Tegus sponsored deep dive #4: Natural Gas (part 3: $CNX and $DEC bear cases and expert call takeaways)

This is the third in my three part series on two nat gas names, Diversified Energy (DEC) and CNX Resources (CNX). You can find part 1 (an overview of the series and why I focused on nat gas) here and part 2 (a high level bull thesis for CNX and DEC) here. I’ll also be doing a podcast with Andrew Carreon on DEC this afternoon; Andrew’s a super sharp investor who has done a lot of work on the space in general (his first podcast appearance was on BSM) and DEC in particular, so I’m really looking forward to discussing the bull / bear case with him (please shoot over any questions if you have them).

Today we’re wrapping the series up by discussing the actual expert calls I did on CNX and DEC. You can find those two calls at the links below.

I had three goals for the expert calls

As mentioned in part 2, CNX and DEC are, at their core, financial engineering and capital allocation stories that trade at huge implied free cash flow yields. Financial engineering / capital allocation stories are implicitly a bet on management doing smart things, so I wanted to talk to some people who had worked with management to see how they viewed them.

From the outside, it can be difficult to compare asset value across companies in energy. Yes, you can look at their inventory reports, cost to get gas out the ground, etc…. but I wanted to talk to some people who had experience with the assets to see if there were any red flags. It’s rare, but it can happen where you’ll talk to someone who used to work at a company who will say, “Yeah, we thought our inventory position was super shitty. I wouldn’t want to buy their inventory for half of what they carry it for.” Obviously everything needs to be taken with a grain of salt (maybe the person saying it left the company in a really bitter manner!), but it’s not unheard of that a former thinks about the company’s assets in a materially different way than the company and market present.

Related to #2: both CNX and DEC have unique bear cases around them (which I’ll discuss in a second), so I wanted to sound those bear cases out against someone who knew the assets.

I guess it’s worth throwing a disclaimer out: I did two expert calls here (one on each company). I’ve also talked to lots of people in the industry (other investors, management teams, etc.) and read plenty of filings here. Am I claiming to be the absolute ax on any of these names after a few calls? Absolutely not. I thought both these calls were really good, but there’s obviously limitations to what you can learn from just a few calls (again, you never know the bias the expert has!) and a few months of research on an industry / company.

But I will say these calls were very helpful. And I’d note that, despite sporting double digit cash flows in a hot sector, neither DEC nor CNX had a single expert call up before I did one. Cardlytics (CDLX) has 139 expert calls up (and is mentioned in another 42); I’ve looked at CDLX before and they’re certainly an interesting company, but I would guess the marginal insight from having the first CNX / DEC expert calls up is a lot higher than the 100+ CDLX call.

Anyway, the purpose of these calls was to learn more about CNX and DEC…. but each company has a specific bear case I was looking to look at further.

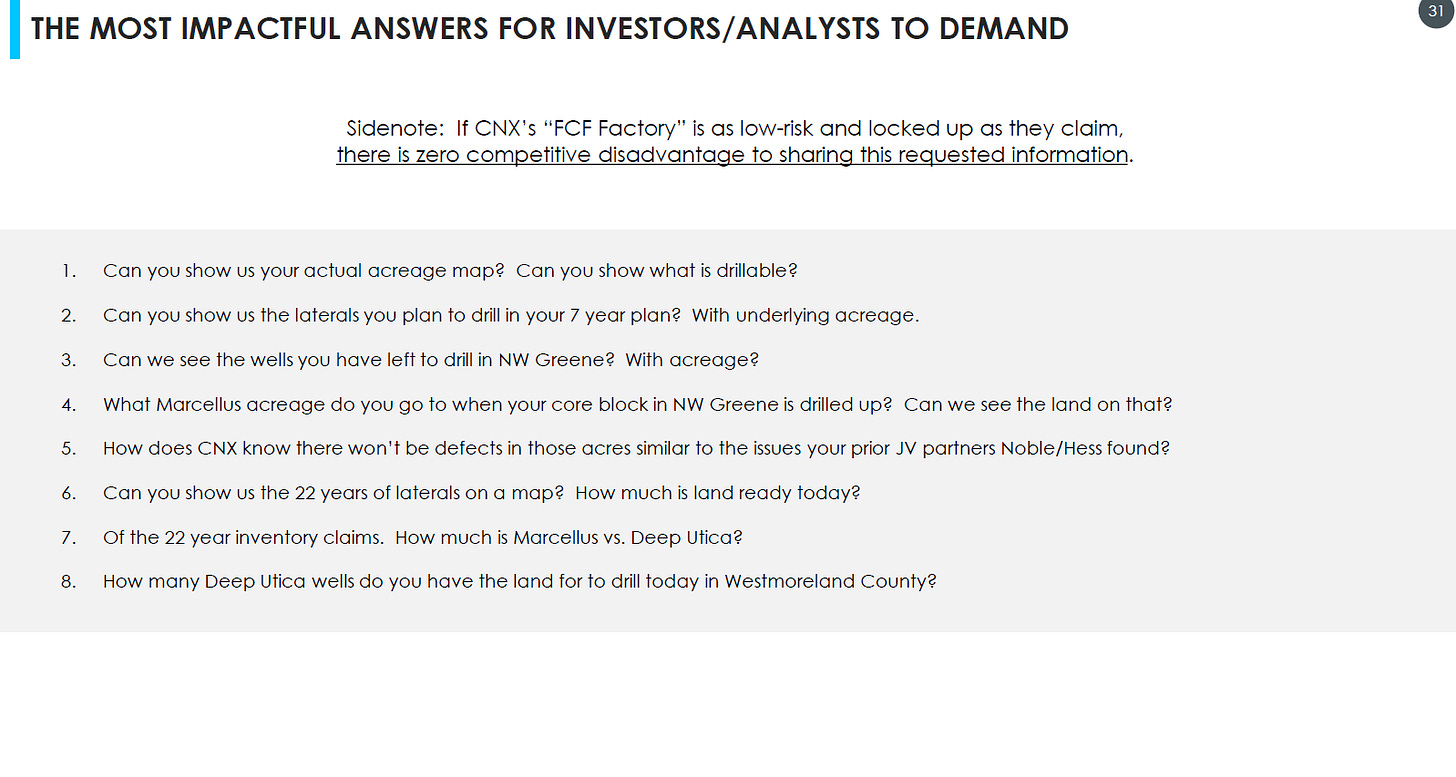

For CNX: NextwaveETF has published very bearishly on CNX’s inventory, and several other investors I talked to had lingering concerns about just how annuity like CNX’s cash flows were (the concerns were varied, but most of them boild down to some part of the Nextwave “the inventory isn’t good and they’ll struggle to replace production” thesis). So I wanted an expert who could speak to the quality of CNX’s inventory versus peers.

For DEC: I get lots of feedback, positive and negative, when I announced I was talking about DEC, so I want to make sure I cover the bear case thoroughly. There are actually three angles to the bear case, though all somewhat connect to each other

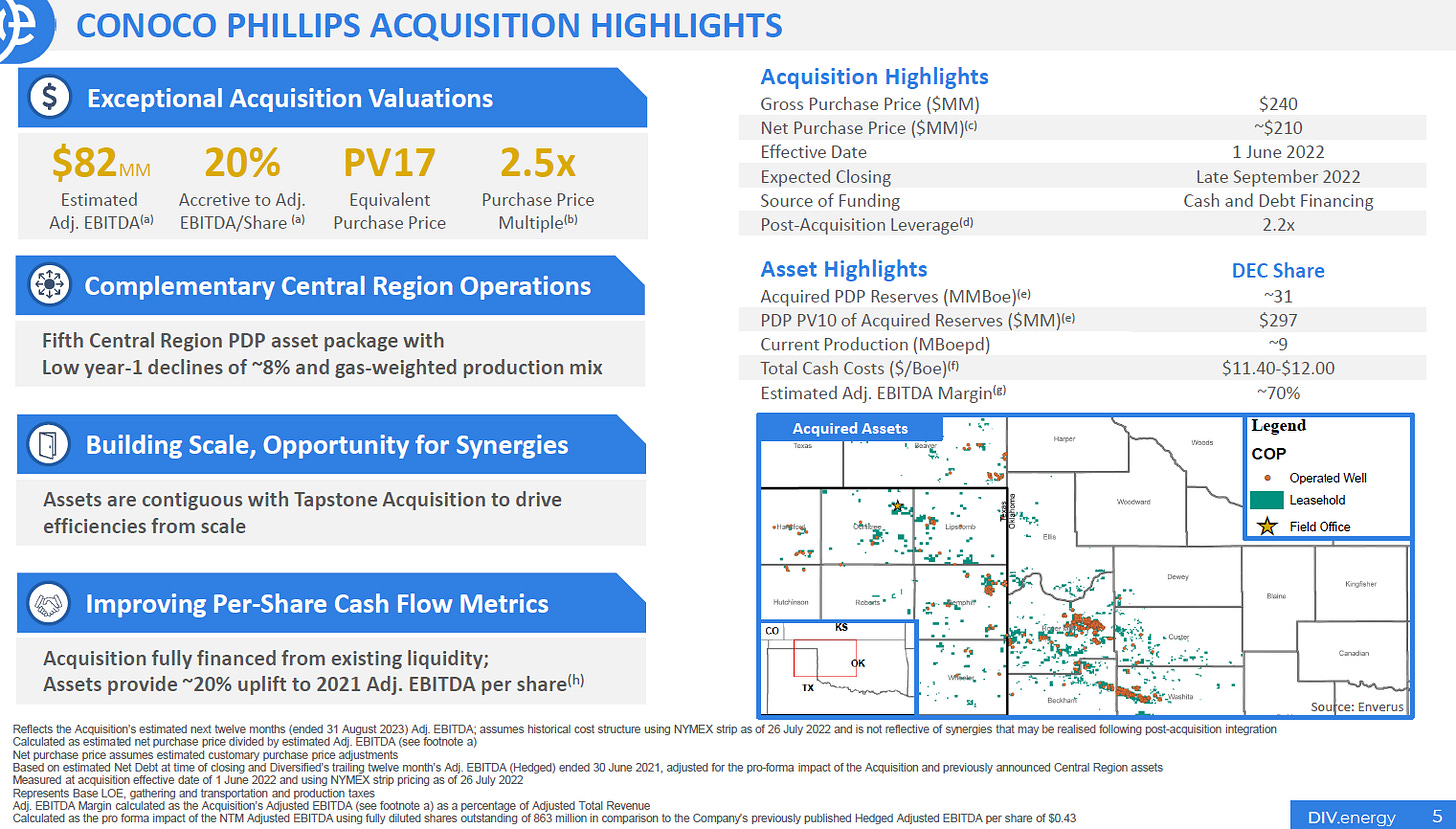

The returns and multiples DEC claims to get from buying old wells are fantastic. Many people question how they can get such great pricing. Consider DEC’s most recent transaction with Chevron: Chevron is an energy super major with an investment grade rating. They can borrow debt for almost nothing (their bonds due 2030 yield <4%). No one doubts that CVX is quite financially sophisticated and strong operators…. yet DEC is saying Chevron sold them assets for PV17 (an implied 17% discount rate on the assets cash flows) and ~2.5x EBITDA? Bears would suggest bulls are fooling themselves if they think Chevron gave DEC a good deal, which brings us to point #2….

DEC claims a cost advantage in handling asset retirement obligations (ARO). Why? DEC would say because they are so focused on asset retirement, and have such scale and focus in their target region, they can retire wells for less than other operators who don’t have the same focus / scale. Bears would say that’s crazy; DEC’s ARO costs can’t be materially lower than peers, and a lot of the “bargain” DEC claims to get in buying old assets is actually DEC underestimating how much ARO will cost them.

Note that I use “bargain” for a reason: DEC often reports that they acquired assets for less than they were worth and thus books gain on bargain purchases as income on their financials. It’s not a huge concern to me as you can just back that out, but bears will point to that as a sign of how aggressive DEC is.

There’s actually a deal between CNX and DEC that shows the first two points off really nicely. Back in 2018, DEC bought some assets from CNX. Going through the two company’s filings reveals some very interesting accounting

CNX’s 10-Q (see p. 15) notes that their balance sheet had almost $200m in ARO attached to those assets, and they took a small gain on sale in selling the assets to DEC.

In contrast, DEC’s H1’18 report suggests that the ARO associated with the assets will be ~$15m, and DEC books a ~$36m gain on bargain purchase

It’s seems crazy that two sides could claim a gain on a transaction. I mean, it makes sense if CNX thought the ARO with these assets were $200m and DEC thought they were less than $20m that each side thinks the deal was a steal, but someone is going to be proven very, very wrong eventually….

The third bear point relates to this Bloomberg article. I’ll let you read the whole thing, but the basics of the bear point are that DEC is not just under reserving their ARO, but that they are actively deficient on their ARO and leaking huge amounts of emissions because they aren’t maintaining their wells.

In fact, some bears suggest this is the whole purpose of DEC and their massive dividend: it’s basically a form of financial engineering that let’s them juice all of these properties for cash, and then stick regulators and the states with a bankrupt entity with huge environmental obligations once there’s no more cash to pay out (Bears would also point out that DEC’s size makes them “too big to fail”; they have so many environmental liabilities that states have to work with them because if the don’t DEC can go BK and stuff the states with the whole thing upfront). Byrne from the diff laid this case out nicely.

I’ll throw a bonus DEC bear point in: long time readers of this blog know I love share buybacks (“why isn’t the company buying back shares” is the opening for most of my podcasts!). DEC is a supposedly financially sophisticated investor that frequently argues they trade at ~half of NAV… yet they continue to pay out a massive dividend and don’t buy back shares. At best, that’s a frustrating decision; at worst, it lends some credence to the “DEC is just financially arb’ing the states and trying to get all of the cash out of their assets before handing state regulators a bag.” The company would counter by saying the promised to pay a big dividend when they IPO’d and that’s exactly what they’re doing…. but I think they could have slowed dividend growth and started buying back shares long ago if they wanted to.

I’ll toss in a little bonus bear point: in the middle of the 2010s, Valeant was a hedge fund darling. Valeant’s core thesis was simple: the pharma industry wastes a ton of money on R&D. Valeant was going to buy already proven assets and be 100% focused on maximizing those assets. It sounded great, and for a while it was a spectacular success. But in the end it came crashing down.

There were myriad issues at Valeant, but you could have avoided the whole thing with one simple first principal: why was Valeant the best buyer of all of these assets? What value were they bringing that the sellers could not realize themselves? The answer was none; Valeant was just pushing pricing way past the limit, and eventually the system would reject Valeant.

I bring that up because the crux of the thesis with DEC is that they can buy assets attractively, often from very sophisticated sellers (CNX, EQT, Chevron). That strategy can absolutely work; indeed, the expert call goes into why they think DEC can successfully acquire assets from majors…. but it does carry some risk that DEC is fooling themselves (and investors) thinking they can get a “bargain” buying assets from sellers this sophisticated.

Of course, with risk comes potential reward! If DEC is right, the returns here are huge as there is a long, long tail of older wells that they can acquire for a song. That’s the allure of these type of financial engineering roll ups: if the work, they can compound at way above average rates for decades!

Anyway, those were the company specific points / bear thesis I was looking to get from each call (there are obviously plenty of other general bear cases on natural gas: regulation, environmental concerns, pricing, etc., but those are general industry risks; I was much more focused on company specific!).

I guess I’ll start with the punch line: both experts were reasonably bullish on their former companies. I try to ask every expert if they would invest in their former company at the end of each call because every now and then you’ll catch an answer that surprises you (“I would put every last dollar into that company and I’ve never sold a single share” or (slightly more frequently), “I wouldn’t touch them with a 10 foot pole; the CEO is in over his head and their assets are awful). Both experts here were reasonably bullish on their former companies.

The DEC expert, “They're just building value as far as I'm concerned with that company”

The CNX expert, when asked if he would advise a company interested in M&A to buy CNX, “Yes. I think that they are in a very key location. I mean a location is a big factor here, and they have a very good fairway of acreage that is in the heart of the Marcellus and Utica development. So the short answer is yes.”

One more here; I asked him directly if he’d invest in CNX and his response was “I would, yes.”

I spent a decent amount of time with the CNX advisor asking about the overall nat gas environment / outlook. He confirmed about what you’d expect: given the pricing environment, companies are looking to ramp up production, but they’re running into all sorts of operational issues (worked shortages, equipment shortages, pipeline infrastructure that isn’t built out enough).

“Actual production, there's a race to ramp up production.”

“The market is getting tighter for the vendors that support operating companies.” “You have a tighter market for vendors driving up costs.”

“I mean there's some risk associated with takeaway of gas that actually comes out of the ground, whether it's storage fields being at capacity or pipeline infrastructure not being built out or enough compression, that kind of thing to handle the amount of gas. So there is a little bit of risk associated with that, but I think things are getting better, especially with regard to the export of liquefied natural gas.”

Roll all of those factors up with continued strong demand, and the expert was pretty confident that the medium term environment is going to be very supportive for natural gas prices. In part, he thought that the current administrations policies would support prices (i.e. the administration discourages investment, which keeps prices higher), a view that I think CNX’s CEO would very much agree with.

“I think we're pretty confident in the medium term. And what I mean by that is, say, I want to say the four- to six-year runway window as far as gas prices not being the bottom completely dropping out of it.”

“ike I mean we've got two more years left in this administration, maybe another four years. And I don't mean to connect that directly to politics and administration. I think it's just a top frame wise.”

“So I think six years in the top end as far as the runway goes, I think is where we're looking for some stability and/or some plateauing of, say, good, strong gas pricing. And that's due to a variety of factors. But I think we're bullish on it.”

Moving on to CNX specifically, the expert didn’t think there was anything special about their land. Saying “nothing special” can have negative connotations, so to be clear this is “nothing special” in the completely neutral way: the land isn’t worth a discount or premium versus your average acre in similar plays.

“Do they have better or worse? I think it's all probably equal. I don't think they have a better or a worse position. I would say that they're on par with their competitors.”

That “average” answer probably applies to all sorts of other things about CNX’s acreage: they have fine infrastructure, their access to water is better or worse than peers, and their decline rates are around the same as comparables.

In regards to the CNX short report, the expert was pretty skeptical. Scattered acreage is pretty common in the industry; in fact, the expert suggested that scatted inventory can be beneficial versus having a fully concentrated position.

“I know this to my core. No operator, I don't care if you are very concentrated in your acreage, it's going to drill any laterals if one 200-acre landowner or another operator controls it right in the middle of your unit.”

“I know this to my core. No operator, I don't care if you are very concentrated in your acreage, it's going to drill any laterals if one 200-acre landowner or another operator controls it right in the middle of your unit.”

“I don't buy that whole idea that it's got to be super concentrated or it's not that good.”

“if it's just organic leasing, like you want acreage in other people's units so that you force them to come to the table.”

“I think other operators need CNX. And they're compelled to come, EQT need them, other private equity companies need them to get some of their wells off the ground. So back to that scattered comment, like that's one lever that CNX has that works for their benefit.”

Given current prices and technological developments, the expert was also reasonably bullish on CNX getting value from their undeveloped and unproven assets at some point,

“There's risk associated with that, but I'm pretty confident in the technology over the past few years where they've gotten better at wider spacing and recovering from areas that operators would have otherwise steered clear from. So I think technology is sort of helping the look of stuff that is unproven.”

On management, the expert was pretty bullish on the team….

“I like the middle management. I like the executive management”

“I think that overall, I mean, I would say, B+.”

But he did suggest that there could be a little dysfunction at the top given frequent change within the C-suite.

“the CEO has been there for the entire length of the life of CNX, but the executive management has all changed, I think, multiple times. So Nick has been there the entire time, but the CFO has changed, the COO has changed, like the Chief Legal Officer changed multiple times. So why is that, I ask. And I'm sure there's some evolution that's happened and so on, but all these other people have changed, but Nick hasn't changed.

This part surprised me a bit, as I didn’t see anything crazy here. CNX spun off CEIX in late 2017; Nick has been CEO and Don Rush has been CFO since then (Don just switched from CFO to CSO). Their COO did “retire” in 2019 only to pick up a job at a competitor in 2020, but he was there for five years and that doesn’t seem crazy to me.

I’ll keep an eye on that / dig a little more going forward; I highlight it because every thread is worth looking at, but honestly I don’t see any “there” there.

There were a few other interesting threads in that call, but I think I hit the high levels here. Overall, my takeaway on the CNX expert call was quite bullish: CNX is cheap and buying back shares aggressively, and nothing the expert said suggested I was missing anything / there was reason to doubt the company’s strategy.

Turning to DEC, the expert jumped right in to the controversy.

“The Bloomberg article was very slanted. I didn't read it. There have been other ones in the past.“

“the Bloomberg article on methane. I mean you can take a FLIR camera when you're filling gas and you’re lawnmower and turn that on, and you think the world is ending because of the fuse that's going so you can show anything you want. You know that. But picture that if I should be filling my lawnmower and went to one of these wells, with a small, tiny leak, it would be miniscule compared to dumping gasoline into your lower, okay?”

In part, the expert thinks the Bloomberg article is based on a misunderstanding; many of these wells are going to be abandoned and leaking no matter what. Diversified is actually doing the states a favor by going and consistently plugging these wells.

“There's a grain of truth there. But in reality, an abandoned well is abandoned for a reason. It's not making gas.”

“So Diversified goes in and says to the State, we'll plug X number of years, enter into a long-term agreement. We'll provide a performance bond, which isn't required by the state. Most of these states have a blanket bond, which literally isn't enough to cover plugging one well let alone thousands. So the states they're in a bad situation because of their laws.”

“Diversified went in and we made agreements, we'll plug 50, 60, 80 wells a year, whatever you're comfortable with, and we'll set out a schedule to do that. And the states kind of have to look at that and say, nobody else is really coming forward”

He also did mention the “too big to fail” issue at DEC: they have the liability for so many different wells, the states would be up a river if DEC suddenly defaulted or tried to pressure DEC.

“It's kind of like the old GM thing. They've become too big to fail. So the states have to deal with them because they have 60,000, 65,000, whatever they have these days, wells with a significant plugging obligation on the backside. So addressing them with a long-term agreement, 10 years or so. That gives the investors, with Diversified, some degree of confidence that the state isn't going to come in and shut them down because we have issues because there's an agreement in place.”

Another of the DEC bear cases is why sophisticated sellers would sell DEC assets at such attractive prices. A common question is if DEC is simply way underestimating the the liabilities attached to those acquisitions. The expert suggested the sellers are simply getting rid of non-core assets that don’t fit their cost model, and which DC is better equipped to manage with a tighter budget. The DEC expert was in charge of acquisitions for them, so hearing him speak to seller motivations is certainly interesting!

“we may have three inspectors in the Appalachia Basin where

Chevron had 50 or 100 and just the model of how they operated said a lot to a Marcellus well that was making an ungodly amount of well Chevron couldn't make a dime on just because of their corporate model.”

“Their (meaning traditional players) operating costs are much higher. They're just looking at things differently. Diversified's model, they're very lean.”

“we're not that EQT, CNX, any of these other companies don't do that. They just didn't do it to the extent that Diversified did and was able to still operate efficiently.”

“Those guys are focused on we could have 10 wells that produce the same as Diversified 50. And it's much easier to operate those 10 for them, and they're thinking they don't want to be bothered with something making 50 MCF a month or anything because it's just not worth it, I guess, to them because that's not the way they're geared, the order producing assets.”

Part of running an energy company is your asset (producing wells) is constantly depleting. For companies with lots of undeveloped acreage, you can refill your asset by going and drilling new wells. DEC is buying much older producing wells, so their most logical area for replacing their declines is continued M&A. And the expert thinks there’s a very long tail of continued accrettive acquisition growth for DEC.

“I think there's enough acquisitions out there to be sustainable for quite some time.”

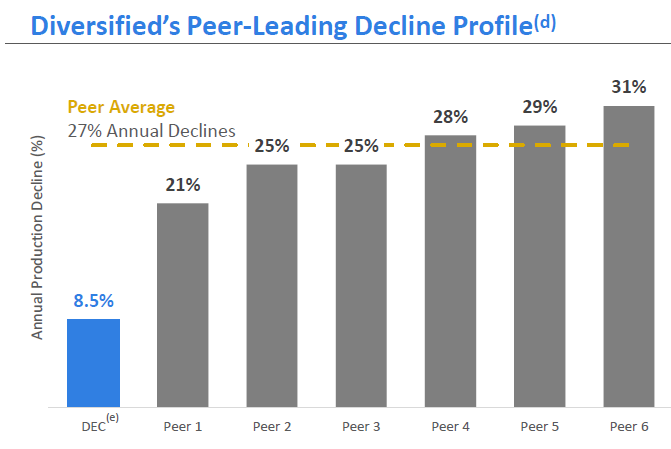

Speaking of declines, because Diversified is generally buying older wells, their declining profile is well below many of their peers.

I wanted to get clarity on that decline; it’s not out of line with what I’d expect from older assets, but I wanted to make sure I wasn’t missing anything. The expert confirmed that the declines make sense and are pretty standard stuff:

“I mean it's a fairly known quantity just because there are so many thousands of wells that like lifetime expectation of those wells, that's going to follow that curve.”

“the decline curves are very well known, very established over many years.”

“So you could pretty much trust them because it's not Diversified’s decline curve. They used to go to a third party. They since brought it back in-house, but they used a third party for several years. when they did their annual reports, and everything went to him. And so it was all basically reviewed and summed out, but he's very well and if you look at some older several years ago report”

Overall, I’d say the DEC call was largely confirmatory to me. I lean bullish on the company, and nothing from this call changed anything about that lean. In fact, it probably confirmed several points. But I still have questions that the call didn’t fully address: the discrepancy between the Bloomberg report and the company’s numbers, I’m still not fully convinced by the logic that lets them buy assets at such a massive discount, and it still strikes me as strange that they’re not buying back shares.

Just to wrap this series up, the bull thesis for CNX and DEC are pretty similar. Both hedge out all natural gas and are, at their core, capital allocation machines. CNX promises to take their free cash flow “annuity” and buyback shares aggressively when it makes sense, while DEC is using their lean cost structure and focus on older wells to buy them for a song and manage their AROs while returning a massive dividend to shareholders.

I was bullish going in on both companies, and nothing in the calls dissuaded me from that bullishness. Honestly, if nat gas stays close to where it is, I think both work very well… and if nat gas declines significantly, I think both work well anyway. That’s the beauty of low valuations and big hedges; yes, you probably make more on unhedged names if prices stay close to today’s levels (or go up), but both CNX and DEC should do really well almost regardless of what nat gas does.

That said, I’d lean CNX over DEC. The upside to DEC is massive; they’re trading for half of their PV-10, yielding >10%, and I believe the worst acquisition they’ve announced came with a 17% projected IRR. That combination is extremely rare…. but if you want to be long DEC, you need to be very confident in their edge in M&A, which means confidence that they are getting great deals buying from some very sophisticated sellers because DEC is way better at operations / handling ARO. I’m not there yet.

In contrast, CNX is a pretty simple story. They’ve got a bunch of nat gas inventory, they trade very cheaply, and they’re asking you to trust them they’ll do smart things with that cash flow. Currently, that’s hammering their share count, but over time it’s possible it involves M&A or something else. I like that combination quite a bit.

One thing I didn’t mention anywhere in this series that I think is worth bringing up right at the end: Diversified has a pretty large partnership with Oaktree. The simplified structure is Oaktree and Diversified split asset purchases 50/50, with Diversified serving as the manager and getting a kicker for their work as manager and some incentive to make the acquisitions really juicy. That’s an important partnership for two reasons. First, it carries great economics. But second, and perhaps more importantly, it serves as a real validation of Diversified. Several DEC skeptics / bears sent me long emails about the downsides of DEC that ended with something along the lines of, “Man, I don’t know what Oaktree is doing here. Maybe that got hoodwinked, but they’re really sophisticated investors that do lots of work. I’m guessing that got comfortable with all the risks I pointed out and still see tons of opportunity; I’m not sure how to reconcile that. Maybe they just think they can get out before the ARO bill comes due?”

Hi,

I thought I'd post it here:

Yesterday DEC announced a ~100m GbP share buyback program and today I received a notification that they bought back 100K shares since yesterday.

Today they also sold 40m GbP of non-core assets. (They claim it to be valued at 4x expected cash flow for 2023)

Cheers

hello,

i m not very familiar with this kind of companies, but income statement looks pretty negative to me, e.g DEC. why did you not talk about this ? it s not a subject of concern ? thanks

Fabrice