Some Thoughts on Stock Dilution Part 1 $TPB

Note: this article started out as one article, but I decided to split it into two separate articles and link the two of them to 1) make it easier to link to specific ideas in the future, 2) break up what was becoming a long article, and 3) because #pageviews. You can find Part 2 here.

I spent a good deal of time last week looking at Turning Point Brands (TPB). It’d been on my list for a while (from this VIC write up), and the upcoming close of the Reynolds / British American Tobacco deals plus some press around smokeless tobacco made me want to look a bit deeper. And I found a lot to like:

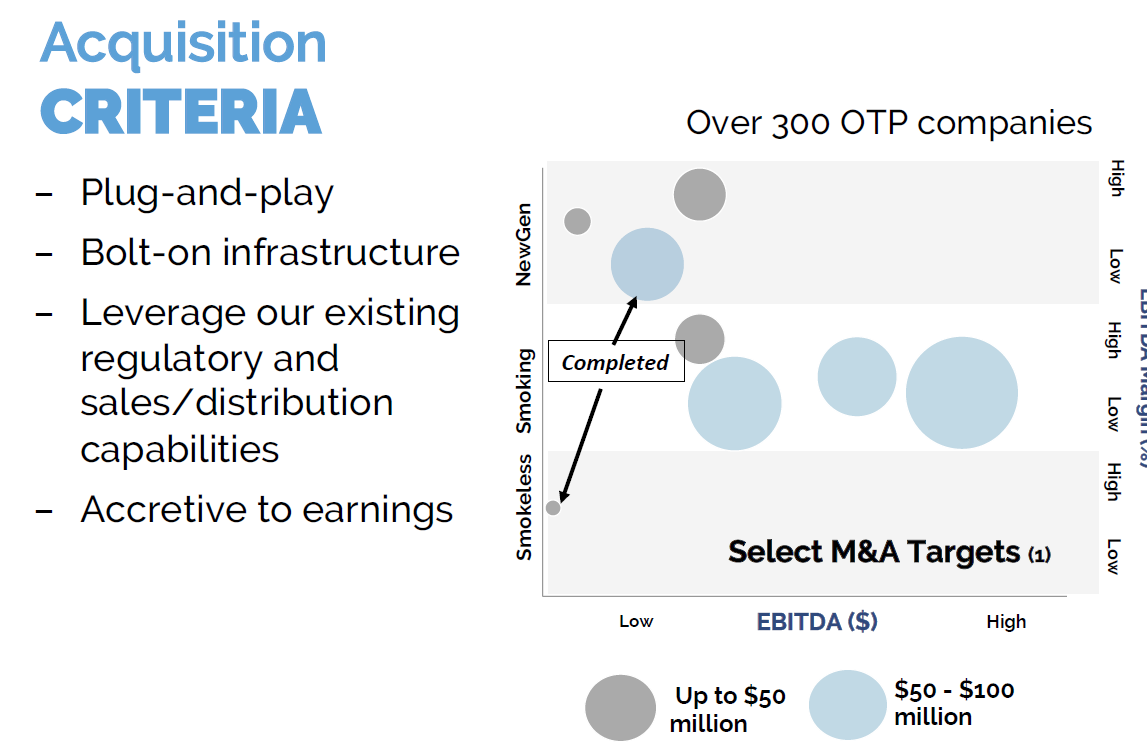

Roll up opportunity: TPB seemed to have all the makings of an interesting platform / acquisition company. They operated in a very fragmented industry, and the early results from their recent acquisitions seemed to indicate they were not only buying at attractive prices but also had the opportunity for pretty large synergies with their purchases through significantly expanding their distribution.

TPB is controlled by Standard General, who made a fortune pursuing a similar strategy with Media General, so there’s some trust that the controlling shareholder would be very focused on generating strong shareholder returns and had experience pursuing the roll up strategy.

Management mentioned several times that they had a great “plug and play” opportunity to leverage their SG&A while increasing distribution.

TPB also had a decent amount of NOLs ($39m), which would boost cash flow and allow for more acquisitions.

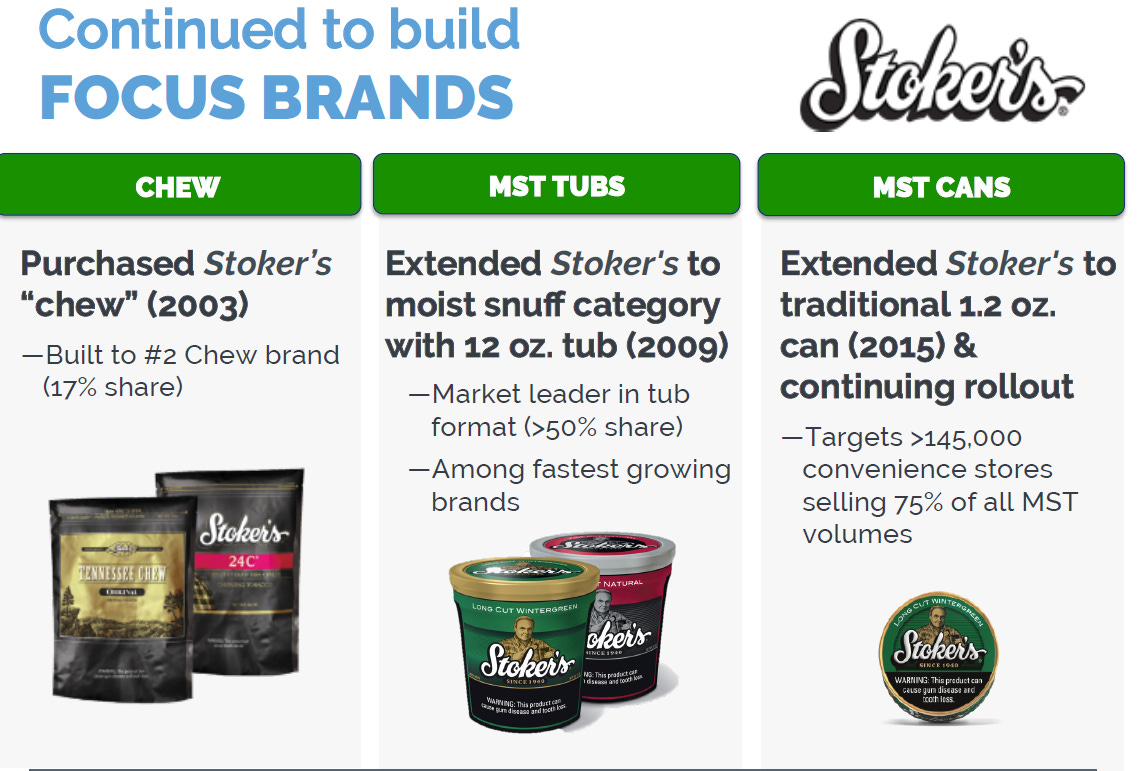

Growth: On top of the roll up opportunity, TPB’s underlying brands were performing strongly and taking share.

Valuation gap: Loose peers like PM and BAT trade for just under 20x EBITDA, while TPB trades for 10-12x (depending on how you treat some addbacks).

It’s somewhat comparing apples to oranges to compare a giant cigarette company to a small smokeless company, but you have to start somewhere. And TPB is actually growing rapidly / taking share; if they can continue to do that given their FCF characteristics, shareholders will do well regardless of if they can actually roll up smaller players or not.

I’ll stop on the TPB value opportunity there. I never got finished with my work because one question kept sticking in my mind: if TPB was such a fantastic investment, why was Standard General willing to dilute them in an IPO at $10/share last year? I 100% get the argument to be made for having a public currency to do accretive deals if you think a company has a roll up opportunity, but if you really think a company is worth $20/share, why would you willingly dilute yourself at $10/share? That question (plus Standard swapping their stake in TPB into a shell company that they controlled) was really gnawing at me; when TPB announced they had started an at-the-market equity program last week, I decided there was just no way I was going to get comfortable with them.

Anyway, TPB is not the company I wanted to talk about today. But they were a quick intro into one of the two or three areas I think I’ve struggled with most as an investor: companies that are going to be consistently diluting their shareholders.

I guess my underlying thought has always been that if I’m buying a stock, I’m doing it because I think it’s undervalued. If a management team is issuing shares of undervalued stock, it calls into question a host of things.

Does management have investors’ best interest at heart, or are they looking to empire build?

Is this a sign of poor capital allocation skills?

Maybe I’m missing something and the stock’s not as cheap as I thought it was?

Can they really come up with a project that, on a risk adjusted basis, returns a positive IRR versus issuing undervalued stock?

Which brings me to the stock I actually wanted to discuss: RLJ Entertainment (RLJE). (For more on RLJE, please see part 2 here)