An open letter to the Golden Entertainment board $GDEN

Below is an open letter we are sending to the Golden Entertainment (GDEN; disclosure: we are long) board in light of the egregious take private transaction announced last week.

Dear Golden Entertainment Board,

Rangeley Capital (“Rangeley”, “we”) owns ~1% of the outstanding shares of Golden Entertainment (“Golden”). We are writing to express our extreme displeasure with last week’s acquisition announcement. While we have no problem with the sale-leaseback side of the proposal, we believe that the sale of the opco to management is one of the most egregious examples of insider enrichment we’ve seen in modern markets.

We also believe management and the board realizes how egregious this transaction is and are taking active steps to hide just how much value they are extracting from minority shareholders. Why do we believe that?

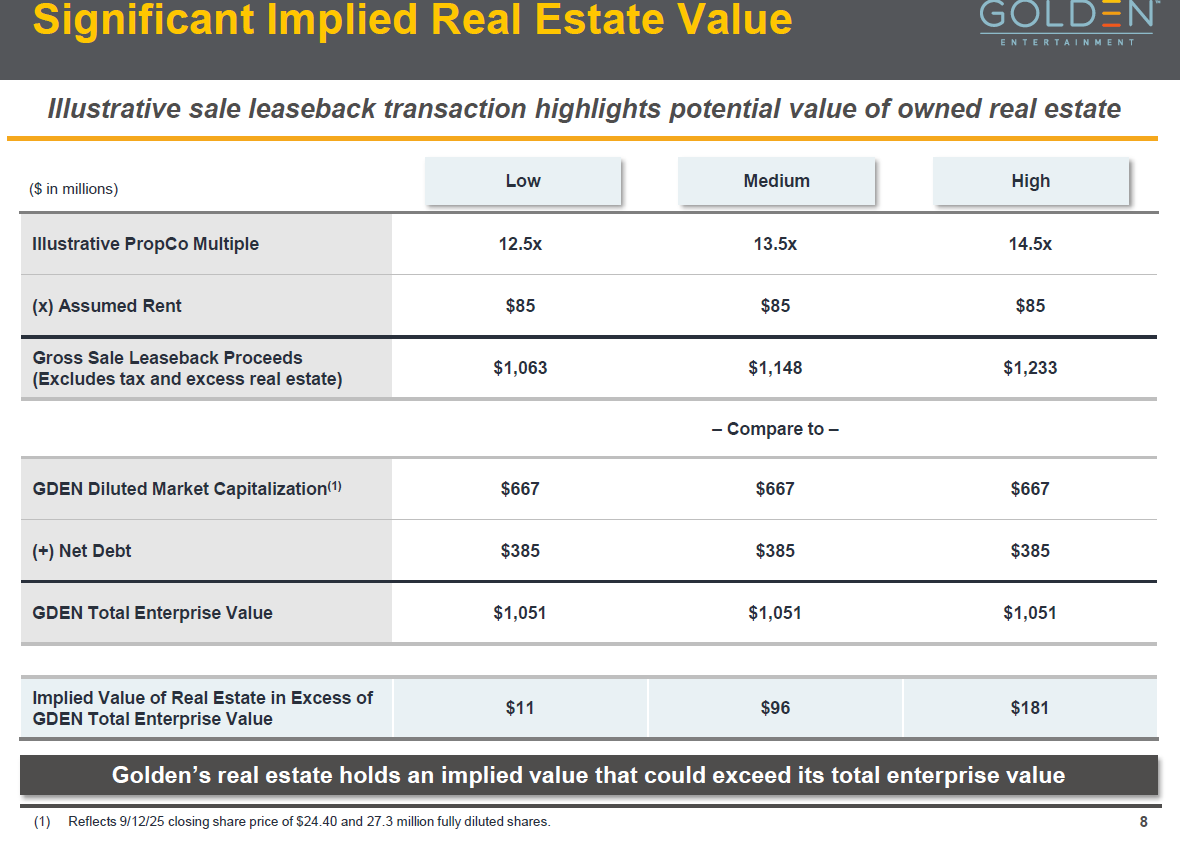

For the past ~two years, Golden management has had one consistent message for shareholders: Golden’s stock price reflects only the value of its real estate and ascribes no value to its operating assets. Golden has communicated that message to shareholders through words (to chose just one example from many, on the Q1’24 earnings call management noted, “given where we’re trading at today, at any market multiple for rent, you could pick a range that’s in a lot of your research reports or where even the REITs are trading at right now, which is depressed prices, that value is in excess of our current enterprise value”), images (see the screenshot below from the company’s September 2025 investor deck), and, most importantly, through actions: the company spent over $100m over the past ~two years to reduce the share count by ~10% by buying back stock at ~$30/share.

In the past, shareholders could go to Golden’s investor relations website and click on “presentations” or “conference calls” to see how management publicly communicated Golden’s value. Here’s a screenshot of Golden’s IR website from April 2025 (courtesy of the wayback machine) showing those links:

Curiously, Golden’s IR site was modified after the acquisition was announced last week to remove the “conference calls” and “presentations” links. Here’s a screenshot of the new website below:

We’d suggest that management modified the website because they know they are stealing the opco from shareholders, and they’d like to make it as difficult as possible for shareholders to uncover the value by seeing management’s historical statements.

Let’s break down the valuation and why we believe this transaction transfers so much value from shareholders to management. The merger announced last week can be broken into two steps:

Golden Entertainment will do a sale-leaseback of their casinos with VICI; in exchange, Golden shareholders will get 0.902 shares of VICI and VICI will assume / retire all of Golden’s debt.

Management will buy the remaining operating company (“opco”) from shareholders for $2.75/share, or ~$75m given Golden has roughly 27m shares outstanding.

We have no problem with the first step (the sale-leaseback); that is a nifty piece of financial engineering that creates value for all shareholders. It’s the second step that is so problematic as it is a completely unnecessary wealth transfer from shareholders to Golden’s management team.

In the last twelve months, Golden has done ~$146m in EBITDA. The VICI sale-leaseback will have ~$87m/year in rent, so net of that rent the Golden opco will do ~$60m/year in EBITDA. On the day the deal was announced, another shareholder published a letter to the board that valued the opco at 5.5x EBITDA; using that multiple would suggest the opco is worth ~$330m. Management’s take private value the opco at ~$75m, or just over 1x annualized EBITDA, and that’s before adding in the inevitable synergies that come from taking a public company private. That’s over $250m of opco value that’s getting transferred from shareholders to management.

Again, this is one of the most egregious insider enriching transactions we’ve ever seen in public markets…. and we think management and the board realize it; taking down the presentations and conference calls from the company website is a smoking gun that the management is trying to hide the value transfer here.

While I’m sure the independent committee will point to the go-shop as a cure all for the flaws in this process, go-shops are always a difficult path to tread, and they’re particularly difficult when a management team is attempting a take private because potential bidders can be subtly discouraged from bidding in many ways. That “subtle” discouragement is true in any go-shop involving a management team take private, but it’s particularly true in a gaming deal that ultimately needs the blessing of gaming regulators who may let potential bidders know that unfriendly bids will not be looked on kindly.

We believe the company needs to immediately take four steps to ensure shareholders receive proper value for the opco:

The company needs to implement a majority of minority vote for approving this deal.

Shareholders should be allowed to vote on the sale leaseback and the opco take private separately.

The go-shop must be run in a fully fair and transparent way, including allowing bidders assume the sale leaseback and bid separately on the opco as well as a management commitment to rolling their equity if a superior bidder emerges and requests it.

The current deal price for the opco must be bumped; we can debate whether the remaining opco is worth 4x or 8x EBITDA, but it’s certainly not worth 1x. Shareholders must receive a fair price for the opco.

We’d highlight step #2 (shareholders should be allowed to vote on the sale leaseback and the opco take private separately) as critically important. The sale leaseback is a nifty piece of financial engineering that delivered value over and above the company’s unaffected share price; there is absolutely no reason that the sale leaseback and the take private deal need to be voted on together. If shareholders want to engage in the sale leaseback but don’t want to sell the opco to management for a song, that option should be on the table, and providing that option to shareholders will allow shareholders to decide whether they receive fair value for all of Golden’s assets.

We would be happy to speak with the board to more fully discuss our concerns and how this bid can be structured in a way that is fair for all parties,

Andrew Walker

Email: info@rangeleycapital.com