More questions at FranklinCovey $FC

Bill Ackman coined (or perhaps stole, IDK) the “return-on-invested-brain-damage” calculation. His basic thought is to figure out what the potential return from an investment is and weigh it against the effort and complexity required to unlock that value. If it’s a super complex and difficult situation with limited return, pass. If it’s massively difficult but the upside is huge, go for it.

I’m frequently guilty of violating the return on invested brain damage maximum. For example, a few weeks ago I spent the good chunk of two days investigating a closed end fund trading at a discount. My thesis was the discount was a bit too big and there was upside as the gap closed, but in the end I realized that I was only talking about a 5-10% gap that would close slowly over time, so the return on invested brain damage there was simply awful.

Anyway, today I wanted to talk about Franklin Covey (FC). I don’t have a position anymore (I had a very small one at the start of the year and discussed it on the blog), but a few small cap investors I respect have pretty large positions so I follow it decently closely in case something about the company clicks for me at some point. Perhaps because of that, every time I freshen up on the company I find myself agonizing over the company. Between that agony, getting accused of using alternative facts when looking at the company, and not having a position in the company anymore, I would venture that Franklin Covey wins this year’s award for “worst return on invested brain damage” for me (category: investments. Donald Trump and his Twitter account would certainly win for most brain damage inflicted on me).

So the bad news is that FC is damaging my brain. The good news is that brain damage means it’s time for an update post on FC!

A brief refresher on what makes FC so interesting: the company is currently switching from a onetime payment model to a subscription model (All Access Pass, aka AAP) that gives unlimited access to most of their offerings. This makes their current results look awful because the subscription most be amortized over a twelve month period, so revenues and earnings on a GAAP basis show massive year over year drops even if the company is actually significantly increasing the lifetime value of their customers by making the switch. The thesis here is that the poor headline results causes the market to discount FC’s stock in the near term, and investors willing to look a few years down the road to when the GAAP accounting normalizes / the power of the subscription model kicks in can make a profit.

A few other things to like about FC:

Share repurchases: Management has consistently used excess cash flow to repurchase shares (~$60m of share repurchases over the past 2.5 years), and they’ve been pretty clear that excess cash will be used to repurchase more shares in the near future. If they get aggressive with the repurchase and retire a bunch of shares before the market realizes the power of the AAP model, current shareholders would be well rewarded.

More on AAP: It’s hard to understate the massive improvement that management says AAP will be versus the old model. 90%+ retention rates, customers paying for AAP licenses worth significantly more than historical spend, the potential for increased add-on sales with AAP (management mentioned a stretch goal of getting 50% of AAP spend as add-on services), selling AAP higher up into the target company’s org chart (i.e. potential for larger sales).

Sum of the parts / international opp: Most of my (and seemingly other investors’) focus has been on the AAP transition, but on the Q2 call management argued the international license division and education business were underappreciated and walked through some pretty interesting SOTP math.

Valuation on “loose” FY18 guidance-Again, the math on LTM numbers is a bit messed up because of the switch to AAP, but on the Q3 call, management said they had no arguments with some math that got them to the “low 40s at a minimum for adjusted EBITDA next year”. At today’s share price, FC's EV is ~$275m and with pretty low capex requirements, the company would be gushing cash flow at that level. Combine that with the share repurchase point and things look bright for shareholders.

Ok, so that’s a quick overview of the upside. If it’s all that simple, why is FC causing me so much brain damage?

It’s because FC is constantly changing their disclosures and making them less useful, so every time I try to track a stat from one quarter to the next, I feel like FC’s removed it or changed it.

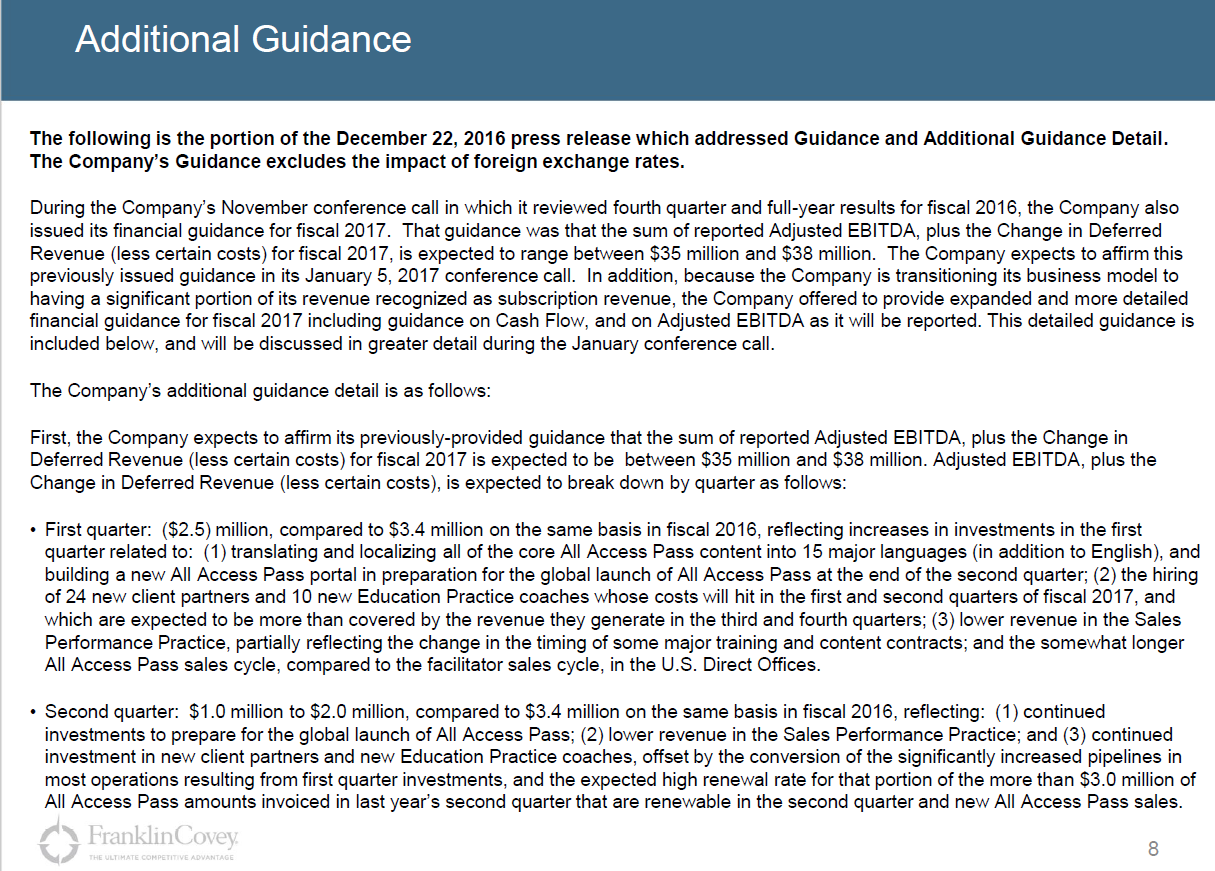

Let me give some examples. Here’s a nice one to start with: FC’s guidance. Here’s how they provided full year guidance in their Q1 earnings slides:

Now those are some useful slides! It clearly breaks down, quarter by quarter, how the company expects to perform on both adjusted EBITDA and deferred revenue. A true model for investor clarity in companies undergoing a business model transition.

Here’s the same slides in their Q2’17 earnings call… Just kidding. They took those slides out the deck (and no, the slides did not return for the Q3 call). But I guess we don’t need slides giving quarterly granularity because they at least gave us the following statement in full year guidance in their Q2 earnings release:

“Adjusted EBITDA and Growth in Deferred Revenue Outlook: The Company affirms its previously-announced fiscal 2017 guidance range for the sum of reported Adjusted EBITDA and growth in deferred revenue (less certain costs) of $35 million to $38 million.

Ok, that’s not as great as what we got in the Q1 slides. But hey, at least we have a general idea of what the company’s guiding towards. And the quote largely matches the one provided in their Q1 results.

Now here’s their guidance quote from their Q3’17 earnings:

“Adjusted EBITDA and Growth in Deferred Revenue Outlook: The Company anticipates a strong financial result in the fourth quarter, and therefore expects Adjusted EBITDA for fiscal 2017 to be equal to, or slightly below, the previously released guidance range of $10 million to $14 million. The Company's original guidance for the fourth quarter was $14 million of Adjusted EBITDA, and that deferred revenue, less 15% for deferred costs, would increase by more than $13.5 million. The Company still expects the change in deferred revenue, less deferred costs, to increase by $13.5 million and expects Adjusted EBITDA to be close to the guidance of $14 million, contingent upon the mix of sales in the fourth quarter. The Company's year-to-date Adjusted EBITDA is within $0.3 million of guidance. The year-to-date change in deferred revenue, less deferred costs, while significant, is $3.7 million less than previously released guidance. While the Company anticipates a strong fourth quarter result, it is possible, but unlikely, that this deficit can be completely overcome for the year”

I mean, what is that quote? Why can’t I get a simple “the company now expects Adjusted EBITDA plus growth in deferred revenue to come in at $XXX to $XXX”? It seem like they’re saying they’re going to come close to their Q4 targets but miss their full year targets, mainly driven by the YTD miss (particularly in Q3), but why can’t they spell that out? Why have we gone from incredible clarity and disclosure in the Q1 slides to this quarter’s gobbledygook?

And it’s not just their earnings release and slides that are getting less disclosure. Here’s a quote from their Q1’17 10-Q:

Despite $3.0 million of sales from our new offices in China, our direct office revenues decreased $2.4 million, including $1.8 million of increased deferred AAP revenues, compared with the prior year. Domestic regional sales office revenues decreased $4.3 million compared with the prior year primarily due to the transition to the AAP business model and decreased onsite revenues.

Now here’s the same piece from their Q3’17 10-Q:

Including $2.6 million of sales from our new sales offices in China, our direct office revenues increased by $0.1 million when compared with the prior year. Sales through our domestic sales force decreased by $1.7 million, which was due to increased AAP sales and the required deferral of these revenues as they are recognized over the lives of the underlying contracts, and decreased onsite presentation revenue.

Notice anything different? The company stopped disclosing the increased deferred AAP revenues. While you can go get the total increase in deferred subscription revenue in their Q3 slides, we can no longer see how much of it specifically comes from AAP. That’s strange.

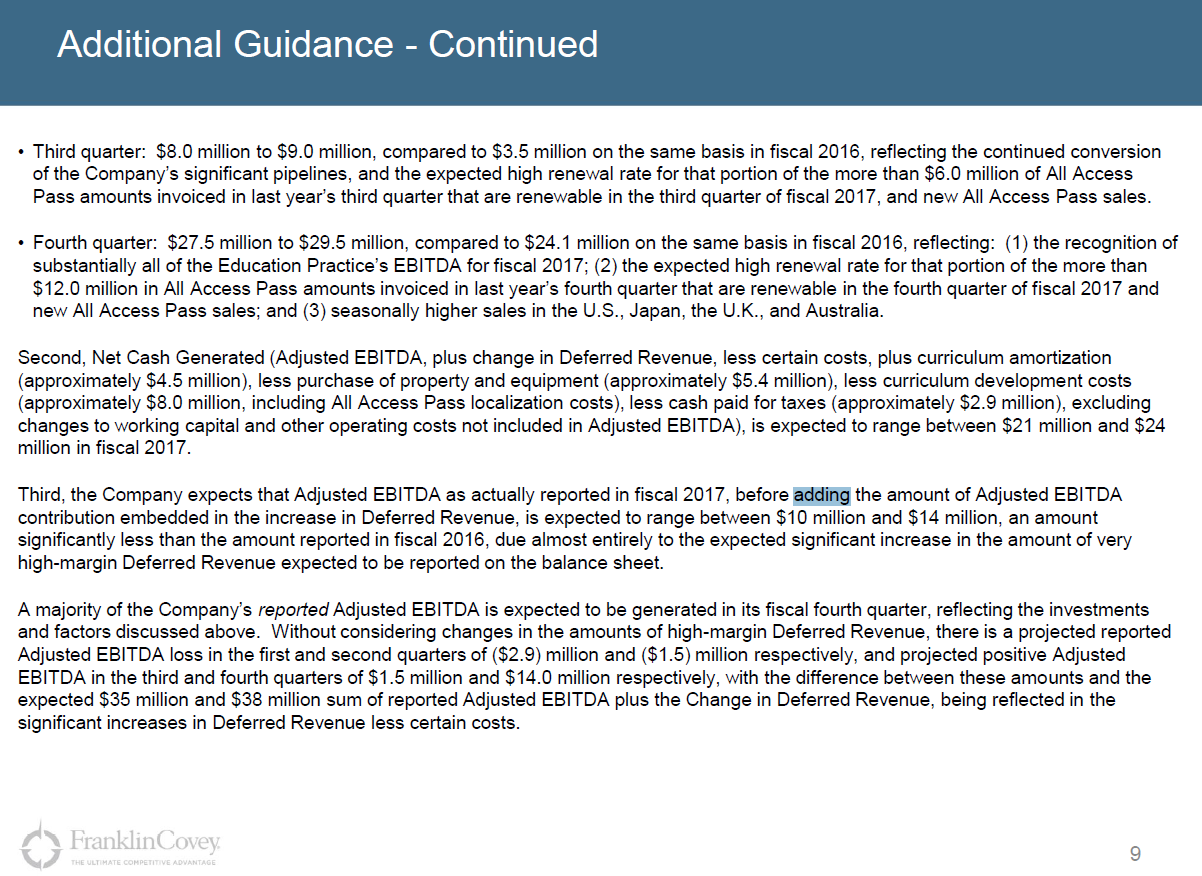

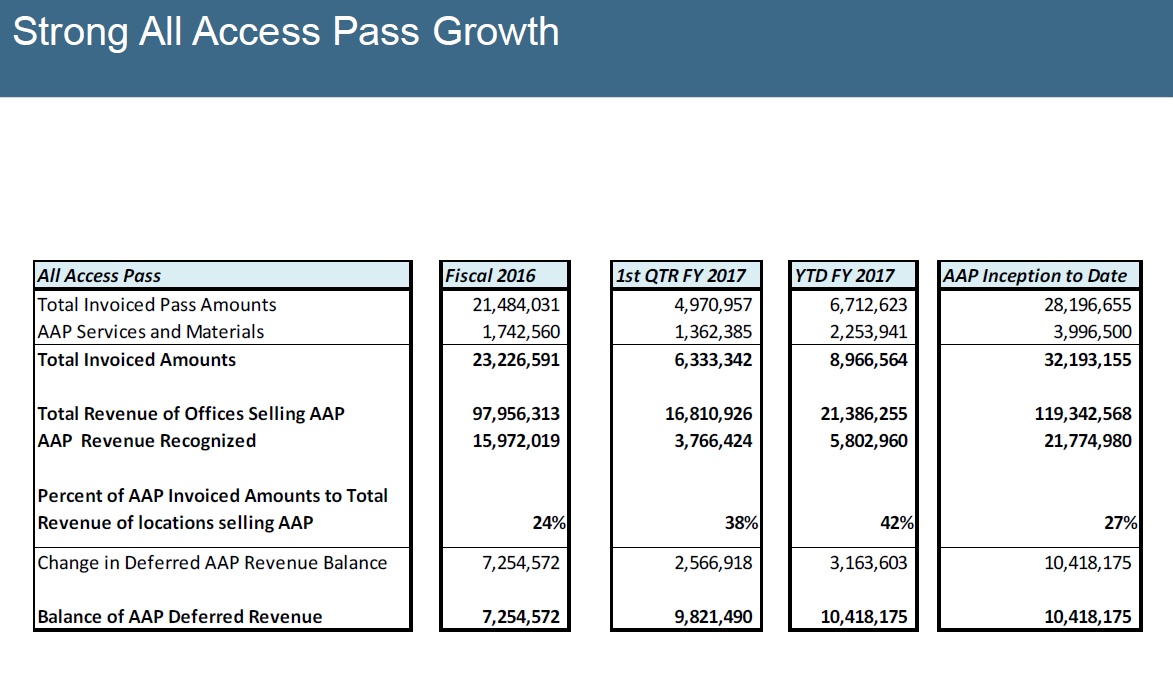

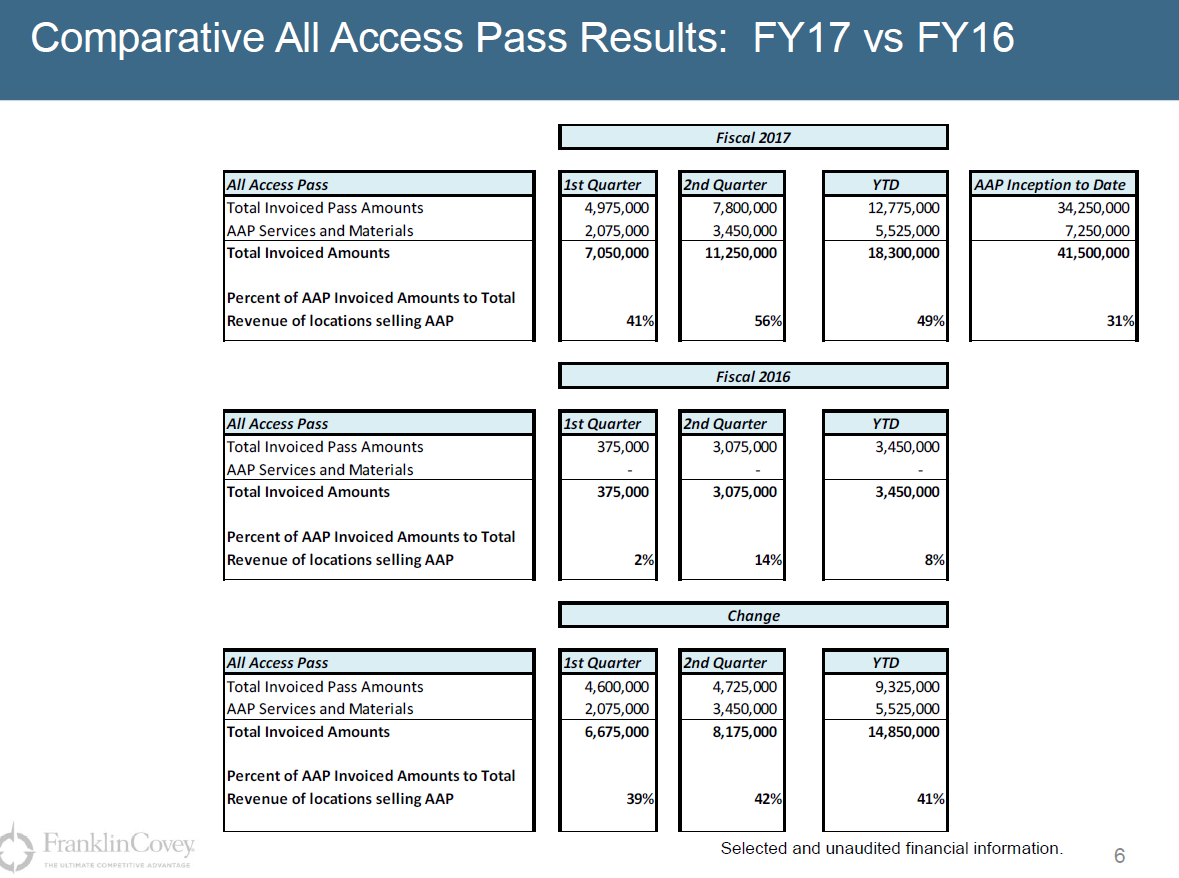

Ok, maybe those disclosures change seems small. But I keep finding other examples of small things that were changed without no explanation or notice given, and in general it just continues to feel like they are doing so to hide weakness in the business. For example, here are their slides from Q1’17 (top) and slides from Q2’17 (bottom) breaking down their AAP growth.

There’s a pretty big change there. In Q1, their YTD number included an update on how AAP was performing into Q2. In Q2, their YTD number simply added their historical Q1 and Q2 results together (i.e. it didn’t include a hint at how Q3 was going to be). Maybe the plan was always to stop providing those “intra-quarter” glimpses at how they were doing, but it’s interesting they stopped providing on the verge of reporting a Q3 well below prior predictions.

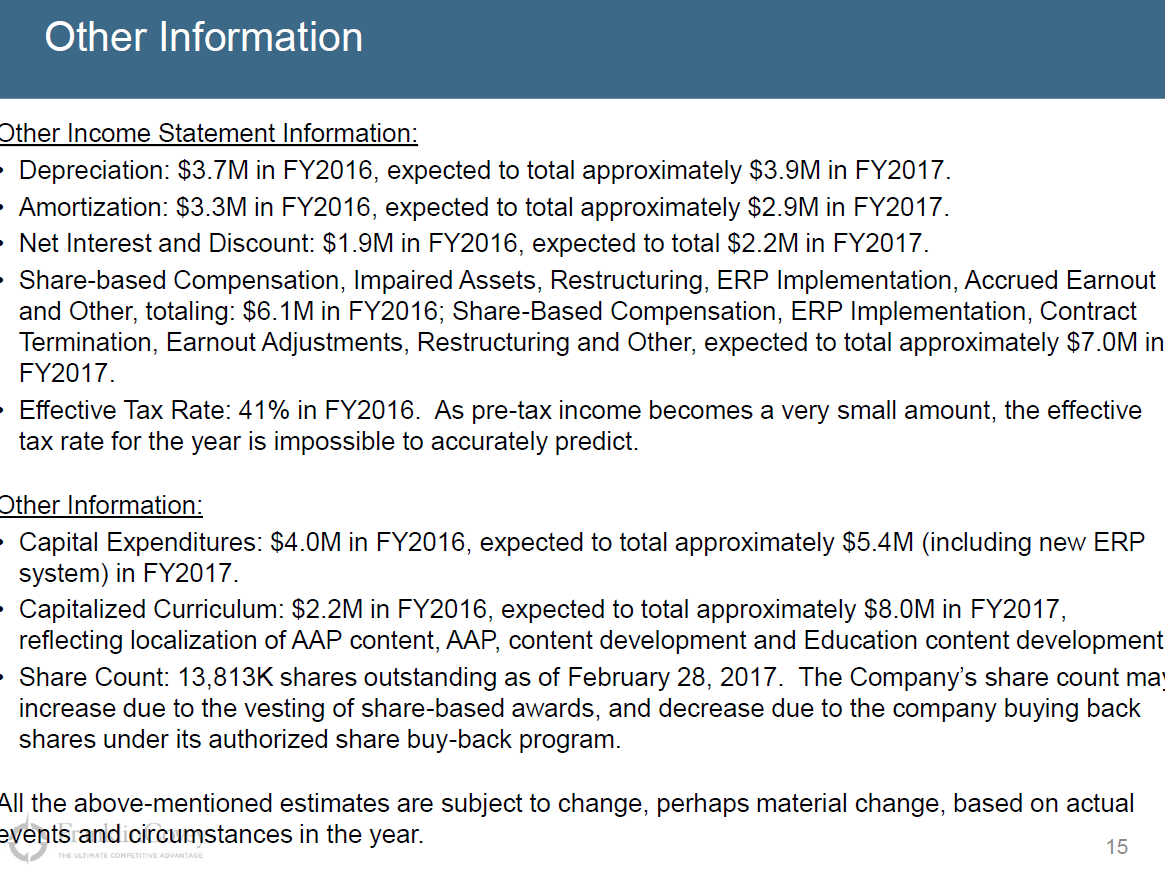

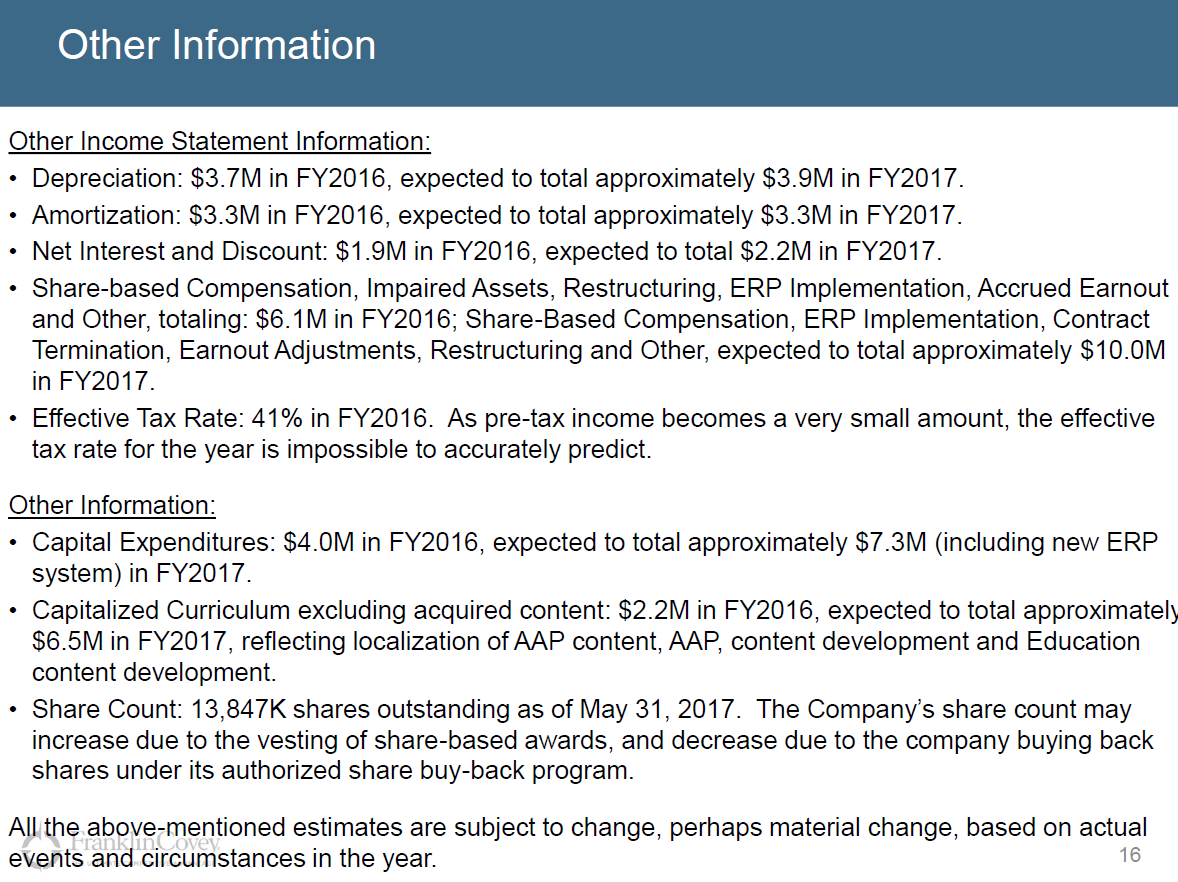

Here’s another little change in their earnings slides that caught my eye. Below are the “other information” slides from Q2’17 (top) and Q3’17 (bottom).

Read those carefully. I count 3 pretty large changes. The fourth bullet (share based comp, impaired assets…) jumps from a $7m charge in 2017 to a $10m charge. Capex jumps from $5.4m to $7.3m, which is mostly offset by a drop in capitalized curriculum from $8m to $6.5m.

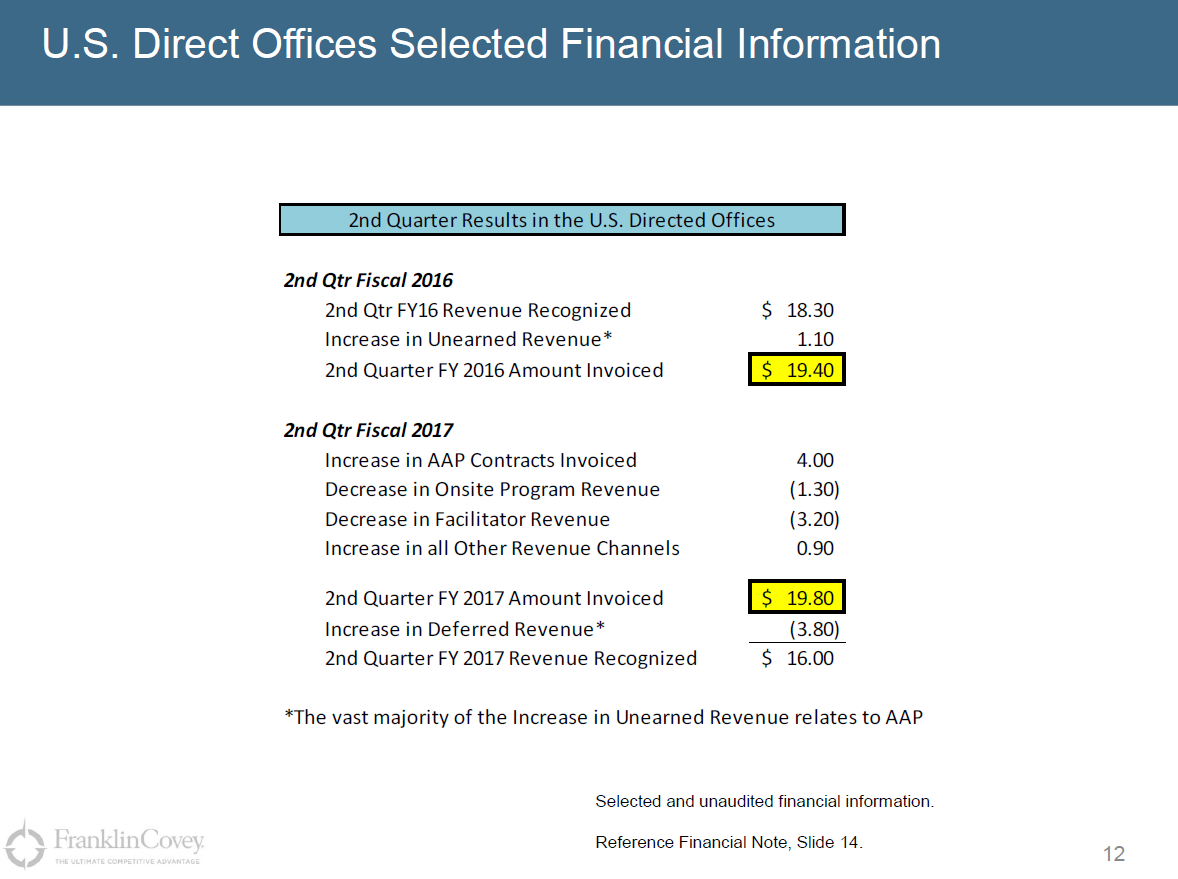

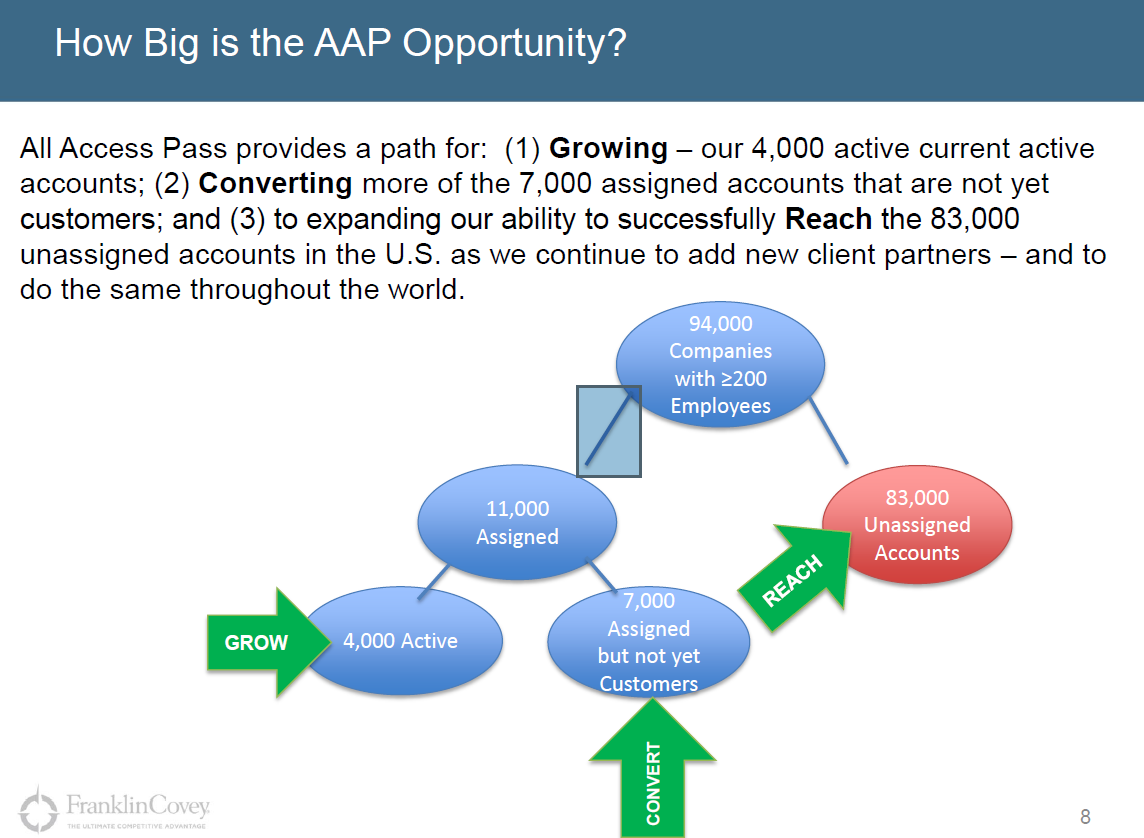

Overall, it just seems like the company is switching from providing hard details and metrics on how AAP is doing. Another change in their slides from Q2 to Q3 does a nice job of showing this point. Slides 11 and 12 in the Q2 slides were completely removed in the Q3 deck; seemingly replaced by slides 8-10 in the Q3 deck. I’m only going to copy and paste one of the slides from each below (slide 12 in Q2 on top, slide 8 in Q3 on bottom) as you can see all the slides in the links above on your own, but to me it feels like FC is trying to switch the focus from the hard business numbers they used to provide and replace those numbers with a hand wave and a “hey, look how big our potential market is!”

The last thing I’ll note that irked me is the company’s slightly shifting stance on share buybacks. On the Q2 call, the company was pretty clear they wanted to repurchase shares. They went as far as to say “the IRR, we believe, we can earn by repurchasing our shares, is much more attractive than most things we can invest in elsewhere.” Then in Q3 the company proceeded to buy up 3 small companies and in the process cause themselves to be restricted from buybacks.

Now, I’m never going to fault a company for pursuing an acquisition if that’s the proper use of capital. But there is something strange about a company getting on a conference call and walking the market through some SOTP math while discussing how eager they are to buy back shares (and driving up the share price pretty substantially; the stock went from ~$16 the day before Q2 earnings to ~$21 after) and then immediately blacking themselves out from doing so, particularly during a quarter where they substantially miss guidance. Perhaps it’s better for everyone that they kept their powder a bit dry and pursued those acquisitions. Perhaps the acquisitions will help them accelerate AAP’s growth and the ROIC will be insane. But it just leaves a strange feeling with me that management would talk up how cheap the shares trade and how eager they are to buy back shares and then not immediately start repurchasing. To their credit, management indicated on the Q3 call their restrictions would lift soon and they would be eagerly pursuing repurchases once they were unrestricted; it’ll be interesting to see if they follow through when they announce Q4 earnings and, if they did, how eager they really were to repurchase shares.

Overall, I guess my takeaway is that I want to like Franklin Covey. The stock looks cheap, I love recurring revenue models, and historically the combo of cheap stock + recurring revenues + share repurchases has been a bonanza for shareholders. But every time there’s a piece of the FC story I want to dive into a bit further, I find myself coming away with more questions than answers. I’ll be eagerly looking forward to their Q4 earnings and seeing if any of those questions start to get resolved.