CSX a fascinating study in comp and activism $CSX

Mantle Ridge and CSX have each employed unique strategies in their current proxy battle

The battle has me thinking a lot about comp and activism going forward

Will strong CEOs leave their current jobs to take over under-performers more frequently going forward? Is that good or bad for investors?

I’ve been thinking a lot about activism and executive comp recently. It’s tough to think about one without the other. I believe it was Charlie Munger who said “show me the incentives and I’ll tell you the outcome”, so executive compensation is obviously going to play a role in any activist fight; either from retooling management’s comp to better tie them to shareholder return (i.e. instead of paying for growth at any cost, pay a management team for improving return on capital), better encouraging management to seek out a sale if that’s what makes sense, or simply for pointing out companies where management is making tons of money while delivering no value. And the recent activism over at CSX has really been making me think about activism and exec comp on a lot of different levels.

Some background: about five years ago, Bill Ackman waged a proxy war at Canadian Pacific (CP) and installed Hunter Harrison as CEO. The results were fantastic, as Harrison slashed costs from 81.3% of revenue at the end of 2011 to 58.6% in their most recent FY. You can see the shareholder returns over his CEO tenure below; I ran the returns from the day he was named CEO officially though the returns were better if you ran it to when Harrison first joined with Ackman and the market started to price in him winning the proxy fight. Either way, it was a big success.

In mid-January, Harrison unexpectedly resigned from CP. This was especially shocking because his current contract expired in June, and if he had made it to the end of his contract he would have gotten something ~$89m in retirement benefits. By retiring, he got nothing; instead, he chose to join with Mantle Ridge (a fund run by a former Ackman protege) to run an activist campaign at competitor railroad CSX.

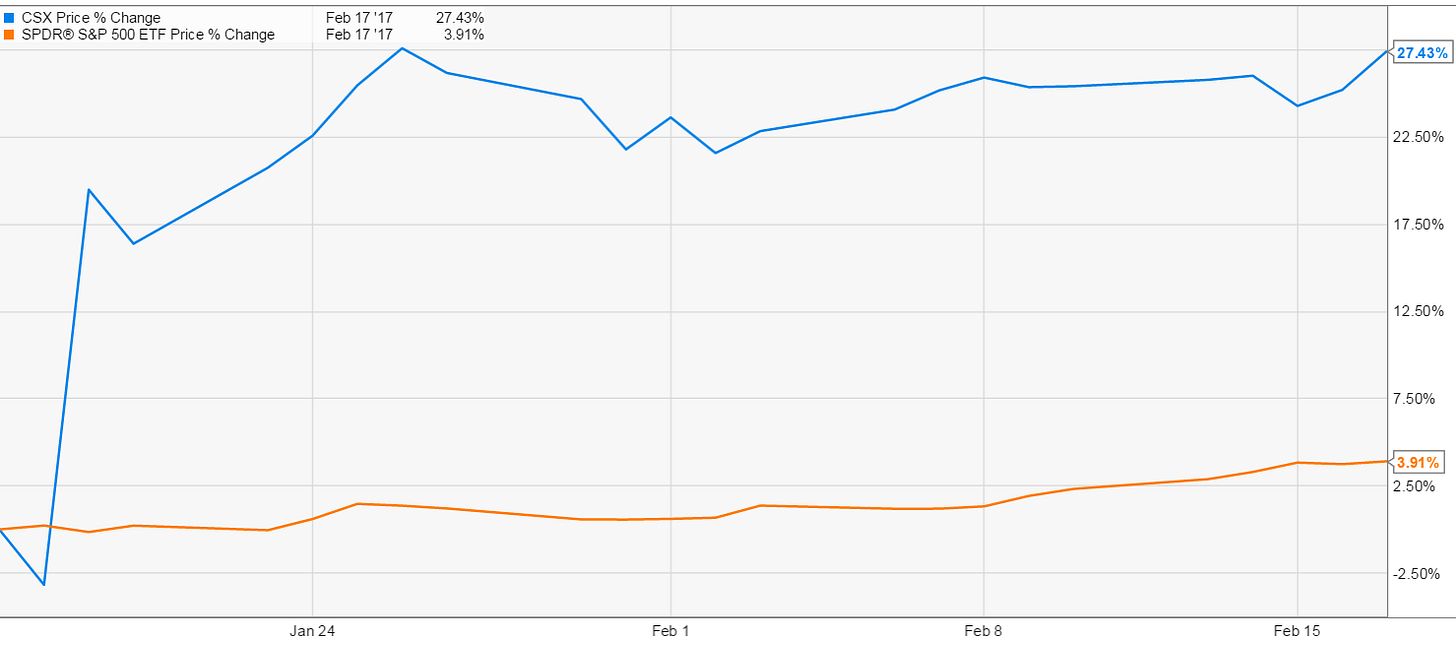

The market clearly really liked the idea of Hunter taking over CSX. Shares have run up ~28% over the past month as investors anticipate a CP-like improvement in operating margins given there’s significant room to improve on CSX’s industry low margins.

So far, everything looks like a typical activist battle. An activist fund (Mantle Ridge) accumulates a big stake in a company (just under 5%). They start negotiating with the company. Investors get excited that change could be coming and start pricing in improvements. The company and activist negotiate, and eventually the company capitulates because they’ll be beaten in a landslide if they do anything that risks giving up that big stock pop. And the CSX / Mantle Ridge battle was following exactly that play book. The two sides negotiated for a month and seemed set to basically hand the keys over to Mantle Ridge / Harrison. Except there was one sticking point: executive comp.

It turns out that, in order to lure Harrison to Mantle Ridge and CSX, Mantle Ridge had promised Harrison that they would pay him for all of the comp he was giving up by retiring from CP early. In addition, because Mantle Ridge was arguing that Harrison’s incentive comp should be struck at CSX”s share price before Harrison / Mantle showed up (i.e. ~30% lower). CSX did not want to reimburse Mantle for covering Harrison’s CP retirement comp, and CSX pointed out that paying Hunter w/ options struck at the price before the activist campaign started instead of today’s would result in a $300m+ pay package. CSX also though Mantle was asking for a few too many board seats. With the two parties at something of a standstill, CSX did something pretty novel and said they were just going to ask shareholders if they wanted to approve that pay package or not. CSX going to shareholders clearly caught Mantle off guard and wasn’t a really good look for them- they had to respond quickly and the letter they put out to was flat out awkward to read, and the whole ordeal created some friction between Harrison and Mantle.

(Seriously, the Mantle letter to CSX is insanely awkward. They keep calling the director they are writing it to by his first name, and it just makes the whole letter come off like it was written by a robot while completely avoiding the elephant in the room that Mantle is on the hook for $90m and doesn't want to pay it. Here’s a line from the letter; I have no idea how someone can write this with a straight face. “Ned, we have come a long way. We are close. We owe it to the shareholders to get a deal done promptly. Let’s do it. If you are willing, we are glad to meet in person and hammer this out this weekend, hopefully delivering good news to the shareholders early next week.”)

I would guess that Mantle / CSX / Harrison reach a successful resolution sometime this week. But that’s the least interesting piece of the puzzle to me. The really interesting piece is thinking about pay structures going forward.

Since Mantle / Harrison got involved, CSX’s market cap has increased by ~$11B. The stock market is roughly flat over the same time, so let’s just assume that’s all alpha. I would guess pretty much that entire move is attributable to excitement over Harrison taking over versus excitement over improved capital allocation / oversight from Mantle’s activism. So I guess my questions are

Is it fair for CSX to pay Harrison’s severance from CP?

I don’t know. Harrison’s rumored involvement w/ CSX created value for all shareholders, so on some levels it makes sense for CSX to pay. But, at the same time, Harrison / Mantle took the risk of giving up that severance w/o any prompting from CSX. Why should CSX have to pay that cost? And Mantle is currently on the hook for that money- is the answer to this question different because CSX needs to pay Mantle the money and not Harrison himself (i.e. would it make sense to pay if Harrison was on the hook, but it's a breach of fiduciary duty to all shareholders to pay the severance to Mantle because that payment has no impact on the overall business or happiness of your exec staff)?

How much of the $11B of CSX’s market cap increase should Harrison get to capture for himself?

Mantle owns 4.9% of CSX’s stock, so they / their LPs have gained $500m+ on CSX’s move. If you assume the traditional 2/20 fee structure, Mantle’s made $100m+ in incentive fees on this (to say nothing of increased ability to fund raise going forward).

Harrison’s increased CSX’s market cap by $11B. Why shouldn’t he get paid like Mantle? Wouldn’t CSX’s shareholders be better off paying him $2B and having him run the business than risk losing him?

Mantle is kind of arguing something like this- “yeah, our new pay package is expensive… but part of that is because the share price has already run up so much and we want to give Hunter credit for that.” But doesn’t that create weird promote rules for incoming CEOs? Argue for ridiculously high profit / growth targets when you’re coming in and get paid for all the value that is created in the stock run up before you take over. After that, if you fail to deliver, you’ve already been paid a pretty decent amount.

Does this structure result in hyperinflation for the best execs salaries going forward?

Mantle is running a super successful activist campaign (see $100m+ in fees calc above) based on taking the best exec in the industry, guaranteeing all of his comp, installing him at a new company, and then having the company reimburse for all of those fees. To the best of my knowledge, I haven’t seen someone try that before. Does this become a common strategy, and if it is doesn’t it create hyper-inflation for top notch talent?

Take this to the extreme- if Jeff Bezos decided to take on the CEO role at IBM, how much would their stock go up? Couldn’t a fund promise Bezos $1B to work with them, take a stake in IBM, and then make that push? Can’t elite CEOs use that threat to push for even larger / crazier pay packages.

Yes, I get Bezos founded Amazon and his equity stake there is so large it wouldn’t make sense. But I would think someone like Bob Iger at Disney or Jamie Dimon at JPM could be prime targets for these types of moves.

Even if it did result in hyperinflation in salaries, would it be good for corporate America?

Elite CEOs are rare beings, and if this results in a more structures that see them take on more challenging situations w/ big potential rewards, it’s probably good for investors and corporate America in the long run.

What happens when one of these bets goes wrong?

Again, I haven’t seen these “guaranteed comp” structures before, so I’m not 100% sure on the details of it. But given the success Mantle has had here, you can bet someone is going to try it with another combo of highly regarded exec / underperforming company. What happens the first time one of these goes wrong (the activist loses the proxy, can’t get reimbursement for the payment, and / or the stock price goes down)? It seems like they’re still on the hook for the payment, so isn’t a fund taking complete existential risk in making these bets?

I know very little about Mantle, but imagine a different universe where the stock is flat after the announcement and CSX doesn’t have to give them the reimbursement. In this world, they lose $90m paying Hunter’s severance. Is that enough to shut the fund down? Or does that demolish that fund’s return for that year? Is there any coming back from that?

I’m still turning over and playing with all of the different threads here. But the whole set up is new and interesting, and if there is a real trend here it could create a lot of opportunity for activists willing to exploit increased CEO mobility and investors who pick up on potential under-managed targets.