Shoretel's Calling $SHOR

Quick Summary

The whole Unified Communications space (UC) is undergoing a massive shift to an internet driven, SaaS-like model

The decline in traditional premise based sales has masked the growth in Shoretel's UCaaS segment and likely left Shoretel trading at a discount to its SOTP.

The potential cost synergies from Shoretel merging with a strategic acquirer (likely Mitel) would be significant and could be worth most of today's share price

Shoretel (SHOR; disclosure: I am long) is currently undergoing strategic alternatives. I think the company represents a strategic asset that could and should attract interest from a variety of strategic and financial buyers. Ultimately, I think a sale will be reached in the near future at a price between $9-10, and at that price I believe a strategic buyer would be getting a steal.

Shoretel provides unified communications (UC), mainly to small and medium business (Basically, they provide phone systems to people). This is a sector undergoing massive upheaval (one of the largest legacy players, Avaya, just filed for bankruptcy), and Shoretel is at the center of that overhaul.

Business phones are much more complex than a simple phone and phone line, as businesses need the ability to do things like route calls within an organization (i.e. have someone at the front desk put someone on hold and transfer them). Originally, this was done by people sitting manually at a corporate switchboard. Starting in the 70s, the manual switchers began to be replaced by private branch exchanges that could automatically make the switches (PBX). These systems were much more efficient than having people manually switch calls, but they involved huge upfront capital costs for the customers as they generally needed to buy expensive equipment (routers, switches, etc.) upfront and hire a staff to maintain them. Overtime, these systems have become more technically complex (ability to call through PCs; conference calling; video capabilities, etc). In this world, Shoretel sold the capital equipment that allowed PBXs to run (voice switches, directors, etc.). Most people who’ve worked in an office are familiar with the office closet with a ton of telecommunications stuff in it that basically no one ever goes into; in general, Shoretel made the equipment that was in that closet. Other players in this market included Avaya, Cisco (CSCO), and Mitel (MITL).

The sector has recently been undergoing another massive shift from internally managed phone systems to cloud based phone systems. Under this model, a company selects a UCaaS provider and pays them a monthly fee; in exchange, the UCaaS provider runs the entire phone system network over the internet. The switch is, on the whole, a boon for the company: the annual cost for a UCaaS system is significantly lower than owning all of the capital equipment (they get their closet back and don’t have to pay for the equipment to fill the closet nor the upkeep to keep it running!), and going to UCaaS also results in significantly increased flexibility. RingCentral (RNG) gave a good example of the savings in their 2016 investor presentation (see slide set 3, p. 8; I’ve included at the very end of this post)- they switched a tech company w/ ~1k users from their legacy system to a UCaaS solution that cut their annual costs from $1.3m/year to $0.3m/year. Companies like 8x8 (EGHT) and RingCentral are leading the charge here; at the very end of this post I’ve included a section “economics of UCaaS” that dives a bit deeper here if you’re interested.

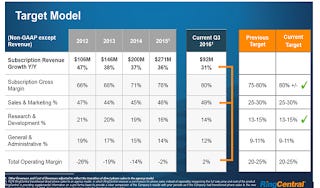

At some point, it’s clear that Shoretel’s products based business (which focused on selling to companies who managed their phones internally) will die. In response to this, Shoretel began building up their own UCaaS offering. Today, that UCaaS business is growing at ~20% per year; however, the company overall is only treading water on revenue as the UCaaS growth has been masked by declines in product revenue on Shoretel’s financial statements.

And that’s where I think the opportunity lies- Shoretel is trading like a dying UC product company despite the fact ~half of their business comes from a rapidly growing UCaaS business that, at peer multiples, would imply a stock price significantly higher than today’s. With the company currently undergoing strategic options and massive synergies available to a potential strategic acquirer, I’m hopeful the company’s true intrinsic value will be revealed sooner than later.

Let’s discuss how the switch from selling products to selling UCaaS affects Shoretel’s revenue. When Shoretel sells a traditional product, they book all of the economics upfront (i.e. sell a switch for $100, you get $100 of revenues that quarter while also booking the cost of that product, the sales commission, etc. that quarter). However, when you sell someone a UCaaS subscription, it actually results in a short term loss even though it might be an economically profitable transaction (if you sell someone a monthly recurring subscription for $50/month, you will book $150 in revenue that quarter. If you have to pay the salesman a $500 commission, the sale results in a $350 loss that quarter even though you might have just gotten a customer that will pay you $600 in high margin revenue for the next 10-20 years. This is somewhat of a simplified example (the commission would likely be amortized over a few years, so the loss isn’t quite as extreme), but it’s directionally correct). These issues are not just limited to UCaaS players; it’s a well-known phenomenon across all of the software as a service (SaaS space): companies that are creating massive economic value by selling long term, profitable, recurring revenue contracts report short term losses as they grow. For this reason, most SaaS companies (and Shoretel’s UCaaS peers) generally trade for a multiple of revenue as their near term profits are negligible.

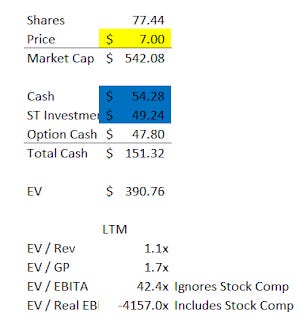

With all that in mind, we can start trying to value Shoretel. At today’s share price of ~$7, fully diluted market cap is ~$540m and EV is ~$400m. Compared to LTM revenues of $356m, GP of $230m, and basically breakeven EBITDA (including stock comp as an expense), the company does not optically look super cheap. SHOR’s best comp is probably Mitel (MITL), which trades for 1.1x revenue. However, Mitel is also doing ~13% EBITDA margins versus Shoretel at breakeven, so while they trade for similar revenue multiples it would be tough to argue Shoretel would deserve the same multiple if there weren’t more to the story.

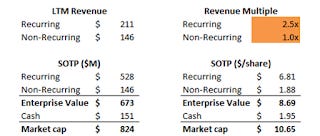

But, as mentioned above, that superficial valuation doesn’t tell the whole story. A better take would try to value the company’s different segments separately. While Shoretel reports in three separate segments (product, hosted and related services, and support and services) separately, a better way to look at them from a valuation standpoint is probably to separate out their recurring and non-recurring revenue streams. The recurring revenue streams relate to their cloud products and support services, while their non-recurring revenue streams generally relate to product sales. Recurring revenue is currently annualizing at $211m and growing in the mid-teens, while non-recurring revenue is doing ~$145m in revenue and declining in the mid-teens yearly.

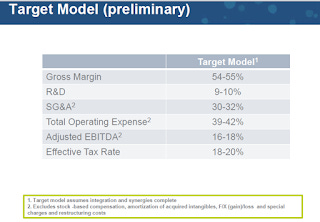

The recurring revenue stream business has several pure play comps; in particular, RingCentral (RNG) and 8x8 (EGHT) represent strong comps. EGHT is trading at just under 5x next year’s revenue and RNG is trading at a bit over ~4x; however, both companies are growing slightly faster than Shortel’s recurring revenue streams and currently their margins are higher than Shoretel’s, and qualitatively it seems like Shoretel’s products aren’t quite as well positioned as those comps. Obviously Shoretel deserves some type of multiple difference, though I’m not exactly sure how much of one. I think 2.5x LTM sales, or ~2.2x forward sales, would be pretty conservative, so I’ll use that number.. Using that valuation, Shoretel’s recurring revenue stream is worth ~$530m, or basically today’s entire share price. That means we’d get Shoretel’s product business and net cash balance of $100-150m thrown if for free.

The non-recurring business is tricky to value. It’s doing ~$145m in sales/year but declining quickly as the company shifts over to more cloud business. Probably the easiest way to value this business is to take a look at what Polycom (PLCM) got bought out for by Siris over the summer. Siris paid ~1.1x 2016E revenue, or ~6.6x EBITDA; that revenue multiple is roughly in line with peer MITL’s current multiple. If we say Shoretel’s non-recurring business is worth 1x revenue, then this side is worth $145m, or almost ~$2/share.

Putting it all together, Shoretel’s recurring revenue business at 2.5x sales would be worth $530m, or ~$6.81/share (assuming all options / RSUs are exercised). The non-recurring business is worth $145m, or ~$1.88/share. They also would have $150m in cash, assuming all stock options are exercised, or another $1.95/share. In total, putting all of those together would mean SHOR is worth ~$10.65/share.

So I think Shoretel is probably undervalued at today’s prices. Would I buy the stock as a standalone business at these levels? Yes, I would. But given my general aversion to tech, I’d probably keep it a small position or look to find an undervalued company in an industry I’m more familiar with.

But Shoretel is going through a strategic process. And what really interests me is just how massive the synergies to a potential acquirer could be. We’ve seen tons of consolidation in this space, and the potential synergies are massive. Just look at Mitel’s recent history for some examples:

Mitel and Polycom agreed to merge earlier this year, only for Mitel to be beat out by a topping bid from Siris Capital.

Mitel made a hostile offer for Shoretel in 2014 (more on that later)

Mitel bought Aastra, a European focused competitor on the product, in 2014.

The synergies in these deals are obvious: there’s massive synergies from cutting SG&A and supply chain costs. In addition, if you have overlapping products, there’s synergies from combining R&D programs, and there are potential cross selling synergies from selling products into each other’s customer bases. The best example of the potential synergies in a merger probably comes from Mitel’s acquisition of Aastra. Mitel originally forecasted $50m of synergies in the deal (~9% of Aastra’s standalone sales, ~4.5% of the combined companies sales). However, as of their Q3’16 earnings call, they have managed to find $89m of synergies (>15% of standalone sales; ~8% of combined company sales) and they see opportunities to drive that number even higher. Mitel saw similar synergies in their Polycom acquisition: the company was forecasting $160m in synergies in the combo (~6.4% of the combines companies sales; ~13% of PLCM’s standalone sales). Mitel and Polycom did not have much product overlap, so all of those synergies were coming from SG&A and supply chain rationalization; if Mitel and Shoretel were to merge, there would be significant product and R&D synergies on top of those.

If we assume an acquirer could realize 9% synergies (on Shoretel’s revenue) from buying Shoretel (in line with the original Aastra projections), then an acquirer would find ~$32m in synergies from buying Shoretel. At today’s EV of ~$400m, an acquirer would be paying just 12.5x projected synergies in buying Shoretel- it could be argued the synergies alone would justify today’s purchase price to say nothing of the actual business or Shoretel’s huge cash balance! In addition to the cost synergies, there are also likely some softer revenue cross selling synergies (pushing products through each other’s customers / salesforce), but those are softer and much harder to value.

We also know there’s at least some potential interest in acquiring Shoretel. Mitel made a hostile bid for $8.10 in 2014 and eventually bumped the bid to $8.50 before walking away. After Shoretel declared they were exploring strategic options, CTFN reported that Mitel was taking another look at Shoretel, though Mitel has denied that charge. Elliot owns 10%+ of Mitel, has frequently supported the industry consolidating, and has openly stated they think a Mitel / Shoretel merger makes sense. Mitel also just sold their Mobile business to Xura for $350m in cash, which substantially improves their balance sheet and would go a long way to funding a potential Shoretel purchase; Mitel made pretty clear that part of the reason they were selling the mobile division was to let them focus on consolidation on their UC side. Outside of Mitel, Vonage (VG, which I’ll have more to say on in the near future) has been a very active acquirer and there would be some synergies between the two, though I think a Shoretel acquisition would be a bit of a change of pace for them. Polycom was just acquired by PE firm Siris Capital, and a combination of Shortel and Polycom would make some sense (it would be similar to the Mitel / Polycom merger, which the market didn’t like but Elliott supported and the companies forecasted large synergies from). Speaking of private equity, Vista Equity Partners has been extremely active taking tech companies private, and they increased their stake in Shoretel from 390k shares to 1.26m shares during Q3 (the firm has frequently taken public positions in companies and then bought the whole thing; having most recently done so with Infoblox (BLOX)).

All in, between the huge potential synergies available to strategic acquirers, the private equity interest in the space, and the combination of a frustrated shareholder base (from turning down the offer 2 years ago and seeing shares consistently trade below that price) and a circling activist (elliot appears to only be in Mitel’s stock currently, but they’re undoubtedly monitoring SHOR and have been involved previously), I just can’t see this being a standalone company once the strategic process ends.

- What could go wrong

o Strategic review failure: Shoretel announced their strategic review process in early August. Rumors of Mitel’s interest came in early September. It’s now January and we haven’t really heard anything. Perhaps the review is going poorly? Perhaps the review is going poorly because acquirers are discovering the business is weaker than anticipated? Maybe people just don’t think Shoretel is a great platform. All of these are possible, and if they’re correct they suggest significant downside.

§ Counterpoint: synergies should be real, and the value of the synergies plus the cash on Shoretel’s balance sheet should support a bid around today’s level. The business would have to just be awful for the company not to be worth today’s price

§ Counterpoint: the business is worth something, and they have almost $2/share in cash. At today’s share price of $7, it doesn’t feel like there’s a huge downside even if the review did fail.

§ Counterpoint: Maybe Mitel really is interested in SHOR but wanted to sell their mobile piece before doing anything with Shoretel? That would explain the length timeline.

o Management: management doesn’t own a ton of shares, the board is staggered, and the company fought off a hostile offer in 2014 without even engaging in negotiations. It’s not clear shareholder value is at the forefront of their minds, and they might decide to take the strategic review the other way and make a bid for someone versus sell themselves.

§ Counterpoint:shareholder revolt. If management decided to remain a standalone after this, there would be a shareholder revolt in all likelihood.

§ Counterpoint:change of control payments. Management updated their change of control payments in May, suggesting maybe they saw the sale end game coming.

o Rapid technological change: communications is changing rapidly, and at their core Shoretel and competitors are providing phone service. Yes, they integrate it into everything you do (so that calls pop up in your CRM system, your outlook system, etc.), but it feels like this could be ripe for rapid disruption from tech players.

§ I’ve also talked to several industry analysts. Most of them seem to think of Shoretel as an afterthought, and Shoretel’s UCaaS business is smaller than RNG / EGHT /VG’s.

- Economics of UCaaS

o Installing your own platform generally costs tens of thousands upfront plus an ongoing service / maintaince fee of ~15% of costs.

§ I saw a JPM report (July 15, 2011) that estimated the costs at ~$60k upfront for a basic system plus $9k ongoing

o In contracts, going with UCaaS can run as low as $10/user/month, though in general most of the full systems seem to cost ~$50/user/month

§ The math of going UCaaS makes all the sense in the world when you’re under 100 people. I believe costs continue to come down and the math and simplification is tilting in favor of UCaaS for people over 100- that’s why we’re seeing a bunch of momentum for the UCaaS players in the 100+ space.

o Why hasn’t everyone already made the switch to UCaaS?

§ I think it has a lot to do with incentives

§ If you’re the legacy phone provider, are you really going to push a solution to your clients that results in a big revenue cut for you?

· No.

· In general, I’ve heard the AT&T’s of the world have really only pushed UCaaS products in markets where they’re facing competition

§ If you’re in the IT department, are you going to recommend a switch to UCaaS?

· It will save your company money

o But it also gets your budget cut. And you have to fire your internal staff that has been managing your phone systems

· I also think there’s a priority issue historically

o The cost savings from taking your phone systems to the cloud pales in comparison to the cost savings from switching a bunch of other stuff to the cloud.

· Lastly, there could be some regulatory issues. I’ve heard that hospitals, finance companies, etc. were initially hesitant to switch to UCaaS as they worried it would violate privacy and other laws.

- Other odds and ends

o I really think Mitel makes the most sense here, despite their protests. The companies have so many overlapping parts and are so similar, the synergies would be out of this world. With Elliott pushing, I think a Shoretel / Mitel merger makes too much sense not to happen.

o Both Mitel and Shoretel have huge installed product bases of legacy UC solutions and are starting to gain traction selling their UCaaS service to their product bases; perhaps this gives them a bit of a tailwind that their competitors don’t have.

o The premise installed locations should be a tailwind for the industry as a whole. The majority of companies, particularly large ones, are still premise based, and the compelling economics of the cloud should drive a long term tailwind as all of these guys switch

§ Even though the switch is happening, I still think there’s some value in the product business as a dying / cash cow type. Mitel had a quote that said something like 70% of people currently using premise based will still be using premised based in 2021, so there should be a long tail to this business (see mitel Q3’16 call).

§ The long tail of this business also makes hybrid offerings (some offices on premise based systems, others on cloud) important, and I believe mitel and Shoretel have big advantages over RNG and EGHT in that.

o Speaking of Mitel, they mentioned that some of the strategic processes might have resulted in competitors getting more aggressive on price. Possible once all of this plays out, margins rebound a bit next year.

§ Avaya going bankrupt is particularly interesting here. I know a lot of people who think they were undercutting on price to try to stay afloat, and now that they’re bankrupt the industry can see a bit more price rationality.

o RNG’s slide from investor day presentation (LT economics of UCaaS)

o Mitel’s slide from Aastra acquisition (11/11/13) (LT economics of product business)