Tegus sponsored deep dive #1: Cable (part 5: Starry)

This is part 5 of my deep dive into cable threats (sponsored by Tegus). This part will dive into the company I think is attacking the broadband market in the most interesting way: Starry. If you’re looking for background on what this series is and why I’m doing it, please see part 1 here. You can find part 2 on FTTH risks here, part 3 on fixed wireless here, and part 4 on Starlink here.

Before we get to part 5, let me again highlight the three Tegus expert calls I used for the foundation of this series. Most Tegus calls are behind paywall, but for the next year, these links should give you access to the calls even without a Tegus sub, so it’s a great trial even if you’re not a sub! The three calls are:

That out the way, let’s dive into Starry..

Starry is a new type of fixed wireless company focused mainly in the urban space. They are going public through a SPAC (FMAC) in a deal set to close in March; the SPAC deal is at a big valuation ($1.66B) and the PIPE has some serious investors in it (Atreides, Fidelity, Tiger, ArrowMark). You can and should check out the company’s SPAC deck, but the basics are Starry boasts an incredible NPS and can build wireless networks that are competitive with fiber at a fraction of a fraction of the cost.

Personally, I think the Starry model is the scariest of the threats I’ve discussed so far. Why?

Well, part 2 detailed lots of stuff on fixed wireless, but the basic thing I kept coming back to is that fixed wireless’s limitations meant it could really only compete with broadband in places where carriers had lots of extra spectrum, which tend to be very rural areas… and even there, fixed wireless probably would only make sense for people who didn’t have access to good “normal” broadband. You can see that in how mobile players are deploying: TMUS is rapidly expanding their fixed wireless offerings (they rolled out three new states last week!), but they know that their fixed wireless option is best for underserved communities that don’t have great broadband currently (perhaps because their product is generally inferior to cable / fiber broadband!).

Starry is a completely different. Their network is designed for urban spaces. Basically, they use high frequency / millimeter wave spectrum (which can carry lots of data but doesn’t travel a long distance / degrades rapidly if it passes through something like a wall). I’ll let the company explain it a little bit (from this interview):

Starry pioneered the use of very high-capacity spectrum in the millimeter wave frequencies. Typically, when you’re building a network using fiber or things like that, you’re digging up streets, trenching thin wires and poles and that’s all very expensive and time consuming. What Starry does is get that last-mile physical infrastructure and just does it wirelessly. And, the reason we are able to do that is we pretty much created a category of using millimeter wave spectrum or high-capacity. Historically, that spectrum was considered difficult to use, fragile junk. Starry pioneered, about six years ago, how to develop and use that spectrum for high-capacity. And, that really allows us to cut our cost structure down dramatically which is a benefit that we just pass on to customers.

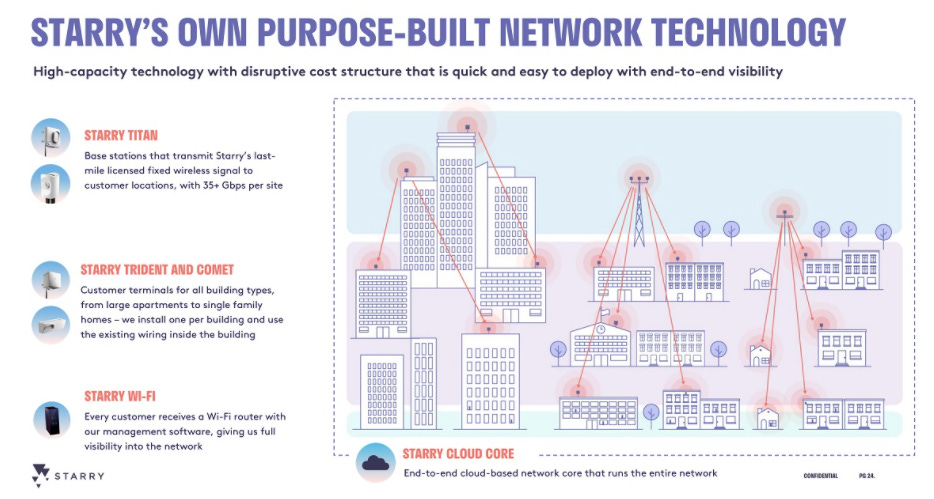

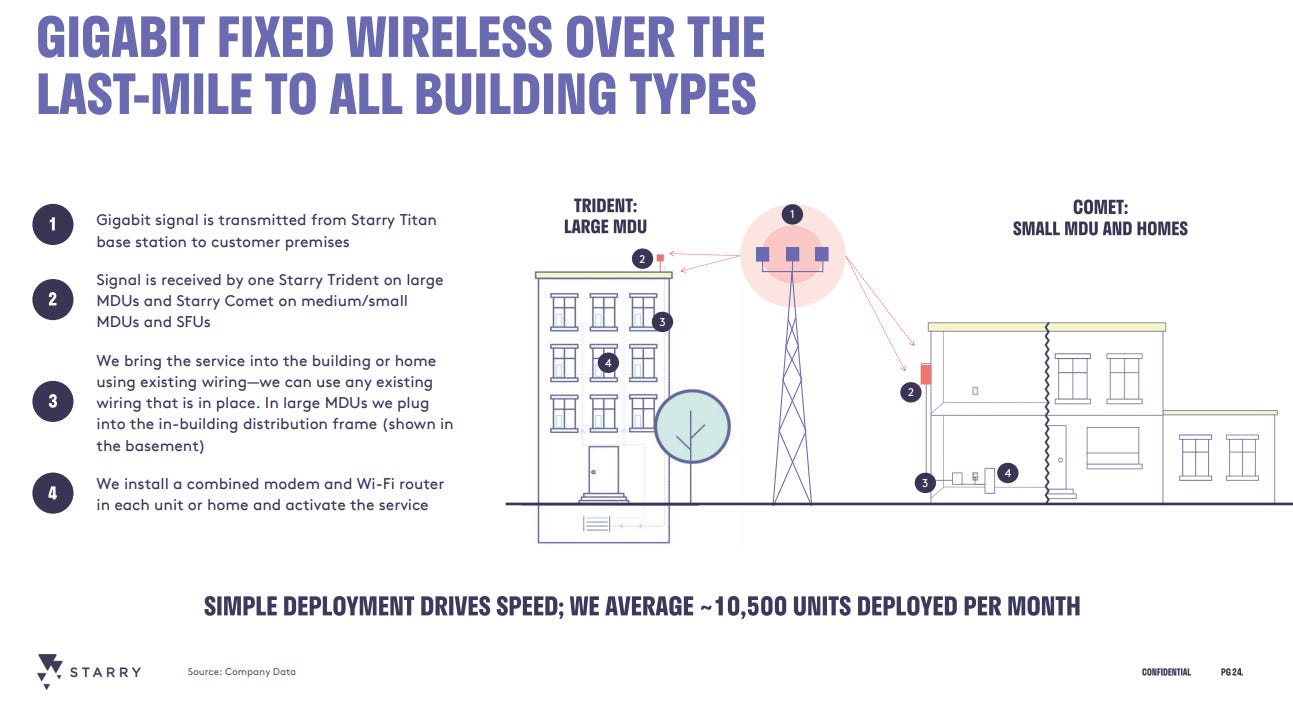

So, basically, Starry got access to a bunch of really high frequency spectrum no one wanted. They take that spectrum and go out and put dishes on tall towers to send out their signal, and they put receivers on the tops of buildings. That’s an important combo; again, millimeter wave degrades quickly if there’s any interference (i.e. if there’s a wall or building between your tower and the receiver), so a tall tower + receiver on the roof let’s them dodge interference.

Starry’s initial target market was large apartment buildings (Multiple dwelling units, or MDUs). That makes sense: MDUs tend to be tall buildings, which gives less interference between the tower and the receiver, and going after an MDU let them leverage the initial install capex against multiple potential customers in one building. However, Starry’s recently rolled out their “Comet” line that let’s them go after small MDUs and homes as well (slide below from Starry’s Jan. 18th investor day).

Starry’s numbers suggest they’re having success attacking MDUs this way. But don’t take it from them; ATUS was asked on their Q4 earnings call about fixed wireless as a threat and said that they were really seeing competition in MDUs. It’s the first time I can remember a cable company saying that they were really seeing impact from fixed wirelesses in a particular segment. Obviously ATUS didn’t specifically highlight Starry, but I think the writing on the wall is clear:

So the overall Starry threat is pretty simple: you have a well funded start up backed by some very sophisticated investors that has found a model that let’s them quickly roll out a product that’s competitive with cable and fiber at a fraction of the cost of building a new network.

That low cost piece is particularly important; a FTTH overbuild is extremely expensive, and you really need to get 40%+ penetration to make it worthwhile (obviously there are lots of other factors). Starry is saying they can build networks at 1% the cost of fiber and break-even at 4% penetration, so their low cost means they can attack traditional broadband in very different ways and still make money. Here’s how the company put it at an analyst interview in December:

There’s a lot of talk for fiber today, obviously and let’s divide that into two categories. Number one, what I will say LECs that are going to invest in fiber, whether it’s companies that have been restructured or whether it’s folks at AT&T or whatever, and our view is that’s going to be, going into solidify their position. I mean, these people already have broadband customers, so really the first foray of that fiber is going to be making sure those customers are shored up. So we don’t necessarily expect a wholesale new set of passings being built out over the next three to five years, at least over the next three anyways. And then you have a lot of private equity type of money coming into the market, given the cheap money conditions. But ultimately as you compare fiber to Starry from a build perspective, we break even at 45 percent from a take-rate perspective. Whereas you can bend it, fudge it, but the reality is you need 40 plus percent take rate in new fiber build to be able to justify it and with a very long payback window, whereas we hit these numbers in about 18 months or so. So we think we’re competitively very well positioned against, what I will call, a slow-moving progression. And frankly, if you’re coming in as a third party into the mix, Starry plus coax plus maybe a new slow roll of fiber, your take rates by default go down and then that creates additional pressure. So we feel really good because, not only can we pass at a very low cost, we can build a network at an incredibly high speed.

And not only is it low cost, but it’s a service that actually seems competitive with cable / fiber. I talked in both the Starlink section and the fixed wireless section about how I thought the services would struggle to keep up with continued growth in data consumption. Starry is aware of that issue and seems to have a solution that can keep up with that demand:

But today for example, in the fixed line broadband we’re seeing 30 percent growth on data patterns, on data consumption, on an annualized basis and that’s compounding. So as you think from a competition and mode perspective, we think of obviously, wireline customer technologies, let’s just call it fiber, has a huge advantage over anybody else in terms of the capacity that they can ultimately be offering and also the speeds. And so you compare that to say, what does Starry have. Is that good enough for the next five, seven, ten, fifteen, whatever, the time horizon that you have. And as we look at, even the technology generation that we’re deploying today at a 30 percent compounded growth on data consumption we’re not going to come close to sniffing the headroom of what we are already deploying today, right? As you think about on a per site basis, 35 to 40 gigabits a second of speed that we’re capable of delivering. And you’ve got spectral efficiency now driving effectively two to three gigahertz for the spectrum utilization off of a single one of those sites, which whose radiation pattern is limited to let’s call it a mild and extreme case between 1.2 and 1.6 kilometers. So there isn’t a whole lot that is on the horizon that as you think about it, that says I will have sufficient speed and capacity. And that’s a really important point for, I think investors. Ultimately what means success for a consumer is not necessarily just the speed you can deliver, but how much capacity you have, meaning how many customers at the same time can consume that much speed. So mobility or mobile-based networks fall short on that because their capacity is limited, number one. Number two, a fixed customer is consuming 50 times more data than a mobile customer. So by default, your revenue per bit falls 1/50. So that’s not a good, smart trade off when you’ve just spent 50 plus billion dollars or whatever it is in acquiring mobile spectrum. And then it’s the same challenge with the LEOs—effectively they’re not as capacity constrained as the geostationary guys are, but ultimately if you just take a step back the United States represents, give or take seven percent of the land mass, alright, of the world and 70 percent of the world is water. So effectively your entire constellation is spending an incredible amount of time over what I will call non-population centers, right, and really what that capacity is appropriate for and intended for. So they’ll have great applications in those, but high-density broadband is not one of them in cities and suburbs.

So I think the Starry threat is very real and, on the whole, the scariest of the threats I’ve talked about in this series. Why is Starry scarier to me than the other threats? As discussed above, the cost and that the current product seems to offer speeds and capacity similar to cable is a big piece of it.

But what really worries me about Starry is not Starry specifically. It’s that, if this model works, I see no reason why every wireless player couldn’t copy it eventually. Starry invested ~$200m in R&D to develop a system that let’s them roll out fixed wireless that can compete with broadband in urban areas.

“To dive a little bit deeper into the intellectual property stack that we have developed and are rapidly deploying, when we started, this technology didn’t exist and outside of the stack we have built, we don’t believe there is any other technology that is available in the market today with the same capability at the same cost structure. We’ve invested nearly $200 million to develop and commercialize our technology with an incredibly talented team. Starry’s expertise spans RF engineering, smart antenna systems, high frequency integrated circuit design, software that runs close to the metal, and network engineering, and software in cloud. We iterate and integrate all of these disciplines to build our technology stack to achieve very attractive unit economics. We also have a dedicated team of care professionals that are quick and responsive and effective sales and marketing engine and a skilled field team that is in the frontlines deploying our network and service our customers. This is the result of our hard work and innovation.”

Verizon doesn’t disclose their R&D number, but in 2021 they spent $29B in SG&A (which should include R&D) and another ~$20B in capex (plus $48B in wireless spectrum spend and another $4B for an acquisition). If the Starry model works, I see no way that Verizon, AT&T, and T-Mobile don’t end up copying / stealing all their tech and their model. If those three are successful, suddenly they could use the Starry model to roll out a fixed wireless product in every major city in America, and we’d see massive broadband competition in the largest cities in America, which would destroy the cable franchises. Again, Starry is saying they can deliver gig speeds at $10-15/HP, and they need just 4-5% penetration to break even on their model. The big 3 wireless players would look at that spend as a drop in the bucket compared to their existing capex plans, and they’d almost certainly get to that penetration just by marketing to their wireless customers (quote below from Starry’s announce call).

“Second, we were vertically integrated as a company with design and built our own technology at low cost and assembled much of here in the United States. As a result, we are able to build a gigabit speed last mile coverage layer at $10 to $15 per home pass. The coverage CAPEX is nominal, and the majority of the CAPEX is variable, and success based, meaning only when the customer orders the service. This is the inverse of a traditional fixed line broadband network where most of the CAPEX is spent up front before a single customer is attached to the network. This allows us to get to even, break even at just four to five percent of homes under coverage.”

This is a point several of the experts I talked to emphasized; the threat from Starry isn’t Starry. It’s that the big wireless companies will eventually copy Starry’s model; in fact, the fate of a Starry investor could come down to how big wireless players view Starry through a buy/build framework (i.e. is it cheaper to recreate Starry’s tech and try to poach their customers, or just pay up for Starry and buy all their tech and customers in one swoop).

So, as a cable investor, my worry is not on Starry in particular, but on what happens to cable companies if the Starry model is proved out and all the wireless companies copy it.

It’s a big concern, but ultimately I think it’s one that cable can overcome. Why?

Well, first I’d note that this is a concern that only applies to very dense urban areas with big MDUs. Obviously that’s millions and millions of households, but that leaves a lot of cable’s franchise protected from the Starry risk.

Second, I’d note that Starry remains alone in pursuing this model despite the apparent success of their initial roll out. The cable and wireless companies aren’t dumb (with one or two exceptions). They’ve seen the model Starry is pursuing for years; I find it curious that none of them have chosen to aggressively copy the Starry model. Perhaps the wireless companies aren’t copying the Starry model because they can’t figure the tech out, but (again) Starry spent a fraction of a fraction of what the major companies spend in R&D and capex every year. I struggle to believe they couldn’t recreate the Starry model if they wanted to. More likely, I think the wireless companies believe there is some risk to the Starry model longer term that suggests investing R&D to copy the model would not be a good spend.

What could that risk be?

I think there are two related risks. The first is that the Starry model looks great when you’re adding your first set of customers to the network, but performance and reliability quickly trails off as the network fills up. This issue is very similar to the one that came up time and again when discussing Starlink; the network works great for the first set of customer, but when you put the second set on the performance of the whole network degrades. Sure enough, it was one of the first risks / reasons for suspicion experts identified when talking Starry.

If I had to guess, this risk is the reason wireless companies aren’t aggressively following the Starry model. They’ve run tests in their labs, and the results suggest that the network will degrade quickly as additional customers come online, and they’ll never be able to recoup their investment into the product. And, if the current wireless companies can’t justify the investment with their huge fixed cost base, spectrum resources, etc….. it suggests Starry’s going to have trouble in the long term. Heck, as noted in part 3, even T-Mobile (the fixed wireless champion) is renting fiber to attack the Manhattan market. I suspect they would have loved to go with the Starry model if they thought it was feasible as they took share and ramped.

The second risk to the Starry model is pretty simple. For a long time, cable has argued that a competitor coming in with a fixed wireless build out is very similar to an overbuilder. Remember that broadband consumes much more data than a typical wireless user, and in order to handle that much data fixed wireless needs to go over much higher frequencies. Higher frequencies degrade faster, so running a fixed wireless network generally means you need to build small cells much, much closer to where people live than you would with a cellular tower. Basically, a fixed wireless network eventually starts looking very similar to a cable network, except at the very end of the network there’s a small cell running very high frequencies instead of coax fiber running into your home.

So I think the second risk to Starry is that they found a novel way to cheaply create a cable overbuilder…. but Starry really only owns their technology and customer relationships. They don’t actually own the network or any of the physical infrastructure. That’s fine now…. but there’s a limited amount of fiber and backhaul capacity in any town. If the Starry model is really successful, on the backend I suspect they are going to run into some real issues with the people who actually own the infrastructure they’re leasing (the towers, the fiber connecting to the providers, etc.). Remember that selling data is very high gross margin but requires a huge fixed investment; in the long run, I suspect all of that gross margin goes to the person who made the fixed investment, not the person who is good at customer service or who has developed a really unique last mile solution (that I suspect can be copied).

(PS- another interesting risk: if the Starry model really works, the success of it will have come in large part from how undervalued the super high frequency spectrum they run their network on was. Going forward, similar spectrum will get bid up like crazy, which will drive up the cost of similar models / expansion).

I’m not a network engineer, so I feel like I’m having trouble explaining that thought. Maybe that suggests I haven’t fully internalized or thought about it properly yet, so let me try a different way. Years ago, there were tons of Mobile Virtual Network Operators (MVNOs). These are companies like Cricket wireless that don’t own their wireless networks, but are simply brands that acquire customers while leasing one of the big mobile networks like Verizon or AT&T. Over time, all of those mobile players went went bankrupt or were acquired for a song because the people who actually own the networks ultimately had all of the leverage in their relationships.

I suspect Starry is going to run into a similar problem. In the long run, the towers and fiber they are leasing can say “Hey, nice business you’ve got there. We own own one of the only two small cells on this block, and all of your infrastructure is on our tower. We’re raising your prices by 50x and taking away all of your excess profits; you can take it or leave it, but if you leave it you don’t have a business.”

Maybe that’s a little on the extreme side. Again, I’m not a network engineer, and I don’t have access to Starry’s data room and contracts and everything. But everything I’ve seen in telecom suggests that the economics ultimately flow to the party that owns the most irreplaceable part of the network; in Starry’s case, that’s the people who built and own the local fiber / towers that Starry’s network operates on, not Starry itself.

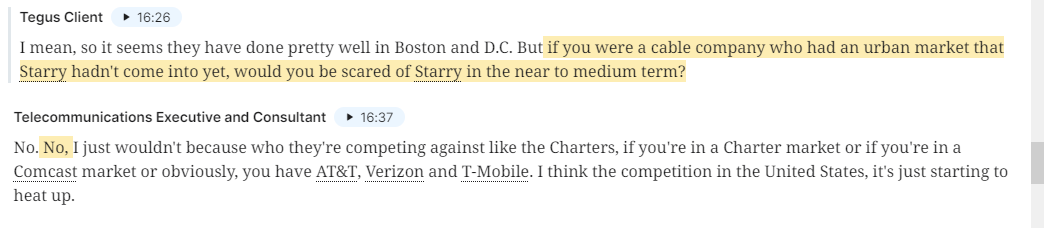

FWIW, the experts appeared to agree with my conclusions. While they generally were impressed by Starry’s execution to date and one suggested Chet (their CEO) was a “great visionary”, in general they thought Starry wasn’t a huge risk to cable in the long run (though they certainly noted competition would be ramping up for cable in the long run!).

I’m going to wrap it up here; overall, I think Starry (and the model they’ve built) are the scariest when it comes to cable, but my “MVNO mental model” suggests that Starry is going to struggle in the long term from not owning their full stack, and the fact that seemingly no one else globally is rushing to copy the Starry model suggests to me that they are likely to struggle as the try to scale up. But I will be keeping a very close eye on them, and I’m always happy to hear or learn more about them if you have any thoughts or different takes!

This series has run long (almost a full month!), but I’ll be back later this week with some closing thoughts to wrap this thing up. See ya then!

Odds and ends

The quote below, from this interview, is super interesting and a great encapsulation of everything in this piece. Starry has found a way to leverage existing infrastructure to challenge cable in a really cost efficient way; the question is going to be if their model can sustain increased customer counts and if the fixed infrastructure ever pushes back,

FWIW, Starry’s SPAC pitch dunked on wireless players trying to use 5G for fixed wireless and LEO satellite internet like Starlink.

“Starry has a combination of capacity, gig speed, and low latency that both low earth orbit and mobile 5G networks lack. We view low earth orbit solutions as unable to serve dense population areas and appropriate for remote locations. Fixed residential customers like Starry’s customers consume 40 to 50 times more data than a typical mobile connection, thereby making mobile 5G unsuitable for a fixed line broadband replacement just from a revenue opportunity of the mobile network.”

Thanks again for all the work you put into the series. It was fantastic.

Fascinating article. Great series; this was completely new to me and very interesting. Thanks for doing this dive!