Rick's Thanksgiving Surprise: A Friday Night 8-K for the Age $RICK

TL;DR: On the heels of RICK’s CEO and CFO getting indicted, the company created one of the wildest disclosure timelines I’ve ever seen, with a key shareholder getting bought out for a massive premium literally days before the CEO and CFO (who signed off on the transaction) “stepped down”…. with all of it getting disclosed through a Friday Night news dump 8-K.

Politics has the famous “Friday news dump,” where politicians will release bad news on a Friday with the hope that the weekend will distract from the news.

Investing has something similar; companies love to quietly file 8-Ks on Friday after market close with the hope that the weekend will distract investors from the news.

I will admit: it’s a weird strategy for investing. The reason a “Friday dump” works in politics is because perception generally shapes reality; if a story fails to break through, then it really doesn’t matter. In contrast, in investing and business, perception matters much less / reality generally shines through1: if a company is writing off $100m of goodwill, it really doesn’t matter if you announce that Tuesday morning or Friday afternoon. Either way, the $100m is lost!

While all Friday afternoons are prone to weird 8-Ks, probably the single best day for weird 8-Ks is the Friday after Thanksgiving. Why? The stock market is closed on Thursday, and there’s only a half day of trading on Friday (the market closes at 1 PM the day after Thanksgiving)….. but the SEC is open until 5 PM. Companies figure that between holiday travel, the stock market closing early, and many senior people treating the day after Thanksgiving as an extra holiday, an 8-K filed late in the day on the post-Thanksgiving Friday is the perfect way to sneak some bad news past investors.

I have a general thesis that the stock market (and world) is getting weirder and weirder over time. If the stock market is getting weirder, then the Friday night 8-Ks should generally be getting weirder as well…. and last Friday’s 8-K dump certainly fit that trend. There were two particularly weird 8-Ks I wanted to highlight.

If you had no context clues at all, the weirdest 8-k would be TOPS’ acquisition announcement. TOPS is “an international owner and operator of ocean-going vessels focusing on modern, fuel-efficient eco tanker vessels transporting crude oil, petroleum products (clean and dirty) and bulk liquid chemicals.” On Friday, they announced a LOI to buy more than $200m of “residential real estate assets in Dubai” in a related party deal with their CEO. The company made a $23.5m advance payment as part of the deal…. which roughly matches their market cap as of Friday’s close2.

Absolutely perfect Friday night dump. Ten out of ten, no notes.

But if you’re including context clues and recent history, the weirdest 8-K would easily be RICK’s Friday night 8-K. I’m not breaking wildly new ground suggesting this 8k was strange; when I did a not so cryptic tweet about wild 8-Ks last week almost everyone instantly knew I was referring to RICK… so I was tempted to just assume “everyone knows this” and not write anything about it….. but the story is just so crazy, and there are some complexities to it that I haven’t seen anyone mention yet. Given that combo, I figured I’d put a few words down.

Let’s start with the 8-K itself. It announced that both the company’s CEO and CFO will be “stepping down” from their positions, with their roles getting filled on an interim basis by internal candidates. It’s pretty wild to see both the CEO and CFO resign at the same time, but that’s actually standard Friday news-dump fare.

Even without the added context we’ll dive into in a second, there are three really curious things about this 8-K:

The 8-K is filed November 28th, but it notes the CEO and CFO both stepped down on November 25 with an effective date of November 28th…. that obviously seems specifically targeted so the company could bury the announcement in a post-Thanksgiving 8-K.

The interim CEO has been at Rick’s since 1999. Among other roles, he created Rick’s Bombshells concept (basically a Hooters knock-off). Bombshells has been an absolute disaster; same-store sales for Bombshells were -19.5% in the most recent quarter. That’s probably the worst SSS number I’ve ever seen (outside of COVID), and Rick’s has responded by shutting down their Bombshells locations and looking to divest what remains. Seems weird to put the person who launched that in charge of the whole company!

The 8-K notes that both the (now former) CEO and CFO who are stepping down will continue to be employed by Rick’s and “will continue to receive the same compensation under their previous titles and will continue to vest in their previously awarded stock option grants under the Company’s 2022 Stock Option Plan while employed by the Company”. I don’t think I’ve ever seen someone leave their C-Suite role and continue to be employed by the company (other than as a consultant or in a transition role)…. much less continue to receive the same C-Suite compensation for a now undefined role!

If we stopped there and mentioned nothing else about RICK, then last Friday’s 8-K would already be pretty special. Announcing a single executive resignation via a Friday night dump is nothing new, but to have both the CEO and CFO step down in the same 8-K is pretty unique, and adding the nuance buried in the 8-k (the timing, continued executive salaries, etc.) puts RICK into pretty rarified air.

But it’s once you start considering RICK’s context and backstory that this 8-K enters legendary territory.

Remember that RICK got hit with a pretty salacious indictment for “conspiracy, bribery, criminal tax fraud and offering a false instrument for filing” back in September (I wrote some thoughts on the charges here); the indictment included both the (now former) CEO and CFO. It’s not a surprise that a CEO and CFO would step down after getting indicted…. but it is a surprise that the company would continue to employ them on effectively the same terms after they got indicted and stepped down! As you might imagine, Rick’s stock has been under just a bit of pressure in the wake of the indictment….

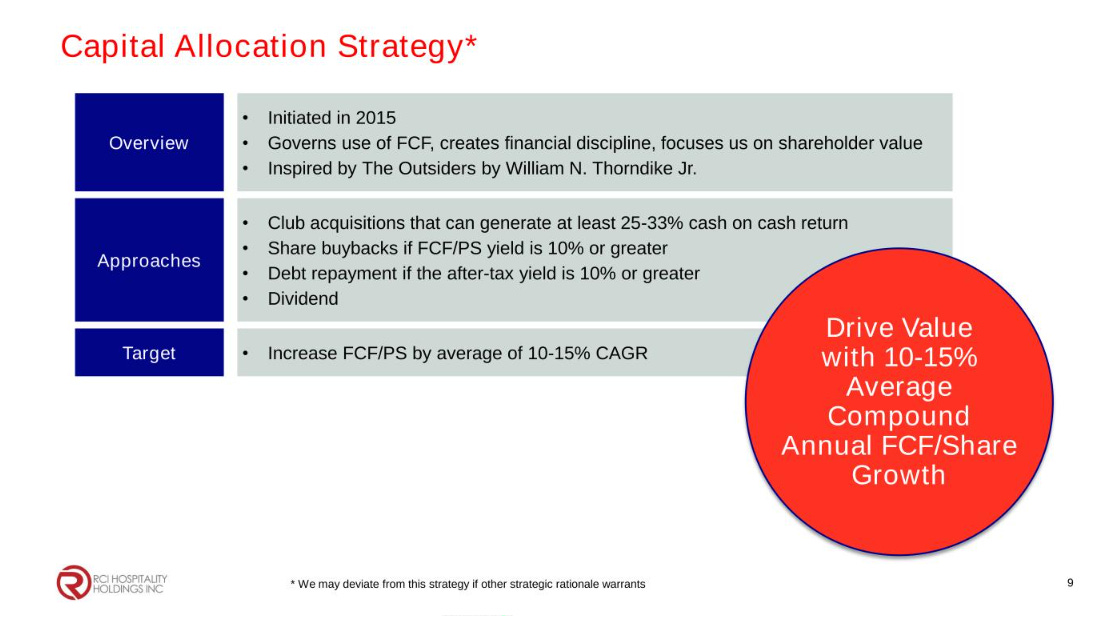

RICK has historically committed to an “outsider” style strategy of repurchasing stock when it was cheap…

That created an interesting dilemma: on the one hand, “outsider” style companies generally respond to stock price drops by buying back a bunch of stock, and RICK had basically committed to that over the years. On the other hand, few outsider companies had faced the “our stock price is down because our top brass was indicted and there’s some risk this is existential / we lose our licenses” setup.

So there was some debate I saw among investors: would RICK lean into a buyback given the share drop? Or would they preserve cash and fortify the balance sheet given the potential existential risk?

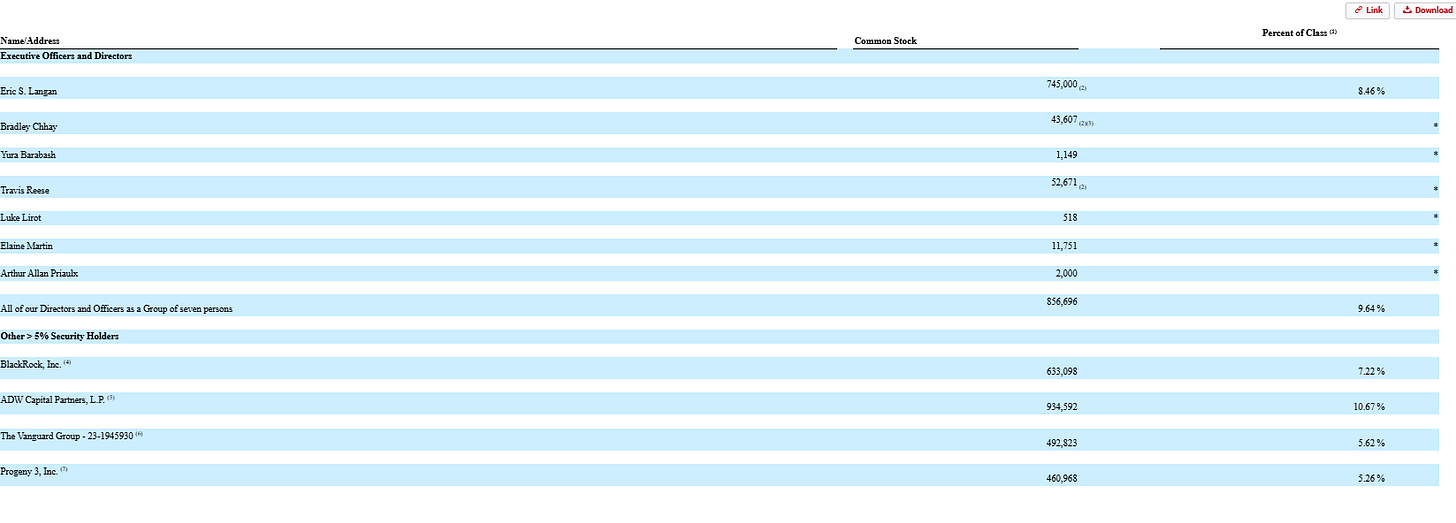

RICK somehow found a way to combine the worst of both of those plans by pursuing a massive buyback at an enormous premium. How? On November 213, they announced a deal to buy out their largest shareholder (ADW Capital) for $36.54/share, a ~50% premium to their closing price the prior day.

In the moment, that buyback was perhaps the most perplexing I’d ever seen. It just makes absolutely no sense. A large negotiated buyback can happen one of two ways: because a seller needs / wants out, or because a buyer wants a big block. If this transaction happened because ADW wanted out, then RICK should have gotten an enormous discount to the last trade. Why? ADW owned ~10% of RICK, and RICK is a somewhat illiquid small cap (market cap ~$250m). If ADW had tried to sell their RICK shares, the stock would have gotten crushed; thus, RICK should get a huge discount if ADW was trying to get out.

On the other hand, if RICK was trying to buy a big block, there are a thousand ways they could have done this better than the ADW transaction. They could have done a big tender offer so all shareholders could participate (and the clearing price would have been way below a 50% premium), or they have just bought shares on the open market (I’d note they bought back ~5% of the stock in FY24, so if they cranked up the aggressiveness just a bit they could have bought 10% of the stock in a year without the huge premium).

So, no matter how you cut this transaction or who you think initiated it, it’s just an insane buyback / decision from RICK. But when you tie the timeline of the buyback to the timeline of the executive resignations, that’s what sends this whole series of transactions onto the Mount Rushmore of wild 8-Ks.

RICK announces the buyback of ADW’s stock at a massive premium on November 21. The 8-k for the deal is filed on November 25. That’s the same day that RICK’s CEO/CFO step down, per the November 28th 8-k. Basically the last thing the former CEO does is sign the 8-K announcing the ADW deal (in fact, if you look at the 8-k itself, it is filed after hours November 25th, but the CEO’s signature is dated November 24th….. is it possible he wanted the signature in and filed before he stepped down?).

Now, you could get all sorts of conspiracy theories going with the deal. Some people speculated that this was RICK bailing out their (potentially politically connected) largest shareholder / biggest cheerleader as the walls were caving in. I personally think that viewing this buyback through an ADW lens is using the wrong focus; I think the focus should be more on RICK. I wonder if taking ADW out was more about RICK’s management entrenching themselves and ADW just being in the right place at the right time to get some greenmail.

Consider: ADW was basically the only shareholder capable of being vocal or opposing anything management did; by buying ADW out, RICK’s management clears the field of any large shareholder who could raise a fuss about the top brass continuing to receive C-suite level comp after having stepped down from their role while under-indictment (and perhaps RICK’s management realizes the indictment would force them to step down from their role at some point!). With ADW bought out, RICK’s former CEO is now, by far, the largest shareholder, and the only investors with ownership even to him are passive funds. With ADW gone, that ownership base gives RICK’s (former) CEO effective control of the company. That’s important: it means he can promote someone he’s been working with for decades to the CEO role while remaining on the payroll, and the combo of a friendly CEO plus continued employment means the company will continue to cover any ongoing legal bills from the indictment. Is that egregious? Perhaps…. but without ADW who is going to make any noise about it? What activist is going to step into a borderline microcap publicly traded strip club that has an indictment overhang and where the (former) CEO personally guarantees the debt while controlling ~10% of the stock? That feels like an insanely fraught activist case where any victory (i.e. winning a proxy) could quickly prove pyrrhic (loans called in when former CEO leaves / drops his guarantees, new board steps into a legal nightmare). Again, this is pure speculation / a borderline conspiracy theory on my part, but viewed through that entrenchment / anti-activism lens, the timing of massive buyback followed immediately by the top brass resigning starts to make a lot more sense.

So my “conspiracy theory” looks like this: RICK management negotiates to take ADW out. They’re willing to pay a huge premium to ADW because doing so effectively entrenches RICK management / gives RICK management a semi-controlling stake and guarantees the company will cover their legal bills / take the heat for them. The moment the ink is dry on the ADW deal, RICK management can step down because they no longer need to worry about any public pressure, so they immediately do so (while appointing very friendly successors and keeping access to their full pay scale).

Anyway, let me take my conspiracy theory hat off and wrap it up here. Again, the RICK 8-K is a wild one, and the more you peel back the onion / remember the history of this company, the crazier it gets.

Truly an 8-K for the ages!

PS- If you enjoy this kind of 8‑K nerdery, please press the button below and share it with another friend who reads filings for fun. The only way I know if these weird 8-K posts are landing is if the posts are getting read / shared!

Odds and ends

I might start doing a regular “craziest 8-K of the quarter” write up… I try to monitor wild 8-Ks on my own, but if I did do that series inbounds / crazy 8-k alerts would certainly be appreciated!

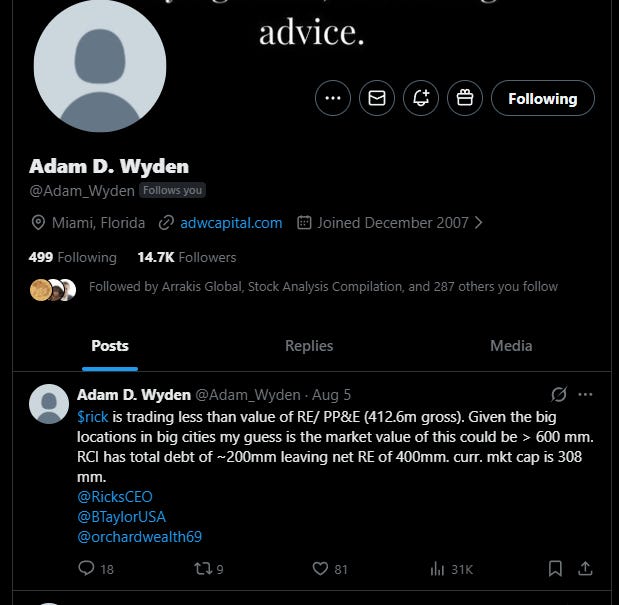

As someone who has been a vocal public proponent of a stock that has gone wrong more than once, I can tell you one of the tough things with it is that your old tweets / articles can age really poorly, and ADW certainly has some of that…. but I do think there is something interesting in ADW’s public statements. ADW’s last tweet discusses RICK trading for less than the value of its real estate; interestingly, the stock closed at ~$36.50/share the day of that tweet. That’s roughly the same price that the big repo just happened at…. as I mentioned in the main write up, I think the buyback may have been more about RICK management entrenching themselves than anything else, but I wonder if this tweet actually served as the basis for some negotiation / got ADW a higher price than they otherwise would have gotten.

As always, there are exceptions. Reflexivity is a thing; a large enough bank run would turn any bank insolvent, and there are several companies that still exist today purely because of meme squeezes a few years ago.

Their most recent registration statement had ~4.6m shares outstanding and they closed trading at ~$6/share.

Speaking of Friday night dumps, they filed this PR at 12:45. The rarely seen intra-market hours announcement of a massive stock buyback at a huge premium!

This one is so crazy that you didn't even find it necessary to mention the ADW buyout at a 50% premium was done with 8MM cash and 22MM of seller financing @12%. I guess if you can't get all cash, converting your equity into debt when revenue is diving and the C-suite is under indictment for tax fraud and bribery charges is not a bad way to go.

+1 For "craziest 8-K of the quarter” write ups !!