Last month, I announced deep dives sponsored by Tegus. The goal of these are simple: every month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry.

I’m hoping this series is a screaming success, with readers and myself learning a ton from the interviews and Tegus getting lots of publicity for their product (which I love and is table stakes for fundamental investors) and that I’ll be able to turn these into a regular monthly recurring feature forever. Of course, that involves everyone feeling like they’re getting value from the series, so please check out Tegus if you’re a fundamental investor and haven’t done so already (again, it’s pretty much table stakes for investors at this point).

Anyway, for my first Tegus deep dive, I figured I’d turn to a familiar sector: Cable. I’ll explain why I chose cable in a second, but let me start by highlighting the three expert interviews I did for this series (note: for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub!):

These posts ran long, so I’m actually going to split them up into multiple parts. In part 1 (which you’re reading), I’m going to dive why I chose cable and their competitive threats for my first deep dive. In part 2 (update: now available here), I’m going to discuss threats from fiber to the home (FTTH) overbuilds. In part 3 (update: now available here), I’m going to discuss threats from fixed wireless. In part 4 and 5, I’m going to cover the maybe the scariest long term threats to cable, Starlink and Starry (Update: part 4 on Starlink is up here and part 5 on Starry is up here). In part 6 (update: now available here), I’m going to wrap it the series up with some concluding thoughts.

That’s my plan for this series…. but if you’re looking for the TL;DR version: I don’t think anything has changed, and I believe cable still has a huge advantage. Heck, I thought one of the expert calls summed it up nicely.

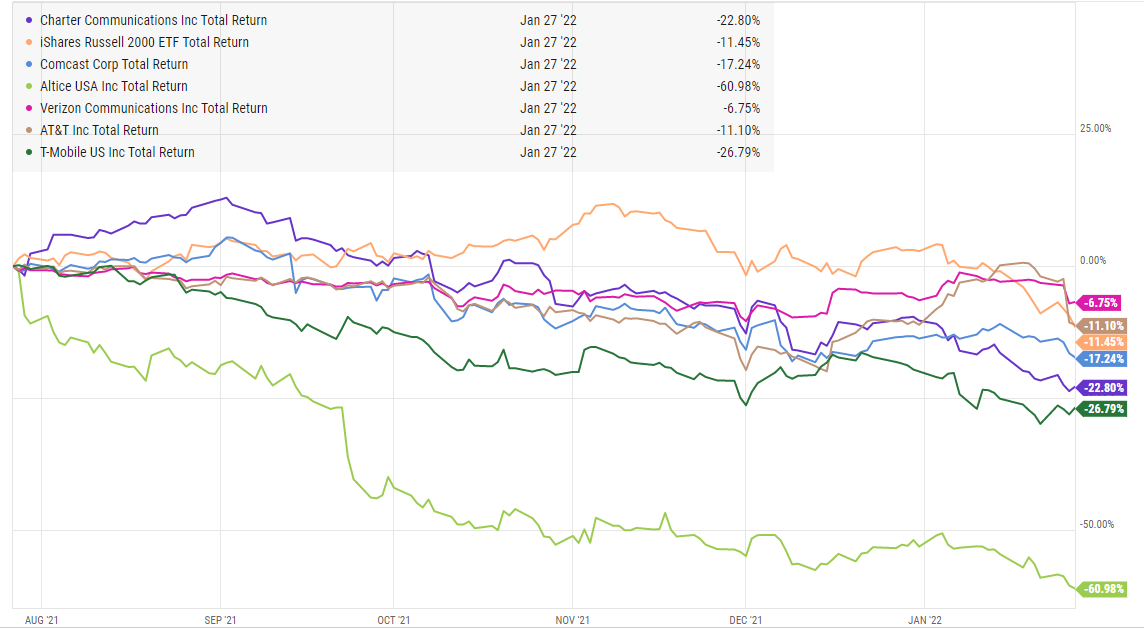

So why did I chose cable for this deep dive? Long time readers will know I’m an unabashed cable bull. Over the past six months, cable and telecom stocks have been slaughtered across the board.

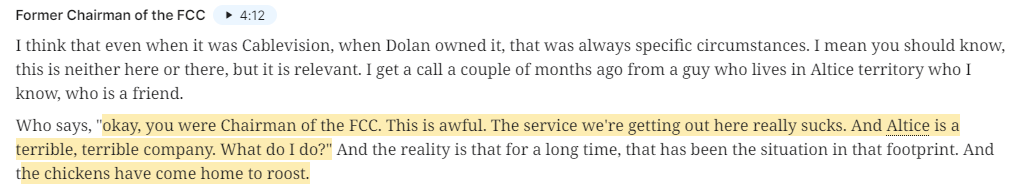

Why have telecom stocks across the board sold off so hard? Simple: AT&T and Altice are drastically mismanaged dumpster fires, and (as one of the experts said) “the chickens” are finally coming home to roost from years of mismanagement.

Ok, ok, I’m kidding; T and ATUS are clearly mismanaged (though IMO T has gotten way better since they changed management), but that’s not why the whole sector is imploding. I believe the sector is imploding because investors fear that we’re entering a converged world where wireless and wired (read: broadband providers like cable) offer the same services, and the increased competition is going to drive a huge price war that demolishes profitability. In addition, for cable specifically, investors fear looming competition from fiber overbuilds and newcomers like Starry (coming public with a massive valuation) and Starlink (I’m not sure I’ve ever been emailed an article as many times as I was this article on Starlink’s success in Rural Canada).

A hypothetical example might show how convergence negatively impacts cable best. Five years ago, a rural or suburban town might have two broadband providers: the cable company and the local legacy telephone company providing DSL service. Today, the legacy telephone company is likely planning to upgrade their DSL to Fiber, and fixed wireless plays from T-Mobile and Verizon are just around the corner. So, on the broadband side, investors worry that cable is going from a competitive environment where they were the only high speed game in town to a competitive environment with three or four competitors in short order. On the telecom / mobile side, Charter and Comcast are rolling out aggressive mobile offers that far undercut traditional mobile plans.

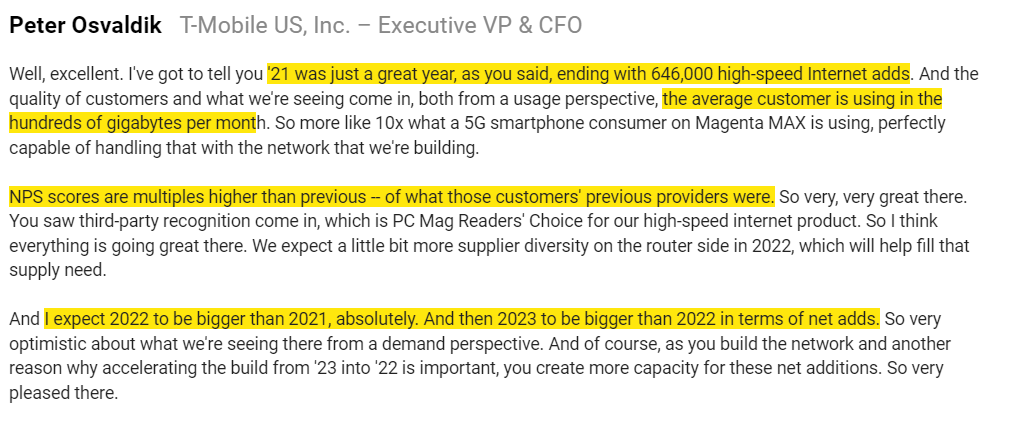

Moving from a hypothetical to real world numbers shows how scary this risk is. In Q4’21, T-Mobile added more high speed internet customers (224k high speed customers in Q4) than Comcast (CMCSA added 212k). T-Mobile is adding exclusively fixed wireless customers, so their fixed wireless is growing faster than Comcast’s traditional broadband (and T-Mobile’s has said they expect adds to accelerate YoY in both 2022 and 2023).

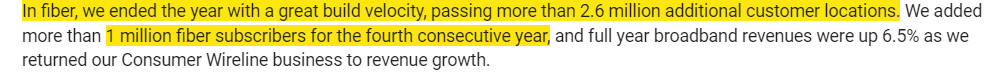

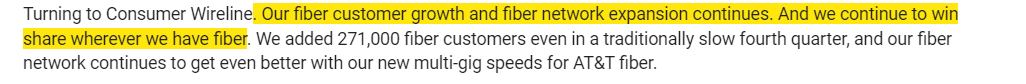

On top of the fixed wireless competition, you have FTTH buildouts continuing to ramp up. AT&T, Verizon, and a bunch of smaller players (LUMN, FYBR, CNSL, etc.) are all making concerted pushes to upgrade their legacy networks from copper / DSL to fiber. Investors are terrified by this investment; in a cable / DSL market, cable is basically a monopoly (not a lot of people want to sign up for DSL’s 25 meg down / 3 meg up speeds in today’s world!). But once the DSL players upgrade to fiber, suddenly cable goes from basically having a monopoly in a territory to competing against a superior product (fiber is a little lower cost to operate than cable, is symmetrical so it has better upload speeds, and it has better theoretical max speeds / is easier to upgrade speeds as consumer demand increases). (The clips below are from T’s Q4’21 earnings call just to give you a feel for how telecoms are accelerating their investments into fiber networks).

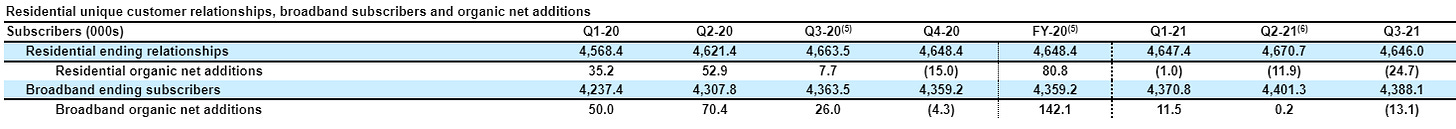

Altice has, by far, the most competitive footprint in cable since so much of their territory has been overbuild by Verizon FIOS Fiber. Since the height of the pandemic, Altice has basically been treading water on broadband subs and in Q3’21 they switched from “treading water” to actually losing subs. Investors see rising FTTH competition for all cable players and worry that Altice’s results now are a preview of what all cable players will report in a few years.

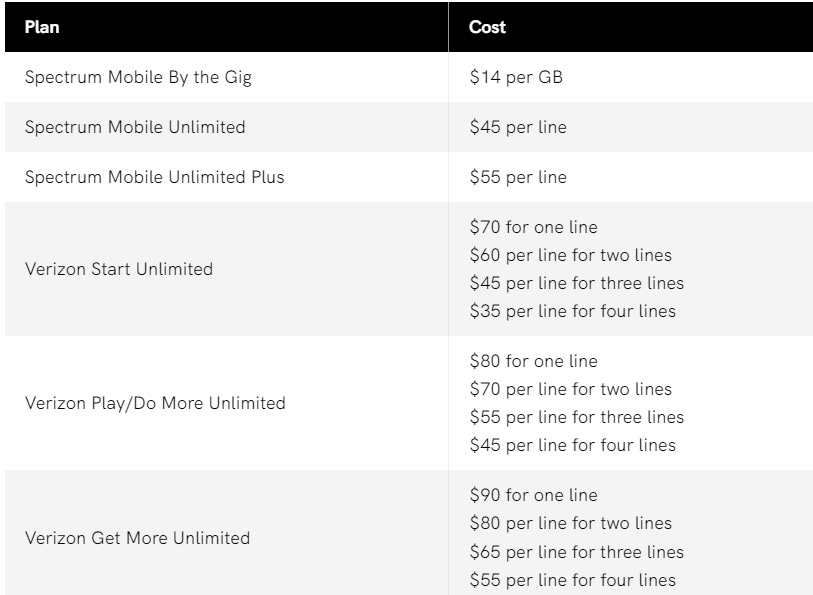

On the other side of the ledger, cable’s wireless business is accelerating massively. In Q4’21, Verizon had “558k phone net additions.” Compare that to Comcast’s 312k wireless line net additions and CHTR’s 380k additions, and you can see cable’s already taking a bunch of share in wireless…. but if you then adjust for the fact Comcast and CHTR are really only selling in the ~33% of the country where they have broadband service, you can quickly see that CHTR and Comcast’s wireless businesses are growing much, much faster than the big wireless players. The reason is simple: Charter and Comcasts’ MVNO run on Verizon’s networks plus have lots of hotspots, and their prices are way cheaper than Verizon. So if you sign up for a cable mobile player, you get a slightly better network for significantly lower cost. With math like that, it’s no wonder they’re taking so much share! (Charter versus Verizon price below from here)

So on one side you have T-Mobile's fixed wireless business growing faster than cable’s broadband business, while on the other you have cable’s wireless taking huge share. Put those two together and investors worry you have a price war: new broadband entrants undercut cable to try to lure broadband subs, while cable undercuts mobile to try to steal mobile subs. Both cable and mobile are mainly fixed cost businesses, so if you start to get into a real competitive price war you could see returns and earnings go down quickly.

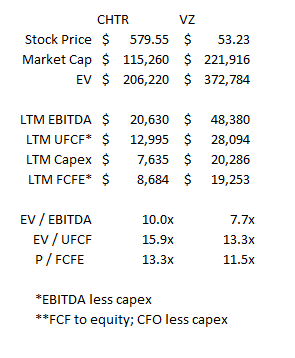

You can see these concerns in both the stock charts of the telecom / cable companies and in their valuation. Charter and Verizon are the two cleanest comps for valuation (everyone else has tons of noise in their numbers; T and CMCSA have huge media segments, TMUS has the Sprint integration, and ATUS is…. well, ATUS is ATUS). Each of them are trading for below market free cash flow multiples (low double digits), which is cheap in both an absolute and relative basis and particularly cheap once you factor in that these are non-cyclical businesses that the market is willing to lend basically unlimited amounts of money to at extremely low interest rates. Charter, for example, recently borrowed 10 years unsecured at 4.75%, and Verizon’s most recent debt exchange got them >10 year paper at <2.5% interest rates. In effect, Verizon and Charter’s debt yields <5% and their stock’s “yield” from a P/FCFE basis is approaching 10%, and the equity “yields” should be growing as earnings grow. When you’ve got a valuation gap that big between debt and equity, taking on extra debt to buyback stock can prove very, very accretive. In fact, that’s exactly what Charter’s levered buyback model does; I’ve noted before I expect them to generate >$60/share in fully taxed free cash flow by 2025, and that number actually increases as the stock goes lower because they can buyback more shares. (PS: Charter’s valuation is a little too generous on an FCFE basis in the table below, as they had NOLs to shield them from taxes historically but they’ll start to pay taxes in 2022, but it’s not worth splitting hairs over and it doesn’t change they EV metrics since those are before taxes).

So you can see from the stock prices and valuations that investors are worried about the looming effects of competition. I’ve been a long time cable bull in large part because I’m extremely skeptical of the competition to cable (in fact, I did a post 3 years ago dismissing fixed wireless threats that holds up reasonably well). My thesis has been simple: nothing can beat the speed, reliability, and low cost of physical fixed infrastructure. It’s simple physics. And cable has the best fixed infrastructure in the world; they’ve laid fiber deep to the places where people actually use data, and that remains an unassailable competitive advantage. Sure, in a lot of markets they’ll face FTTH competition, and going from a monopoly to a duopoly isn’t ideal from an investors point of view… but it’s manageable, and cable has an easy path to upgrade to remain competitive with FTTH. As the former FCC chair said in one of my interviews, a two player market isn’t exactly the definition of free market competition; I think cable can do well even if FTTH continues to accelerate.

So for my first Tegus deep dive, I wanted to refresh and challenge that thesis: is cable still advantaged against the wave of competitive threats coming, or has something changed that puts cable’s franchise at risk?

I’ll be spending the rest of this series pulling extensively from my Tegus Expert calls as well as recent earnings and conference calls for Charter, Comcast, T-Mobile (who unfortunately reports Q4’21 earnings tmr, so I might not be able to grab tons of quotes from that but I have lots of quotes from their recent conference appearances!), AT&T, Verizon, and a variety of others. I’m looking forward to seeing you for part two (FTTH risks) tomorrow.

I am very long and underwater ATUS. l expect a turnaround

Great stuff, thanks Andrew! 💚 🥃