streaming is probably less sensitive, but how much does the average WWE fan spend compared to NBA, NFL, MLB, etc.? What is the age bracket? Is it like video games where it was formerly 30-under males but is expanding (are fans sticky)? This is not attacking the thesis as it could easily still indicate WWE rights offerings go up noticeably (especially given the nature of offerings going to the highest bidder), just raising the question. Again, great work!

If you do another post on WWE. I would more then be happy to read it! Great stuff, thank you!