Some final $DISCA / $T ramblings (don't sleep on a $CMCSA topping bid!)

I’ve talked about Discovery a lot recently, and I think for good reason: the company is going through a >$100B mega-merger that has the potential to unlock enormous value. Combine that potential with the stock getting hammered (down >10% versus a reasonably strong market) since the merger, and I think you have the potential for a significant mispricing / alpha opportunity.

So today I want to spend just a little bit more time talking about Discovery. Just as a reminder for those of you who aren’t religiously following my write ups on Discovery (how dare you!), here are my past / most recent write ups:

November 2020: Could Discovery be Qurate 2.0 (talking about how the launch of Discovery+ could be a catalyst for the stock)

March 2021: What the fudge is happening in to legacy media stocks? (Written at the heart of Archegos squeezing media stocks higher but before we knew what was happening)

April 2021: Discovering value in the wake of Archegos (discussed how the Archegos unwind had left Discovery undervalued)

May 2021: Some Discovery / Warner ramblings (written when the Warner / Discovery deal was rumored but we didn’t have any firm news on it yet)

May 2021: Some more Discovery / Warner ramblings (written a few days after the deal was announced; updated thoughts on my Discovery thesis now that we knew exactly what was in the deal and how it was structured)

The overarching theme through all of those posts was simple: as a standalone company, Discovery+ had the potential to transform Discovery from a dying legacy brand into a business with a place in the streaming world. I thought the early numbers from Discovery+ (both the ones that were publicly published and the “body language” of Discovery execs when discussing Discovery) suggested Discovery+ had done exactly that, and, with the stock trading <10x free cash flow to equity, the stock was significantly too cheap now that they had started to prove their future value outside the cable bundle. Once the Warner / Discovery merger was announced, I thought it was a master stroke for Discovery: a hugely synergistic deal done at a good valuation that strategically knee-capped a lot of potential competitors.

So far, the stock market has disagreed with me. So today I wanted to close some loops and throw some lingering thoughts out on DISCA / Warner now that I’ve had some time to digest the merger further.

Before I get to any of that though, I want to highlight John Malone’s appearance on CNBC. It’s really interesting to listen to him talk about the combined company, and the color he gives on Brian Roberts / Comcast’s interest in Warner is certainly eyebrow raising! I also liked the interview because of the confirmation bias it presented me: I am massively, massively bullish on the combined company’s potential, and Malone sounds just as bullish as I am.

Anyway, now that you’ve watched that Malone interview, start with the question I’m getting most frequently: why has Discovery’s stock sold off so hard since the deal announcement?

Obviously, that’s an impossible question to answer specifically. I will tell you that I’ve yet to talk to an investor who is actually bearish on this specific deal. I know some investors have concerns about the deal, and some investors who think stapling two legacy media companies together is akin to putting duct tape on a leaking damn, but I don’t know anyone who thinks this is a flat out bad deal on its merits.

Still, I suspect the sell off so far has to do with three concerns: leverage and synergy targets, technical overhang, and time to completion (a fourth concern is “these businesses are exposed to the legacy cable bundle”, but as that’s a sector wide concern, not a company / merger specific concern, and it’s been out there for years, I don’t think it needs to be addressed here)

Leverage and synergy targets: This one is pretty self explanatory. The combined company is targeting 5x leverage at deal completion and projecting $3B in synergies, a rather large number against $12B in standalone EBITDA in 2020. The concerns here are that the leverage hamstrings the company on emergence; they need to focus too much on debt paydown / synergy realization and that combo means they cut costs too deeply or can’t invest enough into content to become a truly scaled player in a D2C world.

My rebuttal: some risk here, but I think this is manageable. These are capital light businesses that absolutely spit off free cash flow, so debt should get paid down incredibly rapidly. Also remember that these businesses should have pretty good revenue visibility: the legacy cable bundle side operates on multi-year contracts, so that should provide good visibility, and as the direct to consumer business matures they should have great visibility on that cash flow given the subscription nature of it. On the cost / cutting too deeply side, it’s again a risk, but I take comfort that the Discovery team (who will run the combined company) has a long history of deal making and successfully delivering on deal synergies. I also like that their projections factor in no revenue synergies; I think revenue synergies will be significant (and John Malone agrees with me if you listen to his interview), so that should be additional upside that can bring leverage down even faster.

Bonus rebuttal: Don’t forget that Discovery bought Scripps just a few years ago. They levered up to 5x to get that deal done, and projected they’d get back to 3.5x leverage in two years. Once the merger closed, they hit their leverage target in less than a year and delivered synergies ~double what they originally projected. Yes, Warner / Discovery is a much bigger and more transformational merger than Scripps, but it’s nice that there’s some history of the management team beating their targets and successfully executing. (I also like that this quote makes clear the synergies are coming from overhead cost cuts, not cutting back on content or sacrificing quality).

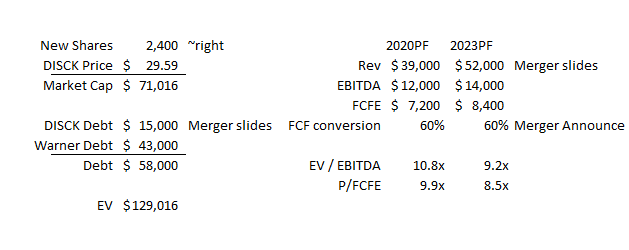

Bonus risk / rebuttal: This relates to the “will they cut too deeply to get synergies?” point, but I’ve also seen some worries that the synergy target is too aggressive here (h/t modest). I hear those concerns; given DISCA’s track record, I tend to think these synergies are achievable (this quote did a reasonable job laying out how they’re think about cost synergies), but more than that I’m not sure it’s a terrible issue if they miss the cost synergies. The revenue synergies from this merger should be pretty impressive (increased leverage negotiating in the legacy cable bundle, improved ad targeting, better customer acquisition from bundling Discovery+ and HBO, etc.), and the 2023E EBITDA number the company presented and most people are benchmarking to includes only the synergies realized through 2023, not the full $3B number (I believe it includes $2b of the $3B, but I’m having trouble finding the exact source for that number). Anyway, bottom line to me is that, as standalone companies, Warner / Discovery did $12B in EBITDA in 2020. The EV of the combined company is ~$130B at the current stock price (~$30/share). If you believe this merger creates the third scaled global media player, I’m not sure it really matters if the synergy number is $2B or $4B dollars. The company will be a free cash flow machine and the stock will be way too cheap (particularly because of how leveraged the company will be!).

Technical overhang: the biggest worry I’ve heard. When the T / Disca merger closes, T’s shareholders will be given 71% of the company. With many T shareholders invested in T for the dividend, and DISCA being a non-dividend paying company, investors are worried that DISCA will be indiscriminately sold when the merger closes, and no one wants to buy in front of that.

My rebuttal: I think the deal is a homerun and the stock is incredibly attractive at these levels. I’m willing to risk a negative mark for a few days to take advantage of a cheap stock now (plus, I get the optionality of a topping bid for Discovery and I can keep some “powder dry” to buy more if the shares do get dislocated in a spin).

Time to completion: The merger won’t close until mid-2022. Integration won’t really get underway until 2023. That’s another 2 years for the media landscape to move further and further from the legacy bundle, and for Netflix and Disney to continue to build on their lead.

My rebuttal: It’s brutal that they can’t close earlier. But both companies can still continue investing in D2C while they wait for the deal to close, and I’m sure DISCA’s management will be working on an integration plan for the next year so they can hit the ground running as soon as the merger is approved.

Anyway, I don’t know why the market hasn’t warmed to the deal so far, but I suspect it’s a combo of those three reasons. All are valid and all are risks, but I think they’re all very manageable given how attractive the combined company is (check out Some more Discovery / Warner ramblings for more thoughts on valuation).

Let’s turn to the second point I wanted to make: there’s a lot of buzz that Comcast will come in with a topping bid for Warner and break the deal up.

I think that’s unlikely; in fact, I think it’s much more likely Comcast bids for Discovery.

Why do I think it’s unlikely Comcast bids for Warner? AT&T has fought the DOJ on antitrust twice in the past decade (first with T-Mobile, then with Time Warner). I don’t think they want to go through the regulatory headache of trying to merge NBC and Warner; they want a quick clean merger that lets them delever their balance sheet and focus on the wireless business. Merging Warner with Discovery gives them that, and it preserves the optionality of letting NBC bid for / merge with the combined Warner / Discovery down the line (when it will no longer be T’s regulatory headache!).

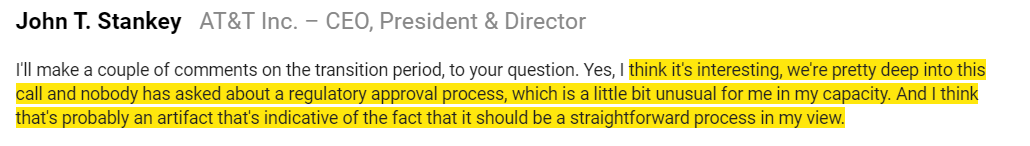

The quote below (from the merger call) drives that point home for me; offhand, T’s CEO just steps in and says “how nice is it that we aren’t talking about regulatory concerns on this call?” Again, T’s objective was to do a deal that let them quickly delever and focus on their core business; not only does merging Warner with DISCA give them exactly that, but it’s really the only strategic merger on the table that lets them hit their objectives of get scale + no regulatory headaches + delever.

So I think NBC / Warner is off the table. Even if NBC came in over the top with a bid of Warner, I think T would turn it down and cite regulatory concerns and uncertainty of closing.

But I would not at all be surprised by a Comcast / NBCU bid for Discovery. In fact, I think such a bid would be a masterstroke.

Remember, the Warner / Discovery deal has big ramifications for both the media and telecom landscape.

On the media side, there are currently two big scaled players (Disney and Netflix) and three medium sized players (NBC, ViacomCBS, Warner). Discovery is the last strategic piece out there that a medium sized player could buy and boost themselves into “big scaled player” status; the two players who miss out on it are stuck in a subscale position with nothing to buy to scale up. By buying Discovery, Warner paints NBC and Viacom into a corner where they are subscale with nothing left to buy to scale up.

On the cable side, T is going to get a massive cash infusion from spinning out Warner. They’re using that cash infusion to cut their dividend and refocus their capital allocation on organic growth (like reaccelerating their fiber to the home roll out). On the margin, that’s bad for cable players like Comcast and Charter; they’ve been feasting on taking share from T’s legacy DSL subscribers; more fiber means more competition and slower market share gains.

If Comcast bid for Discovery, they’d solve both those problems in one fell swoop.

On the media side, NBC buying Discovery would paint Warner into the same corner that Warner is painting NBC in by buying Discovery. Without Discovery, Warner is subscale and their international prospects are awful (they’ve sold the majority of their rights internationally; one of the reasons a Warner / NBC merger makes so much sense in the long term is NBC/Sky have most of HBO’s rights in Europe). Comcast could buy Discovery, integrate it, and then approach a weakened Warner about a merger with the combined (and strengthened) NBC / Discovery a few years down the line. In addition, the synergies between NBC and Discovery would almost certainly be bigger than Discovery / Warner because of the leverage combining NBC (the broadcast channel) with Discovery’s content would give in negotiating with the legacy bundle and because Sky’s European rights would fit so well with Discovery’s international presence (though, to be honest, I like the HBOMax + Discovery pairing better from a long term content perspective than Discovery + Peacock; I just think HBO has more buzzy shows and movies that could better take advantage of Discovery’s potential for churn reduction. I could easily be wrong).

On the cable side, buying Discovery would demolish AT&T’s plans for a capital reset. AT&T is planning on getting $43B in cash from Warner when they spin it off, and they’re using the spinoff as justification to cut their dividend. All of that is gone if Comcast throws out a topping bid for Discovery. AT&T remains overleveraged with the bulk of their cash flow going to paying out their dividend; they’ll have to go explain a dividend cut to their shareholders without the excuse of a merger to give them cover. And, given how leveraged they remain, AT&T will have to reassess how much money / how aggressively they can really approach their fiber to the home roll out and their network investments. Eventually, AT&T will be able to figure it out, but Comcast lobbing in a topping bid for Discovery would set T’s plans back several years, and several years matter when you’re trying to take market share! It would almost certainly be a big boost to both Comcast’s core cable business and their mobile efforts (T’s network would continue to lag, which would let Comcast continue to gobble up share there too).

So it just seems like a Comcast topping bid for Discovery is a master stroke to me. If Comcast went hostile for Discovery, they’d demolish Warner’s negotiating leverage for an eventual NBC merger, and they’d hurt AT&T’s attempts to improve their network and expand fiber coverage (which helps Comcast’s core cable business and their attempts to steal customers from AT&T in the wireless business). And Comcast could even structure the deal in a way that made their shareholders happy; if they did the deal with a similar Reverse Morris structure that separated Comcast’s cable and NBC business, Comcast’s stock would almost certainly skyrocket (in general, investors hate Comcast as a conglomerate and just want access to that sweet, sweet cable business!).

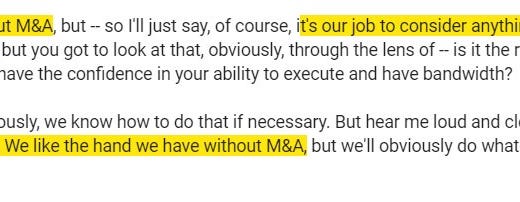

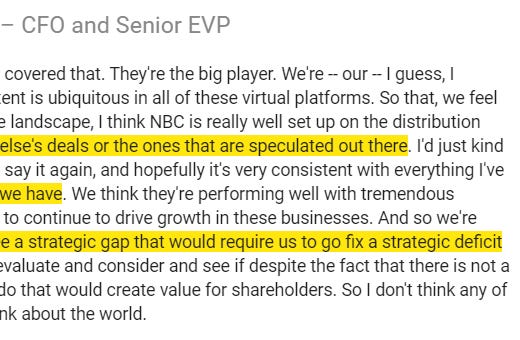

Now, Comcast would counter and say they’re fine without M&A. Comcast’s CFO was at a conference yesterday and repeatedly stressed they were fine as a standalone; he even highlighted that the company was resuming its share repurchase program after a multi-year pause to digest the Sky acquisition. I know lots of people will point to that quote as a sign Comcast won’t get involved here…. but what is he supposed to say? “O yeah, the Warner / Discovery deal is a strategic disaster for us; it leaves us subscale and desperate for a deal?” The way he is talking about M&A now reminds me a lot of how Comcast talked about M&A in late 2017…. right before they launched a bid for Sky and got into a fierce bidding war for Fox.

One more while I’m quoting Comcast management: look at this quote (again from yesterday’s JPM conference). Mike is asked if he’s confident they have enough scale at NBC; just read how much qualifying he has to do to walk himself up to saying “we have enough scale.” He knows that NBC is going to be too small against Disney, Netflix, and HBOMax / Discovery once they merge; the big question is going to be if they get aggressive and throw in a topping bid to disrupt Warner / Discovery, or if they just sit on their hands and are forced to come to the M&A table from a position of weakness in a few years.

A related bonus point: let’s say I’m wrong about who Comcast bids for and Comcast for some reason comes in with a topping bid for Warner instead of Discovery. As a Discovery investor, would you be sad? I would be since I think the Warner/Discovery deal will create a ton of value longer term, but Discovery’s stock is down >10% since the deal was announced and they’d get ~$2/share in after tax cash from Warner in a break up fee if Warner took a better bid. I suspect my sadness on missing out on the deal would be cushioned by Discovery’s stock being up a good deal if someone did bid for Warner (and the market would probably correctly forecast that significant M&A would remain in Discovery’s near future; Viacom would be a very natural merger partner for Discovery if NBC / Warner happened. You could paint an argument for Fox as well, though I think the combined company would skew way too heavy to the legacy bundle).

Moving on, let’s drill down a little further on why I think this merger is so attractive.

First, I should note I’m not the only one who’s bullish. Insiders seem pretty darn bullish; Malone gave up voting control for nothing to get this deal done, you can listen to the CNBC interview linked earlier to hear how bullish he is, and Discovery’s CFO is buying stock on the open market (and interestingly playing the A/K share class arb, as he sold 8k of DISCA to buy 25k of DISCK at lower prices!). It’s pretty rare to see insider buying at Malone companies; he pays his lieutenants so well and with so many options that they generally don’t need to buy stock to make money. So while the insider buying here isn’t massive, I do think it’s notable that the DISCA CFO is buying stock on the open market right after announcing a transformational deal.

That out the way, let’s talk about why this merger makes so much sense.

To do that, think back to 2019. Disney+ launched. As far as libraries go, the app had a pretty skimpy library. Sure, it had the Simpsons and (most) Marvel movies, but I doubt many people were ready to cancel their Netflix subscription and go download Disney+. But Disney+ did have one unique thing: Baby Yoda. The Mandalorian came out alongside Disney+’s launch, and it instantly became must watch TV that helped drive 10m subscribers to Disney+ in its first day.

Now think about Discovery+. Management has constantly talked about how great the user metrics on the service are: tons of engagement, people going deep into their library to check out old Discovery shows, better than expected churn, etc… but what Discovery doesn’t have is “buzzy” shows to lure consumers in and get them to overcome the natural friction of turning Netflix off, downloading a new app, and putting in their credit card / sign up info. Honestly, it’s pretty impressive to me that they’ve managed to get so many people to sign up so quickly for Discovery+ without any big, buzzy scripted shows.

That’s where HBOMax comes in. Things like Wonder Woman or the upcoming Game of Thrones spin offs are going to be incredibly buzzy. They are the type of shows that will drive tremendous engagement and massive sign up levels, but subscribers will quickly churn after watching the buzzy shows if they’re not quickly hit with a library that keeps them tuned in (this article did a nice job talking about that dynamic).

Zaslav has been going around saying a big streamer told him that their churn “would be zero” if they had Discovery’s library. Now he has the chance to prove it out with Warner; he can use Warner’s new titles to drive sign ups and buzz, and then he can use Discovery’s library to keep people engaged and drive churn down.

Obviously, getting churn to zero is hyperbolic. But I do think the combination of these two companies is unique and creates a real Netflix / Disney competitor.

The other key point about this merger is that to be a real global scaled player, you need global content rights. A lot of U.S. investors only think about the U.S. media bundle (I can certainly be guilty of that!) and ignore the international side. Warner’s international rights are a disaster; while they’ve done a good job of bringing a lot of stuff back in house, they’re still out a ton of international rights (remember, NBC/Sky has the rights to HBO in most of Europe). Discovery has had the foresight to hold on to all of their rights internationally; I think a big piece of this deal is Discovery’s international rights will allow HBO/Warner to quickly roll out a global service while they wait for all of the rights they sell to revert back (and then they can add them to the global service they’ve rolled out and further accelerate growth).

So the merger makes sense to me, and at today’s prices you’re paying a value multiple for the combined company: ~11x PF 2020 EBITDA (i.e. before synergies) and ~9x 2023 EBITDA (with a portion of the synergies baked in). And those numbers should significantly understate the combined earnings power of Discovery / Warner as they fully integrate; again, the 2023 EBITDA number doesn’t include the full cost synergy number, and if you believe in the merger thesis you should believe the company has significant revenue synergy and customer churn reduction opportunities as they fully merge (both of which will create huge value.

Also remember that the combined company will absolutely spit off free cash flow; initially, all of that cash flow will be used to pay down debt….. but they should be able to pay down billions of dollars of debt annually, and all of that value should accrue to the equity. And, in a few years when leverage is down to more manageable levels, the company will be spitting off cash and the management team has a history of reasonably aggressive share repurchases. Between the debt paydown and share repurchases, if you’re right on this merger being a success the upside to equity holders could get interesting really quickly.

Anyway, bottom line: I think DISCA is hugely asymmetric right now. No one is factoring in a chance that Comcast comes in with a topping bid; historically, Comcast has not been shy about aggressively bidding for assets they want. Maybe they don’t want Discovery, but I think the strategic rationale is screaming out that Comcast should buy Discovery and screw Warner / AT&T over. Even if I’m wrong on that, I think the Discovery / Warner merger is a home run. People are scared to buy the stock now because the deal will take a long time to close and everyone’s scared of the technical overhang when T releases their shares, but I think the combined company is just much, much too cheap to not have a position in.

Some bonus thoughts

What’s so interesting about combining Discovery and Warner is that they have so much optionality on the back end. NBCU and Viacom are both subscale after this deal goes through, and there’s really no one left for them to buy. Maybe NBCU + Viacom could try merging with each other, but it would be an absolute regulatory nightmare (CBS + NBC under the same house is a no go). In fact, if they did try that and succeed, Discovery + Warner might end up being the winner since they could pick up so much of the divestiture package for a song. So Discovery + Warner is interesting because it gets them the scale to be the third player in media but doesn’t get them so big that any of the future media acquisition plays are off the table for them. Yes, there would be some divestitures if they did another merger (Viacom + Discovery / Warner would be an almost unthinkable portion of the TV bundle, and MSNBC and CNN under the same roof would be a tough sell), but Discovery / Warner could reasonably look at the playing field a few years down the line and either be the first call for people looking to sell assets or for people looking to scale up since they would probably have the cleanest regulatory profile (i.e. because they don’t own a broadcaster, anyone who owned a broadcaster like ABC or CBS could still buy Discovery / Warner, and the lack of a broadcaster could make the combined company more attractive than other media companies if another tech giant decided to follow Amazon’s lead and buy a legacy media company).

A lot of people have said something along the lines of “I don’t think this deal is that bad for cable because Malone owns way more Charter than Discovery, so he wouldn’t do this deal unless he felt sure Charter was fine with a more aggressive T.” I understand that logic, but I disagree with it. Malone is a rationale actor. He’s not going to pass on a super synergistic Discovery / Warner merger just because it revitalizes AT&T and hurts Charter. He knows that if he passes, AT&T will eventually find someone else to do the deal with (Viacom? NBCU? Lionsgate + a bunch of smaller players?). Maybe the deal wouldn’t be quite as clean as Discovery / Warner, but if AT&T wanted to get out of Warner they would find a partner. So I think Malone is making this deal only thinking about what’s good for DISCA. That doesn’t mean I think this deal is terrible for Charter; yeah, they’ll get a couple of more homes overbuilt by T fiber, but I think that’s manageable / pretty marginable versus the whole opportunity set Charter and cable in general are looking at.

Eqwiki and TheScienceofHitting both had posts on Discovery’s merger and Malone’s interview in the past day or two; I think both are worth reading (Eqwiki for a similarly bullish point; TSOH for a more cautious view).

From today's Stratechery:

"Two of those winners seem clear: Netflix and Disney. The rest, though, are very much up in the air, and while Discovery now has the cachet of HBO, it also has the blessing and the curse of its existing businesses. The blessing of the cable TV business is that it throws off cash, and Discovery, with the addition of WarnerMedia’s cable channels, should be able to squeeze the cable operators for an even bigger share of the shrinking pie; the curse is that the attractiveness of HBO Max will be proportional to the degree to which Discovery cannibalizes said cable business. Meanwhile, the blessing of owning studios is that Discovery has direct access to original content; the curse is the same one faced by AT&T originally, which is that making content exclusive, particularly to one’s own subscale streaming service, is value destructive."

I want to think that this blogpost will make its way onto a meeting at Comcast, eventually getting a topping bid for Discovery. And then years down the line we get a movie about this whole saga.