Some things and ideas: August 2021

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

My monthly overview

I'm going to start putting this piece in at the start of every month. I just want to highlight two things

I do four things publicly: this blog / substack (the free side), the premium side of this blog, my podcast (Spotify, iTunes, or YouTube), and my twitter account. You can see my vision for the podcast here, and my vision for the blog and premium site here. If you like the blog / free site, I'd encourage you to check out the pod, follow me on twitter, and maybe even subscribe to the premium site!

I try to be as helpful as humanly possible to anyone whose research / writing I enjoy. In almost every post I do, you'll notice I link to other subscription services or investors who I like. I don't get referral fees or anything for that; these are almost always organic links and highlights that I do not because I was asked to but because one of my goals with the (very small) platform I have is to shine light on other people who are doing good work and make sure they have a platform big enough to encourage them to keep doing good work!

If you're launching a subscription service, or a new blog, or you're an investor who has done some really good research and wants to get some more eyeballs on it, please drop me a line and let me know. If the quality is there, I would love to link to your blog post or subscription service or research (and if the quality isn't there, I'm happy to provide feedback! I have done so with several services and I think my advice is good / appreciated / helpful!), and I'd love to have you on the podcast to talk about all of it. I can't promise anything, but most podcast guests / people I've linked to have been very happy about the reception / feedback they've gotten (I've even been called the king of the sub bumps / almost as good as Twitter / a big sub bump, and I've generally heard from investors with LPs who come on the podcast that they're delighted by the response). My DMs are always open, so feel free to slide into them if I can be helpful!

My Altice jinx and customer satisfaction

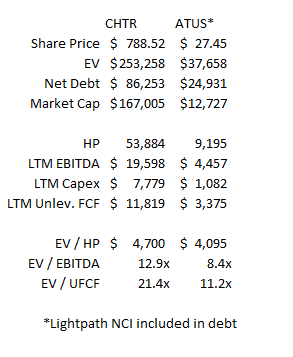

I completely jinxed Altice by calling it the “best” large cap stock in early July. Since then, it’s underperformed Charter by ~30% (and that underperformance has continued as I get set to publish).

Does it suck? Yes, yes it does…. but I’m still pretty confident in Altice. It is just way, way too cheap, and they buyback stock very aggressively. Eventually, the math is going to work in their favor….. unless it turns out they just cut costs too deeply, the operations are a such a mess that customers flee in droves, Altice can no longer collect autopay from their remaining customers, and the whole business blows up.

Altice’s strategy was to cut operational costs pretty deeply, flex their pricing power, and maximize near term FCF; Charter’s strategy was to keep their consumer prices low, invest in customer service, and maximize penetration because they believed that created the highest LTV. I believe it was Greg Maffei who said something along the lines of, “if ATUS’s strategy works, they’ll buy CHTR for a big premium; if it doesn’t, we’ll buy them in bankruptcy.” But it could have been Rutledge, Malone, Faux Greg Maffei, or even me who said that originally. At this point, I can’t remember!

I think it’s very unlikely the ATUS business blows up….. but I could see the possibility. The chart below is from ACSI; look at the trend in score for Altice’s two brands (Optimum and Suddenlink). Since 2017, each has seen a massive decrease in industry score. Most of their peers have been steady or seen slight increases (Comcast, for example, has gone from 60 to 67, though they’re a little bit of an outlier).

So I’ve just kind of been thinking about that chart recently. How meaningful is it? How meaningful is customer satisfaction? All else equal, sure you want customer satisfaction to be higher. But can you really read anything into one company coming a little above or below industry average? I mean, AT&T is at the top, and their stock has underperformed the indexes pretty significantly for years. Yes, I know that a lot more goes into T’s stock price than just customer satisfaction, but if you’re getting super high marks in customer service because you’re spending a fortune on customer service or underpricing your service or something…. well, you’re not really creating value, are you? And if you’re towards the bottom but it’s because you can operate with a cost structure that is magnitudes lower than peers, maybe it’s the right strategy?

I don’t know; it was just something floating around in my mind. If you have any thoughts, I’d love to hear them!

I mentioned I’m still bullish Altice. Please read my July write up for more detail, but the overall reason I remain bullish is pretty simple: it’s just too cheap. I think cable assets are worth 15-20x EBITDA. I know that’s a wide range and I’m not providing a lot of back up, but it’s where I’ve generally settled and I’ve done lots of work to back me up on that range (one thing that gives me confidence? WOW, an overbuilder, sold assets that are much worse than normal cable players’ for 11x EBITDA). Altice is trading for <9x EBITDA and a material discount to other players on an EV / Homes passed basis. Given how levered Altice is, it doesn’t take much of a move in their multiple to result in some pretty outstanding equity returns. And Altice is very committed to aggressively buying back shares (they’re targeting $1.5B for 2021); if they keep this pace up, they’ll be demolishing their share count every year. Combine a cheap multiple with an aggressive share repurchase plan, and eventually either the stock rerates much higher, or they’ll buy back every shares except for the ones I own and suddenly I’ll be a cable magnate. If that’s how this plays out, I’m very much looking forward to that day; basically every cable magnate ends up owning a sports team (Malone has the Braves, the Dolans have the Knicks and Rangers, Comcast has the Flyers, and there are several other), and I promise that my sports team ownership will come with much more shenanigans than their buttoned up ownership (except for Dolan; his ownership comes with plenty of shenanigans but they’re cruel and tragic, while mine will be cheeky and fun)

Concentrated compounding had a really nice recent write up of Altice

And, good news: it seems Altice didn’t repurchase aggressively in July, so hopefully they’re leaning into the current share weakness!

Speaking of Altice blowing up……

Investing in blow ups

One thing that’s been on my mind recently: how much of a red flag is it if someone invests in a company that blows up (either because of fraud, or because it was just overhyped and way overpriced)? What if they’ve done so several times, but their long term track record is still good?

The genesis of this thought was Zymergen (ZY), which blew up earlier this month. ARKK, Softbank, and Baillie Gifford were all big shareholders, and ZY is not the only company that they’ve been invested in that have blown up recently. For example, Softbank’s been in WeWork, Greensill, and a bunch of other epic blow ups. But, despite all of those blow ups, all three have enviable track records running over a pretty decent time period.

I’m not here to debate any of those funds / managers; I know all are controversial, and I know many people argue that they are “one trick ponies” who rode a tech wave to great returns.

So my question is: how do you evaluate a manager who has invested in several frauds / blow ups but has a good track record? Is it a red flag that says they should be avoided? Or is a sign that they’re willing to do really deep work and take concentrated bets on controversial positions, knowing a few will blow up but the overall returns will still be attractive?

Speaking of blow ups….

Tether / BTC

I was listening to this Odd Lots podcast with Matt Levine and the founder of crypto exchange FTX, Sam Bankman-Fried. The whole thing was interesting, but the talk about Tether (starts at ~48 min mark) was eye opening to me. I thought Tether was pretty obviously a….. well, lets be generous and say “speculative” crypto that was pretty much a trading sardine (a speculative asset that traders flip in and out of hoping not to get left with the bag when the party ended, though in tether’s case they more use it to fund trades involving other speculative cryptos which I guess makes it a trading sardine for trading sardines?). I’m not sure how anyone could watch this CNBC interview with the Tether CTO and General Counsel (here’s Matt Levine’s summary and a summary on “protos” and coindesk) or read this FT piece and think Tether was legit. Yet here was the CEO of an $18B crypto exchange vouching for them. When pressed, the largest downside he could consider was some of Tether’s commercial paper defaulted and Tether was worth only ~88 cents on the dollar, when it seems clear that the downside is much, much larger if the worst came to pass.

Obviously speculative, but the quote “clients suggest every large CP dealer desk they ask haven’t seen the Tether flow. That’s pretty stunning, since back-of-the-envelope math suggests Tether bought the equivalent of 1% of the entire market in April alone“ suggests the degree of downside here is massive.

I know there’s lots of speculation in crypto land (I don’t even know how to think about the price of EtherRock). Some stuff is legit (or has the chance to be), but clearly when things like Dogecoin are trading with tens of billions of dollars of market cap just because people think Elon Musk will pump it on SNL there’s a little bit of speculative mania. But for a major firm to defend Tether that fully opened my eyes that the whole system is built on some level of mania / suspension of disbelief. I realize I’m far from the first person to make this point, but it feels inevitable that at some point there’s going to be a big wash out in crypto land and we’re going to see a lot of people swimming naked.

Anyway, nothing on here is investing advice, but if you’re a crypto bull, I think the right strategy is to make sure you have lots of capital on the sidelines to deploy into cryptos at attractive prices if things got really messy. It just seems inevitable to me.

Conviction

My buddy Sleepwell had a nice post on conviction (The Raw Material of Lon Term Investing; he linked to an old piece of mine in it, and now I’m linking to his, so we have a little bit of link / recommendation inception going on!).

PS: I believe Sleep hit the big time and has taken a buyside job. Congrats to whatever firm grabbed him; you’re lucky to have him! I hope he’ll continue to put public posts up for us little people!

Anyway, I really enjoy writing a blog and doing the podcast. But one of the most frequent questions I’ll get is “Hey, this stock that you mentioned six months ago is down. What should I do?” or “Hey, XYZ mentioned this stock on your podcast, and it’s dropped 10%. What do they think I should do?”

I just hate those questions. Not only do they veer into the dangerous territory of investing advice (which nothing on this blog is!), but they’re the hallmark questions of someone who hasn’t done the work on a stock to develop conviction.

Another version of that question I’ll see a lot is I’ll talk to someone who will tell me their best idea is “Company X”, and a big piece of the thesis will be Famous Investor Y has a big stake in the company. I’ll catch up with them in a few months and ask about Company X, and they’ll no longer be invested because the famous investor sold out of the company.

I can’t tell you what to do as an investor (again, nothing on here is investing advice!). But if you’re willing to drop your entire thesis on your favorite position because a famous investor sold, or if a stock is down and you’re asking someone else what to do….. well, you probably shouldn’t be invested in that company.

That doesn’t mean you can’t ask questions, or try to think through why someone sold a stock you have a lot of conviction in! But “stock X is down” is not a good question (in fact, it’s not even a question)! If you’re reaching out about a stock that’s down (or just any stock at all), I personally like to show that I’ve done some work on the company. Ask something like “I was surprised that margins came in so low, and management’s rationale on the call wasn’t that great. Do you think they can get back on track or is this how we should be thinking about margins LT?” or “Their growth was really low, and it seems like they really trailed peers like Company Z, who said their business was firing on all cylinders. Having trouble reconciling the two; what do you think?”

Ok, I’ll hop off my high horse now.

“Bad” equity issuances

Last month I had Chris Krug on the podcast to talk PFMT. I thought he laid out a a really interesting bull case. Two of the key pushbacks that came up in diligencing the company is “Why is the PE firm behind them selling their stake so aggressively after >15 years” and “if the company is so cheap, why are they doing a shelf filing now?” (shelf filings set you up to issue equity in the near future).

We now know the answer to the later question; the company did a big secondary offering in mid-August.

The combination of a big secondary and a semi-control private equity firm selling their shares as quickly as possible is…. not a good look for a company.

This section isn’t meant to beat up on PFMT or anything! But it raised a little thought bubble that’s always floating in the back of my head: if a company does a “bad” equity issuance, are they even investable?

Another example might show this best. Last year there was a really interesting write up on RMNI on VIC. In August, the company did a big equity offering for no discernable reason; it sparked a comment thread on VIC “why on earth would they do this deal?”

When a “bad” deal happens, there are generally all sorts of reasons and excuses. Bullish investors like to say “O, this is a one time thing; some bankers hooked their claws into them and convinced them to do this deal.” or “some big holders wanted to come in, but couldn’t given the illiquidity and this deal was a way to get them in” or “there’s some big, really accrettive M&A on the horizon, but they needed to have the cash on their balance sheet before they could get deep into talks.”

All of those excuses are fine and plausible…. but all of them ring a little hollow to me. Sure, management got suckered into doing a big equity raises by a conniving bank salesman…. but what does that say about management’s ability to value their company and their desire to maximize shareholder value? Seems to me if they can be suckered into a bad equity raise, they can be suckered into taking on debt that’s too expensive, or doing overpriced M&A, or any number of other things. Do you start dinging them for more value destructive moves in the future?

Again, I don’t know the answer, and I’m not trying to dunk on PFMT or anything. The situation just brought to mind that question that’s been lingering for a long time.

PS- RMNI followed up that “bad” equity issuance from August 2020 with another “bad” equity issuance in March 2021. The August deal priced at $4.50/share; the March deal priced at $7.75/share. If only all of my companies would make “bad” trades that end up so profitable!

“Legacy” companies’ hidden value

Nexstar announced a deal to buy the Hill this month. I’m not intimately familiar with the Hill, but it fit with a theme I’ve been thinking about a lot recently: is there hidden value in lots of the “old world” / “legacy” companies?

The best example is probably an industry tangential to Nexstar / The Hill: local newspapers. They’ve been a disasters for years. But, at this point, all of them trade at super low valuations, and they’ve got assets with great potential if you think about it from some angles. They’ve got a local brand with near ubiquitous recognition in their markets, they have great consumer data (at minimum, if you’re looking at one of their articles, they have a great idea of where you live, but if you’re one of the few people who still subscribe to newspapers, they have your credit card, address, demographics, etc.), and a few other goodies (a newsroom that carries enormous local sway, relationships with lots of local advertisers, etc.).

A few years ago, “clicks to bricks” was all the rage. This was internet only companies realizing opening storefronts was a great / cheap way to acquire new customers and gave all sorts of tangential brand benefits. I wonder if legacy companies have that type of optionality; if you think about the multiple a lot of buzzy companies trade at, they could acquire a local newspaper for a song and, if managed right, it could be an insanely cheap way to grow.

If managed correctly is the key word here. The NYT’s stock went on a screaming run over the past few years as they successfully transitioned to an online / subscription business. If local newspapers could do that, they’d be insanely undervalued. But it’s really hard for me to look at local newspapers and their leadership teams (who, for years, buried their heads in the sand as online ate their lunch) and think they have the skills or the will to make that transition. But, given the valuation these trade at, I don’t know if you need much or any chance of success online to make these stocks work.

I focused on local newspapers here, but I think you could apply the same logic to lots of legacy industries that have been beaten down and trade at super low multiples. Bally’s paid Sinclair $85m for the naming rights to their RSNs; that’s a somewhat unique example, but if you got creative there are plenty of legacy businesses with similar reach that growthier companies could make cheap investment into to take advantage of like that deal.

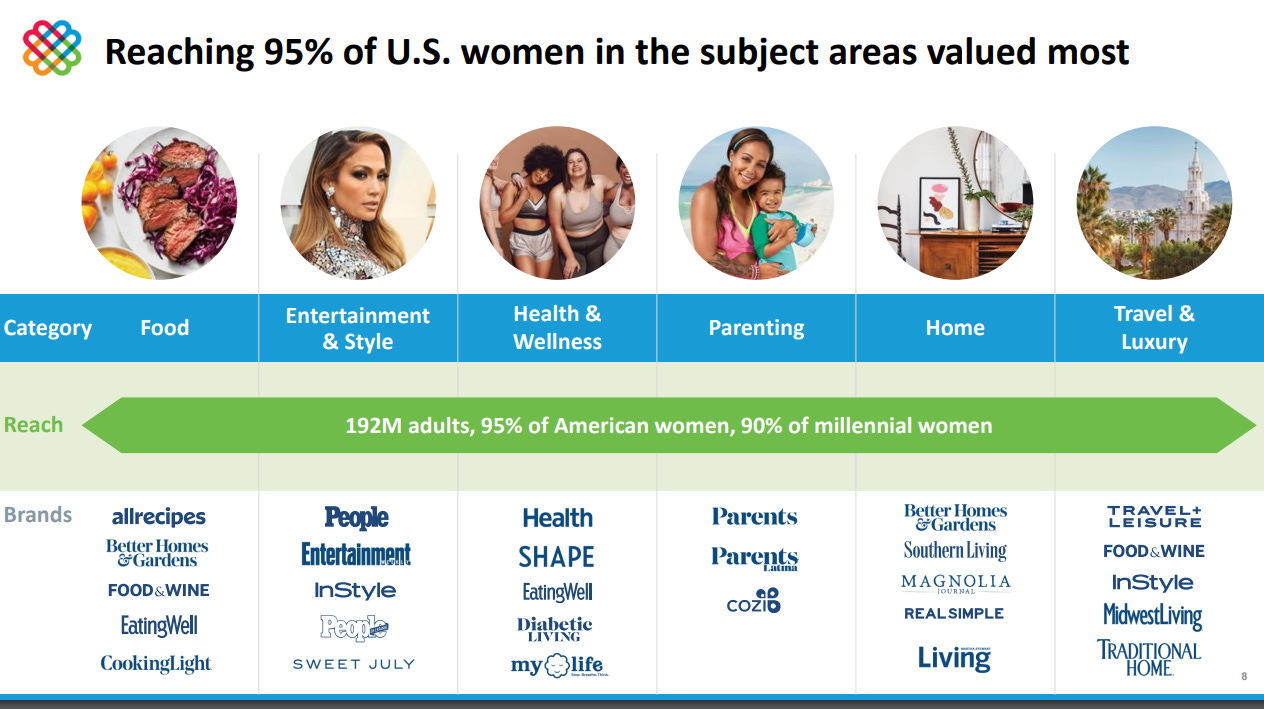

Another I’ve been thinking about? Meredith (MDP). They’re selling their local TV stations and refocusing exclusively on their magazine / digital brands. The remainco trades for around 6x EBITDA; it’s not the best portfolio, but remainco has a lot of similarities to IAC’s dotdash, which is capital light, growing at a nice clip, and most analysts think is worth >10x EBITDA. Why couldn’t MDP get there eventually, particularly given how high the awareness of some of their brands is? I mean, look at the Wyndham deal for travel & leisure; I’m sure Health, Better Homes, and People all have some type of brand recognition and strategic value that eventually MDP could monetize, no?

Update: ~a week after I wrote this, rumors of ESPN looking for a $3B sports betting deal came out. ESPN is a different league than Meredith or local newspapers, but I still think the same trends are there

Podcasts

I launched the Yet Another Value Podcast in August 2020 and provided a longer piece on my vision for the podcast at the start of 2021. They've been a blast so far. You can follow on Spotify, iTunes, or YouTube (and please be sure to subscribe and rate them if you enjoy them!). This month's pods:

Also, Sean’s post “We All Need Some Perspective” was awesome

Mike Mitchell, King of Lumber FinTwit, on ICLTF / GreenFirst

Louis was kind enough to post some follow up answers to questions he got on the heels of the podcasts

This isn’t my podcast, but friend of the podcast Ben Claremon launched the “compounders: anatomy of a multibagger” podcast that I suspect many readers will enjoy. The episode I linked to is on SNEX, an under the radar company that I….. follow closely, and I think you’ll see why after you listen to this episode.

As always, if there’s a company you’d like highlighted on the podcast or a guest you’d like featured, I’m always open to suggestions (even if that suggestion is “I would be a great guest! Why not have me on?”). I’ve been dying to do a podcast on Peloton but none of my Peloton bulls have agreed to come on, so I’d particularly like to figure one of those out!

SPACs SPACs SPACs

This has been a recurring segment for much of this year, highlighting all of the news in SPAC world. Unfortunately, with most SPACs trading below trust value, and some of the more….. aggressive SPAC companies starting to unwind, the news in the space has slowed to a trickle. So, while I continue to love the risk / reward and set up in SPACs, I’ll probably be retiring this space and just looping SPAC news into my “other things I liked” segment going forward.

As SPAC creators get rich, how incentives are shared remains murky

How millennial investors lost millions on Bill Ackman’s SPAC

SPAC boom creates fresh targets for short sellers, activists

QOMPLX and Tailwind mutually agree to end business combination due to market conditions

I’m surprised we haven’t seen more deals called off given high redemption rates and share price performance of deSPACs

Speaking of SPAC deals called off….

Topps SPAC merger Collapses After Loss of MLB trading card deal

Read also: The Day Topps Lost its 70-year grip on the baseball card market- and its billion dollar SPAC

I wrote about the deal and its fallout here, but still shocked this deal almost went through with the MLB contract that at risk!

PS- I tweeted out how I couldn’t believe all of Topps “Push” candies outsold Skittles; right after, I started getting hit with this targeted Twitter ad for Skittles, which I had never seen before. Is the Twitter ad system improving?!?! (O and PS those Skittles gummies look delicious; if I was 15 years younger they wouldn’t stand a chance)

Aldel / Hagerty deal is a great example of how to successfully structure a SPAC deal

An interesting example of deal structuring? Twilio paying above market to invest in M3 / Syniverse

But I don’t get why Twilio is doing that; a strategic company anchoring a deal generally gets a nice discount.

This is a law school research paper. I will admit I did not read the whole thing (I don’t need to be told all the harms and tricks SPACs can pull), but the implications and reforms section (starting on p. 61) are really interesting. I like the idea of a contingent redemption option in particular, though I think the exact mechanics could get wonky. And there are lots of other issues that I could see arising with deals failing if more than 50% redeem, but I still think the overall direction this points is in the right place

Nerd Corner

With “SPACs SPACs SPACs” getting retired, I’m going to introduce a new monthly segment: nerd corner.

There’s no hiding it; I’m a massive nerd. I read 3-4 fantasy books a month, my favorite past time is playing board games with my wife and friends, and I religiously watch every new entry in the Marvel Cinematic Universe (MCU) and listen to fantasy show recaps on Binge Mode (so much so that I even did a Twitter Space talking about the MCU!). I figured a few of you are nerds like me, so I’m starting this segment to give recs of what I’m nerding out over currently, with the hope that you’ll either try it and enjoy it or recommend me similarly nerdy things that I’ll enjoy.

This month’s recs:

Board Game: Harry Potter Hogwarts Battle. This is a 2-4 person cooperative board games. I love coop board games because I get super competitive in normal games, and I find these to be much more friendly / relaxing. If you’re familiar with deck building games like Dominion, the mechanics of Hogwarts battle should be pretty familiar. You and your team start out with a basic deck, and use that deck to buy new and more powerful cards. The goal is to upgrade your deck and defeat the villians before the forces of darkness win. What’s fun about this is the game is split into 7 playthroughs, with each covering one of the years at Hogwarts, and each playthrough adds new cards / mechanics to the game and increases the difficulty. My wife and I have been doing them just the two of us and it is fun though a little on the easy I side; I suspect this would be really ideal if you have some older kids you’re looking to entertain on a rainy day without getting screens involved.

Book: The Emperor’s Blades: Chronicle of the Unhewn Throne, Book 1. Really fun fantasy book. I started reading this at the beginning of the month, and enjoyed it so much I forced my book club to make this our next book. They ended up all loving it too and within two weeks everyone had finished the book. I found some of the characters a little too one dimensional (i.e. a lot of the characters are just pure evil or pure good), but that’s a small nitpick. The book does a great job of world building without overdoing it (I hated how Game of Thrones would spend 50 pages discussing the history of Dornish wine), and there’s plenty of twists and turns and intrigue to keep you flipping the pages (my wife was at ~85% point of the book and supposed to go on a beach trip, and she pushed the beach trip back by two hours just so she could finish).

Other things I liked

I mentioned Peloton earlier this month; I loved this framing of the Peloton optionality when comping it to Apple / Airpods.

Spotify “Opening Up Podcast Subscriptions”

This is the type of innovation and optionality I was discussing when I mentioned Spotify earlier this month

On the other hand: Joe Rogan, confined to spotify, is losing influence

Dan Loeb’s Third Point gets a taste of its own activist medicine

Viacom acquired Pluto for $340m in 2019; given how well it’s doing now, what would it be worth as a standalone?

What’s the hot endorsement deal for 3.5 tons of college football players? Barbecue

Hundreds of AI tools have been built to catch COVID. None of them have helped

It’s behind a paywall, but this is a great post from one of my favorite subscription services. If only our mutual bet on VIRT would start to work….

Just how rich was hello sunshine’s sales price? 5x public media stock values

I’m not sure why someone would buy hello sunshine at that price instead of Lionsgate or one of the smaller free radicals (not taking a position on the stock; just relative values and asset base)

Oh, the irony! Charter, T-Mobile share top J.D. Power MVNO ranking

Discovery+ sets first original movie with food network’s candy coated christmas

Behind the $935M ‘South Park’ Deal: How Trey Parker, Matt Stone Keep Cashing In

They tried to beat DiMaggio. Like everyone else, they failed

Cruise Line Investors Are boarding the Wrong Ships

It’s interesting to me that stances on vaccination policy mark a big strategic bet for some industries now!

Cruise Passenger Dies from Covid, Testing Industry Plans.

I’m sure there are plenty of people who would find how much time I spend on the Peloton or at the gym mystifying…. but I cannot believe how much demand there is for cruising during a global pandemic when a single COVID case could turn the cruise into a trip to hell.

PS- please go get vaccinated. The data for vaccine effectiveness is off the chart, and Delta is an outrageously viral horror show (the images from NOLA’s (my hometown) Children’s Hospital New Orleans are heartbreaking). Plus, the founding fathers would be very much in favor of you getting vaccinated.

Curious no updated thoughts on PSTH!?

Still reading this but about your posed q: "how do you evaluate a manager who has invested in several frauds/blowups but has a good track record?"

Depending on the way they blew up it can be a strike against or not relevant. Also depends on the manager's stated strategy. For example; you're evaluating some black-box quant thing (about the same thing for us value guys trying to evaluate ARKK :)

If they state their strategy outperforms because their engine picks up fraud and then they blow up a position on a fraud... that's bad.

But if it's a momentum quant it's kind of par for the course.

If it's not a quant strategy essentially the same rules apply.

One more thing about manager selection. It is just much easier to ascertain a great manager if they have a strategy that relies on hitting singles or some mean reversion strategy. It is also much easier if they don't concentrate.

If they concentrate and generate the VC distribution of outcomes, yeah... I just think there's no way (from the track record) to find out within a lifetime whether it's luck or skill.

I'm a big fan of ascertaining skill from materials put out there (writing and/or talks) however this can also get you into trouble because there are amazing storytellers with no alpha.

Final point. It is also a bit easier to ascertain skill if a manager is active in an arena where the variability of results between the best and worst managers is very high. The distributions are wider and there are more inefficiencies to take advantage of. I do think the skill translates to other environments. People sometimes argue the advantage came from the environment. That's true but the manager is still skilled. That doesn't mean it will be enough for huge returns if you have to apply it to S&P 500 only.

Holding controversial positions is a positive sign. I believe that's a predictor of some alpha (could still not be enough to cover fees).

Concentrated positions (or actually deviations from benchmark) are a positive sign. However, I really don't agree with the notion that's popular on Fintwit where everyone is looking to concentrate into positions and run a concentrated book.

As a manager, in my very humble opinion, you should always be looking to concentrate towards your best ideas but have a great preference to be highly diversified. Concentration should happen because you find things and you just can't do anything else. The opportunity is SUCH A LOCK you just have to upsize. You can't ignore it and then you hate it but you do it.

But not the other way around where you go looking for 5 things and pile 20% into each. That's one of the worst portfolios imho. It could be somewhat acceptable for an activist team.

TLDR: not necessarily a red flag and not really a sign either.

P.S. With ARKK there's a "control" period which is K.W. time at A.B. The volatility is somewhat similar. The returns aren't. That data isn't as valuable as the more recent data but I'd include it to do any performance analysis. Still, it probably isn't enough given her style.

P.S. II talking about ARKK and signs; analyst turnover is probably a negative sign.