Premium Post: Macerich (MAC)

Value of just their trophy assets likely (significantly) exceeds today's share price.

Editors note: obviously a lot of work went into producing this post. The share price remains super volatile, so it’s a bit higher then when I started putting pen to paper (it’s moved from <$6 on Monday to ~$8 today; that’s a big move, but to put it in perspective this was a $25 stock 6 weeks ago). I didn’t want to try to time the share price; I decided to get the post out now even though some of the price numbers are a bit stale. I will of course be posting updates and such as they come along,

I don't think it's an exaggeration to say that the current environment for commercial real estate is the most uncertain time in modern history. There's just never been an environment like this; basically every non-essential business is shut down, and healthy companies have seen the revenues drop to zero overnight. There are huge unknowns (and I tried to lay out some here): will retailers continue paying rent for stores that the government won't let them open? When will stores be allowed to open? How many businesses are going to actually be able to open their doors when the shutdown is lifted (i.e. how many are going to make it through without bankruptcy / liquidating)? The uncertainty is high, and the environment is certainly not without risk..... but I also think it's presented some incredible opportunities. Today's article is on the company that I think has the most asymmetric risk/reward in the market: Macerich (MAC; disclosure: long).

Macerich is an owner / operator of malls. In general, the outlook for malls was bleak even before Corona, but Class A malls were an exception and were actually seeing growth (I covered a bunch of reasons for this in a post ~2 years ago when BPY was buying GGP, so I won't dive into them here). The good news is that the majority of Macerich's value comes from malls that are on the right side of that "Class A malls do well trend;" their portfolio is among the best on the public markets, and some of their properties are among the highest sales properties in the world (slide below from a TCO presentation).

The overarching investment thesis for Macerich is pretty simply: most of Macerich's debt is non-recourse mortgage debt held at the property level. Because the debt is mainly non-recourse, buying Macerich gives you a call option with mammoth on their portfolio. While I'm sure some of their malls are underwater in the wake of Corona (they are worth less than the value of the mortgage), Macerich will be able to hand the keys to those properties over and the remaining equity will ultimately be worth significantly more than today's share price.

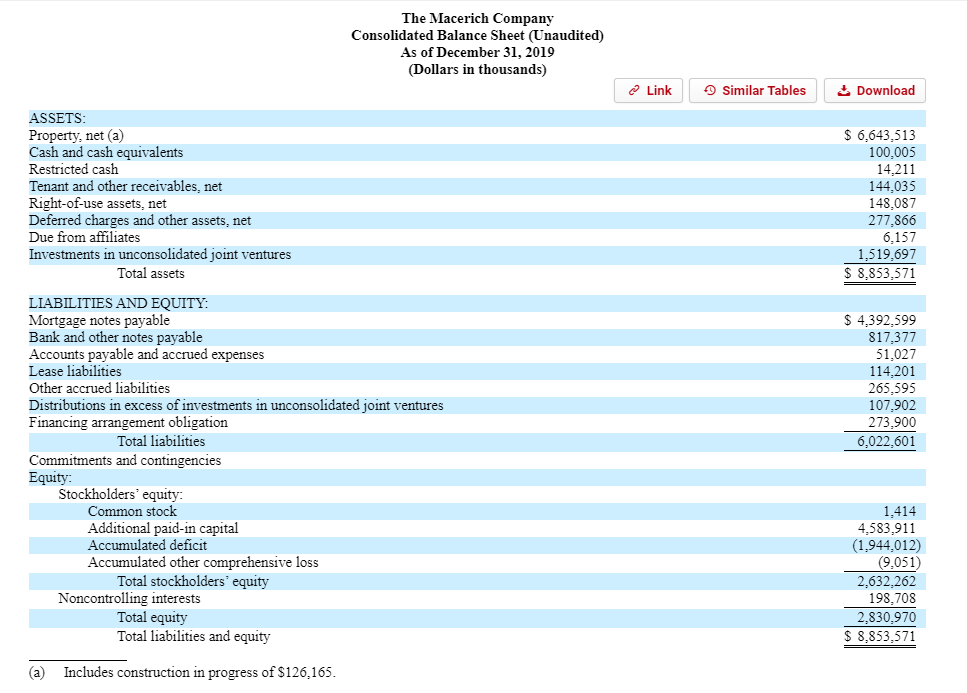

Let's start with the balance sheet. At a glance, Macerich is quite levered, which is obviously a disaster in the current environment (all their malls are shutdown and huge questions on the collectability of revenue and how many of their tenants will make it through the recession). I've screenshotted their balance sheet below; at a glance, you can see how that much leverage (~70% debt/assets) would be a concern in this environment!

However, most of that debt is non-recourse mortgage notes. The only debt that is recourse to the company is the "bank notes" line above.

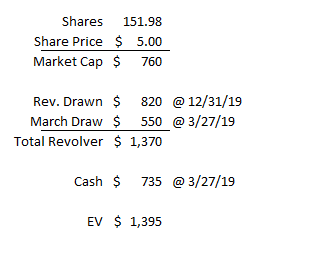

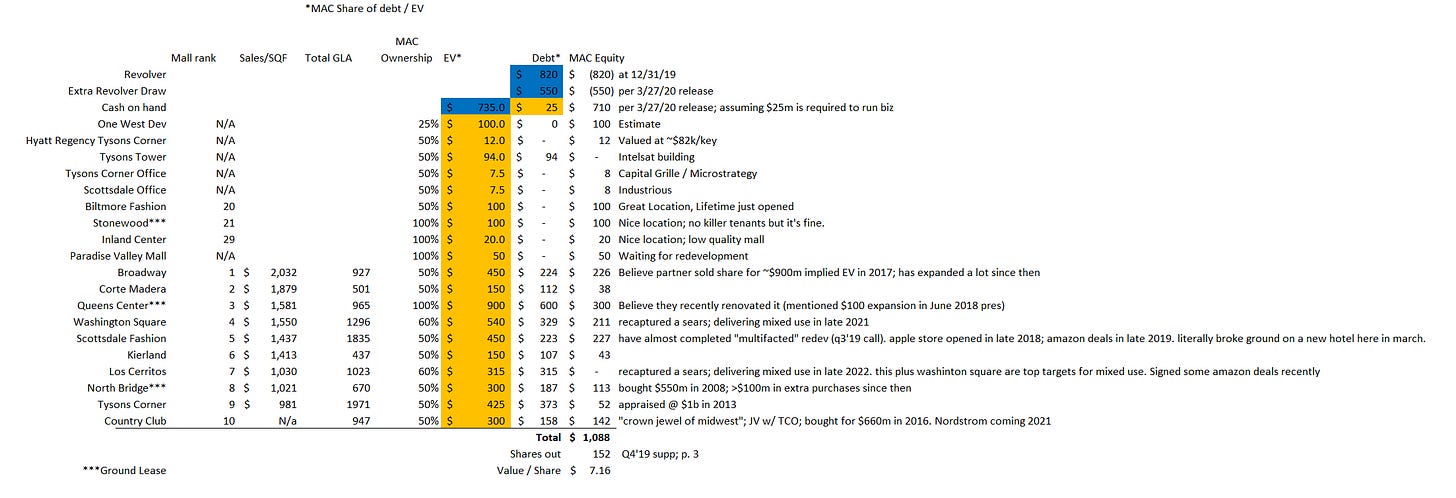

So the way I look Macerich is the below. The company has ~$1.4B of recourse debt (the $820m drawn @ 12/31/19 plus the $550m drawn at the end of March) and $735m of cash (per the end of March PR). Today's market cap is ~$760m, so the company's EV is around $1.4B. The big question is whether or not I can find enough projects with equity in them to cover that EV. I think the answer to that is easily yes.

Macerich's earnings supplements actually gives a lot of information on the individual malls. Below, I've pasted some basic info (MAC ownership, Sales/SQF, and debt at the property level) from their top ~22 malls.

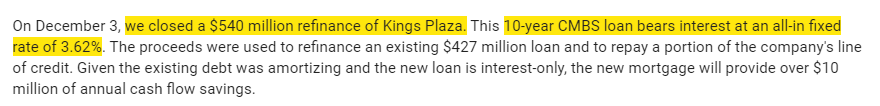

Obviously, that information is pretty stale in the current environment: who cares if a mall did $700/SQF in sales if the mall is closed down for the next six months and half of the stores are going to go bankrupt? Still, I want to highlight them for one reason. Kings Plaza, their ~19th rated mall by sales/SQF, did a $540m debt refinancing in December 2019.

If a bank would lend interest only for ten years against a property, it's because they think there's a decent bit of equity value beneath their debt (and I do mean a lot; Macerich bought the building for $751m in 2012 and put >$100m into it in 2018 to turn a Sears into a bunch of other stuff. Pre-Covid, I'd guess this mall was worth ~$1B). Every individual mall is different and has unique things that impact value, but you can look at the malls above Kings Plaza and pretty quickly think "Kings plaza was worth more than $540m, and a lot of the malls that do more in sales and are similar in size (or larger) than it have a lot less debt than that on them. There has to be a ton of equity value there."

Again, that refi and hypothetical equity value was in an environment very, very different to today's. But I wanted to highlight it because I think it shows how much equity value there could be in these malls if they can successfully make it through to the other side. The easiest example here is Washington Square. This is a wonderful class A mall: it's anchored by a Macy's, Dick's, JCP, and Nordstroms; it has an Apple and Tesla store, and the company had recently recaptured a Sears store that they were planning to kickoff a mixed use redevelopment this summer. The property is bigger than Kings and does double the sales/SQF, but it has roughly the same amount of debt on it as Kings ($329m at MAC's 60% ownership = ~$550m total debt). If Kings could do a refi for $540m in Q4'19, I would guess Washington Square could easily handle $800m. MAC owns 60%; take out the debt and Mace's value from a hypothetical refinancing of that property would have been ~$150m, or ~$1 per Mace share.

Yes, there are a bunch of assumptions there. And today's environment is laughably different than Q4'19's. But I do think it highlights the upside if a few of these malls survive the current environment and return to something like their valuation from a few months ago.

So my goal in the rest of this article is simple: show an overwhelming amount of evidence that there's enough value in Macerich's portfolio to cover the debt and today's share price. If you can do that, you get a free call option on the value in the rest of their portfolio, and that call option could be massively valuable.

I think the first place to start is actually not with MAC's malls. Instead, lets start with One Westside. This is an under-construction office building that's leased to Google. Macerich owns 25% of the project, and their partner has indicated they'd love to acquire Macerich's stake. Hudson and Macerich formed the partnership in 2018, and Google agreed to lease the building in 2019. Hudson bought their 75% stake from Macerich for $142.5m in 2018, which would imply Macerich's stake was worth $47.5m. I'd guess huge value has been created since then; Macerich's share of construction cost has been $50m to date, the partnership has locked down a construction loan to fund the rest of development in Q4'19, and obviously signing Google to a long term lease creates significant value for any project. That's a really powerful combination: a fully funded office build with a long term lease to Google as an anchor. That property is honestly a dream property for anyone looking to get "guaranteed" long term income (like a pension fund looking to match income with liabilities). I'd guess Macerich's share of the partnership is worth at least $100m at this point, and honestly that's probably significantly too conservative.

Sticking with the "things other than malls theme," the next thing I want to look at are their non-mall Tyson's Corner assets. Tysons Corner is a class A mall in Virgina; in 2013, it was assessed at $1B and was, by far, the most valuable property in the D.C. region. Macerich owns half of the mall (Alaska's wealth fund owns the other half and called it one of their best investments ever a decade ago), and the mall owns all of its anchors (Bloomingdale, Macy's, Nordstroms, etc.). There are plenty of good / high end retailers in the mall (Apple, Tesla, Lulu, Peloton, Restoration Hardware). But I don't want to focus on the mall for now. Instead, I want to focus on the assets around Tysons Corner: Tysons Corner Office, Tysons Tower, and Hyatt Tysons (a fourth asset, VITA Tysons, is under contract to be sold; I believe the sale has closed but have not been able to confirm. More on this in odds and ends). Macerich owns 50% of each of these assets (Alaska's wealth fund owns the other 50%), and I would guess each has a decent bit of equity value. A brief overview below

Hyatt Regency Tysons: this is a ~300 room hotel built in 2015. Obviously, hotels are in a rough place right now (occupancy is effectively zero, and will be for the foreseeable future). However, this property does have some advantages: its an easy metro ride to DC, it has no property level debt, etc. I didn't see a lot of disclosures on Hyatt in the company's filings; however, I'd guess the hotel cost >$150k/room to build (here's some sites that seem to back that up, or this suggests a Hyatt Place (a step below a Regency) would cost ~$125k/key, or this Hyatt Regency cost >$300k/key), which would put total replacement cost at ~$45m. Let's assume ~$10m of depreciation since it opened and whack another 30% off its value for the current environment (so valuing them at $82k/key); that would make MAC's 50% share of the hotel worth ~$12m (($45-10m) * 70% * 50%). I'd guess this is pretty darn conservative; it's tough for me to imagine that in a non-distressed /fire sale scenario a hotel like this would go for significantly less than cost to build.

Tysons Corner Office: I believe this is 1861 international dr. It's a six story office building with a capital grille on the bottom; microstrategy.com appears to occupy most of the space (in the excellently named strategy.com tower). There's no debt on this building; conservatively, I'd guess it's worth at least $15m ($7.5m at MAC's share) though without more info on it (lease rates, length, etc.) it's tough to be sure.

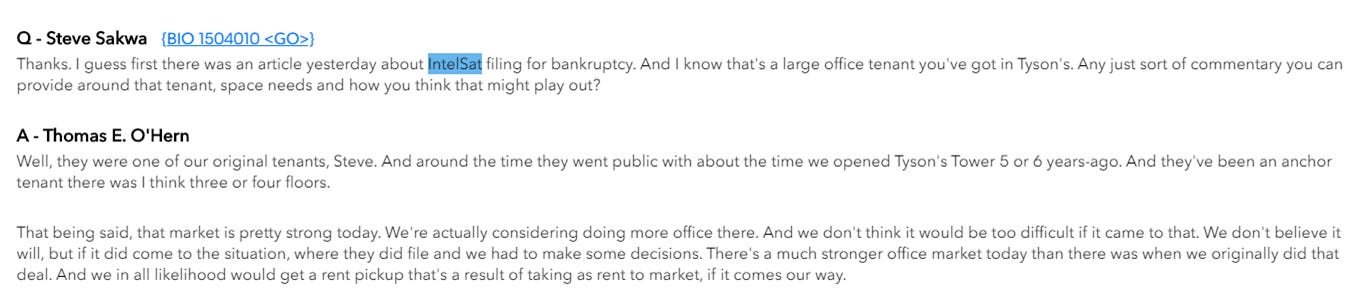

Tysons Tower- this is the only of the three assets with debt against it, as they took a $190m loan out in September 2019. It's a 22 floor office property built in 2011. Intelsat is a key tenant here; they occupy 3-4 floors and have their name on the building. Intelsat isn't the best credit; they're likely to go bankrupt in the near to medium term. MAC has previously indicated that the Intelsat lease is below market and that the office market in Tyson was pretty strong; hard to imagine that's the case today but still lends some comfort. For now, given they just took out some debt on it and they may lose a key tenant at the worst time, I'm assuming that their equity in the building doesn't cover the debt, but that's probably too conservative.

There's one more office / non mall property I want to mention: Scottsdale office. Similar to Tysons, these are offices located next to their Scottsdale Mall. This is an A+ mall that includes a Nordstroms, Apple, Tesla, etc. The office space includes a recently signed Industrious lease as well as (I believe) 7150 East Camelback, which leases to eTrade, One Medical, and a few others. Again, I'm not sure what this is worth, but it has no debt, some nice leases, and it's in a great area. I'd guess MAC's 50% share is worth at least $7.5m (similar to Tysons Corner), but that will probably prove conservative.

Alright, that's mostly it for non-mall goodies. I do think there are several other goodies hidden with MAC's portfolio (I'll cover them in the odds and ends section), but the company doesn't give a lot of clarity on these so I'll ignore them for now. At this point, we've got a valuation that looks something like this:

So we need to find ~$533m in value from MAC's mall portfolio to cover the rest of their recourse debt, plus enough to cover the share price / upside.

The obvious place to look for equity value in MAC's mall portfolio is pretty simple: any of the malls MAC owns that don't have mortgages / debt attached, because then any value that mall has falls straight through to the equity. There are four malls that are really worth discussing here

Biltmore Fashion (597k total GLA, 50% owned by MAC; no debt): This is a fantastic asset; it's a class A / A+ mall in Phoenix (apparently at the busiest intersection in the city). It's not subject to any ground leases, and MAC owns all of the anchors (Macy's and Saks). They literally just opened up a Life Time fitness there (incredible timing), and the rest of the tenant list is very solid (unfortunately they did lose their Apple a few years ago, but still a good tenant list). Pre-Covid, the mall was performing well (Occupancy up 2.1% to 93.1% in FY19, and sales/SQF up 6.5% to $714). Pre-Covid, I would have guessed this mall was easily worth $350m (MAC's share = $175m). It's tough to say what the mall is worth in today's environment: how many stores come back, how long does it take for sales to ramp up, etc.

My guess is that, in a few years, this mall will be back to doing what it did in sales last year, and its value will return. The location is too good, people will want to go to Lifetime, and the anchors are solid.

Obviously, that's not guaranteed. For now, I'm going to assume that the mall as a whole is worth $200m (a bit more than half of what I think a conservative estimate of its pre-Covid value was), with MAC's share being worth $100m.

On their Q4'19 call, MAC mentioned they expected to refi Danbury and Green Acres as well as put a mortgage on one unencumbered mall. Total proceeds to MAC would be >$400m; my guess is that Biltmore was the unencumbered mall they'd refi, and that the majority of that $400m would be from Biltmore.

Stonewood (935k total GLA, 100% owned by MAC, no debt, subject to a ground lease): this is a nice mall (likely high B to low A). There are no great tenants, but it's got solid anchors, it's in a really nice location, and performance has been solid and improving (2019 occupancy up 2.1% to 94%; sales/SQF up ~5% to $697). The company owns all of the anchors (Sears, Kohls, Macys, JCP). It used to have a $95m mortgage on it, but MAC paid that off in late 2017 (my guess is they were prepping to redevelop the mall a bit). Pre-Covid, I would have guessed this mall was worth significantly more than $250m. With no killer tenants but a nice location, I'm going to assume the mall is worth $150m.

Again, it's tough to say exactly how to value this property. If you think the mall is completely dead, then this is probably a little aggressive. But I'll remind you it's in a good location and the book value of the mall is ~$270m (see p. 104 of MAC's 10-K).

Inland Center (605k total GLA, 100% owned by MAC, no debt): this is not a great mall; it's somewhere between a low B and high C mall. Performance has been fine (occupancy was down 3.2% to 93.8% in 2019, but sales/SQF was up >5% to $570). The store locations read like a who's who of dying / legacy retailers (Forever 21, Macy's, JCP (which just opened in 2016!), and a recently closed sears; Inland owns all the anchors except Macy's). My guess is this is the definition of a zombie mall. Still, I wanted to highlight it because there's still value here. The mall has no debt on it, and it's in a reasonably nice location. The book value of the mall is ~$100m (p. 104 of MAC 10-K), with ~$8m of that coming from the land value. I would guess that, even if the mall never generated another dollar in revenue, someone would pay $15-20m for the land and buildings with an eye towards redeveloping it in some form.

Paradise Valley Mall (1,202k total GLA, 100% owned by MAC, no debt): this is one of the weirder assets in Macerich's portfolio. They stopped disclosing sales from the mall years ago because they are preparing to redevelop it; however, some of the anchors (MAC owns the Costco but none of the other anchors) here are doing well, so MAC likely needs to wait for them before they can go full steam ahead on the redevelopment. In the meantime, the mall is still operating (well, if was until Corona closed it down), and it's in a nice location (it's very close to Biltmore). My guess is that ultimately MAC is able to redevelop this very successfully; in fact, it's possible that Corona accelerates the willingness of the non-owned anchors to let MAC redevelop. Until then, it's near impossible to guess the value of this. Their 10-k has a book for the mall of $109m with >$30m coming from the land. I'm going to value this at $50m for now, but I would guess this property is ultimately worth significantly more.

Ok, the next thing I want to dive into is the value of MAC's ten highest sales properties: Broadway Plaza, Corte Madera, Queens Center, Washington Square, Scottsdale Fashion, Kierland, Los Cerritos, North Bridge, Tysons Corner, and Country Club Kansas City.

Before I do that, a quick note: Macerich's supplements gives enough info that you can roughly guess how much NOI each of their malls do. The easiest way to do this is by buckets; for example, their 2019 earnings supplement discloses that their top 10 malls will make up 32.6% of their 2020 estimated real estate NOI. Their top 10 malls are all extremely good malls, and extremely good malls tend to go for really low cap rates. For example, Simon bought Taubman at an implied cap rate of 6.2%. (If Corona hadn't happened, I think Simon was stealing Taubman and the Taubman family was letting them because they got to roll their equity.) Macerich's top 10 malls are of substantially better quality than the average Taubman mall, so regardless of if you think Taubman was selling too cheapily or not Macerich's top malls should trade for a better / lower cap rate than Taubman.

Anyway, pre-Corona, Macerich's top 10 malls were projected to do >$300m in NOI at Macerich's share. Let's say these malls were worth a 6% cap rate (in line with Simon / Taubman); MAC's share would have been worth $5B. MAC's share of these malls' debt is ~$2.6B, so MAC's equity in those malls would have been ~$2.4B (and I think this was probably conservative). That would have covered the ~$533m in recourse debt left over from our math above and left ~$12.50/share for the equity (and give us the rest of MAC's malls, including the unencumbered properties I just mentioned, for free).

Post-Corona, it's difficult to do that math. I'm not sure when the malls are going to be allowed to open, and even when they do open I'm not sure how many of their retailers are coming back, what type of rent concessions are going to get made, etc. So, instead of doing an estimated mall by mall income statement, I'm just going to walk through each of these malls and their assets. I'm going to try to give a valuation that I think is pretty conservative. Often that valuation is just going back to what Macerich bought the mall for a few years ago and assuming the mall is worth close to that or a haircut. Could be right or wrong. But I think overall this process is pretty conservative, and walking through it will show that even if one or two is a bit off, there's plenty of margin of safety here.

That said, let's walk through MAC's top 10 assets:

Broadway Plaza (927k GLA, 50% owned, $224m of debt (MAC share)): this is one of the best mall assets in the entire country. It's anchored by a Macy's, Neiman, and Nordstrom's (MAC owns the Neiman and Nordstrom's). The store base includes all the retailers you'd expect (Tesla, Apple, Lulu, Peloton), and an Industrious opened there in Q4'19. Northwestern used to be their partner in the property; they sold their stake in 2017 after a big 2016 expansion (I believe the value in the NW sale was ~$900m and valued the property in the low 4 cap rate area; quotes below from NAREIT presentation June 2019 and Q1'18 earnings call; respectively). Since the Northwestern sale, the property has done phenomenally. Sales/SQF have gone from $1,326 in 2017 to >$2,000/SQF in 2019. Pre-Covid, I would guess this property was worth well, well in excess of $1B. I'm not sure what they could get if they needed to sell it today, but I feel really confident that this mall is going to retain its value and will be one of the first to bounce back when the country gets started up: the tenant base is just too strong and the location is too good. I'm going to mark the property at $900m (I believe the valuation implied by the Northwestern sale); I feel reasonably conformable that a year from now we'll look back at that mark as completely laughable but it's a start. MAC owns 50% of the property and their share of the debt is $224m (the debt was placed in 2016), so their equity value would be ~$225m.

Village at Corte Madera (501k GLA, 50.1% owned by Macerich; $112m MAC share debt)- another incredible asset. Anchored by a Macy's and Nordstrom's (unfortunately, neither owned by MAC), tenants include a big Restoration Hardware gallery, Microsoft, Lulu, Tesla, Peloton, Williams-Sonoma, Amazon, and Apple. Again, tough to say exactly what this mall is worth today; three months ago, I would have guessed easily >$500m. Still, this is a great location and a great tenant base; I have to believe that this mall will start back up. I'm going to value it at $300m (MAC share = $150m less debt).

Queens Center (965k GLA, 100% owned by Macerich, $600m in debt): another incredible asset (I'll stop saying it now; honestly all of their top 10-15 assets are really good). The book value of Queens is ~$1.2B (per their 10-K) and it has $600m in debt against it. That debt was put into place in late 2012; since then, sales/SQF have gone from $1,004 to $1,581. Again, I'd guess there's huge equity value here, but the mall's tenant base is a little more tired than some of the other trophy assets (it does have an Apple, but no Lulu, Tesla, etc.). I'm going to value this mall at $900m. Why? Pretty strange thought: they got $600m in debt in 2012, and sales since then have gone up >50%. There was absolutely equity cushion beneath that debt, between the increase in sales/SQF plus that equity cushion I'm comfortable that current value has to be at least $900m. In fact, I'd guess that's crazy cheap but I'm fine being conservative.

Washington Square (1,296 GLA; 60% MAC owned; $329m debt @ MAC share): Anchored by a Dick's, Macy's, JCP, and Nordstrom (all owned by MAC except Macy's); other stores include Apple, Lulu, and (crucially) starwarsstore.com (yes, this is a thing). Performing well (sales/SQF up from $1,261 in 2018 to $1,550 in 2019). The company recaptured a Sears that they are in the process of demolishing and turning into a mixed use hotel / restaurant / entertainment boxes (was scheduled to open late 2021; see quote below. It's a JV with Seritage); seems like the city was supportive of trying to keep revitalizing the neighborhood as well. I'm going to assume this is worth as much as Queens Center; probably too conservative as it does a similar sales/SQF as Queens and is ~30% bigger, but that's fine. MAC's share of the EV would be $540m.

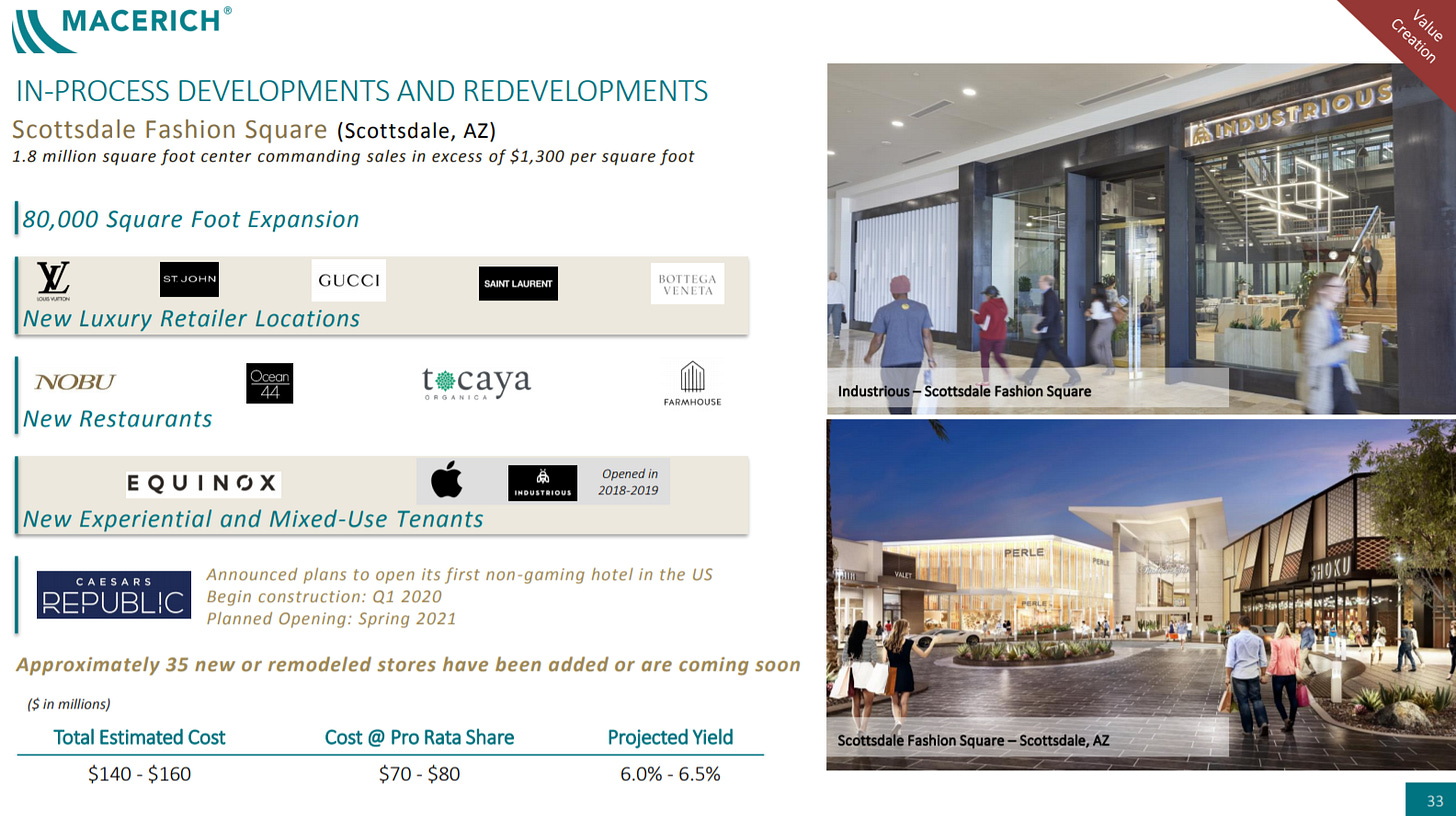

Scottsdale fashion (1,835 GLA, 50% owned by MAC, $223m debt @ MAC share): an absolute jewel. Anchored by a Dillards, Dicks, Macys, Nordstrom, Neiman (all but Dillards owned by MAC); other stores include Apple, Tesla, Microsoft, Tiffany's, etc. Sales/SQF up from $1,159 in 2018 to $1,437 in 2019 with occupancy up 1.1% to 93.2%. The property is undergoing a ~$150m renovation that will see it add an equinox,Versace, and a Caesars hotel (which humorously broke ground maybe a day before Corona shut down the hotel industry) as well as a bunch of other stores. Early returns from the redevelopment have been outstanding. I would guess this property is worth closer to $2B than $1b property (easily) before Corona, but again it's tough to say what it's worth today. Earlier I estimated Queens Center was conservatively worth $900m. Scottsdale is almost as much in sales/SQF and about twice as big. For now, I'll just estimate it's value is equal to what I pegged Queens at; MAC's share would be $450m before their debt.

Kierland (437k GLA, 50% MAC ownership, $107m debt @ MAC share): This is a nice center in a great location; it's got a premium roster (Tesla, Athletica, etc.). It's small compared to the rest of MAC's properties, so I'm not going to spend a ton of time on it. I'm going to assume the whole thing is worth $300m (MAC share = $150m less debt). I think that would prove crazy conservative in a non-firesale sales process, but it's not worth splitting hairs over since it's so much smaller than the rest.

Los Cerritos (1073k GLA, 60% MAC ownership; $315m debt @ MAC share). Anchored by a Macy's, Nordstoms, Dick's, and Forever 21 (they own the Forever 21 + Dicks), as well as a Harkins Theater. Also has an Apple store. Fantastic location off 605 freeway; demolishing an old Sears anchor and turning it into resi / hotel / restaurant space (anticipated opening 2022; JV w/ Seritage). I would guess there's significant equity value here, but given the loan size I'm going to zero this out for now.

North Bridge (670 GLA, 50% MAC ownership, $187m debt @ MAC share): Anchored by the best performing Nordstrom's in the nation (MAC owns the anchor), this is 6 blocks of shops on Chicago's Miracle Mile. I would guess there's tons of equity here. Macerich bought North Bridge (with Alaska fund) for $550m in 2008. They also bought an office building nearby for ~$70m in 2012 and paid $42m for a vacant site next to it in 2014. I believe that lot remains vacant (per google maps; I'd love to due diligence it but it's a bit difficult to travel in Corona world), but the company has plans to expand a new tower at some point. If I add all those up ($550 + $70 + $42m), I get ~$660m in total cost. I would guess the whole is worth more than that, but without more info I'm going to go conservative and say the whole thing is worth $600m ($300m at MAC share).

Tysons Corner (1971 GLA, 50$ owned by MAC, $373m share of debt). Mentioned a bit above when discussing Vita / Tysons Tower, Tysons is in a great location and recently underwent a big expansion and mixed-use enhancement. The property is anchored by Bloomingdales, L.L. Bean, Macy's, and Nordstroms (all owned by Macerich; in addition, a Lord and Taylor closed earlier this year). I mentioned earlier the property was appraised at >$1b in 2013. I would guess that, in a normal environment, the property would be worth significantly more than that appraisal today: it's been expanded, public transit improved, and the office and hotels around it opened up. For now, I'm going to value it at $850m ($425m for MAC share). Again, that seems cheap, but that's fine.

Country Club Kansas City (947k GLA, 50% MAC ownership; $158m debt @ MAC share): The "crown jewel of the midwest" (per MAC website, so you know it's true), Country Club plaza is a really solid asset. It's the #1 tourist destination in Kansas City (again, per the MAC website. It's only ~#22 on trip advisor). Macerich and Taubman bought the property for $660m in early 2016. They actually don't disclose sales per SQF at this property (TCO doesn't disclose property sales/SQF, so MAC N/As it on their disclosure), but I would guess the mall is worth significantly more today than it was when MAC / TCO bought it (this article goes over some of the wins they've had since buying the property; obviously the Nordstrom moving is a highlight). I'm going to value this at a 10% discount to cost for now ($600m total; $300m at MAC share). Again, probably too conservative, but that's fine

Ok, I know that was a lot. I've put a summary table of everything below.

Again, that's just the value for the top 10 malls they own, three unencumbered assets, and some of their other assets. There are substantial assets behind this; I've got a few of the quirkier / easier to overlook once listed in the odds and ends section, but a few quick other examples:

Their #11 mall by sales/SQF is La Encantada. They own 100% of this mall, and it has just $64m of debt against it. The mall is a fantastic assets: great location (average income >$150k in their area) and great performance ( sales/SQF of $927 in 2019 (up ~8% YoY), and occupancy was at 98% at year end). Tenants include Apple, Lulu, Crate & Barrel, etc. The mall is almost certainly worth >$200m (~$150m net of debt), and we've given it no value in the above table. There are tons of assets like that in MAC's portfolio; the critical thing with MAC is that at today's price we're buying all of those malls for essentially free.

MAC and PEI (another mall REIT) are 50/50 partners in Fashion District Philly. This is a new build mall with ~900k total GLA that literally just launched in Q4'19. It takes up 3 city blocks in the heart of Philadelphia with a movie theater, Round One (Bowling / billiards / arcade / karaoke), and an Industrious. MAC's share of the cost of the mall is $191m (per MAC 10-k p. 5), and their share of the debt is $150m. Before Corona, PEI was forecasting that the mall would do >$18m in NOI (at their share) once it stabilized in 2021. At that earnings level, MAC's share of Fashion Philly would have been easily worth $350m ($200m after debt). Today, it's tough to say, but this is a new build mall with a nice tenant base in a great part of Philly. Valuing it at cost seems crazy conservative, but that woudl still result in ~$40m of equity for MAC (>$0.25/share). (quotes below from PEI's Q4'19 and Q4'19 earnings calls)

Are there risks here? Absolutely, but I think there manageable.

Your biggest risk is Corona (obviously). There are a variety of ways to break this risk out, but I'll try to bucket them below

In the near term, your risk is that Corona is shutting these malls down. It's somewhat unknowable how many of MAC's tenants make rent payments while their stores are closed, and even once the malls open, it's unknown how many of the tenants are still around to reopen.

Once the malls reopen, your risk is that the mall "network" is broken. There are two ways I see this risk playing out:

The first is that mall leases often have occupancy clauses. These allow a tenant to break their lease if a mall isn't occupied to a certain level (i.e. if occupancy goes below 75%, the tenant can break their lease).

The second is that, even without the occupancy clause, enough stores don't reopen that the mall becomes a dying mall. Remember, a mall is a network: stores go there because buyers are there, and buyers go there because stores are there. If some stores don't reopen, fewer buyers go to the mall, which leads to less buyers, which leads to more stores closing, etc.

The longer the Corona shutdown goes on, the more risk to MAC's malls. Longer shutdowns =more tenants who can't make rent and more tenants who won't be able to reopen once the shutdown ends.

There are also some risks around changed consumer behavior once malls do reopen. People are going to be hesitant to go into large groups for a long time; that could have some impact on mall traffic for years to come.

An anecdote might show this best: my hometown mall growing up was often pretty crowded in the morning with older people who would walk around the mall (saying hi to all their friends) and then stop for a coffee after their morning workout. How long before that trend restarts? Does it ever? I'm not saying that trend in particular is critical to malls, but I just wanted to highlight some incremental behavior that could sap mall traffic / demand on the margins.

Corona has likely accelerated the shift to online shopping, so even once the economy restarts on the margins some dollars that would have been spent at malls has likely permanently shifted to online.

As mentioned in the "malls are dead" research earlier, online shopping had generally been pulling sales from lower end malls and strip centers. Class A malls had actually been seeing sales increase, and online retailers were seeing sales boosts from opening stores in class A malls. I would not be surprised if the majority of dollars lost to online comes from weaker malls and strip centers; in fact, it's possible class A malls (like MAC's) actually pick up some share as some lower end properties never reopen.

Obviously a lot of dollars had already shifted online (like book sales), but the interesting thing about Corona is that it probably accelerated the shift for some other categories that were still largely done physically (like grocery stores).

Again, these are all risks. I take comfort here that MAC's properties are, in general, really well located malls with great tenants who will certainly be opening up again (that's why I highlighted Apple so frequently). While I'm sure a few of their malls that had bright futures pre-Corona will struggle coming out of this, in general I think the majority of their portfolio will be operating full steam ahead ~18 months from now.

I think the biggest specific risk here is refinancing. The good news here is that, in general, the major / trophy properties have relatively long term mortgage debt. Of the properties that I've mentioned so far, the biggest maturities are Tucson La Encantada (March 2022) and Washington Square (November 2022); after those, Scottsdale's mortgage matures in 2023 and Chandler and Tysons in 2024. All the other big properties have mortgages maturing beyond that.

That mortgage maturity schedule is great news; it means MAC won't be forced to hand over the keys to any of their trophy assets simply because markets are frozen when their debt matures.

The biggest debt risk to MAC comes from their revolver (credit agreement here). The revolver expires July 2020, but is extendable at the company's option till July 2021 (that option becomes available to the company either today (April 7) or tomorrow). The nearest risk would be if the company couldn't extend the revolver for some reason, but I see almost no reason that would be an issue. I base that on three facts:

The company literally just drew the revolver down at the end of March. I would guess they are having some discussions with their banks about the extension when they're drawing down.

There was a wave of insider buying all through the month of march (discussed more in odds and ends); I doubt insiders are buying if they are about to draw down their revolver and the bank is telling them they won't be able to extend.

PEI, another mall REIT with a way worse portfolio and balance sheet, managed to amend their credit agreement at the end of March. If they could amend, I feel pretty confident that MAC will be able to.

Ok, assuming that MAC is allowed to extend, the other to risk to MAC are 1) they blow a covenant in the next few quarters and 2) they're unable to roll their revolver when it comes due.

Let's start with the revolver covenants (pasted below). Given Q1 was should have been reasonably normal (the pandemic didn't really break out till mid-march, so all Q1 rent payments should generally have been made), there shouldn't be any financial impacts or covenant concerns until Q2 at a minimum. Based on my math, I think the finances could get pretty bad in Q2 and the company still wouldn't breach covenants, but it's obviously tough to forecasts specifics.

The covenants are a concern, but I think MAC will be able to handle it. There are three reasons for my confidence

Again, PEI managed to amend their covenants at the end of March

MAC won't breach covenants until July (Q2) at the earliest. By that time, the world will not have returned to normal, but we should have at least some line of sight to the world reopening. Lenders are a lot more likely to give MAC some flexibility if they see some green shoots in the world (plus, as detailed above, MAC has tons of equity value beneath the revolver, so they can offer a bunch of goodies (pledges not to encumber more assets, increase cash flow directed to revolver paydown, etc.) to appease the lenders).

MAC always has the option to sell some assets to pay down the revolver / make their covenants. Yes, they probably wouldn't get great prices if they had to firesale assets now, but given the quality of their portfolio I do think bidders would come out if MAC put one or two properties up for sale.

The other issue is if they're unable to roll their revolver when it comes due next year. Here again, I'm pretty confident they'll be able to for all of the reasons listed above: the world should be much closer to normal, MAC has some unencumbered assets they can promise not to unencumber, they can agree to aggressive amortization schedules, they could even sell an asset, etc.

Ok, this post is running extremely long. I'll wrap this up with a summary:

MAC is not without risk. If you think people never shop again or that they don't return to malls for >3 years, the investment tesis is a lot shakier

However, if you believe that trophy malls retain their value (or even a significant majority of their value) once the country opens up in the next year or so, MAC is astronomically cheap.

The majority of MAC's debt is non-recourse. MAC has the liquidity and unencumbered assets to make it through the crisis.

A conservative valuation of a fraction of MAC's assets yields a share price equal to our in excess of today's share price, providing investors with a massively valuable free call option on the rest of MAC's portfolio as well as the conservative valuation proving to be.... well, too conservative.

I know a lot of people are going to want a firm NAV estimate / upside target. It's really difficult for me to give you one with confidence; it's just too difficult for me to forecast exactly what malls come back, how long it takes for rents to come back, etc. That's why I wanted to the focus of this article to highlight that there's upside just from a conservative valuation of their most valuable asset. Just like it doesn't take a scale to tell you someone is overweight, I don't think it takes a specific NAV target to tell you that MAC is trading below a conservative NAV estimate right now.

Odds and ends

One thing I try to ask myself in every investment: why does the opportunity exist? I think the answer is clear here:

The near term environment for retail is going to be a disaster. It doesn't take much of a leap for investors to here that and think "short every mall".

MAC's financials are complex, with a lot on non-recourse debt. Combined with number one, and it's an easy short / sell when markets are panicky

Obviously, buying a mall in a recession reminds of Ackman's investment into GGP at the height of the financial crisis. MAC isn't close to that cheap, but I do think the ultimately upside will be pretty substantial.

Mentioned above, but worth a little bit of a deeper dive: A critical piece to the investment thesis is that MAC will be able to wait out the current environment and not need to firesale their best assets. They can do that because their debt maturities are reasonably long: in the next year, the only asset level debt that expires are Danbury Fair, Fashion Niagara, Green Acres Mall, and FlatIron crossing. I think there's equity value in all of those, but even if MAC needed to hand the keys over to all of them it would not impact my valuation (none of these were even mentioned in my valuation above). As long as MAC can renew their revolver in some form, they can hold on to their best assets and wait for the world to normalize. Yes, some of their assets will have lost a lot of their value, but many of their assets will see their value recover to pre-Covid levels, and given the valuation it doesn't take many of their assets reaching that valuation to more than cover today's share price and then some.

What would happen if they needed to sell some assets? Right now it would be tough. But in a month or two I think distressed investors will have sharpened their pencils on a lot of these things and will be willing to make a bet on mall turnaround / redevelopment.

I do think that banks will be very reluctant to "take the keys" from MAC. There aren't a lot of mall operators of scale. If a mortgage came due and the environment was still a disaster, I would guess banks are willing to extend the mortgage for a year (with aggressive cash flow / pay down protections) and wait out a better environment / keep an experienced operator like MAC in charge.

There's been a decent bit of insider buying in March. I've linked all of the insider buying below. I'm always hesitant of using insider buying as a buy signal; even in the best of times, insider buying can be fraught with problems (insiders know buying can boost the share price temporarily, and insiders often have much rosier views of their companies than is warranted), but in today's environment I think insider buying is particularly fraught. I've tweeted a few times examples of REIT CEOs buying shares in mid-march only to see the equity effectively worthless a few days later. I doubt there's ever been a business environment that has changed as much or as quickly as the current environment, and I wouldn't be surprised if there were a bunch of CEOs who saw their share price on March 20th, thought the shares were astronomically cheap because they were still using a pre-Covid valuation / operating environment, and bought the stock.... even though the stock will ultimately prove to be way overvalued (or a zero) in the current environment. That said, there has been a bunch of insider buying across the firm at Macerich (I've listed it all below), and I do take some comfort in it. Their head of leasing is buying on March 30... He has to have some insight into how bad the April rent numbers / ongoing leasing discussion are, right? He makes ~$1m in annual comp ($700k in cash comp), and in March he's taking ~a third of his cash comp and buying MAC shares on the open market (his first open market purchase since he joined the company in ~2018). That seems reasonably bullish to me? Or take their President, CEO, and Vice Chair all buying at the end of March. These are smaller purchases as a percent of their comp than the EVP leasing purchase, and these guys have been buying stock for years at way higher prices (here's the President buying last summer at ~$33/share, and here's the CEO buying last summer at $37/share), so they're probably not as much of a signal as the leasing EVP buying.... but I still think there's some signal in the purchases. As mentioned above, MAC's has an option to extend their revolver until July 2021 (if they don't, it expires in July 2020). That option can be exercised starting early April. It's hard for me to imagine that all of MAC's top brass are buying stock at the end of March without, at minimum, at ton of comfort that their revolver is going to get extended.

CEO (3/16 @ $10 and 3/27 @ $6.12)

Director (3/18 @ $6.70)

CLO (18 @ $7)

CFO (3/19 @ $6.30)

EVP, BD (3/20 @ $8)

President (3/16 + 3/18 @ $7.50) (3/27+3/31 @ $5.50-$6)

Vice Chair (2/24 @ $22.5 and 3/11 @ $15 and 3/31 @ $6)

EVP, leasing (3/12 @ $13.50 and 3/30 @ $5.85)

FWIW- other companies with mall exposure have seen some insider buying as well.

BPY has a lot of exposure to malls (they also have lots of office exposure and other real estate). BPY has been repurchasing shares, and BAM was buying shares on the open market through the end of March. Again, they could just be underestimating how bad the crisis is, but I tend to think these are sophisticated real estate investors who have some insight into what's happening on the ground (discussions with tenants, end of march conversations on April rent deferrals / non-pays, etc.). It's probably pretty bullish for the sector overall if they're buying shares (though they've been repurchasing shares for years at much higher prices, so (again)... grain of salt!)

Speaking of April deferrals, I mentioned this in my piece on commercial rent questions, but Pier One's BK docs are very interesting. There was also a WSJ piece with a survey saying half of SMBs didn't pay rent in April. Still, tough to know exactly how bad this is going to be (or going to get) until we start seeing some firm reports.

Simon had a spate of insider buying in mid-March (For example, here's the CEO with a ~$10m buy, Chairman Emeritus, and somedirectors). A nice sign, though I tend to discount buying in Mid-March a bit since I don't think most people had fully adjusted to how bad / long lasting this would be (the buys were done a day after SPG extended their revolver but a day before SPG shut down all of their malls).

I think MAC's buying is a bit stronger signal: more buying across top brass, later in month, etc. That said, if MAC works, SPG probably works too!.

On their Q3'19 and Q4'19 call, Macerich mentioned they'd sold their share of VITA Tysons (luxury apartments) for ~$82m, and that the sale would go through in Q1'20. I'm not sure if the sale closed; I assume it did, as I can't get close to their current cash balance mentioned in their March 27th release without assuming the sale did close. However, if it didn't, that would represent some extra equity value I haven't captured yet (yes, if the sale broke, it would probably sell for a lot less in today's environment, but there's no debt I see against the asset so there is certainly a nice bit of equity value there).

There are a ton of assets that I have given no value here that I think have some equity value. How much? No idea. But every little bit counts. For example, Simon and Macerich have a JV to build outlets in LA. Macerich has sunk ~$36m into that JV so far. The JV has no debt and was intended to open sometime in late 2021. How much is that worth now? Again, no idea. But it's worth something, and I've given them no value for it. A few other possible sources of value:

MAC has spent $22m redeveloping Sears stores so far; those are still in development (see p. 32). I would guess that there will be some return on investment here, but that's not a guarantee. It's entirely possible that some of that development money is worthless in light of COVID (i.e. they took over and were redeveloping a box at a mall that will be destroyed by COVID), but I tend to think there's still some value here.

P. 30 of the 10-k notes "various" assets that MAC owns 100% of. This includes one office building and six stores. One of the stores is leased to Kohls, two or vacant, and three are leased for no anchor uses. The company owns the land at three of the stores and the office, and they lease the land for three of the stores. I have no clue what any of these worth, but (again) there's no debt to them so you'd have to imagine there's several million of equity in these.

Sticking w/ p. 30 of the 10-k, MAC owns 83% of Estrella Falls. P. 104 of the 10-k notes the book value of this land is $79.759m. I have no idea what this property is; MAC used to own the Market at Estrella, but they sold it in 2018.

It is possible that the malls will get some business interruption insurance proceeds (PEI suggested as much in early March). I personally am skeptical, but obviously any proceeds would create significant upside.

Another area of possible upside? These malls are mammoth employers and tax payers (both through property and sales tax) at the local level. I would not be surprised if they get some type of direct subsidy and/or tax relief at the local level. However, aggressive tactics over the past few years may limit the upside here.

MAC took out their JV partner for five malls (Washington, Queens, Stonewood, Los Cerritos, and Lakewood) back in 2014. That transaction implied >$2B in equity for Macerich from those five malls alone. Obviously, that's a stale mark on a bunch of different levels (negative: obviously COVID; positive: sales are way up at most of those mallsl; for example, both Queens and Washington have seen sales/SQF go from ~$1,100 to >$1,500), but I wanted to highlight it just to show how much equity a few of these malls had / would have tif they returned to a normalized environment

There has been activist interest in both the mall space in general and MAC specifically (Third Point, Starboard) before. I would not be surprised in the least if an activist stepped in here at some point; the upside is just too high and the value creation path from proper capital allocation too rich.

Macerich has a JV for a lot of their properties; many of these JVs came in 2015. On the heels of Simon trying to buy MAC (for >$90/share!), MAC sold interests in a 8 of their properties (apparently at a low 4s cap rate) and used the proceeds for dividends and buybacks.