Some things and ideas: May 2019

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month. Podcast and interviews:

You can find this month's Rangeley Podcast here. On it, we discussed Centene's (CNC) deal for Wellcare (WCG, disclosure: long) and Third Point's push to get CNC to shop itself. We also returned to the Anadarko (APC; disclosure: long) Occidental (OXY) merger in the wake of Carl Icahn's effort to (maybe) derail the deal or (maybe) push the board out. Finally, we touched a bit on Jeopardy.

Also, as mentioned last month, I went on the scuttleblurb podcast earlier this month. Our conversation centered on Netflix, but we touched on all aspects of the media space, including broadcasters, the WWE, and several others.

Monthly value theory ponderings: Management delusion

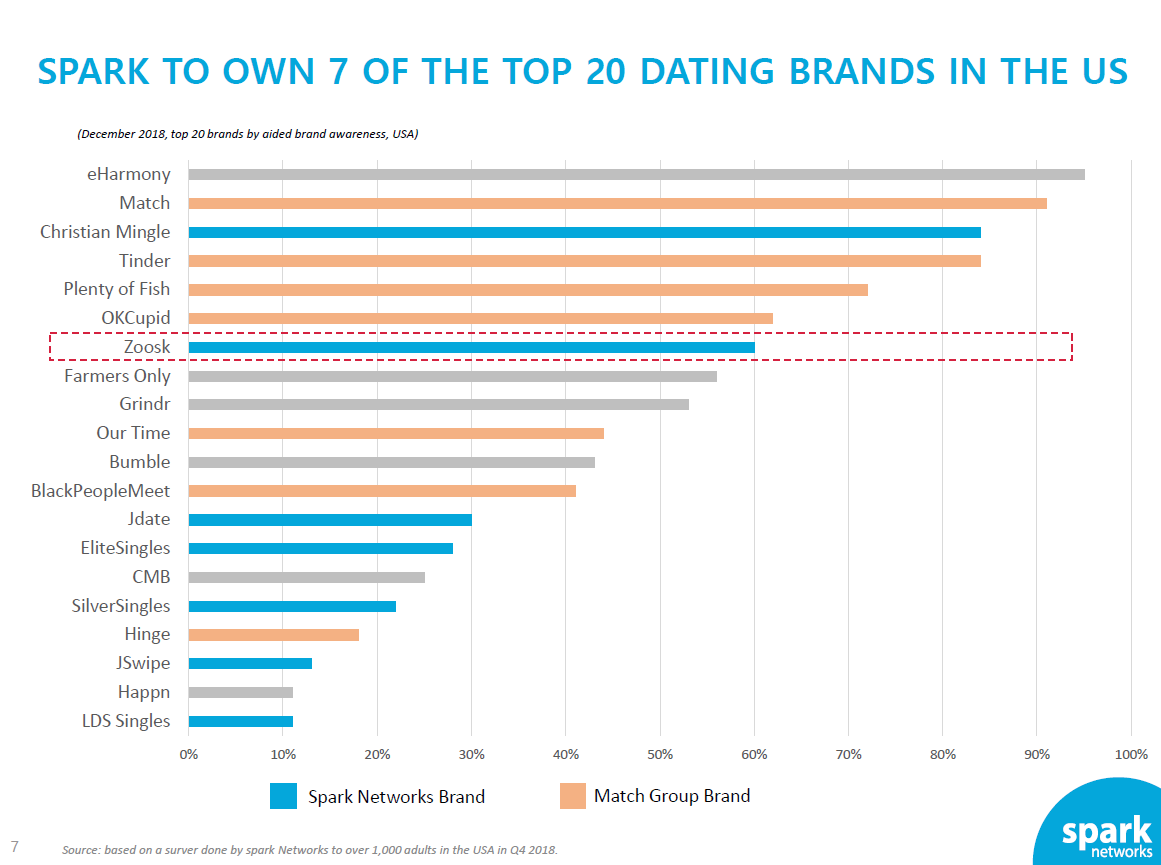

Spark Networks (LOV) is an online dating company. You could consider them something of a competitor to Match.com (MTCH; disclosure: long through IAC), though saying Spark and Match are competitors is kind of like saying Walmart and your local thrift store are competitors. Technically probably true, but it's a stretch. Spark's history is they had a really popular dating app (jDate) with a specific niche (Jewish singles), but the company could never really evolve beyond that product. Spark tried to build out a bunch of other niches (for example, on the theory that they were good with religious dating because they had jDate, the company spent massive amounts of money to try to get Christian Mingle going), but none of the new products ever really caught fire. Today, Spark has evolved into buying mainly legacy dating sites. Case in point: earlier this year they announced a deal to buy Zoosk, an early mover in the "social dating" sites that never quite figured out what they wanted to be (If I remember correctly, Zoosk basically just advertised a bunch on Facebook and built up a huge user base that way, but never developed a user retention or real monetization model) and quickly flamed out.

Anyway, as mentioned, Spark bought Zoosk earlier this year, and their merger deck include the slide below, which I find myself thinking about often.

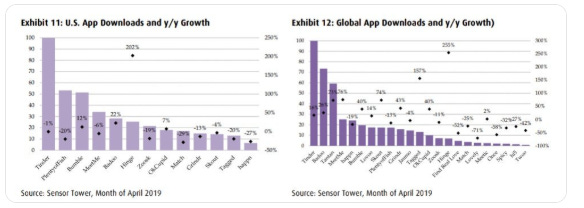

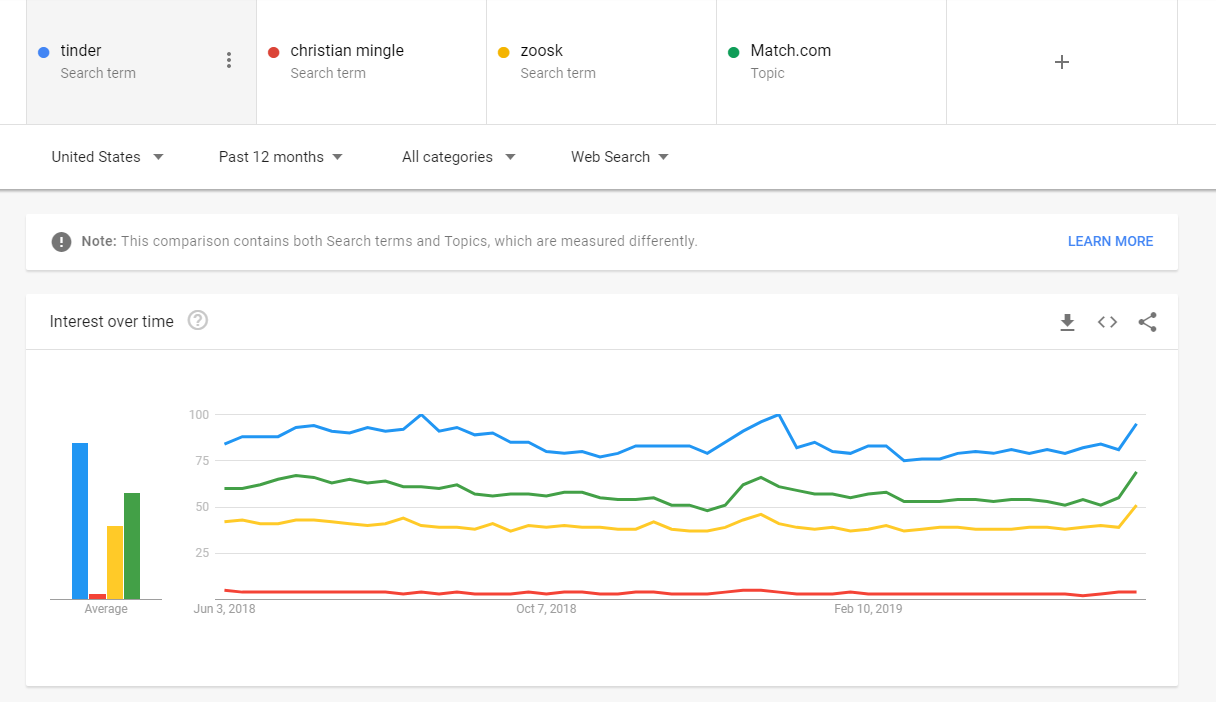

Ignoring the typo in the footnotes ("surver" instead of "survey"), it's incredible to me that a management team could, with a straight face, suggest that Christian Mingle has brand awareness on par with Tinder and approaching Match (or that Zoosk's brand awareness was closer to Tinder than it was to something like EliteSingles.com). There are lots of ways to show just how silly that take is; below are a simple google trends overview of Zoosk vs. Tinder vs. Match vs. Christian Mingle probably gets the job done (something like daily active users by site would be helpful too, but that's tough to lock down one consistent number) and a comparison of app downloads across brands (hattip Jerry Capital for that one); I think both show Tinder is in a completely different stratosphere than the Spark brands.

Any management team that could say the Christian Mingle brand is anywhere close to Tinder with a straight face is either delusional or extremely promotional (or both). But the reason I think about that slide so much (aside from the fact it's just funny) is I wonder if a slide like that disqualifies a management team / company from a potential investment. What's the difference between that slide and Charter's CEO (CHTR; disclosure: long) blaming password sharing for cord cutting and suggesting that Charter will continue to add video customers when all the evidence points and common sense points to cord cutting accelerating? I can promise you that statement was just as delusional then (October 2017) as it is now. James Dolan is completely delusional, and yet MSG (disclosure: long) is one of my largest positions. Moving away from my portfolio, what about aspiring start ups talking about taking on giant cooperations? Uber seems extremely crazy in hindsight ("yeah, we're going to launch a service where customers get into random people's cars, we're not going to follow any local laws or regulations, and we're going to burns billions of dollars every year while we do it. Want to invest?"). Steve Jobs was famous for his "reality distortion field". Where's the line between deluding or distorting for good (to motivate employees, grab the attention of a potential investors, or grab cheap free media that replaces paid marketing?) and a delusional red flag so large that a management team / company are basically uninvestable? To date, that answer has been experience / gut feel, but it feels like there should be something more systematic.

Berkshire annual meeting:

Berkshire's annual meeting was earlier this month, and probably the most interesting thing to come from it is one of Buffett's portfolio managers has been buying Amazon. I think it makes plenty of sense: Amazon has a huge moat and maybe the best CEO of our generation in Bezos. Bezos is reasonably young (55), so if you're investing very low cost capital (which Berkshire has) with a super long time horizon (which Berkshire also has), the investment makes plenty of sense. There are plenty of hot takes about Berkshire buying Amazon stock out there, and I don't feel any need to wade into those waters. But there is one angle to this investment that I think is under-reported on: Buffett has constantly chided himself for not investing in amazon earlier, and Amazon's stock is up ~5x over the past five years. Despite that rise, Berkshire was able to come at Amazon from a fresh angle and buy the stock at what they thought was an attractive price. There are a lot of investors who would really struggle to buy something that they had been following for years after it had gone up by 5x and they hadn't owned it; in fact, I'd wager the biggest struggle for most value investors today is buying a stock (or buying more of a stock) after a big price run up. Often, new information has driven that big run, and sometimes the stock can be cheaper / a better risk reward after a big run up with that new information than it was before the information came out, but it can be really tough not to mentally anchor on the lower price (and I would willingly admit that this is probably my biggest blind spot as an investor). Between Berkshire buying both Amazon and Apple after big runs, Berkshire clearly isn't having that missed opportunity cost / anchoring issue.

Some more BRK meeting articles / notes

While we're on Berkshire, and since we mentioned Anadarko's bidding war in last month's notes / podcast, some links to a discussion on his financing of Occidental's bid (a fantastic bit of financing for Berkshire)

Sports media update: A core tenant of the monthly update: continued highlights of the increasing value of sports rights (mainly because of my love of MSG (disclosure: Long)).

DAZN financials highlights difficulty in changing sports viewing for fans

ESPN pres courts a new generation of fans (interview w/ ESPN pres in WSJ)

Darts for darts sake (how darts became popular in UK TV, "something line England's NASCAR")

MSG shareholders sue Dolan for spending too much time with band

IRS rules Warriors don't need to pay taxes on interest free loan

I say this all the time but might as well repeat it here: people who point to top flight sports teams as bad investments because they don't throw off tons of profits in short term are missing all of the other things that come along with team ownership: business opportunities, political sway, tax breaks, and (in this case) really favorable potential financing from a passionate group of fans.

Top live streamers get $50k/hour to play new video games online

Broadway breaks annual box-office record

Not sports, but with attendance and pricing both up, I think it shows the continued "power of live".

Other things I liked

Meet Matt Calkins: Billionaire, Board Game God and Tech's Hidden Disruptor (and possibly my new idol)

Speaking of idols: Big Bets and a Fast Buzzer: The Secret Sauce of James' Holzhauer's Jeopardy Success (I love Jeopardy. I used to watch it every day after work. True story: in a previous life, I had saved up a month of vacation time and was going to use it to take a month off work to study furiously for Jeopardy and prep to go on the show. I even read Prisoner of Trebekistan and Secrets of the Jeopardy Champions (though read is generous for Secrets; that's more a study guide). I still haven't done taken time off to focus on Jeopardy, but #lifegoals). (Bonus: here's a NYT interview with James)

It was truly a month of idols for me: as someone who loves workout classes and definitely does not have abs, Brad, his quest for abs, and his ability to monopolize Pelton classes were an inspiration.

Game of Thrones not the end of appointment TV

I've made this point a few times, but I wonder if Netflix's strategy of releasing everything all at once actually hurts some of its shows and their ability to break into the wider culture. For example, I love Stranger Things, as do most of my friends. But if it comes out on a Sunday and one of my friends has the time to binge the whole thing, while it takes me three weeks to finish it, then that person and I can't discuss the show at all. With the GoT model of one show a week, you get appointment viewing and everyone has a chance to discuss the show on equal voting if they "keep up", both of which I think help elevate the show.

For Blackstone, Insurance next big thing in push for One Trillion

The Fyre Festival of Capitalism (Biglari Holdings annual meeting recap; incredible) (I touched on some BH history in this post)

Gentlemen at the Gate: With Trillions Pouring in, KKR and Its Peers Must Build Up Rather Than Break Up (disclosure: long KKR)

Robert Downey's Massive Profit Share Tops Avengers' Stars' Deals

The peculiar blindness of experts

Nothing super new in this article for anyone who has read Superforecasting (an excellent book; I liked it so much we gave it to our partners one year), but I still enjoyed the article. I wanted to highlight the last paragraph ("In Tetlock’s 20-year study, both the broad foxes and the narrow hedgehogs were quick to let a successful prediction reinforce their beliefs. But when an outcome took them by surprise, foxes were much more likely to adjust their ideas. Hedgehogs barely budged. Some made authoritative predictions that turned out to be wildly wrong—then updated their theories in the wrong direction. They became even more convinced of the original beliefs that had led them astray. The best forecasters, by contrast, view their own ideas as hypotheses in need of testing. If they make a bet and lose, they embrace the logic of a loss just as they would the reinforcement of a win. This is called, in a word, learning"). One of the toughest things to do as an investor is avoid selling your flowers to buy more of your weeds (selling your winners to buy more of your stocks that are down); often (but not always!) the stocks that are down in your portfolio are down for a very good reason. One of the things that separates the investors I talk to and really respect is their ability to incorporate new information and avoid anchoring bias; they may still like a company / stock after it's down 30%, but they'll generally say something like "things haven't gone as well as I though but I still think there's value and here's why". One of the thing that makes me suspicious of an investor is when a company they're invested in is clearly struggling and they continue to increase their price target (in one case, I saw a company announce disastrous earnings that more than cut the stock in half (from like $12/share to $5 or something) and the investor told me he was increasing his price target from $30 to $40 on the heels of the earnings); the line on hedgehogs updating in the wrong direction obviously made me think of those types of investors.

Why buy from amazon when you can buy from your friends thanks to Storr (basically an ad for Storr, but interesting concept nonetheless!)

The Truth about this diner's enormous plate of 10 Fried Eggs