Hain's accounting issues could present opportunity $HAIN

Hain hasn't filed financials in almost a year now.

Like Comscore, there's a lot of smoke here.

Unlike Comscore, I like the risk / reward at these prices.

Note: I first posted this idea on Sumzero last night / this morning; you can find it in pdf form there as well.

On May 29, 2014, Annie’s reported their FY14 earnings had missed estimates and guided to a Q1 loss. Three days later, the company couldn’t file their 10-K., and two days after that, their auditor (PWC) resigned. Shares were hammered in response, falling from ~$35 before the announcement to ~$28 on June 6th. It was a fantastic buying opportunity for investors: Annie’s hired KPMG as their new accountant a month later, got their filing done, and was sold to General Mills for $46/share just three months later.

Annie’s 14d-9 (found here) lists several companies as peers (see page 26), including Hain Celestial (HAIN). Almost three years later, Hain has been unable to file financials for going on 6 months now. While Hain’s accounting issues are likely worse than Annie’s, we believe the end result is likely to be the same: HAIN will get acquired for a nice premium by a big CPG company, and investors who take advantage of today’s distressed prices will benefit.

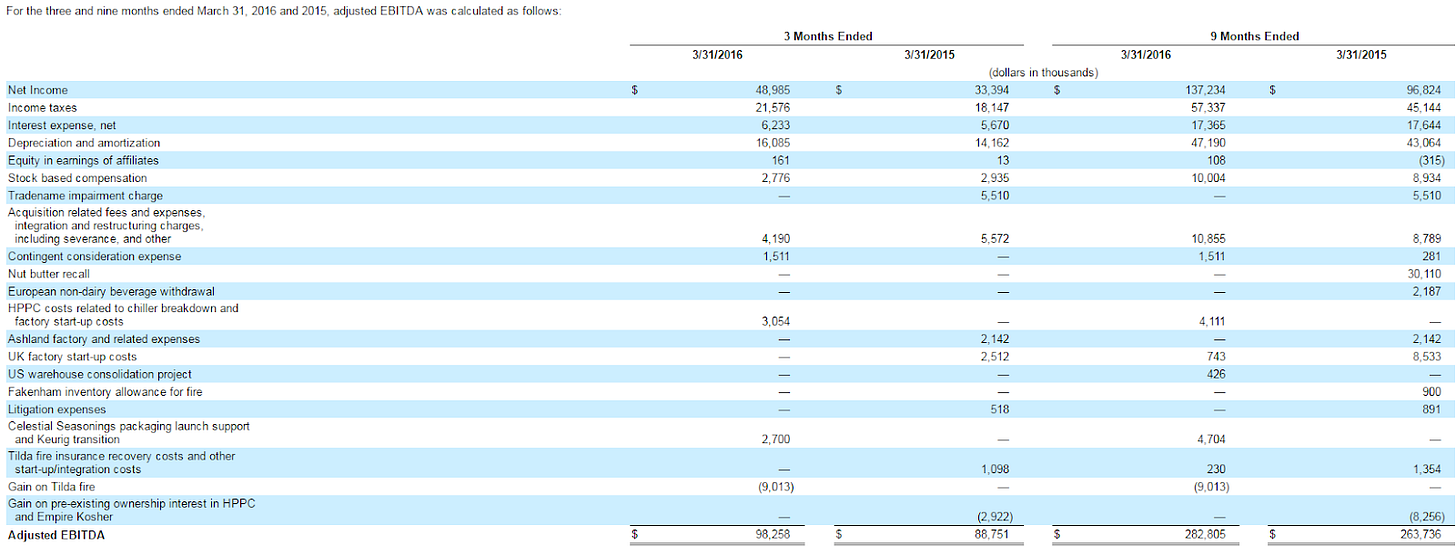

Make no mistake: HAIN’s accounting issues are worse than Annie’s, and there are plenty of indications that HAIN’s issues are real and serious. The red flags here are numerous: HAIN is a roll up with low insider ownership, excessive use of non-GAAP addbacks in their earnings (see page 8), serious accounting issues, and a tendency to trumpet any piece of good news, no matter how minor, while burying negative news in “Friday night dumps”. The company’s two senior most finance execs (their CFO and CAO) resigned right before the recent accounting issues popped up, and the company hasn’t filed or even provided any type of financials in almost a year at this point. Plus, when they do file financials, their core business will almost certainly be weak: trends had significantly softened in the quarters leading up to the accounting issues, and key customers like Whole Foods have reported soft sales which almost certainly impact HAIN.

Despite all those red flags (or perhaps because of all of those red flags), we think HAIN represents an asymmetric long opportunity at today’s prices. Hain would be an attractive acquisition target for a variety of acquirers, and with peer transaction happening in the high teen / low 20s EBITDA multiple range, HAIN would offer significant upside in such a scenario.

I’ll start with an overview. HAIN is a consumer packaged goods company focused on “better-for-you” products that lead to “A Healthier Way of Life” (think organic and natural products). The company has an array of brands you’ve probably heard of or used, including Terra Chips, Sensible Portions, JASON Natural Products (skin and hair care), and Celestial Seasonings (tea).

Hain was founded in 1993 by Irwin Simon, who is still the CEO / Chairman. HAIN has been your typical roll up since founding: they’ve acquired a bunch of different brands (55+ acquisitions since founding) and grown them all by increasing distribution / scale, mainly by utilizing their relationship as one of Whole Foods’ largest suppliers plus (from 2000 to 2005) their “global strategic alliance” with Heinz.

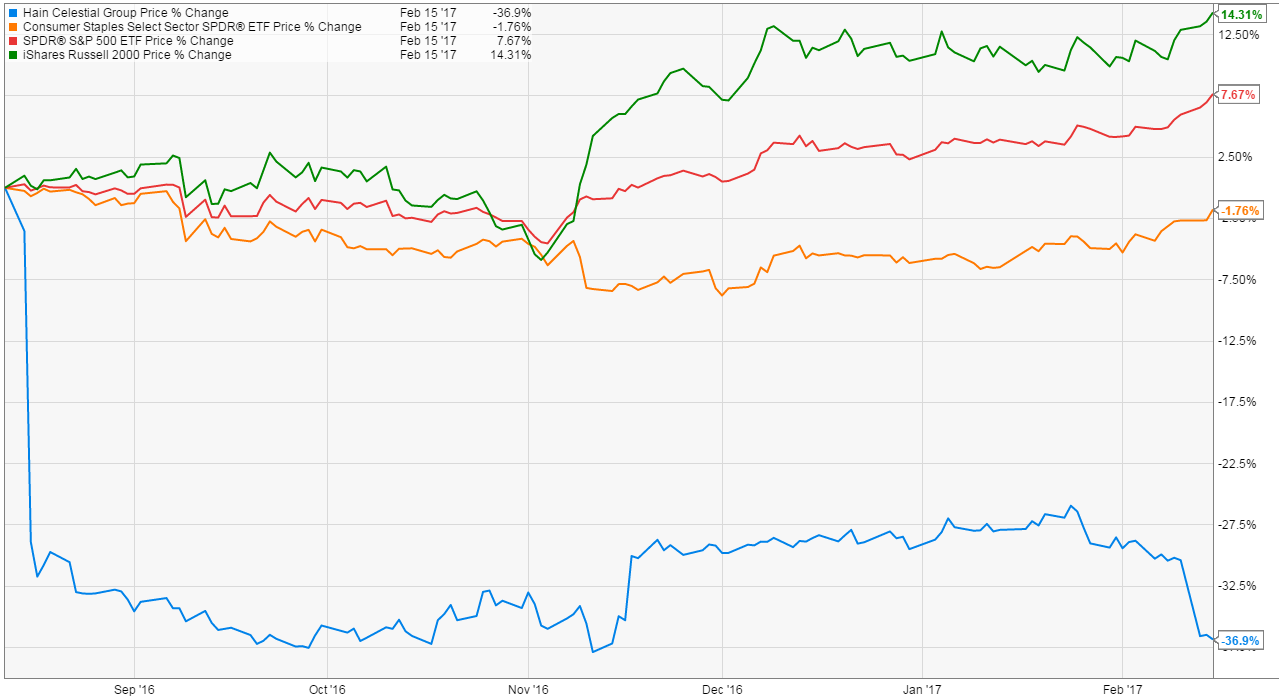

Hain started showing weakness as early as 2015, when increasing competition from both larger players and private labels like Whole Food’s 365 brands started to effect growth. The big problems, however, started last August, when HAIN needed to cancel their earnings release to look into the revenue recognition related to concessions given to distributors as well as look into their internal controls; in connection with that delay, they also announced they wouldn’t be hitting their full year guidance. Since then, the company has put out shockingly little information. They’ve gotten a few bank waivers for their credit facilities, and they announced their independent audit committee review found no intentional wrongdoings, but the company has been relatively radio silent on the process until last Friday afternoon (Feb. 10), when they filed this NT 10-Q after market close that announced an ongoing SEC investigation into the accounting issues as well as expanding their review from just distributor concessions to “perform an analysis of previously-issued financial information in order to identify and assess any potential errors.” HAIN’s share price has been decimated by the lingering issues, as it’s dropped by ~37% in a rather strong bull market.

We think the share decline is overblown and has baked in a close to worst case scenario, and shares should recover rapidly once the uncertainty caused by the lingering accounting issues is removed. HAIN has real brands that would be highly valuable to a strategic acquirer or a private equity player, and we think HAIN would be an immediate acquisition target as soon as the accounting issues clear up. If they continue to linger, HAIN would make for an attractive activist target that could step in and immediately force a sale.

Let’s start with the obvious: how do we get comfortable with the accounting issues? We’ve gotten there in a couple of different ways; obviously, none are perfect, but the combination of them gives us comfort that we are well paid for the risk that something more nefarious is going on.

Brands are real: This isn’t a reverse merger Chinese company that’s claiming to have the most popular brands in China. Hain has real, verifiable brands. You can find them at Whole Foods, Walmart, Rite Aid, and plenty of other major retailers. A lot of their brands are quiet popular and easily findable on Amazon (for example, terra and sensible portion make up 8 of the top 10 brands in the veggie snacks category, and Earth’s Best is the top selling baby formula).

Cash Flow is real: As discussed in our risks section, HAIN definitely makes liberal use of adjustments for Adjusted EBITDA; I’ve pasted their most recent adjusted EBITDA reconciliation at the bottom of this paragraph to give a view. While the adjustments are large and I wouldn’t give full credit for a few, the bottom line is that they do have a real business generating real cash flow. For example, in FY15 Adjusted EBITDA was $375m. CFO was $185, and they paid $23m in cash interest and $47m in cash taxes. That’s a conversion rate of just under 70% (($185 + $23 + $47)/ $375); certainly not perfect, but it at least shows the business is generating cash approaching the levels they say they’re doing. And FY15 had some truly onetime expenses; this “EBITDA to actual cash” number approaches 80% if you go back to FY14.

Bank Waivers- HAIN has already managed to get two bank waivers for not filing their financials on time. In each case the bank gave them the waivers without requiring a step up in interest rate or even a fee, suggesting the bankers were pretty comfortable with the issues here. Bankers can obviously have the wool pulled over their eyes just as easily as the rest of us, but the bankers likely had a bit more interaction / information from HAIN than public shareholders, and that they walked away comfortable enough to refinance HAIN with no penalty suggests the issues are not as bad as the market has priced in.

Board announcements- Obviously, it’s not a great look to bury an SEC investigation and increased scope of an accounting review in a Friday night dump. But the board did an independent review that found no internal wrong doing, and we haven’t seen any board members resign. The combo suggests that the absolute worst case scenario (HAIN is a complete house of cards with no real business piles of inventory rotting away in a warehouse somewhere) is probably off the table

Other softer things- a few other softer things that give me incremental comfort that the worst case scenario isn’t happening here simply because I think things would be going differently if accounting issues were a sign of true fraud.

Recent Strategic Acquisition: This week, Hain announced a small strategic acquisition.

No board members have resigned: I’ve spent a lot of time looking at companies with accounting issues in the past. Generally, you see a lot of board members resign if there are real issues (Comscore, for example, has seen around half their board turn over); we haven’t seen any of that here.

Accounting firm hasn’t resigned or turned over: Unlike with Annie’s, we haven’t seen the accounting firm resign (or get fired… yet).

Management has been speaking to investors / analysts: I haven’t been able to get the CEO or management on the phone yet, but I’ve spoken to several analysts and investors who have been able to talk to them. If something were truly amiss here, it seems like management would have lawyered up.

The combo of those five factors suggests to me that the really negative scenarios are most likely off the table. If that’s right and the accounting issues are concerning but not life altering (say, revenue recognition for distribution contracts plus maybe some accounts receivable issues), then HAIN’s upside could be substantial.

The last financials we have for HAIN is as of 3/31/16. Things have almost certainly changed since then (they provided guidance which they then backed off in delaying their earnings), but it’s the best starting point we have for valuation. LTM sales at 3/31/16 were ~$2.9B, with LTM Adj. EBITDA of $395m. At today’s share price of ~$35, the company’s EV is ~$4.4B, so they’re trading for <12x LTM EBITDA. That would be at the low end of multiples for all CPG companies, and particularly on the low end for a smaller natural / organic company given the wave of consolidation the space is seeing. In the wake of Annie’s acquisition, we’ve seen big food acquire other natural / organic plays like Boulder Brands and WhiteWave at nice premiums. Big food believes these are attractive acquisition targets as they can help accelerate growth as well as deliver large cost synergies while Big Food takes advantage of rock bottom interest rates to fund the acquisition.

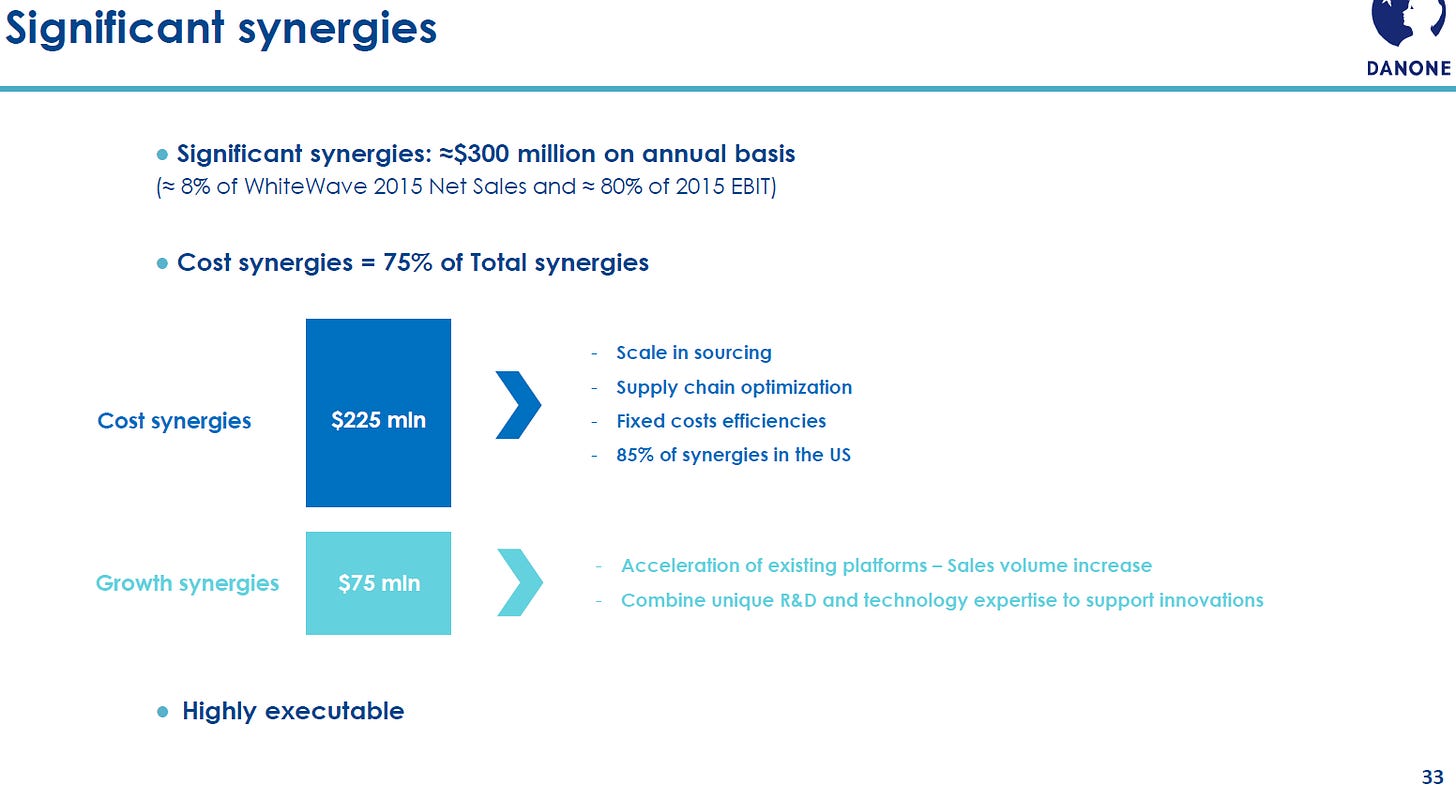

WhiteWave is probably Hain’s best peer, and its acquisition is instructive for what a big food player would see in acquiring Hain. WhiteWave is in the process of being acquired by Danone for ~23.4x LTM EBITDA / ~21x 2016E EBITDA. Danone made clear the acquisition was about improving their growth outlook, but they also saw significant synergies in the deal. Danone’s synergy forecast called for synergies at 8% of 2015 sales levels (and 80% of WWAV’s standalone EBIT!); the synergies were ~75% cost related and 25% revenue / growth synergies. Despite the high multiple and high level of squishier / more difficult to achieve sales synergies, Danone investors loved the move and sent the stock up ~3% on the deal.

It’s reasonable to think that an acquirer could realize an even higher level of synergies from an acquisition of Hain. At under 25%, HAIN’s gross margins are far below most CPG peers; Annie’s, for example, was in the high 30s, and WhiteWave is in the mid-30s. While Hain’s GMs probably belong a little below peers due to some business model differences (including ownership of the lower margin Pure Protein segment), the gross margin gap is much too high and would represent a pretty natural synergy for a skilled big food acquirer. HAIN has admitted that their supply chain is “the summation of all the acquisitions” they’ve done and “not what you would draw on a blank sheet of paper”, and rationalizing it would go a long way to closing that gross margin gap. Add closing the gross margin gap to some SG&A cuts (Hain runs relatively lean, but there would be some SG&A cuts from duplicative overhead, IT, etc.) and even some potential revenue synergies (similar to what Danone forecasted for WhiteWave), and an acquirer could pay a pretty large premium from today’s share price and still realize a ton of accretion. If you assume an acquirer would target 8% of sales as synergy (in line with WWAV / Danone’s forecast), then today’s share price represents ~7.1x EV / post-synergy EBITDA multiple. I don’t think 10x EV / post synergies multiple is crazy by any means given most potential acquirers are trading in the low to mid double digit EBITDA multiple range; a 10x multiple would imply a share price of ~$53; interestingly, that’s right where HAIN was trading at in the days leading up to the original accounting announcement as investors saw WWAV’s and figured it was increasingly likely HAIN would be bought out.

Would management sell the company? It’s always tough to say with founder-led companies. I think Irwin (the CEO / founder) has done a fantastic job anticipating trends and acquiring companies, and I’ve generally found that founders who are adept at buying companies are also adept at selling their companies at big premiums when the timing is right and strategics are desperate. However, I’m not sure how much longer the ball will be in his court. Shareholders are going to be frustrated with the continued accounting issues, and an activist would likely be well received here as Hain is an attractive strategic target in a consolidating industry. With low insider ownership, an increasingly frustrated shareholder base (even before the accounting issues popped up, the majority of shareholders voted against their exec comp package), and limited corporate defenses against an activist (no controlling shareholder, Delaware incorporated, non-staggered board, no poison pill currently in effect, and several other activist shareholder friendly provisions), the company screams for some form of activism if the board doesn’t do something soon. Carl Icahn has been in the stock before and held several board seats (he sold his stake in 2013), so he could look to get reengaged, but several other activists could get involved (Corvex has held a position in Hain before, though they didn’t on their most recent 13-F. SpringOwl’s most recent 13-F shows a small stake. Gamco owns just under 1%).

So how are things likely to play out from here? Their current bank waiver expires on Feb. 27th, so I’d expect we get some form of update from the company in the next week or so. Given the NT 10-Q was just filed with no real news given, I would guess that HAIN is probably going to need another bank waiver. It’s possible the banks demand onerous terms and this idea looks foolish quickly, but I would guess the waiver should be a non-event, though we might get some more information on the issues, a business update, etc. then. After we get the waiver, I would expect another two to three months until the company can file their financials, at which point I think the company is immediately put in play by a variety of strategics. In the meantime, I would not be surprised to see an activist having taken advantage of the recent sell off and elevated trading volume to have acquired a large enough position to file a 13-D and start making noise about getting more information on the business from management.

Other odds and ends

I didn’t dive too much into the company’s business in the write up, as most investors can pretty intuitively understand a CPG company and the power of brands. I do think Hain has one angle that makes them a bit different than most though. All of their products have some play on the better for you angle to them, and the company notes that the supply chain for organic / better for you products is much more difficult than traditional products, particularly as the products scale. I don’t think this is strongest moat in the world, but I do think there is something to the idea that sourcing organic and natural products is much harder / more complex than a normal product and Hain has some advantages that an acquirer would find attractive to buy (on top of just getting the brands and cost cutting upside).

~32% of HAIN’s sales come from millennials versus 20-25% for most food peers. That age demographic gap is attractive to potential acquirers; in acquiring Boulder, Pinnacle specifically called out that Boulder’s brands skewed to a younger consumer base than Pinnacle’s.

For the first 9 months of FY16, HAIN’s effective tax rate was 30.5%, and they get the majority of their sales and earnings from the United States. Tax reform could be a big boost for the company.

~40% of HAIN’s products are co-manufactured. That’s a number that’s roughly in line with what Boulder did before they were acquired by Pinnacle, and Pinnacle constantly pointed to bringing that number down as a big source of potential synergies.

I do think there is something to a “revenue synergy” angle if Hain were acquired by a larger player. Hain’s consistently pointed out that their household penetration for most products is below 10%; given these are higher price point products there’s probably a selling to their penetration but Hain has mentioned increasing to 30-40% household penetration, and I see no reason why they can’t get there or why a large acquirer couldn’t help get them there faster.

The one piece of financial info HAIN has given was an updated debt and cash balance in their September press release announcing their first bank waiver. Net debt declined from ~$745m at March 31 to ~$700m at June 30th, consistent with the thesis that the business is a real one that generates significant cash flow.

Risks

The major red flag (the accounting issues) was discussed pretty extensively in the article, so I’m not going to go too much further into it.

The other two big risks I see are

Recent Results have been weak: I didn’t discuss it too much in the write up because the accounting issues really overwhelm everything else, but recent results had been relatively weak for HAIN. Obviously the company pulled their guidance when they issued the accounting delay, but even before then sales and results had been weaker than expected.

The company had a variety of things to blame for this weakness, including four underperforming brands, some SKU rationalization, weakness in the tail of their smaller brands, and even display format changes at Walmart.

A more negative interpreter might look at the results and say the weakness was driven by continued new entrants / competition in their core segments.

I’ve seen recent Nielsen data that suggests the weakness bottomed out last summer / fall, and that the core brands have been growing again. However, a lot of HAIN’s sales come from channels Nielsen doesn’t measure, so I don’t put too much stock in that data either way.

Ultimately, I just think that Hain has a collection of really nice brands, and management has a proven ability to buy and grow brands through innovative product introduction. I’m not too concerned with near term weakness as long as I think these are still strong long term brands and that there is significant upside optionality from improving the company’s margins.

Lack of “dominant” brand: Unlike something like Annie’s or WhiteWave, which had one or two dominant brands, Hain’s is a collection of smaller strong brands that dominate niches. I do think it’s an open question if an acquirer is willing to pay up as much for 10 smaller brands as they would for one or two bigger brands. Managing ten smaller lines increases complexity, decreases potential synergies, etc.

Ultimately, I think the synergies plus the fact that these are generally pretty good brands would overcome any hesitation over complexity caused by owning multiple brands.