Franklin Covey's big question $FC

Franklin Covey is undergoing a business model switch that makes their financials look worse than they are.

Ignoring the model switch, Q1 still seemed awful and calls into question if the switch is going well or not.

If Q1 was just a blip and AAP is as successful as advertised, investors could do well at today’s price as the business model switch drives significant growth.

Upfront note: This post is long. And winding. And more than a bit complex. The bottom line is FC is undergoing a business model switch that should create a lot of value longer term, but their Q1 results really call into question if the business model switch is on plan, and I think the length of the post reflects just how uncertain I was about the switch after Q1. After banging my head against the FC rock for hours and hours, I decided I was a believer that Q1 was a hiccup, not a disease. I’ve got a really small position, but if you’re looking for a simple story or some light reading, this is not the post for you.

My posts on Shoretel (SHOR; disclosure = long) and Vonage (VG; disclosure = smaller long) had plenty in common. Namely, both were probably too long (though nowhere near as long as this article). But both also centered on a simple premise: GAAP accounting rules can make subscription business models show minimal accounting profits (or even show accounting losses) today even though they create long term value.

This phenomenon is not exactly a secret. A lot of companies have made the switch and found that doing so can actually increase lifetime value of customers (LCV) despite decreasing upfront profits. That increase can happen for a bunch of reasons that are probably beyond the scope of this post to dive into (again, there are tons of reasons, but the psychology behind the inertia created from auto-renewal of contracts versus actually needing to write a check and say yes to a sale probably creates massive value on its own).

However, despite the fact a switch to a subscription model can increase economic value, a lot of management teams are reluctant to make the switch. It’s easy to imagine why they wouldn’t want to switch. Imagine you’re a manager and you are paid a bonus for profitability. If you switch from license sales to subscription sales, your profits for that year (and maybe the next 3-5 years) immediately decrease. You might actually go from a decent sized profit to an accounting loss even though you’re creating tons of value! Now you don’t get your bonus paid for this year. Your board and shareholders are alarmed and wondering what the hell you’re doing. Sure, you can probably explain it to them, but you’re going to have to really break it down for them to get buy in. You might have to rework the incentive system for how you pay you entire sales force. And, hell, the world is constantly changing; what if you switch from a sales model to a subscription model only to find out that your core product has been completely made obsolete before you get the pay back on that switch (imagine Blockbuster switching from renting DVDs one at a time to a subscription model only to be replaced by streaming. That’s a bit of revisionist history as Blockbuster made way more missteps, but hopeful you get the idea!). The bottom line: changing business models is hard work, and it probably requires a management team with a ton of skin in the game or an activist / big shareholder to force them to make the switch (or provide the support with the board and other shareholders while they make the switch). However, while changing models is hard work, the upside can be pretty substantial when the decision is made and executed properly. For example, ValueAct had successful investments in both Adobe and Microsoft that, in part, centered on switching from a license / upfront sale model to a subscription model (here’s a mashable article on the switches).

As a side note, I’ll also say that I think a successful switch from a license to a subscription business model should tell investors something about the product: if people are willing to pay annual / recurring fees for it, it’s probably a good sign that whatever the company is producing is creating some value for their customers.

All of this is a long winded introduction into Franklin Covey (FC; disclosure: long. Quite frankly, I’m only long a little tiny baby position, which reflects the fact that while I’m positive on the stock I’m quite conflicted but did enough work and thinking here that I figured I might as well own a small bit). As you might imagine given the intro, FC is switching from a sales based model to a subscription based model, and the switch is destroying their near term financials even though it’s (probably) creating long term value.

You’ll notice I buried a probably in there. And I think there’s good reason to say “probably” instead of definitely: Q1 results were decidedly unimpressive at best. Management sounded very confident in the switch and strategy, but if things don’t pick up from the Q1 results I’m probably not going to be too happy with the results of my investment.

Anyway, let’s go over some background. Franklin Covey sells courses focused on helping employees improve. Their most famous offering is courses centered around the 7 Habits of Highly Effective People book, but they’ve got a bunch of other content as well (like The 5 Choices: The path to Extraordinary Productivity or The 4 Disciplines of Execution: Achieving Your Wildly Important goals). (Really, most of their business centers on a simple formula: publish a book detailing how to improve skill X in y number of ways (making sure Y is a number of bullets that will easily fit in Powerpoint), and then use the press and brand from that book to sell consulting courses to companies at high margins. As a shareholder, I’m excited that their courses are currently devoid of books based on the numbers “6” and “3”. 60% growth from introducing books based on those numbers alone.

The company used to sell their courses one-off. So basically their sales force would call up HR and training departments and say, “do you need any help with training?” The trainer would hopefully say, “our employees really aren’t that productive”, and then the sales guy would say, “boy, do we have the solution for you! Let us come teach your employees SEVEN ways they can be more productive.” Then FC would either sell the company a bunch of books and manuals that someone in HR could use to teach their company to be more productive, or the company might spring to hire someone from FC to come out for a day and host a seminar or just give a speech.

That’s a pretty normal business model, but it’s obviously not a perfect one. The biggest issue with it is that every sale is discrete: someone pays you for 7 habits, and then next year you need to convince them to buy more 7 habits training or buy a different course if you want more revenue. Hopefully you get a decent bit of repeat business, but there’s obviously a lot of friction in that system.

So in FY16 FC came out w/ a new business model: instead of paying one time for each course individually, a company could subscribe to the All Access Pass (AAP). The All Access Pass is charged per seat / user anually, and gives the company unlimited access to most of FC’s offerings. The hope is this is a win/win for everyone: the company pays a bit more but gets access to all of FC’s different offerings, while FC gets more money for almost effectively nothing (after all, all that material is already out there, so it doesn’t really cost them anything to give a company access to 20 programs versus one).

The issue FC has been facing is that they are now selling a subscription. AAP is a yearlong course that they bill for upfront, so while they get all of the cash upfront they have to recognize the revenue over a full year. That makes their reported results look like they’re shrinking like crazy even if they’re treading water or even growing. An example is probably best to show this: let’s say last year they sold Client X a course for $100. They would simply book $100 of revenue that quarter and move on. If they sold the same client AAP this year and charged them $100, they would have to amortize the revenue over a full year. So they’d book $25 of revenue each quarter throughout the year. In this example, even though the economics have stayed the same, their reported revenue in the quarter has dropped by 75%! And, assuming the company hasn’t changed anything about their cost structure in the meantime, their profits are going to plummet massively during the quarter since revenue is way down but expenses haven’t changed. Of course, in the next three quarters, the company will be much more profitable than they were previously (all else equal) since they are adding $25 of revenue in each quarter but reporting basically the same cost structure.

FC is currently switching over the majority their entire business from selling courses to AAP sale, so their financials look like they are going up in flames. In FY17Q1 (the company is on a fiscal year ending in April), revenue dropped from $45m to $40m, while Adjusted EBITDA swung from a $4.5m profit to a $2.8m loss.

Now, the company was super quick to point out all of the accounting issues that are hitting them as they make the transaction. Go check out slides 8 and 9 of their Q1’17 investor presentation- the company walks through in explicit detail how the investments are depressing earnings and how they expect revenues and profits to inflect in the back half of the year. Or simply check out the third paragraph from their Q1 earnings release (go ahead; I’ll wait). And they have started to provide a number (adjusted ebitda + deferred revenue) that makes a somewhat more apples to apples earnings comparison by adding back all of the deferred revenue (i.e. treating it as a product sale).

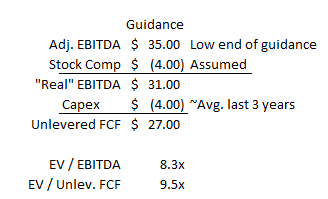

So we know the financials are messy. But the company is really handing us the tools to go about valuing them if you want to do the work. For FY17, FC is guiding to Adjusted EBITDA plus change in deferred revenue of $35-38m. Now that number includes some things I would quibble with, including adding back stock comp of ~$4m, but it’s not major. If we take out $4m of stock comp, we’d get to a “real” EBITDA number of ~$32m. If I average their capex for the past three years, they spend ~$4m/year on capex. Taken out of our ~$32m in EBITDA, the company would do $28m in unlevered FCF per year.

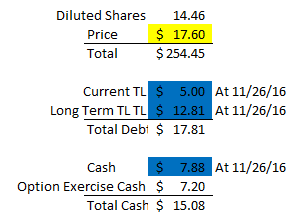

At today’s share price of $17.60, FC’s EV is ~$260m, so you’re paying ~8.3x EBITDA or 9.5x unlevered FCF based on those numbers. Not the cheapest company I’ve ever seen, but that’s relatively cheap for a company that should be have both growth and “predictability” tailwinds going forward as they switch to the AAP model and it (hopefully) raises LCV (FC thinks AAP is substantially increasing LCV, and points out that people switching to the model are both increasing their spend and renewing for substantially more revenue than they have traditionally spent).

Of course, there’s a “but” here, and that’s the company’s Q1 earnings. To put it simply: I thought they were awful. Now, if you listen to the company’s CC, they try to explain away all of the quarter’s weakness as simply an investment to get AAP going and some weakness in China. And I know some people who think “AAP showed continued signs of resonating with customers during the quarter, and that’s all the matters long term.” I get where both of them are coming from, but to me the quarter indicated serious signs of weakness in switching to AAP.

Here’s my biggest concern. Go to page 16 of their Q1’17 10-Q. Read through the “direct offices” line a few times. This is where almost all of their AAP sales are flowing at this point. Sales decreased by $2.4m during the quarter; however, there were a bunch of moving parts (deferred revenue increased $1.8m, a switch in China office ownership (from licensed to company owned) boosted revenue $2.2m, Japanese revenue was up $0.5m, UK revenue was down$1.1m). If I adjust for all of those numbers, I find that “apples to apples” revenue declined by about $2.2m, or almost 10%. Not great if you’re touting how much of a success AAP is going to be and how it’s reigniting your company’s growth.

Ok, maybe I’m reading too much into a relatively small revenue decline in one quarter. But all through the Q and the earnings call I saw signs that the model was having some issues. Here are some more things I noticed

During the Q4’16 call in early November, they said they expected 16 or 17 renewals when their initial batch of 19 AAP customer’s contracts expired. At their January 2017 earnings call, they had only gotten 15 renewals and were “hoping” for 1 more.

During the Q4’16 call, they said they expected results for Q1’17 to be $1-1.5m lower that the prior year before seeing YoY growth beginning in Q2. But then Q1’17 was more than $7m below EBITDA YoY (~$5.9m below if you included def revenue changes), and they’re guiding for Q2 to be $1.4-2.4m below the prior year. That doesn’t exactly send a ton of confidence that the management team is going to hit their targets, nor doesn’t it give you confidence the management has a fantastic grasp on what’s going on.

Speaking of management not having a grasp on the numbers, they also publish their targets for their performance based awards in their 10-k (see p. 78) and 10-q (see p. 8). The performance based awards have 3 levels: a low end, medium end, and high end. If I’m just looking at the adjusted EBITDA target numbers, it looks like they’ve missed even the low end of their targets in each of the last 3 years (FY14, FY15, and FY16). This year, they’d have to come in above the midpoint of their guidance in order to hit the low end of their Adjusted EBITDA award goal of $36.7m. Needing to hit a goal you’ve missed 3 years in a row doesn’t exactly give you confidence the guidance can be hit, and missing even the low end of targets 3 years in a row doesn’t give you confidence management or the board have a great grasp on the business.

Now, some people might push back that it’s really short term oriented to base your conclusions on how the business model switch for an entire company is going based on one quarter’s results. But I don’t think it’s too crazy to analyze the results of these quarters very closely; this year is when the first set of AAP renewals pour in and poor results while they do so can be a sign that the transition isn’t working. And if the model switch doesn’t work out, the results probably aren’t going to be pretty for FC shareholders: this is an asset light company w/ 15%+ EBITDA margins and >60% gross margins, so any weakness is going to result in massive operating de-leveraging and probably a whole lot of downside.

Ultimately, an investment in FC comes down to one thing: do you think the switch to AAP will create long term value, or do you think the switch is going to be somewhere between “bleh” and a disaster. If the former, the stock will do really well from here. If the latter, the stock will do somewhere between poorly to awfully.

And, despite the weak Q1 and muted growth (see “odds and ends” section for more on that) over the past few years, I just can’t help but look at FC and think that there are tons of signs that management is right and the switch is creating value. I’ve put some of the things management likes to highlight as evidence the switch is creating value in the “odds and ends” section at the bottom of this post. All of them are interesting, but the thing that really interests me is the company’s sales force: they’ve increased it from 192 people in last year’s Q1 to 216 people in this year’s Q1. And if you go check out their website, you can find a ton of job postings (particularly for their education division, which I haven’t really focused on here but seems set for continued strong growth).

I’ve been burned before by investing in companies ramping up their sales force and thinking it was a sign that a growth / expansion plan was going well (turned out it was just a sign of management over-optimism and incompetence), so I suppose those jobs numbers should be taken with a grain of salt. But when I look at the hiring ramp, the signs of AAP success that management is highlighting, and my own personal views of the AAP value add versus the old process of selling one course at a time, I just believe that the AAP switch is creating value and shareholders will be rewarded over time as that becomes more clear to the market.

Other odds and ends

This goes a bit with the “management missing targets piece above”, but aside from the AAP Q1 concerns, my other big concern with FC is growth (or lack of it). The company’s education segment has grown quite a bit over the past few years, but their core business really hasn’t shown much growth, and that includes periods before the AAP switch where the accounting / investment wouldn’t have been an issue.

A super bear would say that FC’s products are of limited value, and FC made the switch because their business was churning customers as fast as they could add them and they had no path to growth.

I don’t think that’s right- the company constantly cites their high client retention rate, and while I can’t independently verify that I can verify the strength of some of their brands based on the amazon reviews and their speakers based on the site I linked to earlier.

While the lack of recent growth is a concern, I’m comfortable with it. Even if they don’t grow their customer count much going forward, an investment is centered on AAP being a success, and if it is I think their base profitability level will increase significantly as AAP lets them charge customers more.

FC is a full tax payer (41% tax rate in FY16; 36% in FY15) with a relatively unlevered balance sheet. A lower tax rate under Overlord Trump would be a huge boon for them.

Some of the stats management has thrown out suggesting switch to AAP is creating value

Early renewal rates are high (~84%) and encouraging

They think customers are renewing for more seats / higher dollar value in year 2 than in year 1

Customer promotor scores are high

The first batch of clients who switched to AAP increased spend from $10.9m in 2015 to $15.9m in 2016 (source: Q1 call)

I didn’t mention it much in the article, but both their international licensees business and education business appear to be doing very well. The reason I didn’t mention them much is because, while they’re valuable, an investment in FC really hinges on the success of AAP at this point. Obviously licensees and education growing or shrinking helps or hurts on the margins, but if you get your AAP call right those don’t matter too much unless they are just unmitigated disasters.

Education: Their education business is based around their “The Leader in Me” program. It’s grown from 1.9k schools worldwide in FY14 to over 3k schools worldwide in FY16. It seems like growth slowed a bit in Q1, but management was pretty adamant they could add 800 new schools this year, which would be ~25% growth in schools, and it seems like the program has been very well received as renewal rates are in the mid-90s.

International: In places where FC doesn’t have an office themselves, they’ll license their business to an international partner who runs an office and pays FC a royalty in exchange. This has been a super strong business for FC over the past few years (it did $9m in EBITDA in FY16); however, in Q1 FC internalized their China license, so while the total international business will probably still do ~$5m a year in EBITDA going forward, it won’t be as big as it appears in the historical financials and, in the long run, it’s rise and fall will probably mirror the rise and fall of FC’s brands.

The company has a history of funneling excess cash flow into share repurchases. They did a massive share repurchase in Jan. 2016, doing a dutch tender to retire just under 2m shares at $17.75/share (more than 10% of shares outstanding).

One potential concern- the company isn’t actively repurchasing shares currently. I always worry when a company with a history of repurchases stops. Is it because they no longer view their shares as a bargain? Do they think the business is about to hit a real rough patch and want to preserve liquidity? In FC’s case, I think it’s because they are making a big investment into AAP and they’d need to take on leverage if they wanted to buy back more shares, but always something to consider / monitor.

FC’s financials are a bit complex. They sold a building a few years ago, but because they still lease the building the transaction is treated a bit funny and their balance sheets shows a financial lease related to the building and they also report some income from subleasing a part of the building. In addition, they capitalize all of their new courses and then amortize that cost over the next few years. The company does not add back that course amortization in their EBITDA numbers (that’s clearly an operating expense) so it doesn’t really effect the headline numbers, but it does mean cash flow can be a bit lumpy depending on the level of investment in courses during the year. My personal take has been to take the financial lease off their balance sheet and subtract the income they report from it; I also just ignore the difference between capitalized curriculum and amortized curriculum and assume it relatively balances out over time. I’m sure there are better / more sophisticated methods to dealing with both those issues, but I don’t know why you’d spend a ton of time looking at them. The bottom line is those complexities barely budge the needle on FC’s value, and Investment success in FC is going to be determined by the success of AAP, not correctly applying obscure accounting formula to the financial leases.

The company does do a decent bit of international sales, so FX does matter and hit their FY16 results a bit. Surprisingly, it doesn’t appear to have hit their Q1’16 results too much, but given how strong the dollar has been I wouldn’t be surprised if it’s a bit of a headwind for Q2.

Insider ownership is interesting here: the proxy lists insider ownership at 33.5%. It might not be quite that high, because a lot of the insider ownership comes from Knowledge Capital’s 20% ownership (the principal of Knowledge is a board member, and the CEO seems to have a stake in Knowledge), so insider ownership will be lower depending on how much of Knowledge they actually own. I also don’t love that the CEO has been in charge since 2000 and almost all of his direct ownership of stock is still through options (of his 708k shares, 500k are from options), but overall insiders interests should be relatively aligned with shareholders.

Also, it seems everyone in the Covey family has some type of employment at the company (see p. 21 of the proxy). Two of them appear to be very popular speakers, so I don’t think there’s anything crazy going on here, but worth mentioning.