Shopping for some forced selling $DBI

I mentioned this briefly in June’s state of the markets, but perhaps the most mysterious area of the market for me in the past few years has been index adds/deletions. There’s no area of the market I hear so many investors talking about (seriously, talk to any small cap investor about an off the run idea, and at some point you’ll hear “this will qualify for inclusion in the Russell next year, and that’ll result in hundreds of thousands of shares to buy”), and there’s no area of the market with such intense focus where the result has been so lackluster IMO (to use the example I used on the podcast, BUR got added to the Russell in June. BUR has ~220m shares outstanding, and the Russell add called for just shy of 30m shares to be bought. Somehow, the stock was down ~10% in the month leading up to that huge buy. I have no clue how a block that big (it represented basically a full month’s worth of trading volume!) can cross and have the stock leak lower the whole month into the block).

Anyway, the Russell adds / deletes grab all of the headlines for forced buying / selling, but there are other places where you can find forced buying / selling, and those are often much more lucrative as they’re much less followed.

Consider, for example, Designer Brands (DBI). You probably know DBI best as the owner of DSW (Designer Shoe Warehouse). The stock has been in absolute free fall since reporting Q1 earnings in early June; the stock had traded most of the year in the $9-10/share range, but post earnings they drifted to the high $8s and have gone basically straight down to today’s price in the mid-$6s.

Now, you might look at that chart and say, “O, it’s pretty obvious what happened; Q1 earnings were a disaster.” But it’s hard for me to look at the results or the stock price movement and say that’s what happened. The stock closed the day after earnings in the high $8s, the company reaffirmed their full year guidance in the Q1 earnings release, and the earnings call included quotes like “This quarter, we were pleased to deliver results in line with our expectations as we gained traction on our path to returning Designer Brands to growth” and “We anticipate that comps will continue to improve throughout fiscal 2024 as our new strategic initiatives, which we will discuss on this call, are further implemented.”

So it’s really hard to match the huge stock drift down with the results reported. Given that mismatch, let me provide an alternative theory on why the stock has been so weak: a major forced seller.

If you check Bloomberg’s holder list for DBI, it will show Pacer Advisors as the largest owner with ~11m shares representing ~22% of the shares out.

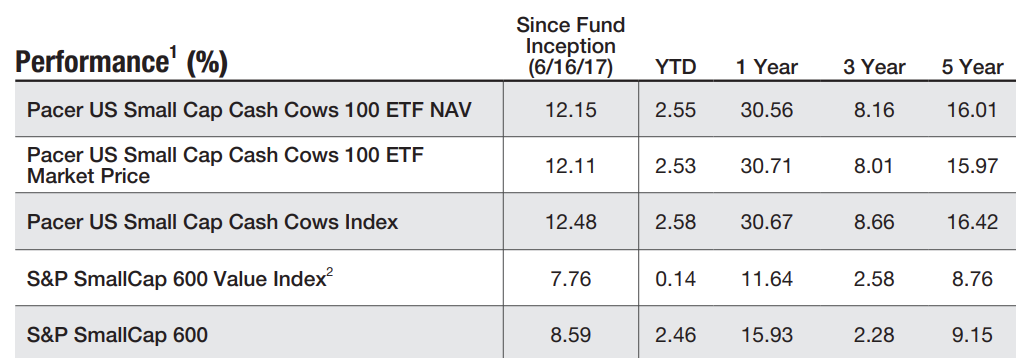

Do some digging and you’ll see that ownership was from Pacer US small Cap Cash Cows 100 ETF (appropriately named CALF). CALF seeks to invest in the companies with the highest free cash flow yields in the small cap universe, and it has absolutely smashed the index since inception.

That wild outperformance has resulted in some serious inflows; CALF runs just shy of $9B. However, they run a very mechanical model; they invest in the 100 highest free cash flow stocks in the S&P 600, anything outside of the 100 highest free cash flow stocks is ruthlessly kicked out of the index / ETF.

You can probably see where I’m going with this; CALF’s huge size caused them to take a big position in DBI. As DBI faltered in 2023 (in some part due to self inflicted wounds; in some part due to an awful retail environment), their FCF dipped substantially and they no longer qualified for the CALF ETF. That caused CALF to boot all ~11m shares when they rebalanced in June; Bloomberg share ownership (screenshotted below) shows the story nicely:

So I’d argue DBI’s free fall through June and into today is less about anything fundamental at DBI, and more about forced selling from a rule driven ETF. It looks like most of CALF’s block of DBI crossed on June 21; I’d guess that market makers and liquidity providers were absolutely stuffed with DBI stock and the past few weeks has seen them relentlessly bleeding out all the stock they took from CALF.

Is there opportunity here? I’d say yes; DBI has guided for $0.70-$0.80/share in EPS in 2023, so today you’re buying them at <10x EPS…. and you can easily argue that’s a trough EPS number. In FY22, DBI did $134m in adjusted net income, and they were throwing up similar amounts pre-COVID ($135m in FY19; $115m in FY20), so that was not a COVID boom flash in the pan number. DBI has ~60m shares outstanding, so if they could return to that level of earnings you’d be talking about DBI doing >$2/share in EPS.

You might have noticed in the paragraph above I switched from EPS to net income before bringing it back to an EPS number. There’s a reason for that: DBI has historically been a huge repurchaser of their shares, including buying back >$100m of stock in FY23 at just over $10/share (including a ~$15m tender offer at $10/share in June / July). When a business with a history of buying back stock sees their stock swoon and has the liquidity available, they generally respond by aggressively buying back stock; I would not be surprised if that’s what happened here. In fact, given DBI got a $47m tax refund subsequent to Q1’24 (so it’s not on their balance sheet as cash in the reported results / any screener), I’d be a little surprised if they didn’t buy back stock aggressively (as a CFO, a ~$50m cash windfall tends to burn a hole in your pocket when your stock is down 30% from where you bought back $100m the year before!).

There’s a lot more we could discuss at DBI (I think the business is maybe not a structural winner but at minimum structurally relevant as opposed to a lot of retail peers; I expect continued momentum as they anniversary / lap getting Nike back late last year; etc.), but ultimately this is a pretty simple thesis. DBI’s shares seem pretty clearly dislocated from forced selling of a rules based ETF that had an enormous position, and as the market digests that huge inflow of shares I expect the stock to rerate back to where it was pre-forced sale. And, if the company is aggressive using their share buyback, longer term this forced sale could create an enormous amount of value for the remaining shares.

So that’s the thesis. Obviously this is small cap retail, which carries a higher degree of risk than the average company… but, from my seat, this seems a pretty crystal clear case of forced selling creating a temporarily depressed stock price.

PS- just to address what I’m sure will be a question, my first thought when I saw the share weakness was “o, maybe there’s some awful alt data out there.” That does not appear to be the case to me; as noted above, management sounded pretty confident on the Q1 call in early June, and the alt data I’ve seen has seemed fine…. though obviously trading quarters and alt data isn’t really a game I play. So take all of that with a grain of salt, but just pre-addressing that one since it was my thought as well!

PPS- the dream scenario here is probably something like DBI announces their Q2 results in early September, reiterates (or raises) guidance, and says “yeah we took that ~$50m tax refund we got and plowed it aggressively into share buybacks as the stock got destroyed on a dislocation in late June.” Again, as mentioned above, just given the company’s buyback history I’d be kind of surprised if they didn’t deploy some of the cash into buybacks at these levels…. but there is something that could serve as an even shorter term catalyst. DBI’s executive Chairman has pretty deep pockets and, while he hasn’t bought shares on the open market in a while, he’s historically had no problem plowing tens of millions into open market purchases when he thought the stock was cheap. Just given that history, it’s certainly possible we see a big insider buy sometime in the next month that could course correct the stock a bit. (screen shots of historical buys below)

Thank you again. I am encouraging you to write more blog posts similar to this one :-).

Very useful. Please post more deep and short dives.

Did I miss an update here? If not, anything to say after 2nd quarter earnings?