Tegus sponsored deep dive #4: Natural Gas (part 2: $CNX and $DEC bull cases)

This is the second post in my three part series on natural gas in general and CNX and Diversified Energy (DEC) in particular. In part 1, I went into why I chose nat gas overall. Today, I want to talk about why I chose to look at CNX and DEC in particular, and in tomorrow’s post I’ll dive into what I was looking for in my expert calls and what I learned (update: part 3 is now up!).

So why did I chose to look at CNX and DEC?

At the highest level, it’s because I think they’re both cheap and potential actionable. I wrote up CNX and their great capital allocation late last year and have continued to follow them / do work on them since (I remain surprised more investors don’t follow CNX; it’s a financial engineering story whose Chairman literally wrote the book on beating the market through financial engineering. Plus, he clearly has high regards for the CNX management team (he called CNX’s CEO excellent at ~44 min mark of this pod) and the CNX asset base). On DEC, my friend Andrew Carreon has done tons of work on them and makes a compelling case (Andrew pitched BSM on the podcast last year; I believe we will be podcasting on DEC in the very near future!). Both companies are quite cheap: DEC’s dividend yield is >10%, and CNX is trading for <5x their 2022E free cash flow projection of ~$3.69/share.

So yes, both of these companies are very cheap. But, to me, what sets them apart from other nat gas focused companies is that both DEC and CNX are running models more focused on “financial engineering” than taking natural gas price risk. Both hedge huge amounts of their near term, medium, and even long term price exposure. For example, the slide below is from DEC’s Q2’22 investor deck and shows how they think about hedging: ~80% of the next year’s production, ~60% of year 2, and then 30-50% of production after that (CNX follows a reasonably similar strategy).

That hedging gives them fantastic visibility into their earnings / cash flow and serves them well when prices are crashing, but when prices are skyrocketing (like now) it limits the exposure to an immediate gush of cash flow / super normal profits.

YTD, DEC and CNX’s returns have lagged their most relevant peers, often pretty significantly, as the market looks at their massive hedging program and says “o, these guys are missing out on the super normal profits; hard pass.”

But just because the two of them are largely hedged does not mean DEC / CNX won’t benefit from the rise in energy prices. Each company will stand to benefit in three ways:

While the companies have mainly hedged out their near term gas production, they have not entirely hedged it out. In the short term, each will realize large profits on the small amount of production (~10%) that they don’t have hedges on.

Gas prices are so high right now (and in the near to medium term) that land / wells / projects that were uneconomic to drill a few years ago will now produce incredible returns (if you have a well that produces gas with an all-in cost of $3.50/Mcfe, it’s completely uneconomic when gas is at $3 and an absolute grand slam of a project when gas is >$5). CNX (and, to a much lesser extent, DEC) can use the boost in strip pricing to accelerate their drilling programs, which will bring more production online (and that production will be unhedged).

While both DEC and CNX have hedged out the majority of their near and medium term production, strip prices have risen across all aspects of the curve. For example, CNX has just started putting on their 2027 hedges. At the start of the year, nat gas for 2027 was ~$3. Today, it’s ~$4.50. That’s a huge move…. but it actually might under state just how much an impact it will have on the companies’ bottom line. Consider DEC: in H1’22, their cash cost for gas production was ~$1.64/Mcfe. Their realized prices, after hedging, was $3.15/Mcfe for a cash margin of ~$1.51/Mcfe. Let’s say their costs stay relatively flat for the next few years and they realize that current 2027 gas price of ~$4.50/Mcfe. That means margins will go from ~$1.51/Mcfe today to ~$2.86/Mcfe in 2027. In other words, prices are up 50%, but margins double thanks to the power of operational / commodity price leverage.

So while the stocks have lagged peers (and rightfully so given how much cash unhedged peers are throwing off), I suspect the market is too pessimistic on both DEC and CNX. Both are gushing cash flow currently, and their future cash flow outlooks have materially improved as prices have risen. Even better, CNX and DEC have shown a commitment to both maintaining hedges and returning cash to shareholders, so shareholders can feel confident that both will use the current price strength to lock in future cash flows that will then be returned to shareholders (largely through reasonably aggressive share repurchases in CNX’s case, and through dividends at DEC). That’s a powerful combination!

Just to drive that “gushing / returning cash flow” point home, I want to steal a slide from each company’s most recent (Q2’22) earnings deck.

I’ll start with CNX; they like to describe their cash flow as a “low-risk” “annuity”. Obviously that’s a bit of simplification (there are clearly operational risks in any business!), but between their land inventory and hedging CNX does resemble an annuity. And management is clear: if the stock remains cheap, they will use their free cash flow to hammer their share count. The combination of a free cash flow “annuity” and aggressive repurchases at low multiples are powerful; CNX showed how the combination could get them to an $8/share free cash flow number by 2026.

For Diversified, I stole the slide below, which shows how the company’s share price has lagged the recent run in natural gas prices to the point where it now trades for ~half of PV-10 (net of debt and hedges). Given how “locked in” DEC’s cash flows should be thanks to the extensive hedges and how quickly DEC returns cash to shareholders, that’s a very interesting discount!

Anyway, for today’s post I wanted to discuss why I chose CNX and DEC as the subject of these expert calls, and hopefully I’ve done just that (they’re cheap, they return cash, etc.). Tmr’s post will discuss the takeaways from the expert calls and the key points I was looking to hit, but before I go there it is worth diving into one other point on DEC.

Both Diversified and CNX are unique versus peers in that they look to hedge out much of the energy curve and turn themselves into financial engineering machines. However, if you took the hedging strategy out, CNX would look extremely similar to other nat gas majors (EQT, AR, etc.).

DEC, however, has another layer of uniqueness. DEC is an acquisition machine with a very particular acquisition target, and the result is DEC’s assets look materially different than other companies.

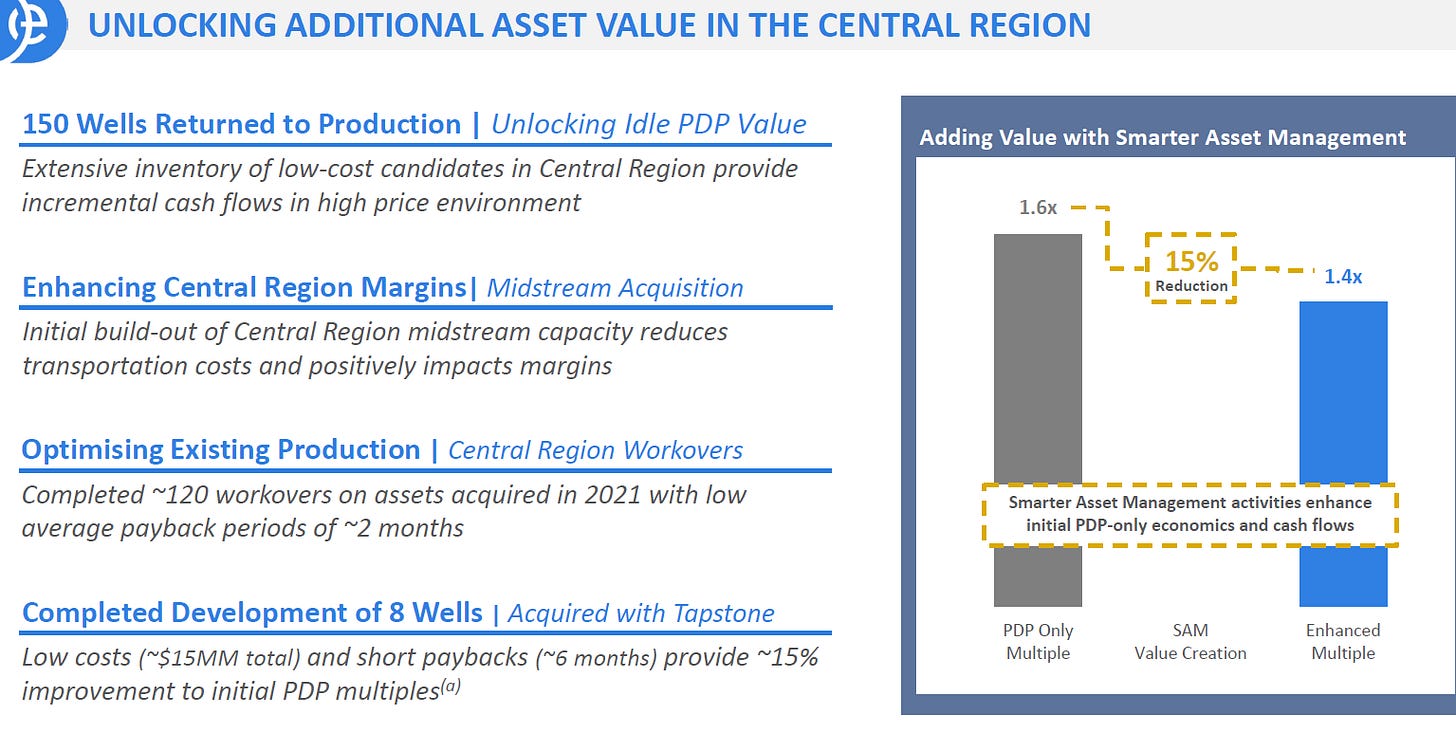

DEC’s target assets? Older, mature wells that are no longer a core focus of their owner (my friend Byrne Hobert called DEC an “orphaned stock for orphaned assets”, and here’s a recent profile that goes into DEC’s strategy a little more). These wells often have significant asset retirement obligations (ARO) in the form of environmental liabilities on the back end. DEC looks to acquire these assets for a song, and then use their asset management (“smart asset management", or SAM) to improve the well’s decline and eventually handle the environmental obligation at a discount to what the previous owner could have done.

This model has come with some controversy (I’ll discuss that tomorrow), but it’s tough to argue with the multiples it’s let DEC acquire at. DEC has done two acquisitions this year, and the numbers absolutely jump off the page. The first acquisition was done at >PV40 (meanings the discount rate on the projected cash flows is >40%) and a 1.4x EBITDA multiple, while the second acquisition was done at a ~2.5x EBITDA multiple and PV17.

Now that all might sound boring (though I would never describe a 40%+ IRR as boring), but DEC would argue that the “buy old assets” model is perfect for their financial engineering strategy.

First, older assets tend to be much easier to model and have much better decline rates than newer assets, so older assets fit much better with DEC’s “hedge and leverage” strategy and gives DEC some of the best decline rates of any of their peers.

Second, because DEC is so focused on older wells, they have a competitive advantage at managing asset retirement. They can insource asset retirement operations that might not make sense for other firms who handle less AROs (indeed, some of DEC’s recent acquisitions have been buying plugging companies), and their scale and knowledge lets them drive costs below peers, which serves as both margin enhancement (every dollar less it costs them to retire a well is a dollar the get to retain) and an advantage for future acquisitions (if DEC can retire a well for $1k less than their closer competitor, DEC can bid more than peers for acquisitions and still realize a profit (i.e. they could bid $400 more for the well and still realize a $600 more in profit versus their peers).

Anyway, that’s the high level for why I wanted to do more work on CNX and DEC: they’re cheap, they’re returning cash like crazy, and the market seems to be more focused on how much potential cash their hedges have cost them in the short run while ignoring just how good their cash flow outlook is.

I’ll be back tomorrow with part 3: key takeaways from my expert calls on CNX and DEC.

One last point that I struggled to put somewhere in the write up: Byrne called DEC an “orphaned stock for orphaned assets”. My thesis has largely focused on the later point, but there is something to the former. DEC trades in London. It sounds silly, but I have consistently found that U.S. domestic focused companies that trade in London trade at a discount that corrects if and when the company switches their listing to a domestic one. It sounds silly; every time someone pitched that “relisting trade” to me as part of a thesis I would say “that’s just too simply; there’s no way the market is that inefficient…” but I’ve just seen the “company relists from London to the U.S. and sees their multiple discrepancy versus peers collapse” trade happen to many times to dismiss it out of hand. When meme stocks were ripping, there was a joke “do you like accounting or do you like making money?” I kind of feel like that about dismissing relisting trades completely out of hand at this point; I wouldn’t want to have that as my entire thesis for a stock, but it is a nice catalyst that you shouldn’t underrate if you find a company that you like and that you think is too cheap.

This is a good article and I'll recommend your blog to other Substack writers and readers.

CNX looks like an interesting commodity stock that should be traded as a commodity stock like ADM or BG. Its charts are bullish.

Short interest is around 15%. That shows sophisticated speculators are playing the commodity market, and it's one reason the stock looks under priced.

I haven't decided whether to get into CNX. If I do, and this is not advice, I might sell CNX 9.16.22 expiration $15 strike puts for an annualized return on risk of about 18%. The net debit would be about $14.75. That is a 15% or better discount (MOS Margin of Safety) on the stock. The delta would be -.16, meaning that there is about a 16% probability that the stock would be assigned at $15 if the stock fell below $15 by the end of the trading session when the puts options expire. The OTM probability is about 95%.

Traders who want a smaller discount and greater chance of buying the stock at a lower price could sell the $17 or $16 puts.

In addition to or instead of selling puts, speculators could do a CNX buy/write (B/W. Buy CNX at $17.31. Sell CNX 9.16.22 $17 covered calls for about $1.10. That would yield about a 45% ARoR. If the stock is called, the trader can sell the puts. And continue the wheel of buying and selling CNX and its options, which are lightly traded and have fairly wide bid/ask spreads.

DEC doesn't come up in StockRover.com or on Think or Swim.

@realDonJohnson

https://djincometrader.substack.com