A quick note as $HMHC's tender deadline approaches

Wednesday (April 6) is the deadline for HMHC shareholders to tender their shares. I have no way of knowing, but I suspect it will come down to the wire whether or not enough shares are tendered for the deal to go through. So, while remembering that nothing on this blog or website is investing advice (and that I’m not looking to form a group with anyone), I wanted to post a quick reminder to shareholders: I believe the sales process was flawed, and I think shareholders would be better off holding on to HMHC as a public company and/or demanding that Veritas bumps their bid to a level that more accurately reflects HMHC’s valuation.

I will refer you to my podcast with Chris Colvin for (lots) more background (as well as my tweet thread), but there is one particular point that I wanted to harp on because, honestly, I haven’t been able to get it out of my mind: how wonky the divergence between HMHC’s initial forecasts and their final forecasts, and how that likely had a chilling effect on HMHC’s deal process.

Why haven’t I been able to get it out of my mind? Because it’s honestly malpractice that a company could shop themselves when near term numbers were presented this inaccurately.

A quick recap will show you why I think this was so bad; it takes a second to pull everything together from the proxy, but I’m going to do it for you here because I think when you lay it all out it becomes so clear how terrible this deal process was and why shareholders would be better served not tendering / holding out for a higher price or keeping the company as a standalone.

So let’s start pulling. The background to the merger reveals that HMHC ramps up the process to sell themselves in August and September 2021. The management team provides the board with their initial three year financial plan on August 10, HMHC signs an engagement letter with Evercore on September 3 (see p. 16), the special committee meets for the first time on September 21, Evercore reaches out to 60 potential buyers in November (see p. 18), and in November and December 20 different parties sign confidentiality agreements.

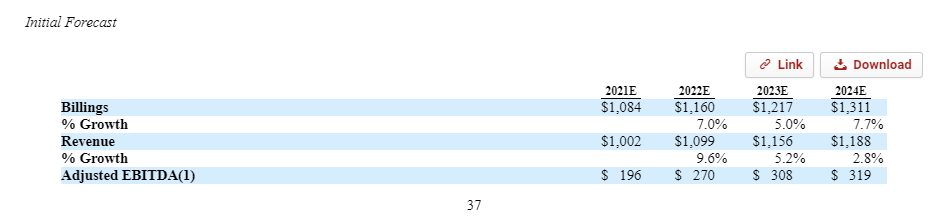

If you look at p. 37 of the proxy, you can see the exact numbers that HMHC is using for this process. These are the numbers the board sees in August and decides to pursue a sale on, and these are the numbers the 60 potential bidders are asked to value HMHC with.

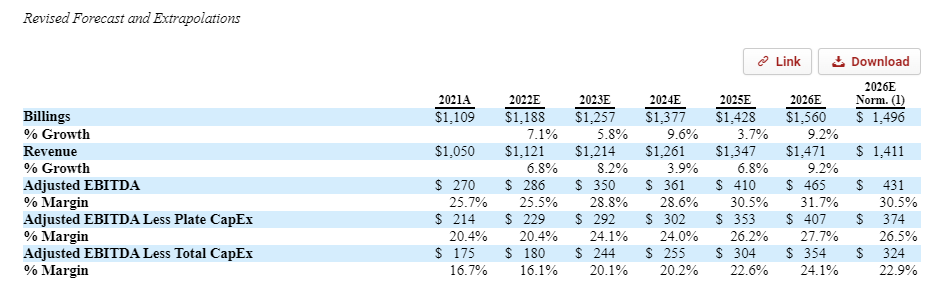

Fast forward to January 14, 2022. At this point, every bidder for HMHC has dropped out except for two: Veritas (who would ultimately “win” the auction and is trying to close the tender for HMHC right now), and “Party B.” The management team goes to the board and says “Hey, our projections were just a little light. We’d like to go back to the bidders with some new projections.” The board approves, and the below “new” projections to the two remaining bidders.

Again, this was detailed more fully in the podcast, but this is the most bonkers business update I’ve ever seen. In August 2021, management was projecting 2021 EBITDA would be $196m, and 2023 EBITDA would come in at $308. Roughly four months later 2021 actual EBITDA has come in at $270m (~37% over initial projections!), and 2023E EBITDA has been bumped by more than 10% (from $308m to $350m).

If you’re the board, I’m not sure how you don’t stop the process dead right there. ~58 potential bidders saw your business under the August 2021 projections and passed. Is it possible that they passed because they looked at the first projections and said “O, this business isn’t quite as growthy as we thought; must be a little more work to do under the hood and we’re not here for a turnaround?” As a board, shouldn’t you be readjusting your valuation and expectations materially higher based on these new numbers? The business is now projecting EBITDA >10% higher than initial projections, and EBITDA increases should fall straight through to free cash flow. With that much more EBITDA, is it possible it would be better to be a buyer than a seller? Or wait for some of that growth to come in and then try to sell for a much higher price?

I don’t know the answer to any of those questions, but it seems worth at least a discussion!

Instead, the board plows ahead with the sales process, even though at this point Veritas is basically the only party involved. With the new projections in hand, Veritas bumps their prior offer of $17.50-$18.50/share (made in December) to $20/share (made February 17th). After some haggling, Veritas bumps their offer to $21 and the deal is announced. Of course, the Veritas deal is a “no-shop” deal, meaning that Evercore and HMHC can’t even go back to all of the buyers who left the process and say “Hey, turns out we were way wrong on our projections; want to take another look given our business is minting money versus our prior projections?”

Veritas (and, to a lesser extent, Party B) are literally the only parties who ever had a chance to bid on HMHC with a full view of just how profitable HMHC is currently and how much better HMHC’s out year projections are than the initial projections.

Malpractice.

There are lots of other things about the HMHC sale that I don’t like or that strike me as funky. I’d encourage you to listen to the podcast to hear them laid out in great detail. Still, having things you don’t like in a deal process is somewhat typical for M&A…. What really gets me about HMHC is I think this is the worst deal process I’ve ever seen, and I can’t believe the board is trying to sell the company at this price given how flawed the projections were.

Personally, I think shareholders would be better served not tendering their shares, letting the company execute on the current plan, and then taking another look at the M&A landscape in a year or so when HMHC continues to deliver on their growth trajectory and earnings are much higher.

Hopefully, the company will have a more shareholder focused board overseeing their next steps, and they’ll run a more competent sales process if and when they decide to pursue one in the future.

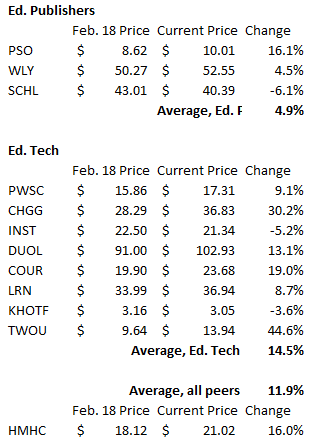

PS- Page 30 of the SC 14D9 lists 11 companies as peers for HMHC. It’s worth noting that since February 18th (the last close before the HMHC deal was announced), 8 of the 11 peer stocks are up, with the average peer stock up almost 12%. Obviously the market can do anything in the short term, but the way peers are trading (combined with the robust projections) suggests to me that HMHC’s “deal break downside” is much, much higher today than it was before the deal was announced (even if you ignore how strong HMHC’s Q4 earnings and outlook are!).