Novelion might not be an orphan for much longer $NVLN

Novelion has a fantastically interesting history

The company's financials currently look like a train wreck

A relatively conservative sum of the parts shows significant upside from today's prices

Novelion (NVLN; disclosure: long) is not for the faint of heart. In addition to a history of FDA fines for “fast-and-loose” interviews and a still pending DoJ investigation, the company has a massive debt load (face value of debt = ~1.5x market cap; debt trades in the 80s) and a rather “storied” history that includes banker pitches that doubled as coke fueled wife swaps.

Despite all the noise, I think Novelion represents a fantastic risk/reward at today’s prices of ~$10.50/share. Significant insider buying late last year confirms the potential for the company, and conservative assumptions value shares at more than double today’s prices. In an upside scenario, it would not surprise me to see the stock acquired for 3-4x today’s share price in the next year.

Novelion was formed from the merger of QLT and Aegerion late last year. Going into some background on each of the companies is critical to understand why I’m so bullish on the potential here.

Let’s start with QLT, as it’s the simpler story. In late 2012, QLT had a new board take over; they were led by Jason Aryeh, who is now Chairman of Novelion. They sold QLT’s key products to Valeant and Mati for a nice prices and used the cash to pay out a big special dividend ($200m) and buy back a significant amount of shares (~10% of the company). After those moves, QLT had three assets: a significant cash balance ($100m+), an orphan drug (now called Zuretinol, discussed later), and a Canadian tax domicile with a ton of Canadian NOLs.

QLT understood that a small company with no revenue didn’t have the infrastructure to support running an orphan drug through Phase III trials, so QLT’s team went looking for a merger. And while the team was fantastically successful at finding merger candidates, that weren’t so successful at closing those mergers. First, in mid-2014, QLT struck a deal to merge with Auxilium that valued Auxilium for ~$21/share. The merger broke when Endo Pharma came over the top and bought Auxilium for $33.25/share. Then, in mid-2015, QLT announced a deal to merge with InSite Vision in a deal that valued InSite at ~$0.178/share. The merger broke when Sun Pharma bought InSite for $0.35/share.

So merging w/ Aegerion to form Novelion was actually QLT’s third shot at merging. Obviously, I like the fact that QLT’s first two mergers broke because someone paid a massive premium for the other side of the deal, as it seems to indicate QLT had an eye for spotting undervalued pharma companies. So what exactly were they seeing in Aegerion?

Aegerion has two drugs: Juxtapid (Jux) and Myalept (Mya). Both are orphan drugs (similar to QLT’s phase III Zuretinol), which means they are approved for a small patient population and enjoy extra regulatory / patent protection. Jux is used for patients w/ homozygous familial hypercholesterolemia (HoFH), a rare disease (effects one person in every 160k-1m people) that impairs the body’s ability to remove LDL-C (bad cholesterol) from the blood. Mya is used for Generalized Lipdystrophy (GL), a group of rare symptoms (affects ~ one in a million people) characterized by a lack of adipose tissue. The lack of adipose tissue causes a leptin deficiency, which makes patients experience significant fatigue, unregulated appetite, and leads to enormous issues.

Both Mya and Jux are very serious drugs. They come with boxed warnings discussing their side effects and they’re only available through a Risk Evaluation and Mitigation Strategy (REMS) program, not at a standard pharmacy. REMS program are designed to educate doctors about the risk of dangerous drugs, monitor patients during treatment, and restrict access to patients who truly need the drug.

Because of their small patient populations and strong patent protection, orphan drugs are often sold at huge costs ($300k-500k/year is typical). The high price point creates an incentive for pharma companies to expand drugs labels or even encourage doctors to prescribe it off label.

This is where Aegerion ultimately got in trouble. Their CEO went on TV and made off-label claims for Jux that got them in trouble with the FDA. The trouble ultimately ran deeper than just the CEO, as it turned out their sales force had been pushing the drug aggressively and their REMs program wasn’t up to speed. Ultimately, all of these issues got their CEO fired (and obviously the coke fueled wife swap rumors didn’t help); however, the damage had already been done as the share price had collapsed and the DOJ was demanding penalties. These issues, plus the release of a competitive drug class (PCSK9s) for Jux, destroyed Aegerion’s stock price, revenues, and cash flows.

Obviously Aegerion came with a lot of hair on it. But I believe that QLT merged with them when things were at their most negative. QLT’s cash balance gave Aegerion the cash infusion it needed to avoid bankruptcy, and Aegerion’s sales most likely bottomed in 2016. At its core, the new Novelion is an orphan drug company with two approved products and one about to enter phase 3 trials. Looking at recent multiples assigned to orphan drug companies, it’s easy to see tremendous upside from today’s prices.

Novelion’s value comes from three places: Jux, Mya, and QLT’s retinoid program. Below I’ll discuss how I look at valuing all of them, and then in the end put them together to come up with a target price.

Myalept

I’ll start with the program with the most value. Mya is used in patients w/ leptin deficiency from GL. They have orphan patent protection on the drug through Feb. 2021 and biologic exclusivity through the mid-2020s (twelve years from Feb. 24, 2014, though the company thinks there’s a way to get this closer to 2030, which would create massive value); however, this drug is a biologic. Biosimilars (generics for biologics) are currently very expensive and complex to create (this article gives a bit of an overview on some of the issues), and given the small market size and difficulty of bringing on a competitive biologic, it is feasible that Mya is never genericized.

Myalept was passed around a few times before Aegerion got it. It was first owned by Amylin, who hoped to use it for obesity and diabetes in patients with lipodystrophy. Bristol-Myers and AstraZeneca bought Amylin in a complicated deal in 2012, and Astra eventually bought Bristol out of their share of the partnership. However, AZN was hoping to get Myalept approved for partial lipdystrophy (PL), a much broader indication (more people), and the FDA only approved for generalized lipodystrophy (GL). On the heels of that disappointment, Aegerion acquired the drug from AstraZeneca for $325m in late 2014 / early 2015.

Mya is now growing rapidly; Novelion is guiding to 2017 sales of $75-80m after doing ~$50m in sales in 2016, and I think it could serve as the “crown jewel” to a variety of companies in an acquisition. Failing that, I think it’s a crown jewel for Novelion in its own right and it alone is probably worth around Novelion’s entire EV today.

There are two things I point to when I say Mya has the potential to be a crown jewel. First, you can look at the general pharma M&A environment and see that orphan drugs are in incredibly high demand. Horizon bought Raptor Pharma, which had two approved orphan drugs, for 6.6x sales last year after an intense bidding war. Second, looking at Aegerion specifically, the background information section for their QLT merger reveals several bidders coming out to look at buying Mya or partnering with Aegerion on it as a way to help alleviate Aegerion’s stress. We can see why bidders were so eager to get their hands on Myalept in Aegerion’s forecasts for the QLT merger, as they were forecasting sales would grow from ~$50m in 2016 to $111m by 2018, over $200m by 2021, and topping out at just shy of $250m in 2025 before coming down to a small base after that. With 75%+ gross margins, if management is correct in those predictions then this is a drug that could be throwing off almost $200m annually in a few years. With that type of growth profile and the way orphan drugs are trading, Mya could easily be worth more than $500m today based on both M&A multiples (Raptor’s 6.6x sales multiple versus Mya’s $75m forecast for 2017) and a DCF valuation.

At today’s share price of ~$10.50, Novelion’s EV is <$450m and its market cap is <$200m, so based on that math Mya alone could be worth more than Novelion’s entire share price today. If I’m wrong and Mya is worth less (say $325m, or what Aegerion paid for Mya in late 2014. Given the rise in orphan multiples since then and the sales growth Mya has seen since the acquisition, I can’t see it being worth much less), Mya would still cover all of Aegerion’s debt and almost all of today’s stock price.

And even that valuation might be conservative, as all of these forecasts have only been for GL patients. Mya is an injection used for leptin deficiency, and management thinks leptin is a very interesting area with all sorts of potential new indications for Mya. There’s also a chance that Mya is eventually approved for PL as well. If any of that comes to pass, it could add hundreds of millions to Mya’s franchise value, which would be fantastic upside from today’s share price.

Juxtapid

Jux is the drug with the most questionable value. The drug went from $213m in sales in FY15 to $100m in FY16 and a forecast for just $80-85m in FY17. The big question is if this year represents the bottom or if sales of Jux will continue to decline.

Jux has certainly been hurt by all the FDA / DoJ / regulatory issues mentioned above, but the main reason for Jux’s decline have come from PCSK9s. PCSK9s are a competitive product that are both cheaper than Jux and have fewer side effects (Jux is terribly hard on the liver and doctors who prescribe Jux must test patient’s livers every three months), so most doctors and insurers are now requiring patients who want to go on Jux “step through” PCSK9s (i.e., try to take a PCSK9 and fail) before they’ll allow people on Jux.

Novelion’s theory is that there are some patients w/ HoFH who find PCSK9 ineffective. Novelion thinks they can grab those patients and stabilize sales at or above today’s levels. If they’re correct I would guess the drug is worth $300m or so, but it’s really tough to see that math given the drug is still declining by ~20%/year in 2017. Still, Jux has really nice GMs (85-90%) and will throw off really nice case flow, so there’s absolutely some value here. If we value it at 2x 2017E sales, Jux is worth $165m. Value could obviously swing up quickly if sales bottom this year and start to grow again, or this could be off if sales continue to decline rapidly, but I’m confident there’s at least some value here and honestly $165m feels a bit on the conservative side given the range of outcomes.

Jux has orphan exclusivity through December 2019 and composition of matter through 2020, though the company isn’t forecasting generics until their method of use patents epire in the mid to late 2020s.

Zuretinol / Retinoid program

This is related to QLT’s ultra-orphan retinoid drug, Zuretinol. Zuretinol is a synthetic retinoid compound for treatment of certain rare forms of Leber’s Congenital Amaurosis (LCA) and Retinitis Pigmentosa (RP). The forms of LCA and RP the program treats are very rare forms of two diseases that are already quite rare; combined, there are less than 5,000 people in the world with the indications the program tries to treat. Because there are no treatments currently approved for these orphan diseases, Zuretinol has Fast Track designation from the FDA.

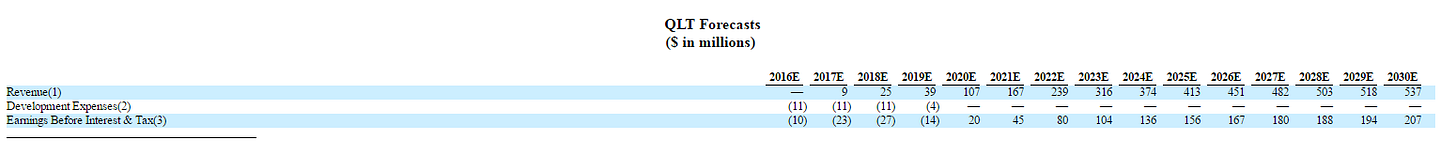

Novelion will meet for review w/ FDA + EMA in first half of 2017. If approved, I would expect Phase 3 trials to begin by year end, and we could be looking at a launch sometime in 2019 if trials are successful. If approved, the potential is enormous: the proxy shows management was forecasting over $500m in annual sales for Zuretinol with extremely high margins, so the potential value on approval is in the hundreds of millions or billions of dollars. (Chart below from management projections p. 87)

The question is simply what the odds of success / approval are. The success rate of drugs going into phase 3 trials is ~50%. Given the orphan nature prior Zuretinol trials (less patients and more limited data), I think this might be a more difficult approval so I’ll assume 25% chance of success. If I say the drug would be worth $400m on approval and has a 25% chance of success, it’s worth $100m.

Just to confirm I’m thinking about the upside correctly I’ll note Allergan acquired a drug in the same retinoid area for $60m plus milestones in September. That drug is only phase 1 and frankly I think its technology isn’t as strong as QLT’s program, so a $60m payment for that drug confirms that QLT’s program would have mammoth upside if approved (and also suggests valuing it at $100m when it’s about to enter phase 3 is probably way too conservative).

It’s also worth noting that Novelion believes Zuretinol could get a pediatric priority review voucher. These can be pretty valuable- Sarepta just sold one for $125m, though that price is down quite a good bit from what they were fetching a few years ago. Valuing Zuretinol at $100m is basically saying it’s worth less than the potential priority review voucher and the drug itself has no value; I feel that’s way too conservative but the math gets crazy so quickly at bigger levels I don’t think we need to be more aggressive.

Again, this is a pretty binary outcome (it’s either a rejected and a zero or approved and worth hundreds of millions of dollar, though they could capture some value by selling the priority review even without approval), but given I think we’re buying the company for less than the value of Mya and Jux at today’s prices, having an option worth potentially hundreds of millions thrown in for free works for me.

Valuation

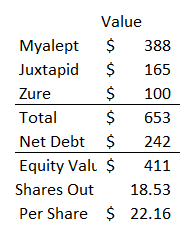

Putting it all together, I think there are three key sources of value for Aegerion

Myalept: Worth ~$400m at ~5x 2017E sales, a discount to peer transactions.

Potential upside: approved for new indications, including partial lipodystrophy (the FDA rejected for that indication due to lack of data, not based on bad data). Exclusivity extension, either due to patent extension or no competition due to biologic nature.

Potential downside: Stops adding new patients. New forms of treatment replace it. Negative patient effects (i.e. death from taking drug).

Jux: Worth ~$165m assuming 2x 2017E sales.

Potential upside: sales return to growth (recently approved in Japan; people start switching back from PSCK9s if they prove ineffective).

Potential downside: all patients switch off. Brazil (largest foreign market) stops selling.

Zuretinol / Retinoid program: Huge optionality on upside. Estimating at $100m in value, but this is binary (i.e. it’s either worth $0 or hundreds of millions).

Potential upside: successful approval

Potential downside: no approval; can’t find a market.

Putting the three together, Novelion would be worth ~$650m, which would value the equity at over $22/share.

What gives me confidence that I’m right?

Two things give me confidence that the value of the combined companies is way higher than today’s price.

First, as I mentioned above, I think the former QLT’s management is sharp. They bid for two companies in the past two years and were beat out by massive topping bids. They clearly see the value in Aegerion, and a key piece of my confidence comes from the fact that as part of the merger they and some other sophisticated healthcare investors bought a ton of QLT shares (~13% of the combined company’s shares outstanding) at $8.80/share (adjusted for a five for one reverse split) to give the company a good cash base to work from. Yes, that’s a discount to today’s share price, but the price was actually a premium to QLT / Aegerion’s share price when the deal was announced.

Second, the background section of Aegerion’s merger documents reveals that several parties were interested in bidding on Aegerion. In particular, the Myalept asset seemed to be in demand. For example, company B offered to acquire Aegerion for at least $2.55/share ($12.75/share adjusted for the split) on May 24, 2016, but Aegerion turned them down because they didn’t like the all stock nature of company B’s bid and thought the offer undervalued Aegerion’s assets. Company C offered to work with Aegerion to license Mya in Europe but dropped off when Aegerion made clear that they could develop Mya themselves. Company D also got involved and wanted to acquire either all of Aegerion or Myalept, but eventually backed out after the DOJ investigation heated up. These were mainly inbound indications of interest for Aegerion, which makes me think that once the DoJ investigation and everything is in the past, a bidding war for Aegerion could really play out if they were put on the block.

Why does this opportunity exist?

With every investment, I try to think of a reason why I might have an edge. I think a variety of factors have presented the opportunity for Novelion.

First, there’s still plenty of hair on the company. The combined company hasn’t even filed their first financial report together, so any valuation has to be pieced together from estimating a PF balance sheet. And not only do you not have a working combined balance sheet yet, but the separate companies’ financials looked absolutely horrific on their own. Aegerion, on its own, looked like it was about to go bankrupt. Their YTD net income for 2016 (through September) showed a loss of $138m and they were massively levered (QLT had a net cash balance; all the debt for the combined company comes from Aegerion. Given the new company is still probably too heavily levered, having Aegerion support all the leverage without QLT’s cash was completely unsustainable). They’re under DoJ investigation. Their biggest product for 2016 (Jux) is facing investigations and mammoth competition that resulted in YoY sales being more than cut in half, and people are worried that it will go to zero. And QLT doesn’t look much better- it has no revenue and has lost $33m through the first 9 months FY16. It’s easy to look at these companies merging and think it’s just two desperate companies merging to stave off bankruptcy for another month or two. But I think that’s too simple.

The losses for both companies have been driven by one-time items like Aegerion’s $40m settlement w/ the DoJ and QLT’s failed mergers and write off of an investment. Heading into 2017, expenses should normalize, and if they do, Aegerion’s underlying cash flow generating powers should flow through. In fact, Aegerion has done a great job cutting a ton of costs to the point where they likely would have been cash flow positive on their own in 2017. Showing positive cash flow while investing in QLT’s retinoid program and with Myalept growing rapidly would let the market see the underlying strength of Aegerion’s core products.

How could I be wrong?

If I’m wrong, where’s it likely to be?

DoJ lawsuit: Given the massive losses and other shenanigans at Aegerion, it’s no surprise they are still under a significant regulatory burden. They’ve already settled their shareholder suits and have reached a preliminary settlement with the DOJ and SEC to pay them ~$40m; however, the settlement is preliminary and there’s no guarantee it couldn’t get rejected and the SEC / DOJ force Aegerion to come back to the table for a higher settlement that bankrupts them.

Why does DoJ / SEC get settled successfully? They reached a preliminary agreement, and it’s tough for me to see this deal being a high enough level political priority that the government rejects a $40m settlement.

Mya issues: Myalept is obviously the key driver here. Any issues with the drug, whether it’s patent related, patient safety related, etc. would lead the company on a fast pass to bankruptcy. This is just a risk of investing in non-diversified orphan drug companies; I feel comfortable the underlying science behind the drugs and patents are strong enough that this is a true tail risk.

Jux never stabilizes: If I’m wrong and Jux doesn’t stabilize at ~$100m and instead is on a fast pass to $0, then the upside isn’t as great and the near term cash picture doesn’t look as good.

Drug pricing: This is an across the board risk, but these products are obviously not cheap- we’re talking in the tens or hundreds of thousands of dollars per year across the board for these drugs. For example, Myalept did >$50m in sales in 2016 and ended the year with 125 active commercial patients, so it’s doing >$400k/year/patient in revenue. Jux is pricey as well, and Zuretinol certainly will be if/when approved. Any form of massive government crackdown on pricing would really hurt these drugs.

Why won’t this happen: Again, paying $300k+ annually for orphan drugs is actually pretty typical, and Novelion’s drugs do not have much in common with the Valeant / Turing / Marathon drugs that created pricing controversies (in general, those drugs had some combo of having been genericized for years or being sold to populations much larger than orphan). Novelion’s drugs are patented orphan drugs that target truly small / ill populations. Having high prices for these drugs is the way the system is supposed to work to encourage R&D in these areas. Anything can happen, but I have to think Novelion’s portfolio would only be exposed to pricing crackdowns in the most extreme pharma pricing crack down type scenario.

Orphan Designation revoked- Novelion is obviously reliant on the orphan designation to protect products from competition. If a law were to pass that revoked the orphan designation, it would be a disaster for them.

Why this won’t happen: Messing with orphan drugs / patients if just awful politically. I had an expert put it to me this way once (this is near a direct quote)- “the moment you start messing with an orphan population, you get a patient advocacy group who rolls out some sick children, often in wheelchairs, on the steps of the legislature, and then every night you have the local news covering these kids talking about how you’re ruining their lives. It’s the worst move any politician can make.” If you look at all the coverage for the FDA approval of Sarepta’s Duchenne drug, you can see just how strong that political pressure can be.

Catalysts

Acquisition: The orphan drug space has been on fire recently, and I have to think Novelion is a natural sale candidate as the stink from the DoJ investigation fades and the company stabilizes. Novelion’s chair is the former chair of QLT, and he’s shown an extreme willingness to sell assets at the right price.

DoJ Settlement Finalized: Finalizing the DoJ settlement would take away one more risk and probably let investors get a bit more comfortable with the name.

Refinancing: Carrying a $325m convertible note makes absolutely no sense for a company of this size. I don’t think management has any desire to dilute shareholders through a debt of equity swap at these levels, but I wouldn’t be surprised to see them try some form of creative refinancing to right size the debt load.

Zuretinol progress: any progress here, particularly in getting the priority voucher, could move the stock.

New Myalept indications: as mentioned above, Myalept could have potential in a variety of other areas, including approval for partial lipodystrophy. Progress in any of those areas would greatly increase Mya’s value.

Other Odds and Ends

The combined company hasn’t filed their first balance sheet yet, which can make putting together a cap structure tough. Still, you can find the prelim balance sheet here and they gave an updated share count post stock split here, which should be enough to get started. It may be worth subtracting another $10-20m from the cash balance to account for burn in Q4, but ultimately it shouldn’t change the story one way or the other.

There are some warrants outstanding, but they only pay off if the DoJ settlement is increased for some reason. Unless you really see the DoJ payment ballooning, they don’t really move the needle one way or the other (they don’t move it at all if the final settlement resembles the preliminary one).