My spin on $VTS's spin

I’ve said it before and I’ll say it again: the best book for modern value investing is Joel Greenblatt’s You Can Be a Stock Market Genius (note there’s nothing unique about that statement; most investors would have the book at towards the top of their list!).

The whole concept of the book is looking in the nooks and crannies of the market for areas where there might be forced selling that could create alpha, and a big area of that focus is spin offs.

Fast forward to today, and whenever a company announces a spin-off you can bet every event investor is going to sharpen their pencils on the company to see if there’s any alpha to be had. But, to be honest, the crop of spin offs over the last few years has been pretty lackluster; I think companies know there’s a market for spins, so they’ve taken to spinning off their worst assets knowing that there’s a crop of event investors who will be the natural home for any spin. It’s hard for me to remember getting really excited about a spinoff in the recent past; there have been a few winners over the past few years but it’s generally been a minefield.

There’s actually a really fun way to show what a minefield it’s been: November 2021 was randomly a very active time for spinoffs, with four different companies getting spun (IBM spun KD, BLUE spun TSVT, ADS spun LYLT, and O spun ONL). If you bought any of those spins…. well, at least you generated some tax losses?

You could probably caveat that a few ways. IWM is down ~20% since then, and a bear market in stocks probably isn’t going to be great for new, small spincos. And I also ignored the first day of trading for TSVT (it opened for one day at ~$13 and then traded up to $42; IDK what happened); given TSVT is trading at ~$12/share now, you wouldn’t have done great either way but maybe you could accuse me of bias for ignoring that first day?

Anyway, last week Jefferies (JEF) spun off their Vitesse Energy unit (it now trades under VTS). I was holding back from writing anything on it because I was kind of hoping for some super puke of VTS shares as Jefferies shareholders received and subsequently sold their shares.

Unfortunately that didn’t happen so I’ve got no horse in this race…. But I did a decent amount of work on VTS, and a few things in the VTS spin jumped out to me as “this is emblematic of the larger issues with spins today,” so I figured I’d put some thoughts to paper.

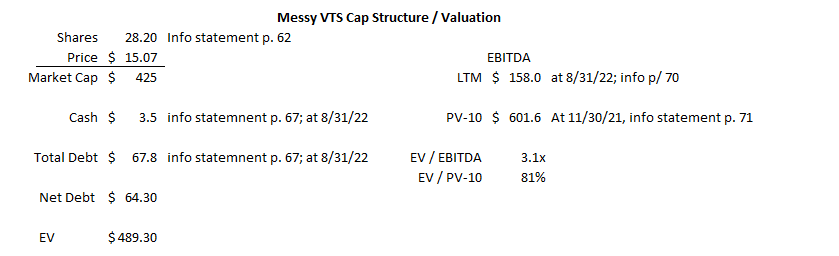

Let’s start with the basics. You can and should review the VTS info statement here. I’ve pulled out a few key items from the info statement in the (very sloppily and messily thrown together) chart below to give a baseline for how big the company is and how they’re valued.

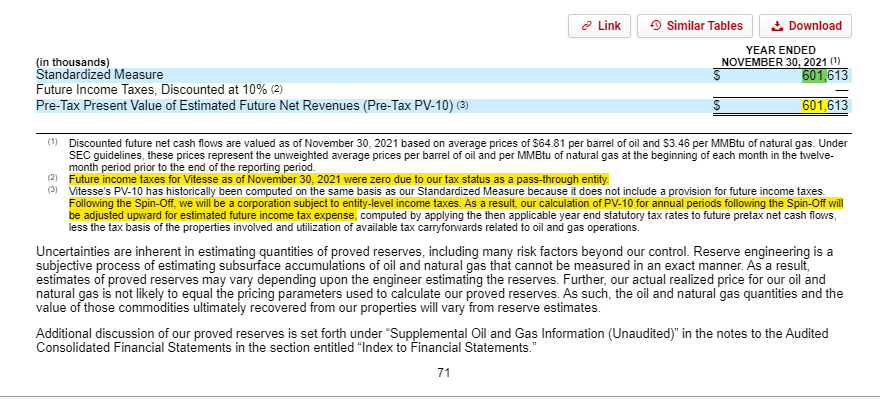

IMO the most important part of the info statement / that valuation is the PV-10. It’s on p. 71 of their info statement; I’ve grabbed the relevant clip below:

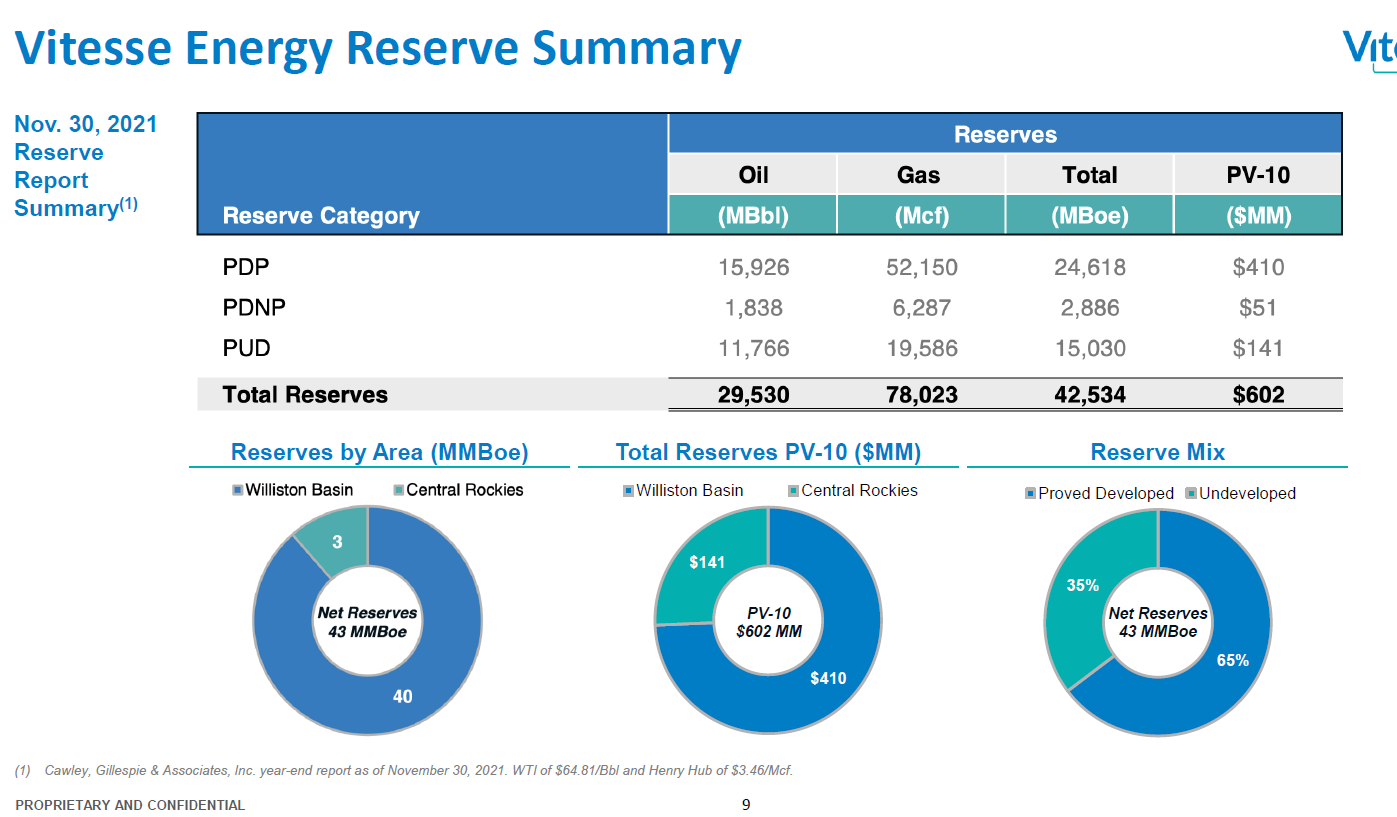

They also broke their PV-10 out a little further in their investor deck:

Anyway, there are two things about that PV-10 table that should jump out to you.

The company is assuming no future income taxes in their PV-10.

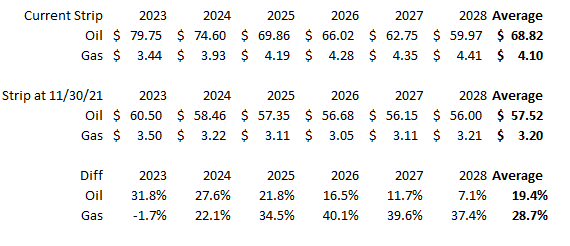

It’s as of November 2021; energy prices have obviously been just a bit volatile since then. I put together a quick strip comparison below; you can see oil prices for the next ~5 years are ~20% higher than at the time of their last PV-10, and gas is almost 30% higher. That should drive a nice uplift in PV-10!

The jump in energy pricing is nice…. but the first item (no future income taxes) is the number that jumped out at me.

VTS could assume zero taxes when they were wholly owned by Jefferies because they were structured as pass-through entity for tax purposes. Post-spin, VTS will be structured as a “normal”, publicly traded C-Corp.

There are advantages and disadvantages to being a publicly traded C-Corp. One of the main advantages is you have a liquid currency that you can use for acquisitions. One of the main disadvantages is you now have all of the costs that go with being a public company and you are subject to double taxation (profits are taxed at the C-Corp level, and then your shareholders will eventually be taxed on those profits when they receive dividends or eventually sell their stock).

Here’s what I think’s so strange about the VTS transaction: I see no way that they benefit from being a public company. It just seems really strange that they would get spun onto the public markets.

To start, just consider their PV-10. Most investors value oil and gas assets at some percentage of PV-10*; when it was a pass through entity, VTS didn’t have to pay taxes. As a publicly traded C-Corp, VTS will need to pay taxes, so their PV-10 will instantly decrease.

(*it’s not just me saying you should look at PV-10; that’s how VTS talks about valuing stakes in already producing assets!)

Let's go back to 2010. So there are 2 ways to invest in the upstream oil and gas business. One is you buy an interest in a well that's already been drilled. Low risk, low return, but there's a tremendous amount of liquidity there. It's about a 10%, 12% PV10, PV12 piece of business.

Maybe you’re saying, “hey, at some point someone needed to pay taxes on VTS, so what’s it matter if they add them as a public company?” Sure, someone needs to pay taxes on everything eventually. But why add the double taxation layer to VTS? Why not sell it to a private equity firm (or, honestly, at this size, just a high net worth individual) who could keep is structured as a pass through?

It’s hard to think of a good answer to that question. Really the only good one would be “the market will give VTS a good enough valuation that VTS will be able to use their equity currency to pursue attractive / value accretive acquisitions.” And, if you read the VTS info statement, it’s clear that’s VTS’s plan.

But I’m not sure how VTS can believe their equity will get a good enough multiple to use as a currency. NOG is a publicly traded owner of non-operated assets (similar to VTS). They trade for ~3x EBITDA; that’s not a multiple you can really use your equity accretively for acquisitions!

On top of that issue, there’s reasons to think VTS should trade worse than NOG. Again, VTS is a company that had ~$600m of PV-10 before taxes. Their LTM EBITDA (as of August 2022) was $158m. NOG did ~$292m in EBITDA…. in Q3’22 alone, so in NOG we’re talking about a company that’s literally 10x bigger / more profitable than VTS.

Size tends to matter in the stock market. The larger you are, the more liquid your security is, the more people who can invest in it, etc. But size really matters when you’re very small; there are fixed costs to being a public company, and you need a certain size just to get operational leverage over those fixed costs.

VTS’s LTM EBITDA of ~$158m does not include their public company costs (as a public company, NOG’s LTM EBITDA of course already includes those costs!). And those costs are going to be pretty hefty; VTS’s proxy notes that they will incur ~$15m in one time costs just to complete the spin off (see p. 23). That’s an insane number; again, VTS’s PV-10 without taxes is ~$600m. They’re burning ~2.5% of that just to get public. On top of that, I generally estimate the average cost of being a public company at $3-5m/year (it could be higher). VTS’s LTM EBITDA is ~$158m, so they’ll be spending 2-3% of that every year on public company costs.

It’s just weird. Jefferies is an investment bank. They’re very sophisticated. I’m not sure what about today’s market screamed to them, “hey, you know what would create value? Adding a massive layer of public company costs and taxes to this super small non-operated oil and gas company we own! The market is definitely desperate for a microcap oil and gas spinoff with a huge corporate burden!”. I’d love to know what angle they saw where this spin would create more value than a variety of alternatives. Wouldn’t the ~$15m VTS is spending to go public have been better spent on acquisitions or just paying it out as a dividend?

Speaking of acquisitions, VTS clearly plans to grow their way out of this “we are too small for our public cost burden” issue. Their info statement makes that very clear, or you can go listen to VTS’s presentation at the very end of the Jefferies investor day here. This is a company that wants to acquire their way to growth….. but again, I’m not sure how they can do that. VTS is now a tax paying company; in any M&A process, they’re going to be bidding against pass through tax entities, so VTS will always be starting from a disadvantage because they’ll have a higher tax rate than their competitive bidders.

Anyway, I have no real agenda for posting on VTS; I really wanted to like this idea, or for it to get puked on the spin and have a chance to buy it really cheaply. But the puke never happened, and as I was researching it I was just getting hit over the head with “these are the exact issues facing the spin off market / potential spin off investors today,” so I figured I’d quickly throw some thoughts down.

To sum, now public, VTS is trading at a slight premium to their larger public peer (NOG)…. if you ignore all of the added costs of being public VTS is going to have. They’re going to have a massive need to grow through acquisitions to justify being public, and given their stated debt limits, the difficulty of raising leverage in energy, and their commitment to paying a dividend, the only way for VTS to grow is going to be through issuing a ton of shares. That would be fine if they were going to trade with any type of multiple, but it’s just hard to see their being public playing out that way (and banking on that “trading with a multiple” in some part depends on banking on the capital markets giving the stock a generous multiple, never a bet a company should base going public on and certainly never a bet a value investor wants to make!).

VTS’s info statement mentions that there’s only one publicly traded competitor in the non-operated oil and gas field (obviously referencing NOG, though I believe that’s stale; GRNT went public late last year so now there’s two!). Perhaps there’s a reason there are so few public comps!

Great analysis. Thank you. We will be sending our subscribers to this post!

What do you think of the sustainability of their dividend - $66mm / yr or >15% yield at current prices?