Premium Post: This stone cold steal of a deal should result in some capital gains....

In hindsight, I’m not sure we’ll ever see a weirder period for M&A than February 2020. Companies were getting bought for big numbers, only to turn out to be worthless a few months later.

Obviously, the Taubman / Simon deal (discussed here) would be a headliner here; Simon announced a deal to buy for $52.50/share in late February, a ~60% premium to Taubman’s unaffected price. A month later, Taubman’s shares might have been worth a tenth of the deal price if they were trading standalone.

Ebay’s sale of Stubhub stands out too. The >$4b deal closed in mid-February; by mid-March, StubHub was on the verge of bankrupt (this deal was written up in the Forbes article “Worst Deal Ever”).

However, while rare, the reverse was possible too: agreeing to acquire a company in February that saw their value explode higher in March. The company I want to discuss today, INTL (or possibly by the time I post this the company will be SNEX; they’re changing their name in early July and I’m writing this article through June. I’ll refer to them as INTL for simplicity through the rest of this article), pulled off exactly that type of deal when they agreed to buy GCAP. In fact, I think the market is underestimating just how good of a deal INTL is getting, and I think as the deal closes and the benefits to INTL become clear shares are likely to trade significantly higher.

Let’s start with the basics. INTL agreed to acquire GCAP for $6.00/share in February. GCAP gets most of their revenue from retail trading of forex and metals futures (they own forex.com). These are businesses that tend to benefit from increased volatility (increased volatility = more trading and wider spreads) = more profits, and GCAP had been struggling for years with low volatility. 2019 was a particularly poor year, with record low vol nearly across the board leading to GCAP’s stock hitting record lows. This “selling the whole company for cash in the worst environment possible” dynamic was not lost on people who followed GCAP; in fact, one analyst even congratulated INTL on a great deal on the merger call but questioned why GCAP would do this deal now.

Of course, the ink was barely dry on the INTL / GCAP deal before volatility exploded higher as Corona swept the globe. Both INTL and GCAP benefited significantly from the increased volatility. How much so? In January, GCAP was forecasting $37m in EBITDA and $3m in net income for fiscal 2020. In the ~one month from signing the deal on February 27 through the end of March, GCAP did $90.5m in EBITDA and $65.5m in net income. They’d add another $18m in EBITDA and $11.9m in net income in April.

(An easier way to put it? The table below is from the very end of GCAP’s last deal proxy; book value increased from $225m at the end of Feb. 2020 to $305m at the end of April 2020. An $80m increase, or more than 35%, in two months!)

Those are astronomical numbers. Obviously, the environment in March/April was unique and unsustainable. But the huge windfall cash flows are real, and all of that value will accrue to INTL once the GCAP deal closes. And the value is significant: INTL only has ~19m shares outstanding. In March and April, GCAP did just under $80m in net income. That’s ~$4/share in value that has just dropped into INTL’s lap, and that’s ignoring any ongoing benefits to the GCAP platform (from continued increases in volatility, or the higher user base / AUM number, etc.).

The dramatic windfall for GCAP did not go unnoticed by GCAP’s shareholders. Three of GCAP’s eight directors pulled their recommendation for the merger, and an activist fund implored the board to break the merger if INTL didn’t bump their bid. While activist shareholders imploring a company to seek a higher bid is nothing unique, just shy of half the board pulling their recommendation for a merger between signing and deal vote is incredibly unique. In fact, I can’t think of any other deal where a director pulled their recommendation post-signing.

Still, with the deal set to close on terms post the successful GCAP shareholder vote, all of that increased value will accrue to INTL. And that turns INTL’s stock (already cheap) into a steal.

I’ll circle back to the GCAP merger and how accrettive it was / is for INTL in a bit. Let’s talk a little about INTL itself.

Their 2019 annual report is quite instructive, but basically INTL is a financial services / global brokerage roll up focused on global trading with institutional clients. This isn’t the best business in the world, but INTL has earned good returns on capital from rolling up a bunch of smaller firms, realizing scale benefits (tech, back office, etc.), and often cross selling acquired companies customers (i.e. buy a dairy trader, then cross sell their clients with your livestock traders and your livestock clients into the dairy team).

Again, this isn’t my favorite business in the world, but the results have been pretty good since the company was founded in 2003.

INTL is still run by the same team that founded them in 2003, and insiders own ~18% of the equity. Given the insider ownership, the track record, and the focus on shareholder value creation / return on equity (adjusted return on equity is the only performance target currently used for executive comp), I think an argument could be made that INTL belongs in a discussion of “Outsider” type companies.

Anyway, I think the right way to look at INTL is to think of it like this:

What would I pay for the core INTL business?

How much value has accrued to the GCAP business (which ultimately accrues to INTL shareholders) since the merger?

How much value do I give the synergies between INTL and GCAP

So let’s start with the first: what would you pay for the core INTL business excluding GCAP?

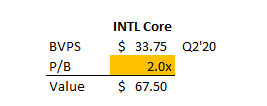

Well, at Q2’20 (ending March 2020), INTL’s book value was $33.75/share. Similar to GCAP, INTL’s core business benefits from volatility, so I would expect book value continued to grow nicely through Q2, but let’s just use $33.75/share. INTL targets a 15% return on equity, and has pretty consistently come close to that target.

A business that can consistently do 15% ROE is likely worth around 2x book value (translating to a ~13x P/E ratio). You could argue it’s worth a bit more if you think it can grow organically (which I do think INTL can do!) given investing organically at a 15% ROE creates significant value or simply because a 13x P/E is pretty conservative in a world of near zero interest rates, or you could argue a 15% ROE deserves a bit of a discount if the company is achieving a higher ROE due to excess risk taking / leverage. I think INTL likely deserves a bit of a premium given growth opportunities (both organic and inorganic!), but for now lets just assume INTL’s core business is worth 2x (I think their balance sheet is reasonably conservative, so I don’t think they deserve the leverage discount). That multiple would put the core business worth around ~$67.50/share, or substantially more than today’s share price of ~$50/share even before the GCAP acquisition.

Ok, the next thing we need to do is figure out the windfall profit to INTL from striking the GCAP deal before GCAP’s business went ballistic. As mentioned above, GCAP did ~$80m in net income in March and April. While business will likely remain elevated in the near term, I’ll just assume that windfall ends after March/April. That $80m increases INTL’s value by ~$4/share.

Most analysts I’ve seen have stopped here and said “Wow, INTL acquired GCAP and GCAP minted a bunch of money since the merger announcement.” And, obviously, that’s nice. But I actually think it overlooks the most accrettive part of the deal: the synergies between GCAP and INTL.

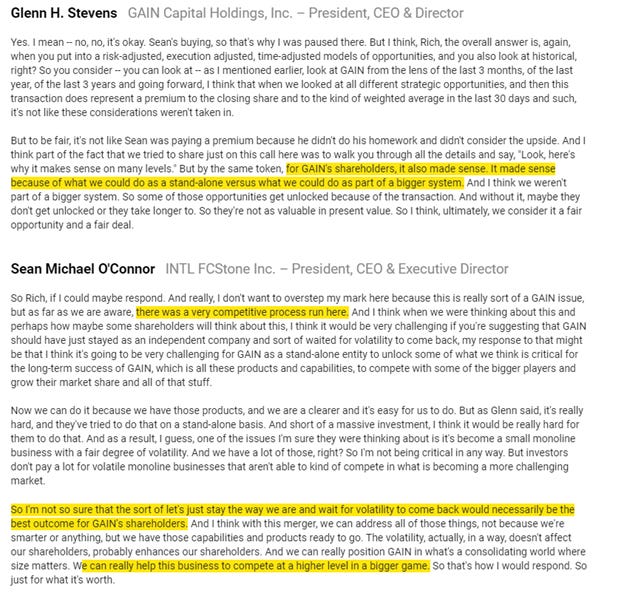

I’ll attempt to quantify these in a second, but first I would encourage you to read the GCAP / INTL merger call transcript to get a sense for why I think these synergies could be so big. The language on the call is like nothing I’ve ever seen before. The GCAP CEO (i.e. the seller) is constantly interrupting to rave about how excited he is for the combination and how synergistic the deal will be. The INTL CEO has to come on and temper GCAP’s enthusiasm (the conspiracy theorist in me would suggest he’s trying to temper the market expectations so no one lobs in a competing bid!). The best example of this dynamic is probably the clip below:

Seriously, that’s really unique. GCAP’s CEO (the seller) comes in and says how synergistic the transaction is and how much value will get unlocked. Then INTL (the buyer) comes on and says the process was super competitive and this is the best deal for GCAP’s shareholders. Normally you’d expect those roles to be completely flipped; I don’t think I’ve ever seen this combo of “seller is bullish; buyer tempers expectations”, and I think it speaks to just how good / synergistic the deal is for INTL even before the “Corona windfall” came into play.

(An extra note: at the end of the prepared remarks, GCAP’s CEO again cuts in with the following quote on synergies, “Sean, if I may just add to your point on the summary page there about opportunity, I think it's key that people realize those are measured and post-close timing in months, not in years. In a lot of situations, these deals put years on stuff. And I think what's really indicative of the value that can be created, to your point, in a short payback period, you'll notice a lot of those say 3 to 6, 0 to 3. And on the long tail of 12 to 18. That's key because it shows you what can be converted very quickly.“ Again, I’ve never seen the seller CEO hop on a call and talk about how bullish he is on the timing and value creation from merger synergies, particularly given the seller is taking an all cash deal)

So how good is the deal? INTL is buying GCAP for ~$240m. INTL was projecting $32.4m in cost synergies from the deal. That’s a huge synergy number given the deal size (INTL is paying <8x synergies for GCAP!)…. and I think it might be conservative. Why do I think that? GCAP’s CEO bullishness on the synergies is one hint. INTL also suggested as much on the merger call (from the call: “significant expense synergies. We've gone through this in a lot of detail. We like to be very conservative in these estimates. This is sort of what we've come up with. In large part, this is just very simply taking out very obvious public company costs”). But I also think it’s conservative because there should be pretty simple cross selling synergies that should result in significant revenue synergies (per the call, INTL gave GCAP no value for revenue synergies but saw “some pretty big revenue synergies over time”).

INTL has guided to $32m in cost synergies from the deal. I would not be surprised if the overall earnings accretion from the deal, after revenue synergies and everything, came out to more than $40m. For now, let’s just use that $32m number as our synergy number. I think the way to think about the synergies is to assume that INTL paid a fair price for GCAP as a standalone business (before factoring in the COVID windfall) and all of the value from cost synergies flows through to INTL. If that's right, and we assume the synergies are worth a 5x multiple (I actually think they should be worth more!), then the value from the deal’s synergies are $160m (INTL estimated synergies below)

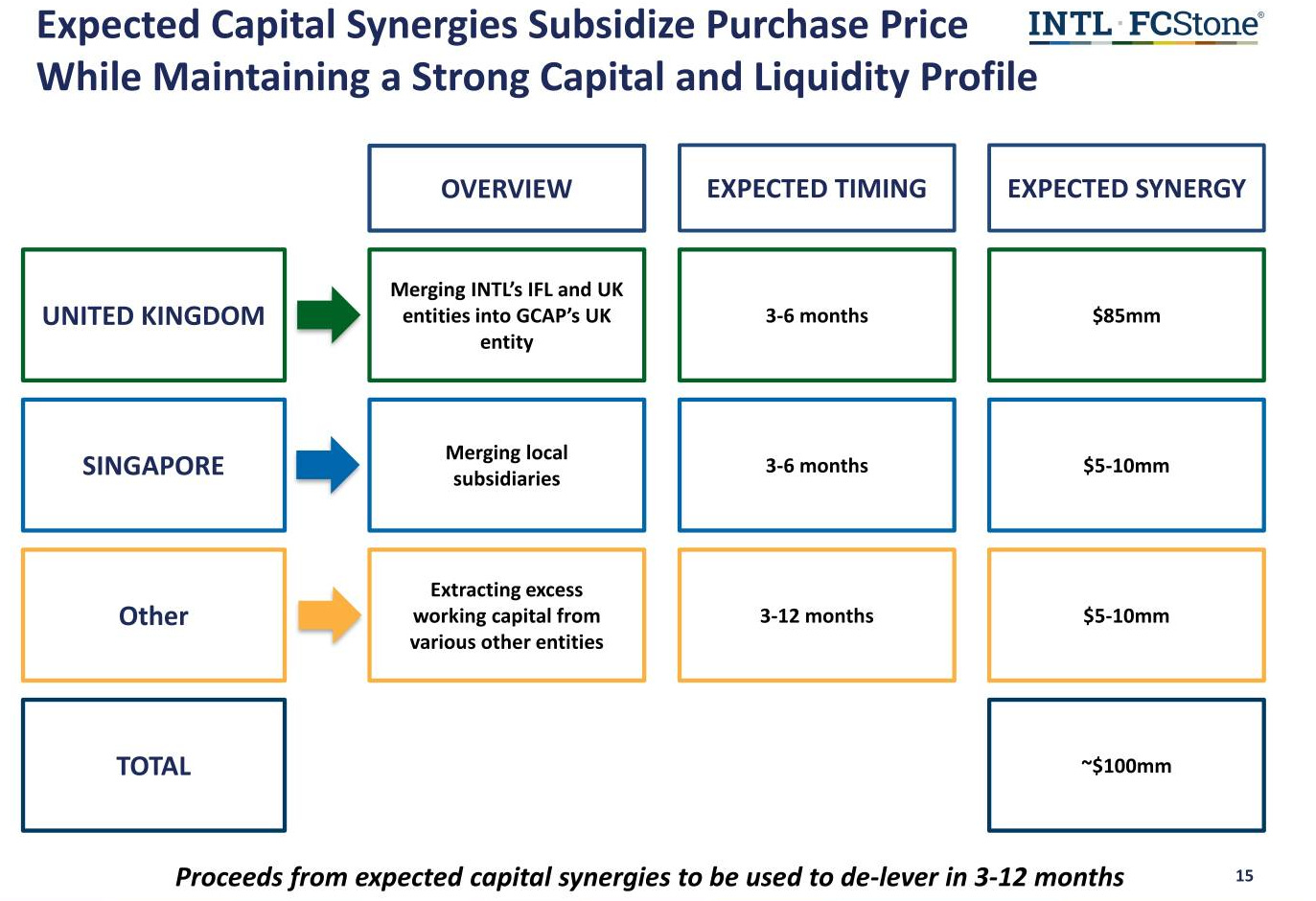

There’s one more piece of synergies that could be worth significant value here: freed up capital. Being a financial services company requires a lot of capital to fund trades. INTL expects that by merging various subsidiaries, they’ll be able to free up $100m of capital from GCAP (see slide below). This newly freed up capital can then be used to delever (most likely), return to shareholders, or reinvest into new business. Either way, this freed up capital has significant value. I’m not sure if I want to give INTL full credit for value creation from this freed up capital (though most likely that’s the right approach); still, if I only give them credit for 50% of the value of the freed up capital, that’s another $50m in value.

Putting it all together, I believe INTL’s core business is worth 2x book value, or ~$68/share. INTL is realizing another $4/share from the windfall profits at GCAP in March/April, $50m (or >$2.50/share) from freeing up capital at GCAP, and $160m (or ~$8.50/share) from the value of their GCAP synergies. Put it all together, and I think INTL is worth about ~$83/share post deal.

There are a few ways we can check to make sure this valuation isn’t too pie in the sky. I think my favorite is to take the PF financial slide they published in their merger deck and use those numbers (I’ve pasted the slide below). Notice this is only an earnings slide, so it doesn’t factor in the windfall profits from Corona over the past few months nor does it factor in the $100m in freed up capital from GCAP (it also ignores possibel revenue synergies). Still, we can use it to check our valuation. INTL estimated that, in year two, the combined company could do an ROE of 20.4% and would deliver net income of $112m, or ~$6.34/share. INTL today trades for ~$50/share, which would be a <8x multiple to those PF earnings. That’s too cheap; again, INTL should likely trade for a lot to mid-teens earnings multiple, or something like $80-100/share if they can hit their targets.

There are obviously questions and risks here. INTL is a roll up, which increases risks along a bunch of different angles (execution, lingering integration issues, future acquistions, etc.). I think there are some long term headwinds here; the trend has been towards larger banks taking more of this trading share versus smaller / independent players; INTL’s been able to carve out a relative niche by focusing on smaller / off the beaten path market, and there’s the chance increasing complexity in markets actually beenfits them, but I still suspect they’ll need to be much large longer term if they want to survive / thrive.

Still, because so much of this recommendations rests on the thesis “INTL is stealing GCAP,” the biggest risk here is “why did GCAP choose to sell so cheaply in the first place and why did the board not try harder to renegotiate the deal post COVID volatility windfall?”

It’s a difficult question to answer for sure. However, I do have a suspicion: i suspect running a small company in an out of favor industry is hard, and INTL is willing to pay top performers very well. P. 51 of GCAP’s proxy mentions that some insiders may have interests in the deal different than a normal shareholders, and on the GCAP / INTL call it was mentioned that GCAP’s CEO planned to stick around and run GCAP as an INTL subsidiary. GCAP’s CEO owns ~5% of GCAP (worth ~$12m at deal price); it’s entirely possible he looked at the payout from continuing to run GCAP as a standalone versus his payout from selling to INTL and running the company with all of the INTL synergies and figured he’d make a lot more in the later scenario.

Anyway, I’m going to wrap it up here. My bottom line: INTL is likely too cheap as a standalone business, but when you throw in the windfall from the recent volatility related profits plus what an absolute steal the GCAP deal was, INTL becomes extraordinarily cheap. As the GCAP deal closes and the synergies fall through INTL’s balance sheet, I expect shares to quickly rerate upward.

Other odds and ends

INTL’s 2019 annual report is worth a read. I’ve pasted a brief excerpt below where the chairman discusses shares being undervalued and working on different methods to boost valuation. In general, I’m pretty dismissive of these attempts, but I highlight it because it could be a sign INTL is prepping to get a lot more aggressive in communicating their value to the market. (Also note that the chair is discussing the company being undervalued before they got the windfall profits from the March / April volatility plus the theft of GCAP).

In 2019, INTL invested $10m into the income statement for organic growth initiatives. Those investments should start to pay off in 2021; this should prove another mini-tailwind to earnings growth.

INTL’s proxy statement is interesting. Their is a clear focus on high returns on equity for paying management, and insider ownership is reasonably high with insiders owning ~17.5% of the company. Sean O’Connor, the founder/CEO, owns just shy of 1.3m shares. At today’s prices, those are worth >$65m versus annual pay of <$3m in FY18 and <$6m in FY19, so he should be reasonably focused on continuing to build shareholder value.

A focus exclusively on ROE can be a double edged sword. While investing at high returns on equity creates shareholder value, which is ultimately what a company wants, focusing exclusively on return on equity can encourage management teams to pursue higher risk projects or take on excessive leverage. Lehman was probably the poster child for this, but there have been plenty of other. That’s certainly a concern, but I think it’s reasonably outweighed by management’s reasonably high equity ownership. In addition, as mentioned above, INTL invested $10m through the income statement in 2019; if management was only concerned with gaming the metrics and maximizing short term ROE, I don’t think they would make that investment. A small sign perhaps that they’re not concerned exclusively with maximizing their bonus but actually building long term value.

INTL is interesting because it serves as something of a portfolio hedge because it benefits from two things that would likely be quite negative for the market as a whole; INTL’s earnings increase when volatility goes up (due to increased trading volumes) or when interest rates go up (they earn more on their client balances).

It wasn’t huge, but in March, INTL bought back 163k shares, or just shy of 1% of their shares outstanding. That’s more than they had repurchased over the past ~5 years. Again, not huge, but ramping up share repurchases to any extent in March 2020 is generally the sign of good capital allocation / shareholder value focus.

I’ve been using low to mid-teens earnings multiples to value INTL; it’s possible that’s conservative. P. 46 of GCAP’s proxy shows a wide range of valuations (you can find more in this supplemental proxy), but the media/mean peer trade for mid to high teens valuations. I’m not sure any of those peers are 100% perfect comps, but achieving a valuation closer to them versus my estimates would obviously be a huge boost for INTL / my price target.