Quickie idea / question: What's going on with $DOYU / $HUYA

This post is another in a series I do on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. The hope is to provide the jumping off point for a discussion of an idea I find extremely interesting right now, as I suspect the opportunity could be fleeting.

This will actually be the simplest quickie idea I’ve ever done, because it’s more a question than an idea. The idea / question? What the heck is going on with the DOYU / HUYA spread? I’ll note I tweeted this question out earlier today too in case someone makes a great response on twitter after I post this!

Some background might help: Tencent is a major shareholder in both DOYU and HUYA. In August last year, Tencent asked the two to merge, and they quickly reached a merger agreement in October of last year. It’s an all stock merger of equals deal, though it is a little more complicated because each side is paying a small-ish dividend before the deal closes and Tencent will be selling their live streaming business to DOYU for $500m as part of the deal. Still, for our purposes, it’s a simple deal where each DOYU will receive 0.73 shares of HOYU when the merger closes.

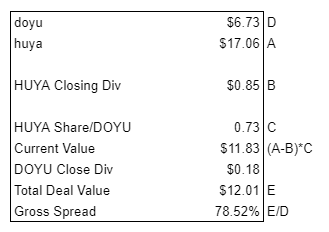

Since the merger announcement, DOYU and HOYU shares have traded reasonably in line with each other. However, in May, the spread between the two started to widen, and that gap got even larger over the past week. As I write this, DOYU is trading for ~$6.75/share; if the HOYU merger closed tomorrow, DOYU would be worth ~$12/share (see math below; I’ve adjusted for dividends on both sides though even at a glance you can see how big the discrepancy is!). That’s an absolutely insane gap.

So here’s my question: what the heck is happening? When a spread balloons like this, you’d normally expect there to be some type of horrible news…. but I’ve checked all the usual places (SEC filings, Bloomberg, Seeking Alpha, random twitter accounts, etc.) and I don’t see anything on there. And, even ignoring the deal spread, DOYU’s stock bottomed out at the absolute height of the COVID crisis around the current share price. So DOYU’s price and the huge spread isn’t just saying that something is wrong with the merger…. DOYU’s price is telling us that there is some type of disaster going on at the company.

What is that disaster? Again, I don’t know. DOYU is a Chinese ADR that operates a Chinese “game-centric live streaming platform”, so you could imagine all sorts of awful things getting priced into the share price (someone eating their lunch, massive accounting scandal, huge regulatory crackdown, or some other type of disaster)…. but, again, I’m not seeing anything anywhere (and the Tencent backing certainly helps with the biggest “outright fraud” type tail risks, though it certainly doesn’t remove them completely!). My guess is that someone has been leaked something, but it feels strange to me that the spread could get this wide and the share price this low for weeks without anything leaking.

Anyway, that’s my take. I’ll remind you that nothing on here is investing advice; I have done almost no work here and am more just fishing for “what the heck is going on.” But if you’ve seen anything, please let me know!

Its China investing my friend and its hubris to think the market is that inefficient.

You are investor in the US and those in-the-know are in China. Its why rarely if ever invest long there.

news out, deal blocked by regulator.