Sponsored Deep Dive #8: Burford $BUR (part #1: overview and credibility)

Preamble: This is the eighth entry in my deep dives sponsored by Tegus series. The goal of these are simple: every other month, Tegus is going to give me a few expert interviews and I’m going to use those to dive into an investing topic. Some months, it could just be a dive into a specific company; other months, it might be a dive into an industry. You can find the first deep dive into the risks to the cable industry here, the second into Regeneron here, the third into Party City here, the fourth on natural gas and CNX / DEC here, the fifth on the odds Elon needed to close his TWTR deal here, the sixth on the offshore space here, and the seventh on revisiting cable here.

Unfortunately, this will likely be the last Tegus deep dive; however, I have several plans for similar series / podcasts episodes going forward, so stay tuned!

Before I get too far ahead of myself, I should note that Tegus has made the three calls I did that formed the basis of this post free to check out for the next year:

Former Senior Executive at Burford Capital (this focused on how much they could recover from their Argentina judgement)

Former Executive at Burford Capital (this focused on Burford’s underwriting and funding of new cases)

Former Employee at Burford Capital (this focused on why a lawyer would chose to join Burford and how the industry will evolve over time)

I’ll also note that I’ve done several podcasts with my friend Artem Fokin on Burford (our initial one from summer 2021 is here and holds up very well, and we did one on the heels of their big YPF win too. You can see his original Burford research piece here), and my friend Lionel Hutz had a nice write up on Burford on the heels of their YPF win here. All those posts / podcasts are well worth revisiting alongside this piece; in fact, I’d encourage you to because I want to dive right into Burford without going over some basic history that’s already well covered in those pieces!

Let’s start this post by answering a simple question: why chose Burford for this series?

The answer is simple. Buford likes to talk about their business as having four “pillars” of value.

Each of those pillars is very interesting. There are questions and concerns around each of them, but if things break right you could argue anyone of those pillars could be worth a significant percentage of today’s share price.

Let’s start by talking about pillar #4, the YPF case. In late March, Burford won their Peterson / YPF case.

Burford’s share of the YPF award in on their books for ~$1B (as of March 2023; they report Q1’23 earnings June 13, so most of the numbers I’ll use throughout this presentation are Q4’22 numbers but the YPF value is relatively up to date!), but that’s almost certainly not the precise number they’ll get. In an absolute best case, their share of the award could be above $6B (again, this is in an absolute best case scenario; I’ll discuss why they won’t get this much later). Burford’s market cap is currently just under $3B, and they’ve got ~$1B in net debt. So, in the absolute best case scenario, the value of the award from YPF would cover more than all of BUR’s share price and net debt and leave you with their core business (which largely forms pillars #1-3 in the slide above) for free.

And that core business is extremely valuable! The tangible book value of Burford excluding their Peterson assets is ~$3.60/share (again, as of Q4’22). The core Buford business consists of what is likely the best litigation financing business in the world and includes a 3rd party asset management business with $3.4B in AUM and a core portfolio of litigation assets that have historically realized 88% ROICs and 29% IRRs. Given that historical return level, Burford’s core business should almost certainly be valued at more than book. If you slap a 2.5x multiple on Burford’s core book (which would not at all be unreasonable for a business doing 29% IRR; in fact, if you think they can continue to deploy capital at anything close to that rate (an open question that will be discussed later in this piece!), the business would be worth substantially more than 2.5x book!) and add in a few dollars per share for the value of their asset management business….. well, you’d come up with a value for Burford’s core business that’s around today’s share price, suggesting that you’d be getting all of the YPF proceeds for free!

But there are a lot of assumptions on those bull cases. On the YPF side, the ultimate damages number to Burford could be as high as ~$6B or as low as ~$2B depending on an upcoming court ruling. And, even once the damage number is known, the damages will be owed by Argentina, and Argentina is not exactly known for paying their debts in full. On the core business side, Burford’s historical returns have been incredible…. but Burford is now much larger, which means they’re trying to deploy more capital than they ever have. Anyone who’s familiar with finance knows returns tend to go down as you get bigger, so there’s a question of if Burford’s returns will drop now that they’re larger. Plus, their spectacular returns have not gone unnoticed, and private equity money is pouring into the space. Any form of financing / funding is ultimately a commodity, raising the question of if Burford can continue to realize anything close to their historical returns as competition ramps up.

Those are a lot of very interesting questions, and getting the answer right on any of those questions could create conviction the market is significantly under or overvaluing Burford.

I’ll note there are no definitive answers to these questions; the future is unknowable, and I’ve spoken to dozens of experts on these topics and if you speak to enough experts you can find one willing to express any opinion. But my hope with these interviews was to gain some clarity / confidence on what the most likely outcomes and answers are.

One last note: Muddy Waters had a short report on Burford back in 2019, and while many of those allegations are dated or have been put to bed (among others, the company wisely got a non-related party CFO in late 2019), that short report left a lot of investors (including myself) with some skepticism / fear of Burford, so another goal with these interviews was to gain a little more confidence in the company’s culture and trustworthiness.

So those were all the questions lingering around my mind that I wanted to answer with this deep dive / these expert calls. Those questions out the way, let’s get to it. I’m going to divide this post into three sections:

Company Culture / Can I trust them

How does the business evolve over time / what do returns look like going forward (covered in part 2 here)

YPF collectability (covered in part 2 here)

Because this post ran long (what else is new!), I’ll cover the preamble and section 1 in today’s post, and cover the second and third sections in a post later this week (editor’s note: that post is now live).

Section #1: Company culture / Can I trust them

I’ll start off by talking about company culture / addressing lingering issues from the Muddy Waters report.

The thought process here is simple: at its core, Burford is a financial firm, and from the outside in all financial firms are basically a black box. Given the black box nature, buying into a financial firm involves an implicit level of trust in management that buying into any other company does not involve. Yes, we can look at historical results and cash flows from the company to get some idea of how the assets perform, and the firm’s statements are audited… but these are esoteric assets and a firm that really wants to bury problems or play games can probably find a way to do so (for example, you could try to avoid taking a mark on cases that are going against you by just endlessly appealing the cases and just holding them on your balance sheet at cost).

One goal for the series was to get a little more comfortable with the management at Burford, so I intentionally targeted expert calls with people who had worked at Burford and were there when the Muddy Waters report came out to see how people inside the company thought about it.

On this count, all of the experts were in alignment: the people running Burford are high quality. Every expert described the management team as “incredibly smart” or something along those lines; the quote that probably stood out the most to me on this was from this interview,

suppose the one sort of last criticism that I ever hear about the company, comes down to management, trust of management. That's the point that I always keep coming back to because in terms of whether it's Jon, Chris, or Aviva, any of the other senior sort of leadership that really make the world go around at Burford, I trust them all implicitly, they are incredibly smart.

I'm not saying it's rare that you're in a situation where you're obviously not the smartest guy in the room, but you're doing well to be in a room with Jon or Chris and sort of feel that you're sort of going to outgun them intellectually. They're incredibly bright. Jon is a university professor who just has an incredible brain for numbers and law. And Chris is a very good lawyer and has a very good intellectual approach to it. And that comes with a lot of respect. So the final point for me is always, do you trust the management. And for me, it's a resounding yes, because I think I've got a huge amount of faith in Chris and Jon.

They're incredibly intelligent guys. And it's also about how they view and how they value Burford. Burford is their baby. I know it's certainly sort of a 15-year company, but it's kind of their life's work, and all roads have been leading to this. And they take immense pride and protection in building what they're building and doing what they're doing. So it has their DNA all over it.

Or, if you want a quicker summation, this expert boiled it down to a paragraph:

I mean super smart people, very ethical, but also very results driven. They were very concerned about returns for investors, understandably. So it was an intense environment, I would say, where there's a lot of pressure to find good deals and move good deals through the process and try and close on them, but that was all sort of driven by their desire to grow and to return value for shareholders and investors in the private funds.

Bottom line: I think the answer is yes, you can trust the Burford team. I don’t think every expert found Burford to be a perfect fit for them and their career (in fact, I think two of the three experts found Burford wasn’t a good fit for them), but every expert did have high regards for the quality and integrity of everyone else in the Burford organization (and this matches what I’ve generally heard from people I’ve talked to outside of the expert call structure as well).

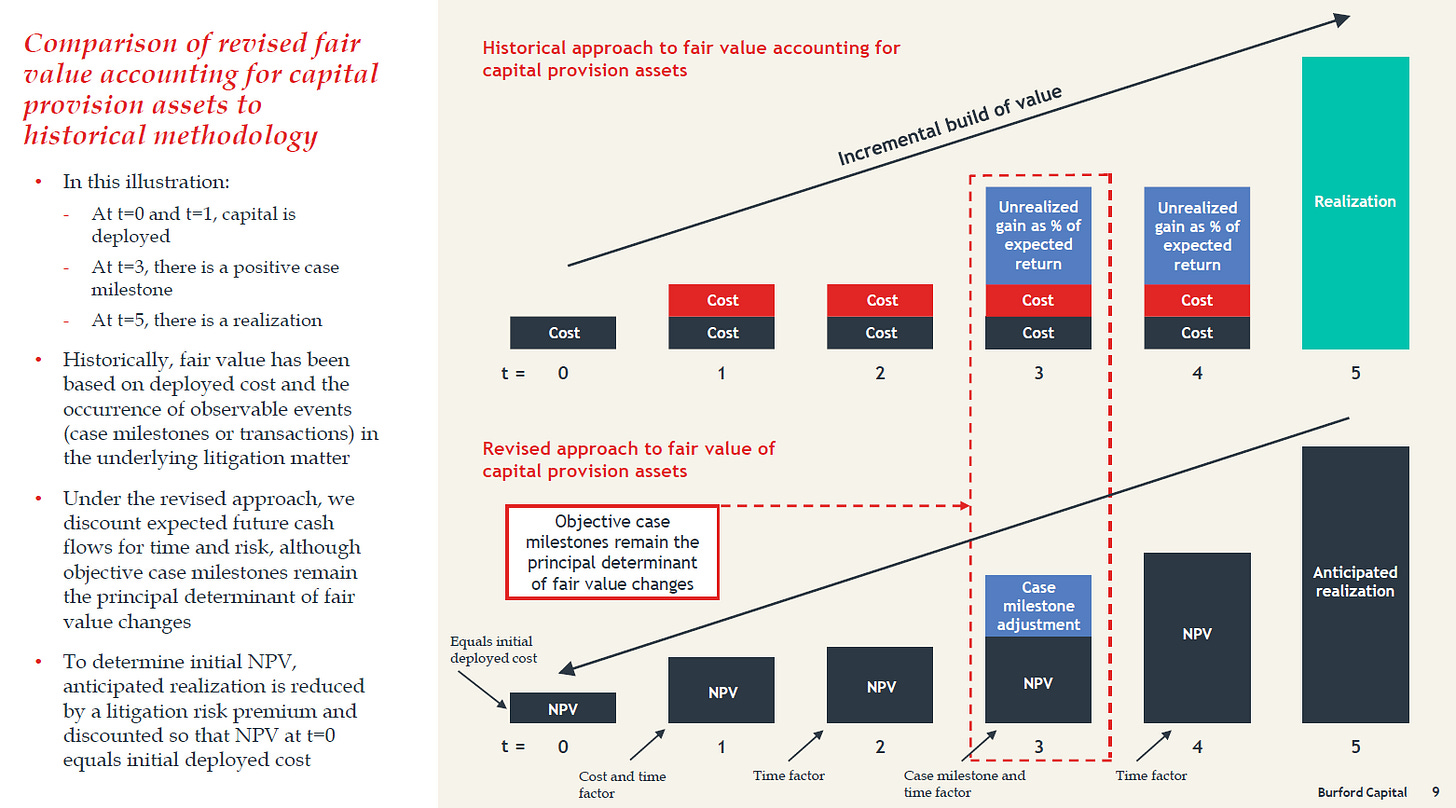

One last note in this section before moving on: this year Burford engaged with the SEC on how to use fair value accounting in their financial statements. I don’t think the SEC engagement changes the semi-black box nature of a financial firm or the importance of trust in management discussed above, but the hope is with an SEC blessed method of accounting there’s just a little less worry about BUR’s financial statements going forward.

Stay tuned for part #2 later this week (editor’s note: part 2 is now live), where I’ll cover “How does the business evolve over time / what do returns look like going forward” and “YPF collectability”. See ya then!